(Original title: The main capital | The two major technology leaders are “rising”, with more than 1.6 billion funds hot! The main force in the late trading is rushing to raise these stocks)

Technology stocks were the main players rushing to raise funds.

According to the statistics of the Securities Times·Databao, the net outflow of main funds in Shanghai and Shenzhen today was 19.597 billion yuan, of which the net outflow of ChiNext was 3.238 billion yuan, and the net outflow of Shanghai and Shenzhen 300 constituent stocks was 6.087 billion yuan.

Among Shenwan’s first-tier industries, only five industries rose today, and the computer and communication industries were the top gainers, all of which rose by more than 2.5%. Among the 26 declining industries, 8 industries fell by more than 1%, and the real estate, transportation, non-bank financial and household appliances industries were the largest decliners.

In terms of capital flow, only 4 industries received major net inflows. The computer, electronics, and media industries received net inflows of more than 1 billion yuan, respectively 5.255 billion yuan, 1.93 billion yuan, and 1.023 billion yuan; the communication industry received 988 million yuan. Yuan.

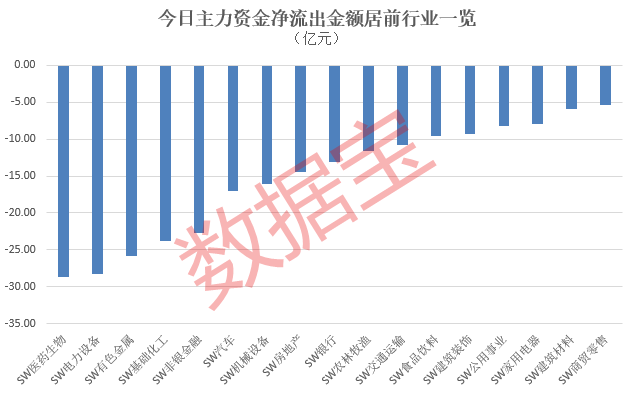

Among the 27 industries with net outflows of main funds, the pharmaceutical and biological industry ranked first, with a net outflow of 2.872 billion yuan for the whole day; followed by electric equipment, non-ferrous metals, basic chemicals, and non-bank financial industries, with net outflows exceeding 2 billion yuan .

The two leading technology stocks are favored by the main force

From the perspective of individual stocks, a total of 34 major stocks have a net inflow of over 100 million yuan. HKUST Xunfei ranked first with a net inflow of main funds of 812 million yuan; server leader Inspur Information followed closely, with a net inflow of 811 million yuan of funds throughout the day, and the stock has achieved two boards in three days. The two major technology leaders have a total of over 1.6 billion main funds.

HKUST Xunfei rose strongly today, and its intraday stock price hit a new high in the past year, closing up 7.2%. Previously, the company had given the exact product release time for entering the AIGC track. In February of this year, iFLYTEK responded on the investor interaction platform that it has successively open sourced a series of Chinese pre-training language models in 6 categories and more than 40 general fields for the field of cognitive intelligence. The Chinese pre-training model on the Github platform The number of stars reached 13,346, ranking first, twice that of the second. The company said that it has further launched the generative pre-training large-scale model task research in December 2022 on the basis of the current core technology, industrial scenarios, and industry data. product, which will be released at the production level on May 6, 2023.

It is reported that my country’s AI server market is currently growing rapidly. According to the latest “China Accelerated Computing Market (Second Half of 2021) Tracking Report” released by IDC, the scale of China’s AI server market will reach 35.03 billion yuan in 2021, a year-on-year increase of 68.6%. Inspur Information’s Inspur AI server market share reached 52.4%, and the market share exceeded 50% from 2017 to 2021.

In addition, there are TCL Technology, BOE A, People’s Daily Online and so on. In terms of stock price performance, there are Inspur Information, People’s Daily Online, Chuling Information, 360, etc. with a daily limit.

According to the statistics of Databao, 65 stocks suffered a net outflow of main funds exceeding 100 million yuan. Dongfang Wealth was sold a net of 683 million yuan, with the outflow topping the list. The company announced yesterday evening that the company’s subsidiary Orient Fortune Securities Co., Ltd. has recently completed the issuance of non-public corporate bonds (first phase) for professional investors in 2023. The bond issuance scale of this issue is 1.5 billion yuan, the coupon rate is 3.50%, and the redemption date is February 14, 2025. All the funds raised are planned to be used to supplement the working capital of Orient Fortune Securities.

Afterwards, China Merchants Bank and Changan Automobile were the top net selling stocks, with net outflows exceeding 400 million yuan.

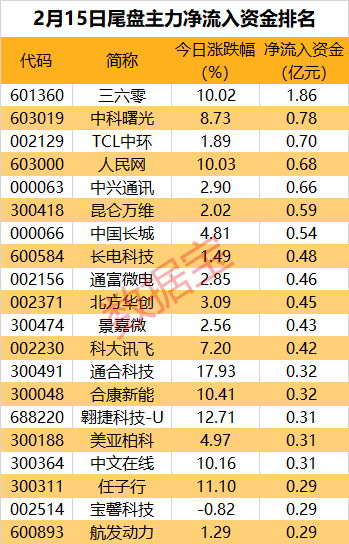

7 shares won the main force to raise more than 50 million yuan in late trading

According to the statistics of Databao, the net outflow of main funds in the two cities in late trading was 429 million yuan, of which the net inflow of ChiNext was 96.5814 million yuan in late trading, and the net outflow of Shanghai and Shenzhen 300 constituent stocks was 346 million yuan.

From the perspective of individual stocks, there are 7 stocks with a net inflow of more than 50 million yuan in late trading, and 360 has a daily limit today, and the main force rushed to raise 186 million yuan in late trading, ranking first. Yesterday evening, the company issued a bid-winning announcement announcing that its wholly-owned subsidiary 360 Digital Security Technology Group Co., Ltd. successfully won the bid for the project of “National Network Security Education Technology Industry Integration Development Pilot Zone Network Security Industry Base Major Infrastructure Group” project, and the bidder is Xi’an Future Industrial City New Infrastructure Development Co., Ltd., the project value is about 240 million yuan. The project mainly builds a digital city security operation center with the city security brain as the core, a digital city security research institute; builds a digital security industry base; builds a set of security operation service system.

Afterwards, Zhongke Sugon, TCL Zhonghuan, and People’s Daily Online were the most aggressive in the late trading, with 77.8494 million yuan, 70.3412 million yuan, and 68.2314 million yuan respectively.

Many blue-chip stocks were fleeing by the main force. BYD, Sungrow, and Oriental Fortune were the main players fleeing more than 80 million yuan in the late trading; China CDFG, Tianyu Digital, Luzhou Laojiao, Kstar and other main players had the largest net outflows in the late trading, all exceeding 40 million yuan. (Data Treasure He Yu)

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the official app of “Securities Times”, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.