Today (September 20) afternoon, Sony Holdings Group (02103.HK) suddenly plummeted, and its stock price fell to 0.37 Hong Kong dollars, a drop of more than 90%. As of the temporary announcement of the suspension (3:38), the share price of Sony Holdings was reported at HK$0.50, a decrease of 87.01%, and the latest market value was HK$1.785 billion.

On the same day, there were rumors in the market that the personnel department of Sony Holding verbally notified all employees of the group headquarters to reduce salaries. Among them, the level of vice president was reduced by 70%, the level of general manager was reduced by 60%, and the level of director was reduced by 50%.

Regarding the rumors of salary cuts, a person close to Xinli told the “Daily Business News” reporter that the rumors were true. The company’s HR notified the heads of various lines in the headquarters on September 17, and they were notified one-on-one.

It is worth mentioning that on September 15th, Fitch Ratings released a report, adjusting the outlook of Sony’s long-term issuer default rating from “stable” to “negative” and confirmed the rating as “B”. Previously, Standard & Poor’s has adjusted the rating outlook of Sony Holding Group from “stable” to “negative” and maintained its long-term issuer credit rating as “B”.

The share price of Sony Holding Group plummeted on September 20. Source: Oriental Fortune

Emergency suspension of stocks and debt double kills

Regarding the stock price plummeting this afternoon, the person responsible for Sony Holdings responded to the “Daily Business News” reporter and said that an announcement will be issued later today.

However, the “Short Trading Suspension” announcement issued by Xinli Holdings this evening also only stated that “an announcement containing inside information is pending.”

In fact, the share price of Sony Holdings plummeted today, and some clues have appeared in the market before.

On September 15, the international rating agency Fitch lowered the outlook for Sony’s long-term issuer default rating from stable to negative, and its long-term issuer default rating was maintained at B+.

Not long before, Standard & Poor’s also adjusted Sony’s rating outlook to negative. Standard & Poor’s pointed out in the report that the adjustment of the rating outlook to negative is due to the damage to the capital market channels of Sony Holdings and the narrowing of its financing channels. In view of the volatility of its US dollar bond prices and the current pessimistic market sentiment, Sony’s overseas capital market channels are uncertain, and the company may need to use internal resources to repay overseas maturing bonds.

Screenshot of Sony Holding Group’s announcement

On September 18, the eight departments of Jiangxi Province issued a notice stating that they will implement key supervision on real estate companies that cannot repay their debts.

The reporter combed and found that Sony’s US$246 million bonds will mature in October 2021, and two other US dollar bonds (totaling US$453 million) will mature in January and June 2022. Their transaction prices are much lower than Face price.

However, since September, the number of US dollar bonds issued by the Sony Holding Group has fallen by a record. On September 17, the price of Sony’s October 2021 U.S. dollar bond fell by 25.5%.

As of the end of June 2021, Sony has 14 billion yuan in cash in hand, which is enough to cover 13.3 billion yuan of short-term maturity debt and can provide partial support for debt repayment. However, part of the cash still remains at the subsidiary level or joint venture projects.

At the same time, Sony’s joint venture project exposure will limit its cash flow. A high degree of participation in joint venture projects may reduce the company’s autonomy to mobilize cash from the project company. The consolidation rate calculated by Sony Holdings based on the equity ratio is only 60%-70% of the project company’s sales. The consolidation rate of its projects in the first half of 2021 is even lower, at about 45%.

Standard & Poor’s expects that Sony Holdings will reduce land acquisitions in order to retain liquidity for debt service. It is expected that the company will reduce its 2021 land purchase budget to only 15%-20% of the cash income from contract sales, which is much lower than the approximately 40% in 2020. Given that the company has 14.4 million square meters of land reserves as of the end of June 2021, the reduction of the land purchase budget should not have an immediate impact on the land reserves of Sony Holdings, which are sufficient to cover more than two years of sales.

Despite the company’s debt reduction, S&P expects Sony’s leverage ratio to rise to 5.8 times in 2021 and 6.1 times in 2022. At the same time, Standard & Poor’s predicts that Sony’s gross profit margin in the next two years is expected to fall from 24.4% in 2020 to the 20%-21% range, which will cause a drag on the leverage ratio. The construction expenses of Sony Holdings may also be reduced to a certain extent, thereby slowing down the property delivery process in the next 1-2 years.

Or there may be short-selling institutions

Judging from the USD debt situation previously announced by Sony, although prices have fallen, there has been no substantial default. The above-mentioned insiders close to Sony told the “Daily Business News” reporter that it is not ruled out that some people take advantage of the decline in bond prices and the low liquidity of Sony to raid short positions.

As of now, Sony Holdings has a total of three USD bonds during the duration: USD 210 million issued in June 2020, with a coupon rate of 10.5%, bonds maturing on June 18, 2022; and RMB 250 million issued in October 2020 USD, coupon rate 9.5%, 364-day bond; USD 250 million issued in January 2021, coupon rate 8.5%, bond maturing in January 2022.

The outstanding amount of the above three US dollar debts totals approximately US$694 million, one of which will mature in October this year. Fitch pointed out that the trading price of its bonds due in 2022 has appeared at a discount of 20% to 25%, indicating that Sony Holdings may need to use cash to repay all three bonds.

However, the management of Sony Holdings stated at the performance meeting that for nearly US$700 million in US dollar debt, Sony Holdings will reserve its own funds or apply for new US dollar debt coverage based on market conditions.

“It is difficult to explain the stock price drop by nearly 90% that day from the fundamentals of the industry and the company. There may be such institutions in the market. When everyone has insufficient confidence in real estate stocks, they use high-debt real estate stocks to sell short. Institutions.” The above-mentioned person close to Xinli said.

From a fundamental point of view, first of all, Sony’s liquidity is relatively small, relatively speaking, it is relatively easy to short; secondly, the cash flow of Sony is so tight that the funds for maintaining stock prices in the secondary market cannot be mobilized.

It is worth mentioning that in July this year, a document titled “Letter for Help from Zhang Yuanyuan, owner of Sony Real Estate” was circulated on the Internet. The rescue letter stated that in 2019, Xinli Holdings founder Zhang Yuanyuan encountered a financial fraud group when he promoted the listing of Sony, so that he owed 1.6 billion Hong Kong dollars in loan sharks and has not been able to escape the debt crisis. Since then, Xinli Group issued an announcement on its official microblog stating that the distress letter was false news, which had been spread overseas as early as a year ago. It was caused by a resigned employee. The company has already reported to Nanchang police.

Public information shows that as a large-scale comprehensive property developer, Sony Holdings has taken a leading market position in the residential property development business in Jiangxi Province, and has expanded its business to the Yangtze River Delta region, the Guangdong-Hong Kong-Macao Greater Bay Area, central and western core cities, and Other regions with development potential in China have achieved a national layout.

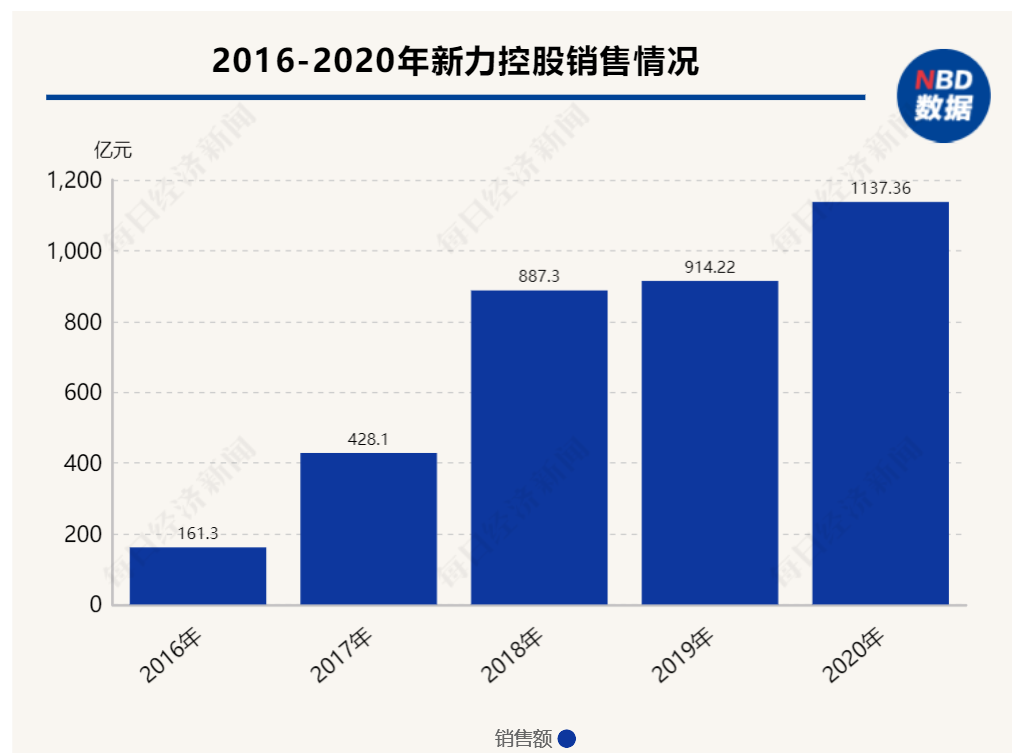

From 2016 to 2018, Sony’s sales were 16.13 billion yuan, 42.81 billion yuan and 88.73 billion yuan, with a compound annual growth rate of 136%. After successfully landing on the Hong Kong Stock Exchange in 2019, the sales of Sony Holdings shares that year were 91.422 billion yuan. In 2020, the sales of Sony Holdings reached 1137.36 yuan, successfully joining the “hundred-billion real estate enterprise camp”.

In the first half of this year, Xinli Holdings achieved full-caliber sales of 58.8 billion yuan, which has completed 51% of its annual sales target.

(Original by Maggie Real Estate, if you like, please follow meikedichan on WeChat)

Cover image source: Photograph.com