After the bankruptcy of the Silicon Valley Bank (SVB) on Friday, investors warn of a domino effect that could affect the start-up scene and other banks. Bank customers are faced with the anxious question of whether and when they will get their money back. While the authorities and the US government are trying to calm the situation, there are fears in Silicon Valley that the SVB will drag numerous start-ups into the abyss.

Customers of the SVB withdrew 42 billion US dollars on Thursday and thus plunged the institute into bankruptcy. At the end of the day, the bank was short of approximately $958 million in cash in its treasury. This emerges from the order of the Californian financial regulator Department of Financial Protection and Innovation (DFPI), with which the authority declared the bank’s insolvency on Friday and took over the business.

Silicon Valley Bank’s client base consists of technology companies, start-ups and venture capitalists. Technology funds such as Peter Thiels Founders Fund, Coatue Management and Union Square Ventures advised their partners on Thursday to withdraw their deposits. In addition to business accounts, the SVB also keeps salary accounts for employees in Silicon Valley. Long queues formed in front of the bank’s branches.

Stock market crash

The collapse was triggered by doubts about the liquidity of the bank. On Wednesday, the SVB had a surprise communicatedto compensate for an investment loss of around USD 1.8 billion by issuing a new block of shares worth USD 1.75 billion. In another transaction, a financial investor should take over ordinary shares worth 500 million US dollars.

The news caused SVB Financial Group’s share price to plummet. On Thursday, the paper closed 60 percent in the red. The crash affected the entire banking sector. Shares of major banks around the world fell. As the trend continued in after-hours trading and at Friday’s open, the DFPI stepped in.

Ultimately, the SVB’s downfall was the increase in US interest rates and its specialization in the startup scene. Thanks to the tech boom of recent years, the illustrious group of customers had no money problems and asked for fewer loans. At the height of the boom in 2021, SVB had around $91 billion of customer deposits parked long-term in a comparatively low-risk asset portfolio of mortgage-backed securities and government bonds.

In the meantime, the US Federal Reserve has raised interest rates and another hike is on the cards. The bonds in the SVB portfolio thus lost value because they bear lower interest than current bonds. At the same time, it was to be expected that, given the rise in interest rates, start-up customers would no longer be able to access cheap money and would rather go to their own reserves – and thus withdraw money from the bank. There was also talk that the rating agency Moody’s could lower its rating of the SVB.

With a row “strategic measures” the SVB tried to avoid a liquidity shortage. On Wednesday, SVB sold nearly all of its $21 billion worth of salable bonds, announcing that the move would result in a $1.8 billion loss on its balance sheet in the first quarter. The minus should be compensated with the issue of new shares. The news triggered the price slide. Then on Friday came the feared one Devaluation of Moody’s.

The collapse of Silicon Valley Bank is the largest US bankruptcy since Washington Mutual filed for bankruptcy in September 2008 as a result of the real estate crisis. SVB was ranked 16th on the list of the largest US banks. The books contain assets totaling around 209 billion US dollars. Barely a year and a half ago, SVB Financial Group was valued at around $44 billion on the stock exchange. Now she’s broke.

Fear of startup bankruptcy

The bank failure could become a bigger problem for the startup sector. Deposits are insured by US law, but only up to $250,000 each. However, many business customers had millions in the bank – it remains to be seen what is left of them. The Federal Deposit Insurance Corporation (FDIC), which acts as the administrator, is trying to liquidate the SVB and use the proceeds to service claims beyond the statutory deposit insurance. There is no buyer for the SVB so far, but some of the big banks should at least consider a takeover.

The FDIC has yet to determine the proportion of unsecured investments. It is to be expected that most of the last 161 billion US dollars will be uninsured. At the end of 2022, the bank had estimated to the SEC that a good 95 percent of deposits were not protected by deposit insurance.

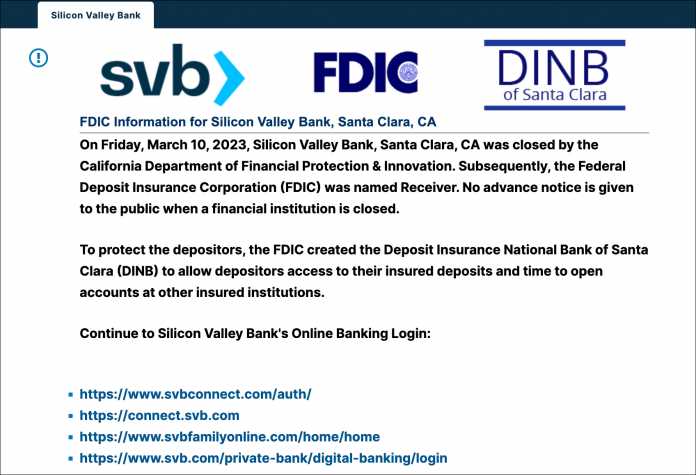

The new Silicon Valley Bank homepage, which was shut down by the Financial Regulator.

(Bild: Screenshot)

The SVB customers lack this money, at least for the time being. For start-ups, this can mean that they will no longer be able to pay the next salary round. Also for the operative business now money is missing. In addition, young start-ups in particular will find it difficult to secure follow-up financing in view of the declining tech boom and higher interest rates. Fear of a series of bankruptcies is raging in Silicon Valley.

The bankruptcy of the SVB could pull hundreds of small tech companies into the abyss, warns Garry Tan, president of the start-up forge Y Combinator, on the US broadcaster CNBC of a domino effect. He estimates that more than 1,000 start-ups have been affected by the bankruptcy and that around a third of them will soon find themselves in existential difficulties if they cannot get their money.

The FDIC has an advance payment on liquidation proceeds for owners of uninsured depositors for the coming week provided in promising. According to unconfirmed reports, that could happen as early as Monday if the FDIC makes progress on its liquidation over the weekend. The total depends on how much assets the FDIC can already liquidate. According to a Bloomberg report, it’s about 30 to 50 percent of unsecured deposits or even more.

German start-ups affected

In Germany, too, start-ups are affected by the bankruptcy, reports the Handelsblatt. Among them are companies like HelloFresh and Lilium. The Federal Financial Supervisory Authority (BaFin) confirmed to the Wall Street Journal that it was in contact with SVB’s German subsidiary.

In addition, experts and politicians worry that the crisis of a niche regional bank will spread to other small banks and markets. “It’s like a Lehman Brothers moment for Silicon Valley,” Time magazine quoted an anonymous founder who has millions in the SVB. The US investment bank Lehman Brothers collapsed as a result of the real estate crisis, fueling the global financial crisis.

In Washington, the US government is therefore trying to calm the situation. US Treasury Secretary Janet Yellen called a crisis meeting with the authorities involved on Friday. You have “complete confidence that the banking regulator will take the right action,” Yellen said on Friday. Government economic advisers pointed to new rules introduced after the 2008 crisis to make the banking system less vulnerable overall.

Meanwhile, the British central bank has initiated bankruptcy proceedings for the SVB subsidiary in London. SVB UK reportedly has around 650 employees and handles thousands of accounts. Treasury Secretary Jeremy Hunt spoke of a “serious risk” for the tech sector and assured companies in the UK that were hit by the bankruptcy that they would be helped quickly.

(vbr)