Gold prices have been soaring in China, setting new historical highs and causing a frenzy among investors. The Central Bank of China has been buying gold internationally for 16 consecutive months, pushing up prices and prompting concerns about the implications of such actions.

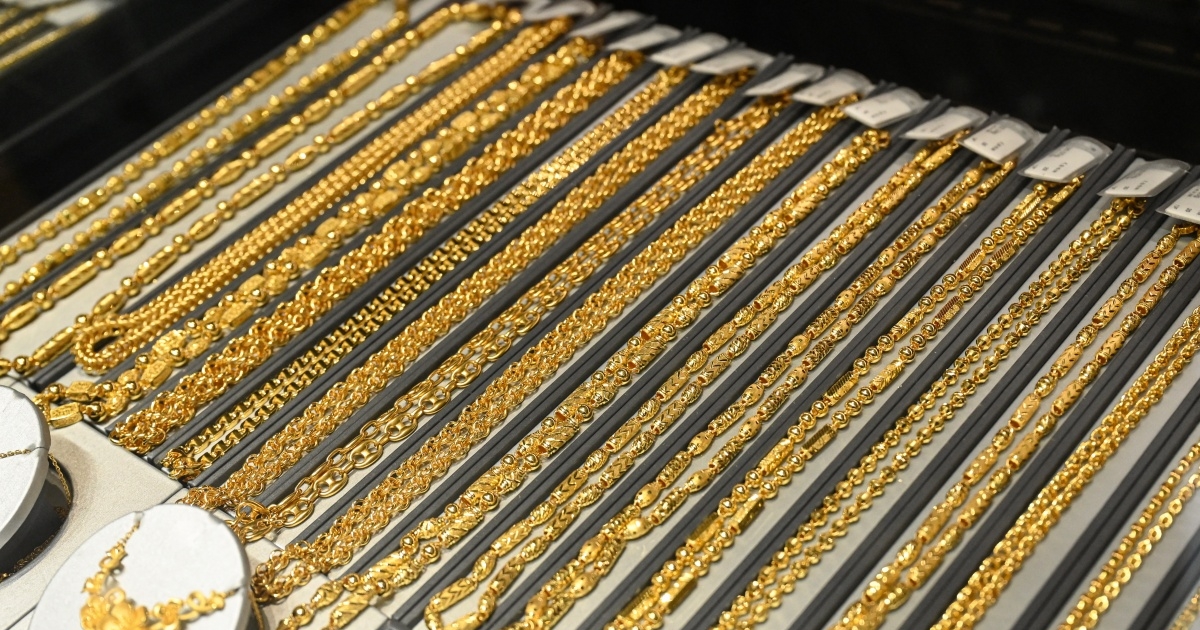

The spot gold price in London exceeded US$2,160 per ounce, while the COMEX gold futures price reached US$2,172.2 per ounce, both setting new records. In China, Shanghai gold rose to 505.88 yuan/gram, with retail prices ranging from RMB 657 to RMB 660 per gram. The surge in gold prices has been described as a roller coaster ride for investors.

The People’s Bank of China announced that as of February 2024, China’s gold reserves were 72.58 million ounces, an increase of 390,000 ounces from the previous month. This marks the 16th consecutive month of increasing gold holdings, with a cumulative increase of 9.94 million ounces since November 2022.

Experts speculate on the reasons behind China’s aggressive gold buying, with theories including preparation for a Taiwan invasion, preserving financial resources amid economic challenges, and meeting increasing demand for safe-haven assets. Some analysts suggest that rising gold prices could be seen as a precursor to war.

The surge in gold prices has sparked alarm among Chinese investors, with some viewing it as a sign of troubled times or even an impending conflict. As the debate continues, experts advise investors to pay attention to the central bank’s actions and make informed decisions about gold investments.

As the price of gold continues to rise, the implications of China’s gold-buying spree remain a topic of debate and speculation among investors and experts alike.