The war in Ukraine is going on longer than expected and this makes the threat of one ever more concrete global food crisis. In the last month, the price of wheat recorded the largest increases among agricultural commodities, with an increase of 8% compared to the previous month. Price performance was largely driven by the Indian government’s announcement of a restriction on grain exports to manage domestic supplies. This announcement also surprised the markets because India had, on the contrary, declared its intention to increase exports given the supply losses from Ukraine which led to a rise in the prices of wheat on the global market.

In fact, in April India exported a record 1.4 million tonsalmost six times higher than that exported in April 2021. Now these quantities will have to be sourced elsewhere, and this could further reduce the already scarce stocks of the main exporting countries.

Agricultural commodities have more and more supply problems to deal with and the war in Ukraine, as well as unfavorable weather conditions are threatening the supply of key crops for the resilience of our economic system.

It must be considered that the areas of the conflict and in particular the regions of the Donbass they are those with the highest concentration of wheat production for Ukraine (source Mazziero Research).

In addition, the United States Department of Agriculture (USDA) also predicted a sharp decrease in winter wheat production in the US for 2022/23, due to drought in the southern plains.

Granaries of the world

Ukraine and Russia are two heavyweights in world agriculture and the outbreak of war between the two has forced importing countries to seek alternative sources of supply. Russia and Ukraine are among the world‘s top three exporters of wheat, maize, rapeseed, sunflower seeds and sunflower oil. Furthermore, Russia is the largest exporter of fertilizers globally.

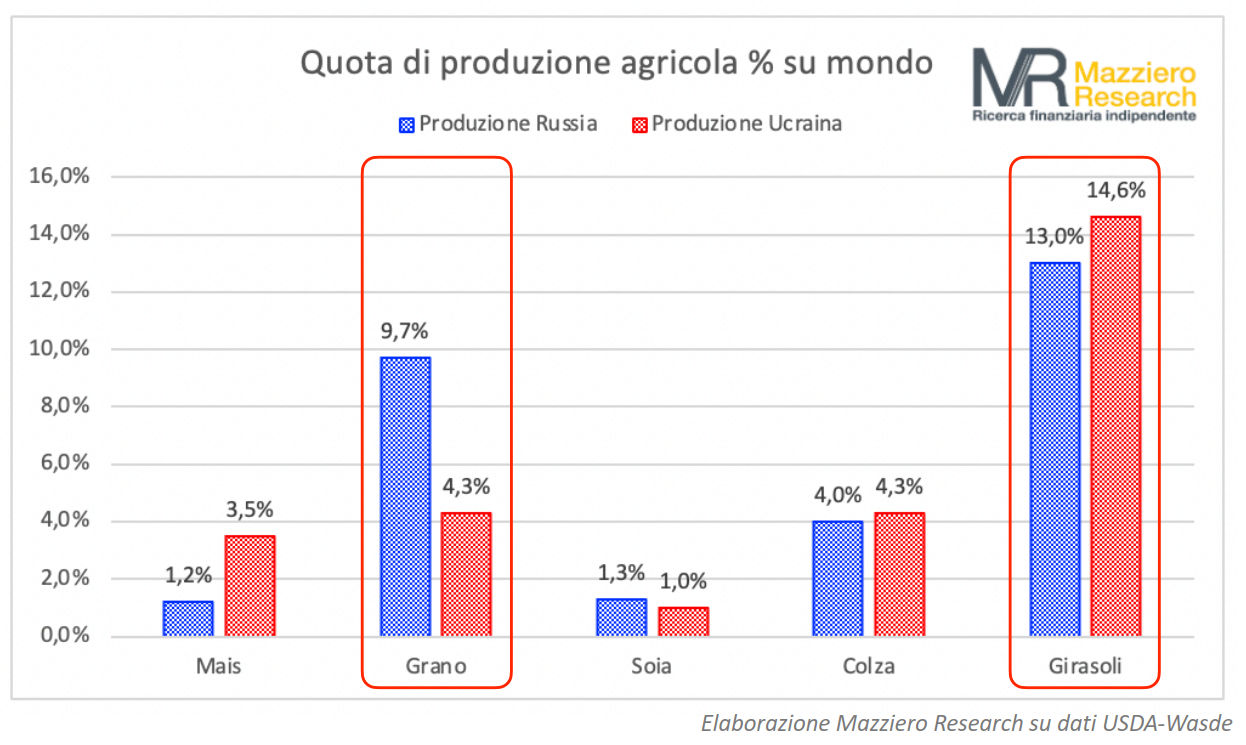

As we can see from the graph drawn up by Mazziero Research, Russia and Ukraine together produce the 14% of the world‘s wheat (9.7% Russia and 4.3% Ukraine); while from both countries it reaches beyond 27% of world sunflower production.

Impact on emerging countries

Given that emerging countries have limited capacity to replace these imports with substitute products, the adjustment to the shock in agricultural commodity prices will result in lower consumption for the 770 million people which according to the FAO were, even before the outbreak of the conflict, in a condition of malnutrition.

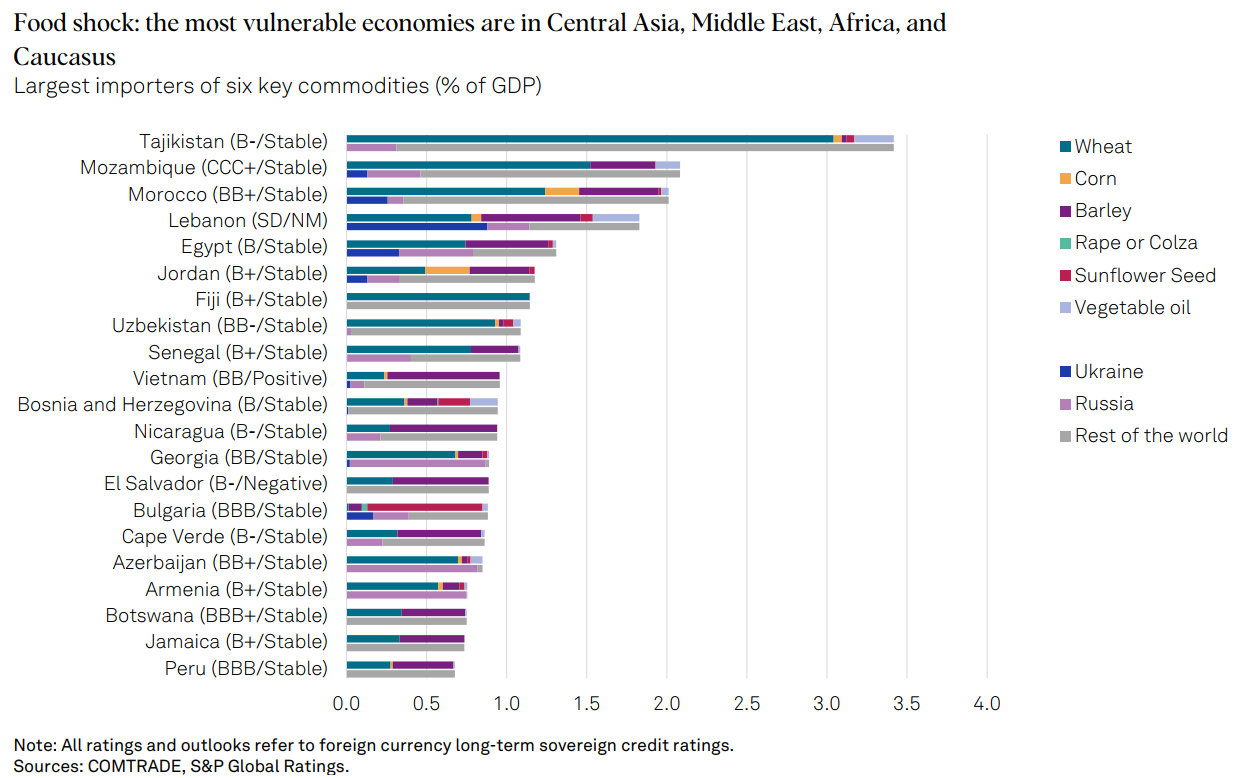

According to an analysis conducted by S&P Ratings, there are several countries that could suffer the highest consequences of a food crisis. For example the three nations of the Caucasus: Tajikistan, Uzbekistan and Armenia, are particularly exposed due to their complete dependence on Russia for imports of five key commodities such as wheat, corn, canola, sunflower seeds and sunflower oil. Similarly, the four Arab states: Morocco, Lebanon, Egypt and Jordandepend on Ukraine for their food supply and are therefore susceptible to war-induced port disruption.

As we can see from the graph below elaborated by S&P Ratings, the economies most vulnerable to a food shock are: Central Asia, the Middle East, Africa and the Caucasusbeing the largest importers of six key commodities as% of GDP.

Russia is also the world‘s largest exporter of fertilizer products, it is the leading producer of all three major fertilizer nutrients: nitrogen, phosphate and potassium. For these reasons, analysts at S&P Global Ratings predict that a significant amount of this trade could be disrupted by the continuing fallout from the conflict and the global food shock will last for years, not months.

Meanwhile, USDA estimates will be released on Friday 10 June world agricultural supply and demand which will give us more information on the current state of the economy. In addition, tomorrow 9 June, the Food and Agriculture Organization (FAO) and the United Nations will publish their Food Outlook semestraleessential for observing developments affecting global food and feed markets.