(Original title: The global central bank’s gold purchases set a new record, A-share gold giants are approaching the daily limit, the main force has entered the market, and jewelers’ first shares are most favored by institutions)

The slowdown in inflation and interest rate hikes has given gold ample room to rise. In 2023, will the A-share gold sector take advantage of the trend to rise?

On January 9, the stock price of Zijin Mining rose by 9.68%. The latest stock price hit an eight-month high, and the value of the A-share market reached 235.6 billion yuan. It is understood that Zijin Mining is China’s largest listed mineral gold company. In 2021, the company’s mineral gold production will be 47.5 tons, and the total domestic mine gold production will be 258.09 tons in the same period. The company’s output accounts for 18.4% of the total domestic output.

On the disk, many gold concept stocks rose sharply. Jinyi Culture was blocked by the daily limit in early trading, and Shengda Resources, Dia shares, Jincheng Chengxin and others rose by more than 6%.

According to the statistics of Securities Times·Databao, the total net inflow of main funds of gold concept stocks today is 890 million yuan. Zijin Mining ranked first with a net inflow of 629 million yuan, followed by Intime Gold, Western Mining, and Jinyi Culture.

International gold price rebounded sharply

Institutions are optimistic about the trend in 2023

The international gold price maintained a rising trend after New Year’s Day. As of now, the price of gold in London has remained around $1,878 per ounce. Data show that the price of London gold has risen for three consecutive months since it hit a stage low of US$1,616.51 per ounce in November last year, with an increase of more than 16% during the period.

It is reported that in 2022, the global central bank’s gold purchases will hit the highest level in history, and the Chinese central bank will restart gold purchases. According to data from the World Gold Council, in the first three quarters of 2022, the global central bank’s gold purchases reached 673 tons, the highest level since records began in 1967. In 2022, under the background of violent fluctuations in asset prices in the global financial market, central banks of various countries choose to increase their holdings of gold to achieve the goals of diversifying risks, stabilizing volatility, and fighting inflation.

According to data from the People’s Bank of China, as of the end of December last year, the central bank’s gold reserves reported 64.64 million ounces, an increase of 970,000 ounces from the previous month. This is the second consecutive month that the central bank’s gold reserves have increased.

Minsheng Securities stated that the term spread continued to invert, implying that the US recession is expected to gradually increase, the 10-year treasury bond interest rate and the benchmark interest rate have deviated, and the effect of interest rate hikes on nominal interest rates has gradually diminished. The rate hike in December slowed down, and the market It is expected that interest rate hikes will stop in the first half of 2023, and loose monetary policy can be expected. From the perspective of real interest rates, nominal interest rates may peak in the first half of 2023, while inflation may repeat. With the start of the Fed’s interest rate cut cycle, the bull market in gold prices will be officially established.

Galaxy Securities believes that as inflationary pressures in the U.S. are eased by rising employment and wages but the risk of economic recession increases, the market expects the Fed to further slow down the rate hike process and end the rate hike cycle in the first half of 2023, which is good for gold prices.

40% of the gold concept stock market earnings ratio is less than 20 times

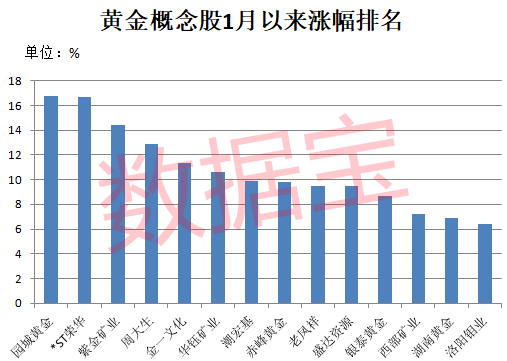

According to the statistics of Databao, in just 5 trading days from January to now, the gold concept index has increased by 4.46%, outperforming the Shanghai Composite Index by 1.65 percentage points during the same period. Six stocks including Yuancheng Gold, *ST Ronghua, Zijin Mining, Zhou Dasheng, Jinyi Culture, and Huayu Mining have increased by more than 10%.

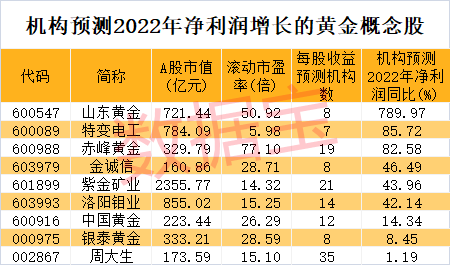

Judging from the valuation level, as of now, 40% of the stocks have a rolling price-earnings ratio of less than 20 times. The rolling price-earnings ratios of TBEA and Western Mining are all below 10 times. TBEA’s rolling price-earnings ratio of 5.98 times is at the lowest position. The company plans to produce 1.5 tons of gold in 2022. In the first half of 2022, the company’s gold business income is 236 million yuan.

In terms of institutional attention, a total of 26 stocks received positive ratings from securities firms’ research reports. In comparison, jewelers are more favored by institutions. According to the statistics of Databao, Chow Tai Sang has received positive ratings from 35 institutions. The company is one of the largest jewelry brand operators in China, and its main products include diamond-encrusted jewelry and plain gold jewelry (mainly gold jewelry). Other jewelers such as Dia, Chaohongji, Laofengxiang, Yuyuan, and China Gold have all been rated by more than 10 institutions. According to the unanimous forecast of more than 5 institutions, Shandong Gold, TBEA, Chifeng Gold, Jincheng Chengxin, Zijin Mining, and China Molybdenum Co., Ltd. are expected to see their net profit growth rate exceed 40% in 2022.

The agency predicts that Shandong Gold will have the highest net profit growth rate, and the net profit growth rate is expected to reach 7.9 times last year. According to the 2022 semi-annual report, Shandong Gold’s Linglong Gold Mine, Jiaojia Gold Mine, Sanshandao Gold Mine, and Xincheng Gold Mine have successively achieved cumulative gold production of over 100 tons across the country.

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insights into policy information, and seize wealth opportunities.