There is no peace for construction companies

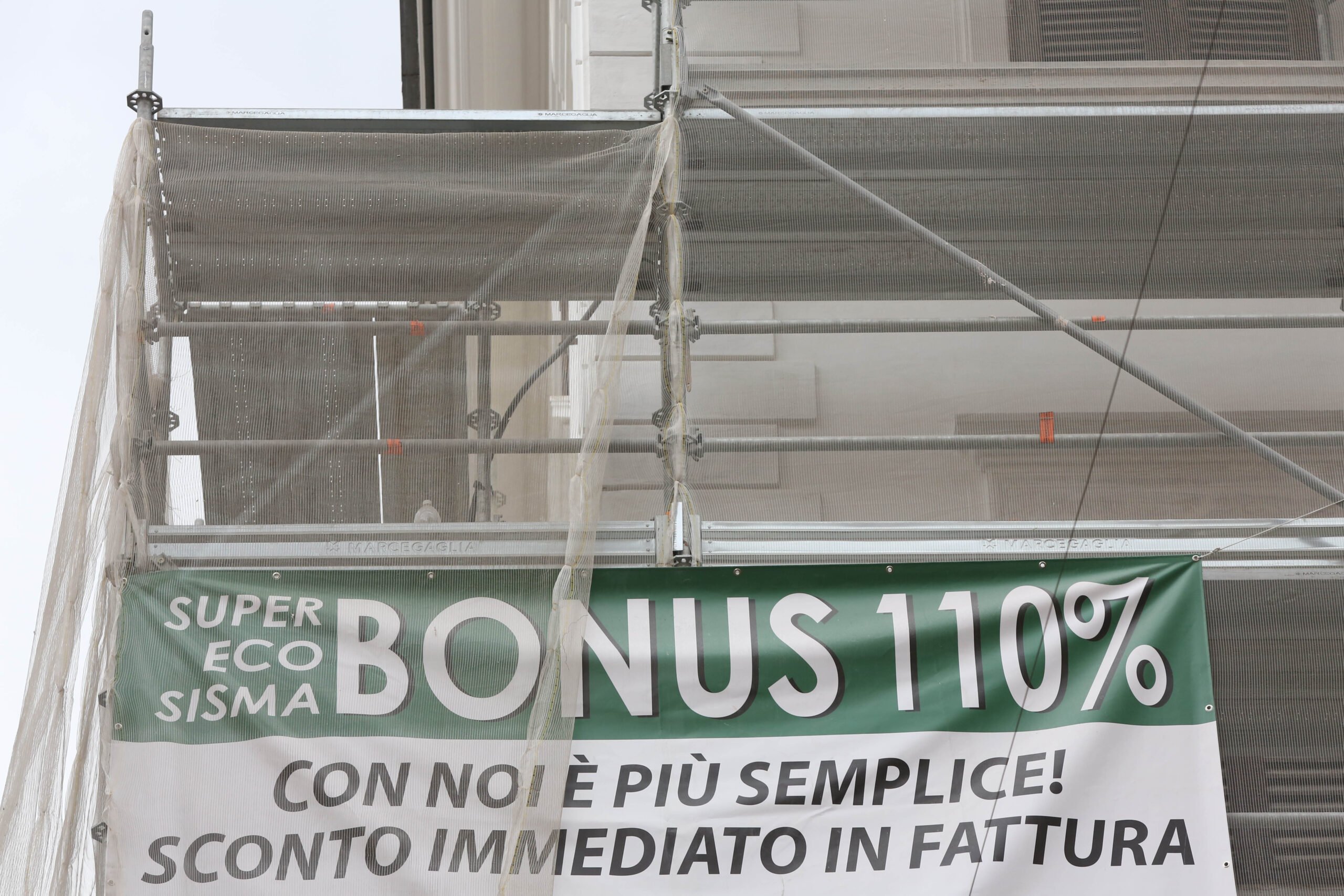

They thought they had found a lifeline in the Superbonus 110%. And instead they are in a lot of trouble with the risk of jumping due to low liquidity. The Council of Ministers has blocked the possibility of transferring tax credits and invoice discounts without solution for the past. At the same time it has also launched a series of measures aimed at speed up the Pnrr. But the point is that now construction companies are navigating on sight suffering the joint effect of the blockage of the tax credit market, the increase in the cost of money and the greater difficulties in accessing credit linked to the increase in interest rates, as well as the lenders fear of new bad debts. The perfect storm.

“It was decided to intervene and block this sale in the future, because there has been a rise in credits and, alas, planning was lacking in the previous government. The number of credits has been allowed to rise without monitoring and verification. We were faced with a situation now practically almost out of control. For this reason it was necessary to intervene” explained the deputy prime minister Antonio Tajani at the press conference. The government then announced that on Monday it will receive representatives of trade associations to evaluate possible operational proposals aimed at buffering a situation that is the result of “a wicked policy that costs each Italian 2 thousand euros each. Because this is the balance of this experience” as explained by the Minister of the Treasury, Giancarlo Giorgettialso announcing the end of the invoice discount.

In the same decree, the executive also clarified by law the joint and several responsibilities of the assignees establishing that, without prejudice to the cases of willful misconduct, joint and several liability is excluded for transferees who demonstrate that they have acquired the tax credit and are in possession of all the documentation relating to the works that gave rise to the credit. The provision therefore protects intermediaries, banks and post offices. Finally, he undertook to find a solution for companies in the construction sector as well.

Block for the purchase of tax credits by local authorities

Yet just recently, builders had seen the light at the end of the tunnel: some local authorities had started buying tax credits. The province of Treviso was the first to come forward, purchasing 14.5 million credits to be brought into compensation over the next few years. Then the Veneto Region, Basilicata and Pieonte moved. But, on the basis of findings from the Accounting Department, the executive has decided to stop local authorities to avoid an impact on public finances. For the president of Ance, Federica Brancaccio, a misstep that risks putting the sector on its knees,

“Since October we’ve been waiting to understand how to solve one situation that has become dramatic: we don’t realize the devastating consequences on the economic and social level of such a decision”explains the president in a note. To this then they also add the delays in the payment of compensations (over 600 million) promised by Mario Draghi’s government for the increase in material prices.

With the bowls still, according to the Abi, the market is still until 2027

Meanwhile, the purchases of tax credits by the banks are at a standstill. According to reports from the Italian Banking Association, if there are no regulatory corrections, the blockade will go on until 2027. “The problem of the saturation of the fiscal capacity will manifest itself in all its intensity” explained the director general of Abi, John Sabatini, in the latest hearing in the Senate Finance Committee. “The purchase operations carried out in 2021 are added to those of 2022, and will last until 2026-2027 “, that is the last of the five in which the compensation of the credits deriving from the superbonus can be carried out.

Because of this Abi asked to introduce “a new method of use to offset tax credits” for credit institutions and the post office. But so far the option has not been considered by the government.

For now, the match remains in the hands of the construction companies

“Every billion of problem loans results in the blocking of about 6,000 interventions (including single-family houses and condominiums), with the risk of bankruptcy of at least 1,700 construction companies and the loss of about 9,000 employees” estimates the National Association of Building Builders (Ance). “Under a conservative assumption of a stock of stranded tax credits of 15 billionthe macroeconomic effects could be extremely worrying” continues the association.

The budget? According to Ance, at this point in the story, they refer to each other 25,000 failed businesses and 130,000 unemployed more in the construction sector. “This estimate does not include the possible bankruptcies that could occur in companies in the construction supply chain supplying construction companies). Such a situation would cause problems on approximately 90,000 construction sites, which would translate into as many families in crisis” specifies ANCE.