Caijing Capital Market News November 19, market hotspots have increased significantly, and hydrogen energy has exploded into the hottest sector, driving the rise of the main line of new energy. Brokerage concept and real estate rose in the afternoon, while chemical raw materials, transportation logistics, sensors, auto parts, etc. rose at the top. The salt lake lithium extraction callback fell before the decline, the chicken concept and the civil aviation airport weakened.

Plate distribution

In the broader market, the index fluctuated in the red market after the opening, and it rose and strengthened in the three-line afternoon, and closed at a high end in the end. As of the close, the Shanghai Composite Index rose 1.13% to 3,560.37 points; the Shenzhen Component Index rose 1.19% to 14,752.49 points; the ChiNext Index rose 1.04% to 3,418.96 points. The total turnover of the two cities was 1.1132 billion yuan, and the net purchase of northbound funds was 8.293 billion yuan.

Market trend

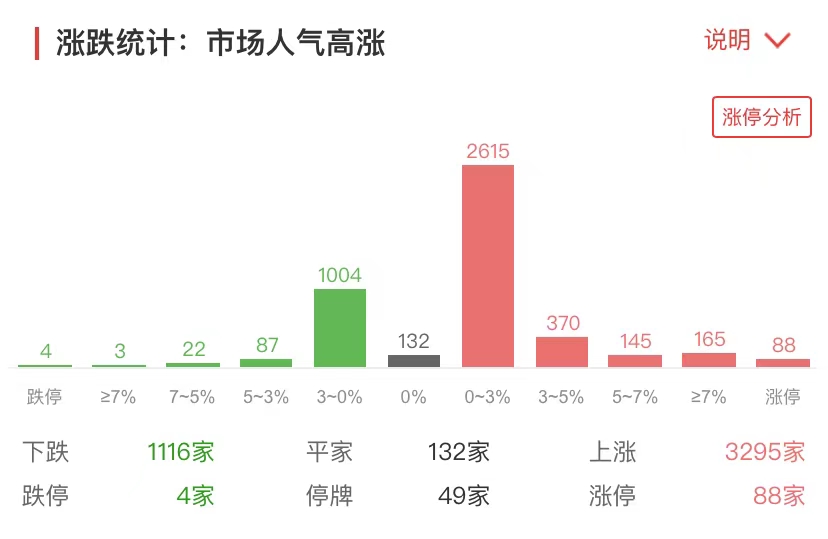

In terms of individual stocks, under the third-line rise of more than 1%, 3295 shares closed up, 88 shares rose by a daily limit, 1116 fell, and 4 shares fell by a limit. The number of individual stocks rose and fell in line with the index trend.

Individual stocks

Regarding market trends, Soochow Securities analyzed that the boom track has recently become the core of the market’s leading gains, but the risk of chasing gains is still relatively high. Under the current market environment, the effect of low absorption and ambushes on the left is more ideal. In terms of operation, it is recommended that investors, on the one hand, have a proper midline layout for low-value and low-value sectors, and on the other hand, keep track of the high-prosperity track.

Today’s market theme: Hydrogen energy outbreak!The main line of new energy is still going up

On November 19, with the increase in market hotspots, the theme of today’s market became a little fuzzy. The explosion of hydrogen energy led the market and led the new energy main line. As of the close, hydrogen energy rose 3.28%, Zhongtai shares, Zhiyuan new energy 20% daily limit, Meijin Energy, Dongfang Electric, Yangmei Chemical, Jincheng shares, Kangsheng shares daily limit.

Hydrogen energy leads the rise of individual stocks

Although the main line of new energy continues to rise, it is slightly weaker than the other rising sectors. Among them, solar energy rose by 1.67%, lithium battery rose by 1.38%, wind energy rose by 0.92%, upstream resource stocks rose from a high level, and the salt lake lithium extraction fell 0.73%.

On the news, the Ministry of Transport recently formulated and issued the “14th Five-Year Development Plan for Comprehensive Transportation Services.” The “Plan” proposes to actively promote the application of new energy and clean energy vehicles and ships in the field of transportation services, and increase policy support for operations, traffic, parking, and charging. Accelerate the planning, layout and construction of infrastructure such as charging, replacement, and hydrogenation. The proportion of new energy vehicles in public transportation, rental, logistics and distribution vehicles is not less than 80% in the national ecological civilization experimental zone and the key areas for air pollution prevention and control.

Galaxy Securities pointed out that a number of blockbuster documents have been issued successively this year, proposing prospects for the development of hydrogen energy. The “14th Five-Year Plan” hydrogen energy industry plan has been released in many places to lay out future hydrogen energy infrastructure construction. Different policies all reflect the strong support for the hydrogen energy industry. The agency said that overall, the policy supports the development of hydrogen energy, and the long-term development potential of the superimposed industry is large. It recommends investment opportunities in hydrogen production, storage and transportation, and core components and vehicles in the hydrogen energy industry chain.

Market changes: the concept of brokerage and real estate rose rapidly in the afternoon

On November 19, the brokerage concept fluctuated sideways after the opening of the market, and suddenly rose in the afternoon. Many brokerage stocks moved collectively. Xiangcai shares raised the closing board and Great Wall Securities rose to touch the board. As of the close, brokerage concepts rose 2.38%, Xiangcai shares rose by daily limit, Great Wall Securities rose 7.53%, Guangfa Securities rose 6.23%, and Orient Securities rose 4.42%.

Brokerage concept led the rise of individual stocks

In the afternoon, the real estate sector also moved with the concept of brokerage. During the early trading period, the real estate sector fluctuated sideways around the flat line. In the afternoon, there was a gentle upward trend. In the late trading, it rose to the top and then settled at a high level. As of the close, real estate rose 1.62%, of which Vantone Development’s daily limit, Guangyu Development and Sunshine City rose more than 9%, Special Development Services rose 8.86%, and Poly Development rose 7.29%.

Real estate leading stocks

On the news, in terms of the brokerage concept, Soochow Securities believes that the top-down logic of the brokerage sector is becoming more and more clear and the market has gradually formed a consensus of “from high to low”, and the securities sector’s valuation is obviously attractive. At present, what constitutes the long-term α of the brokerage sector is the sub-industry chain under the wealth management business, the derivatives business that has room for growth overseas, and the investment banking business and asset management under the registration system, mergers and acquisitions and other expansion businesses. The medium-term boom is impressive. With the continuous expansion of investment advisory pilots and the establishment of the Beijing Stock Exchange, a series of capital market reforms are expected to continue to improve the performance of securities firms.

In terms of real estate, the China Interbank Market Dealers Association recently held a symposium with representatives of real estate companies. Some real estate companies that plan to issue bonds in the interbank market recently participated in the meeting. Since then, the issuance of the inter-bank bond market for real estate enterprises has accelerated. Since November 10, 10 real estate companies have announced the news of issuing bonds in the interbank market, involving an amount of approximately 14.33 billion yuan. From November 1-10, real estate companies have issued 10.60 billion yuan in bonds, and the issue was issued in October. The scale is only 18.68 billion yuan.

In addition, on November 19, Agile Group Holdings Co., Ltd. issued a voluntary announcement on the scheduled repayment of fixed-term loan credit. Agile stated that as of the date of this announcement, funds have been remitted to the bank account designated by the credit agent in order to meet the repayment date on time The Hong Kong dollar loan of 3.345 billion Hong Kong dollars and the US dollar loan of 60 million US dollars were repaid.

According to the announcement, on May 21, 2018, the Agile Group was granted two fixed-term loan credits of HK$88.34 and US$200 million for a period of 48 months. It is reported that among the credits, there are about 3.345 billion Hong Kong dollars in Hong Kong dollars loans and 60 million US dollars in US dollars loans that will mature on November 22, 2021.

Market changes: “Double Eleven” shopping boom promotes logistics boom

On November 19th, Transportation Logistics pulled up higher, and the plate trended strongly throughout the day, closing at a high point in late trading. As of the close, delivery logistics rose 2.32%, of which Xiamen Xiangyu rose 10.05%, Shentong Express, Yunda Express daily limit, Yuantong Express, Feilida rose more than 8%, SF Holdings rose 3.18%.

Delivery logistics led the rise of stocks

On the news, monitoring data from the State Post Bureau showed that from November 1st to 11th, postal and express delivery companies across the country handled 4.776 billion parcels, a year-on-year increase of more than 20%. Among them, a total of 696 million shipments were processed on November 11, a record high.

Monitoring data also showed that in the first three quarters, the total business volume and business revenue of the postal industry reached 981.54 billion yuan and 927.93 billion yuan, an increase of 29.3% and 18.7%, respectively, an increase of 2.2 and 5.1 percentage points from the same period last year. Among them, the express business volume and revenue completed 76.77 billion pieces and 743.08 billion yuan, an increase of 36.7% and 21.8% respectively.

China Merchants Securities pointed out that this year’s e-commerce platform promotion model and rhythm have changed, and the peak of promotion has changed from the “single peak” (November 11) in previous years to the “Double peak” of this year (November 1 and November 11) , But the business volume growth from the 1st to 11th is still more than 20%. At present, online consumer demand is still strong, and the industry’s business volume growth rate is stable. Under the dual effects of policy dividends and adjustments to payment fees, the industry unit price has risen, and the overall industry has entered a benign development channel.