Through the major asset restructuring in 2020, Chongqing Beer (600132.SH) has advanced from a regional beer company to a national beer company.

On the evening of April 1, 2022, Chongqing Beer released its 2021 annual report. During the reporting period, sales volume, revenue, and net profit attributable to shareholders of listed companies all increased. One of the important driving forces to achieve growth is the company’s high-end strategy.

At present, China’s beer industry has entered the “stock market”, coupled with repeated epidemics, rising raw material prices and other factors, the development of the beer industry is facing many challenges. In this case, high-end development has become the main direction of the development of beer companies, and even thousands of yuan-priced beer has appeared in the market.

Under the multiple challenges, how will Chongqing Beer tell the story of high-end, and how far will the high-end strategy help the company go?

In 2021, the revenue of high-end products will account for 35.69%

At the end of 2020, Chongqing Beer completed a major asset restructuring, and Carlsberg injected all of its high-quality beer assets in China into Chongqing Beer. As a result, Chongqing Beer has not only become the only platform for Carlsberg to operate beer assets in China, but has also grown from a regional beer company to a national beer company.

After completing the restructuring and achieving advanced scale, how will Chongqing Beer perform in 2021?

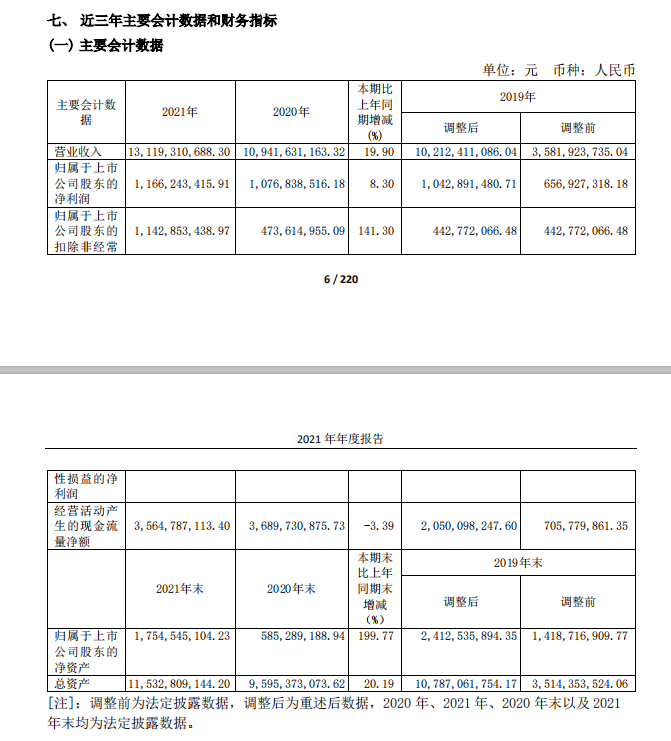

On the evening of April 1, the 2021 annual report released by Chongqing Beer showed that in 2021, the company achieved beer sales of 2.7894 million kiloliters, a year-on-year increase of 15.10%; realized operating income of 13.119 billion yuan, a year-on-year increase of 19.90%; The net profit was 1.166 billion yuan, an increase of 8.30% over the same period of the previous year (statutory disclosure data) 1.077 billion yuan.

Image source: Screenshot of financial report

The growth of Chongqing Beer’s sales, revenue and net profit in 2021 is related to the advancement of the company’s high-end strategy.

The financial report shows that in 2021, the company’s high-end product sales and revenue will increase by 40.48% and 43.47% year-on-year, respectively, and the growth rate has greatly exceeded that of mainstream and economic products. (Chongqing beer is divided into product grades according to the consumer price. Above 10 yuan is high-end, 6-9 yuan is mainstream, and below 6 yuan is economical.)

In this case, in 2021, the sales revenue of Chongqing Beer’s high-end products will reach 4.682 billion yuan, accounting for 35.69% of the company’s revenue. Compared with 29.82% in the same period of the previous year, it has increased by about 5.87 percentage points.

The reason why Chongqing Beer vigorously promotes the high-end strategy is related to the current situation of the entire beer industry. According to the analysis of Chongqing Beer’s 2021 annual report, after the production peaked in 2013, China’s beer industry has entered a downward cycle. Statistics show that in the eight years from 2014 to 2021, except for a slight increase in 2018 and 2019 and a 5.60% increase in 2021, the output in the other five years all declined. Compared with 2013, production in 2021 will drop by as much as 29.61%.

“The industry development in the past 8 years has proved that China’s beer industry has entered the ‘stock market’.” Chongqing Beer’s 2021 annual report stated.

SPDB International also analyzed in its research report in January this year that in the context of limited sales growth, the consumption upgrade and high-endization of the beer industry will be the biggest driving force for the development of China’s beer industry in the future.

Is the thousand-yuan beer an IQ tax or a general direction of high-end?

The beer industry is moving towards high-end, and major well-known beer companies are competing for layout.

In addition to Chongqing Beer, China’s top five beer companies currently include China Resources Beer, Tsingtao Beer, Budweiser Asia Pacific and Yanjing Beer. Recently, Tsingtao Brewery’s 2021 annual report shows that during the reporting period, Tsingtao Brewery’s high-end and above products achieved a total sales volume of 520,000 kiloliters, a year-on-year increase of 14.2%. competitive advantage. At the beginning of 2022, the company’s newly developed and listed art collection ultra-high-end product Tsingtao Beer “Legend of the World” continued to lead the consumption upgrade of the domestic beer industry to a new height.

Image source: Screenshot of Tsingtao Brewery’s financial report

On April 2, on the official flagship store of Tsingtao Beer Taobao, the price of Tsingtao Beer Centennial Journey I Legend 23.9 degrees 1.5L reached 1399 yuan a bottle. In fact, not only Tsingtao Beer, but also brands such as China Resources and Budweiser have successively launched thousand-yuan beer products.

More than 10 yuan is considered a high-end beer, but the company has made the price more than 1,000 yuan. Is sky-high beer or ultra-high-end beer the direction of high-end beer? It is worth noting that because beer cannot be stored for a long time like liquor, there is a view in the market that thousand-yuan beer is an “IQ tax”.

Chinese food industry analyst Zhu Danpeng said in an interview with a reporter from the “Daily Economic News” that for thousand-yuan beer, companies may not pay so much attention to sales, and more just use it as a brand marketing gimmick.

In August 2021, Li Zhigang, president of Chongqing Beer, said in an interview with the media that if there is a demand for high-priced beer in the market, he will also consider it, “but there is no idea of selling a bottle of beer for 1,000 yuan or 100 yuan.”

In any case, thousand-yuan-level beer has appeared. How far will the high-end beer develop in the future? Essence Securities analyzed in a recent research report that high-end beer sales accounted for 11% in 2020. It is expected that by 2025, the sales volume of high-end beer will reach 14%, and the sales volume will reach 41%.

In 2021, the sales revenue of Chongqing Beer’s high-end products has reached 35.69% of its revenue. How will the company promote the high-end strategy in the future? On April 2, Chongqing Beer responded to the interview of the “Daily Economic News” reporter, saying that the proportion of the company’s high-end products in the product portfolio still lags behind the international level. In the future, the company will continue to promote the high-end strategy and further enhance the high-end products. proportion.

Chongqing Beer also stated that the company has a “6+6” brand combination of “international high-end brands + local strong brands”. Based on this brand combination, on the one hand, the company can upgrade existing products to achieve high-end; on the other hand, it can continuously launch new high-end products. “All our work will focus on high-end products. For example, the promotion of our big city plans and the development of new retail channels will play a role in accelerating the process of high-end products.”

Rising raw material prices test companies’ ability to cope

Not only is the industry entering the stock era, but for the beer industry, it is also facing the pressure of repeated epidemics affecting consumption and rising raw material prices.

According to the analysis of SPDB International’s research report in January this year, starting from the second half of 2020, the price of beer raw materials will rise again on a large scale. In 2021, the price of imported barley will increase by 23.4%, the price of aluminum will increase by 40.2%, and the price of corrugated paper will increase by more than 20% during the year.

Rising raw material prices will undoubtedly push up the cost of beer companies. In 2021, the raw material cost of Chongqing Beer in the wine, beverage and refined tea manufacturing industry will be 4.13 billion yuan, accounting for 66.15% of the total cost, an increase of 5.37 percentage points compared with 60.78% in the previous year.

Image source: Visual China-VCG111330989582

Entering 2022, the cost of raw materials for beer will further increase. According to a research report by SPDB International on March 9, as Ukraine is an important exporter of crops, the situation in Russia and Ukraine has not only caused the price of crude oil and crude oil products to rise, but also caused the price of crops (including wheat, barley, corn, etc.) to rise sharply. . Since mid-February, the price of barley, the main raw material for the beer industry, has risen by 23%. On the other hand, the price of aluminium has also risen by 16% since mid-February.

Under the pressure of rising raw material prices, how does Chongqing Beer respond? The company replied that the company has made preparations in advance in 2021, and locked the volume and price of most raw materials. At the same time, during the bidding process, the company also conducted more price comparisons and digested some raw materials, packaging At the same time, by increasing cost savings and improving efficiency to cope with the pressure caused by the increase in overall costs; in addition, the continuous growth of sales volume has produced a greater scale effect, making the amortization of fixed costs, offset some of the impact of rising costs.

Chongqing Beer also said that when the above three measures could not absorb the pressure caused by rising costs, the company also adjusted prices to absorb part of the rising costs. “Chongqing Beer’s price adjustment strategy is based on different channels, different regions, and different brands.”

According to the statistics of SPDB International’s research report in January, in October 2021, Chongqing Beer upgraded the 330ml small can of Wusu liquor and changed the packaging to increase the price; in the fourth quarter of 2021, the price of each bottle of Dawusu in Xinjiang will be increased. 0.8 yuan, the ex-factory price of Green Wusu increased by 2 yuan.

For the development in 2022, Chongqing Beer once again mentioned high-end, that is, “continue to promote high-end products in the core market and consolidate the share of core beer”. The company also stated that while promoting the digitization of sales channels, it will continue to add new channels and new retail, and use the big data of e-commerce platforms to develop new flavors and new packaging, and accelerate product innovation iterations.