Owning oil-related stocks is certainly not popular these days, for obvious environmental reasons. Nor has it been particularly profitable in recent years. It can be read in the report by Fabrizio Quirighetti, CIO and Head of Multi-Asset of DECALIA, wondering: What if the industry’s strong performance in 2021 was more than just a reflection of the post-pandemic rebound in crude oil prices and impact investing was a better option than divestment?

“The pressure on the big oil companies comes from many fronts: governments (now including the US administration) with their goal of zero CO2 emissions by 2050, environmental activists, pension funds, the general public and even the courts ”. The attack on Big Oil, the report reads, “is certainly a simple and popular choice but not necessarily the best way to save our planet.

Of course, the abandonment of fossil fuels is vital for the planet, but it is a transition that will last several years and will also require significant changes in consumption patterns. In the meantime, the demand for oil will remain and there are many large unlisted producers, often active in countries where climate change and ESG aspects have much less weight, who will satisfy it promptly ”.

The impact on listed companies

“Even with regard to listed companies, simply liquidating their shares means placing them in the hands of other, perhaps less well-intentioned, investors,” writes Quirighetti. “True, it would make it more difficult for the big oil companies to get new funding on the equity markets and it could also increase the cost of debt“. But what are these arguments worth given the amount of money they generate?

According to Quirighetti, we must also recognize the efforts made by energy companies to limit their environmental impact, both direct (eliminating their greenhouse gas emissions) and indirect (reducing the concentration of coal in the fossil fuels they produce). “Maybe, and just maybe, Big Oil can be part of the solution”.

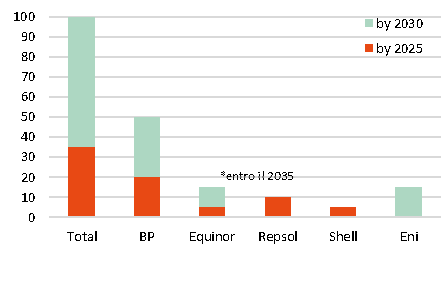

The following graph, developed by DECALIA, shows investments in Clean Energy by selected oil companies ($ bn)

Europe vs USA in renewables

In Europe, the report reads, “producers are allocating large sums of money to alternative energy sources (wind and solar) as well as emerging opportunities such as carbon capture or green hydrogen. Royal Dutch Shell, Total, BP ed Equinor they are now all aligned with the zero emissions target in 2050. Aker BP, a small independent exploration and production company active on the Norwegian continental shelf, is undoubtedly even more advanced in the transition, with an emissions level equal to less than a third of the global industry ”.

According to Quirighetti, “The American counterparts, Exxon Mobile and Chevron in particular, they are undoubtedly further behind. While they have also announced plans to reduce their CO2 emissions, neither has made a commitment to reach net zero. Nor did they claim to participate in large-scale solar or wind projects. However, there are other US companies more involved in the necessary energy transition, for example Occidental Petroleum in the field of carbon capture “.

Ultimately, the report reads, “Investors who simply choose to ignore the oil sector may be guilty of a serious misjudgment. By getting involved, shareholders have more weight e power to effectively guide change. And they could also find it financially rewarding ”.

The graph below, developed by DECALIA, shows the large oil companies expanding their clean energy options Renewable Capacity Target (in GW)