The recent adjustment of the U.S. stock market reflects the general outlook on Wall Street. Even the top U.S. banks are swaying in the face of market adjustment, and the strategies given by people with different titles are quite different.Only American retail investors, as always, are the top irons, and they will carry out bottom-hunting when they fall.

This week, JPMorgan head of global strategy Marko Kolanovic told his clients to buy the dip. At the time, his boss, JPMorgan CEO Jamie Dimon, was predicting to the media that the market would fall catastrophically if financial conditions tightened and the Fed raised interest rates more than four times.

Meanwhile, another JPMorgan advisory veteran, Bob Michele, the asset management group’s fixed income chief executive, urged the bank’s clients to “hide in cash” and warned that the Fed’s put options on the S&P could be 30 percent lower. %. “If the market’s main concern is to fight inflation and the Fed will let the market fall further, any put option could be a 15%-30% drop in stocks, not 2%-3%,” he said.

No matter who is right or wrong, American retail investors believed in Marko Kolanovic’s strategy and hurriedly entered the market to buy dips. Institutions sold in a hurry amid more hawkish Fed minutes and Powell remarks. Interestingly, this time, hedge funds did not stand on the opposite side of retail investors, but together with retail investors, they bought on dips to support US stocks.

As Bank of America’s Jill Carey Hall stated in the report, the bank’s clients were “net buyers of U.S. equities (approximately $500 million in gold purchases) in the first week of 2022, during which time the S&P 500 The index fell 1.9%. Both ETFs and stocks are assets that customers are actively buying.”

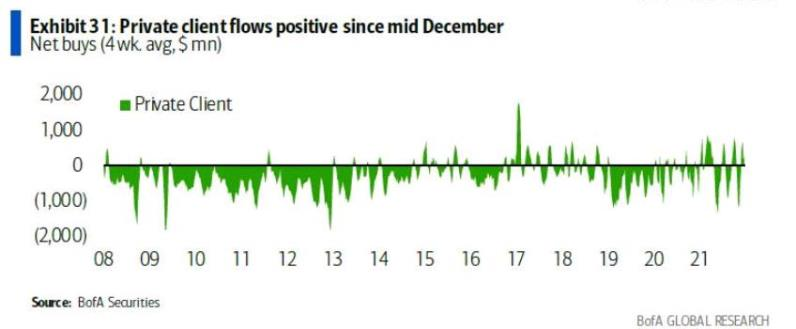

Jill Carey Hall continued to dig into the recent stock market capital flows, saying that the bank’s retail and hedge fund clients were the leading buyers during the sharp market correction last week, while other institutional clients were the clients who sold the most since the beginning of the year, with a net outflow of funds. The volume is the most in one week in the past year.

Jill Carey Hall also said that it continues to understand that the types of stocks purchased by its customers have no particular preference, and the market value is mixed.

Notably, as Goldman Sachs recently observed, retail investors are typically aggressive buyers in January, while other groups are sellers. On average, January was the strongest month for U.S. bank customer inflows into U.S. stocks, with net buying in 10 of the past 14 years, Jill Carey Hall said.

Retail investors bought $1.07 billion on Tuesday, the third day in a row that they bought more than $1 billion, said Peng Cheng, a quantification strategist at JPMorgan. Retail investors were braver in last week’s rout, with net buying on so-called Black Friday hitting an all-time high of $1.6 billion.

Even more interesting things have happened! When retail investors and hedge funds became the main bargain hunters, public companies were not idle. According to Bank of America data, the bank’s corporate customer repurchases started the year strongly and were above January levels in past years, including 2019 (before the COVID-19 outbreak). U.S. stock market buybacks this year have been led by technology, healthcare and financial stocks.

Analysts believe that more companies are expected to buy back. Because they typically accelerate buybacks in January-February after year-end seasonal weakness.