On April 30, local time, Berkshire Hathaway’s 57th anniversaryshareholderThe conference was held in Omaha, Nebraska, the hometown of its founder, Warren Buffett.this timeShareholders’ meetingIt is the first time since the outbreak of the epidemic in 2019 that it will be held offline. In addition to Buffett and Munger, Berkshire Hathaway’s two vice chairmen, Ajit Jain and Greg Abel, were on hand to answer questions this year.

According to the forecast of the conference, the number of participants this year may exceed 40,000 and set a new record.

In a high-profile question-and-answer session, Warren Buffett, 92, and his longtime business partner, Charlie Munger, 98, answered five and a half hours of questions.

△The general meeting of shareholders will start at 9:15 a.m. local time on April 30 (10:15 p.m. Beijing time). question and answer session.

Since the outbreak of the epidemic, the world economy has faced a severe situation, and pessimism has permeated among global investors. Against this background, the “stock gods” have made a lot of money this year. Acquisition of Alleghany for $11.6 billion,Coca ColaBig gains, successful betswestern oil… a pen operation can be called a “gold finger”.

At this shareholders meeting, Buffett’s retirement schedule, company successor, future investment plans, etc. once again became the focus of the global market. In addition, when is Buffett investing? How to choose companies to invest in China, etc., has also attracted investors’ attention.

Duchuang & Shenzhen Business Daily compiled the wonderful views and ideas of Buffett and Munger in the most watched Q&A session at the shareholders’ meeting, and shared their investment wisdom with readers.

▎Buffett: ‘Always have a lot of cash on hand’

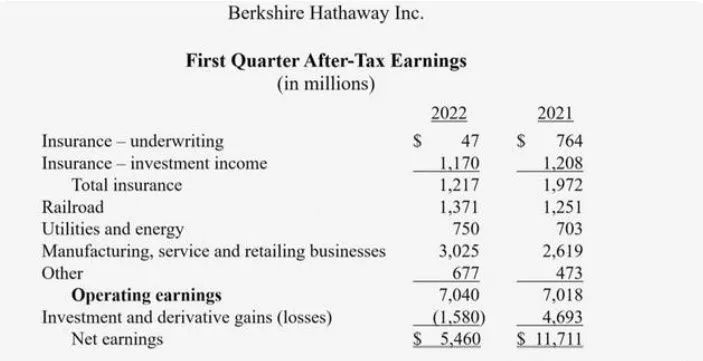

The latest financial report shows that Berkshire Hathaway’s operating profit in the first quarter was $7.04 billion, a year-on-year increase of 0.3%.net profit5.46 billion US dollars, down 53% year-on-year.The manufacturing, services and retail sectors saw earnings rise 15.5% to $3.03 billion, with rail andUtilitiesSegment earnings rose slightly.butInsuranceUnderwriting revenue fell to $47 million from $764 million a year earlier, and the investment business, which was hit by the economic downturn, lost $1.58 billion.

At the shareholder meeting, Buffett listed stock trading in the first quarter. The company bought a total of $51.8 billion in stock in the first quarter, while selling $10.3 billion. Among them, between the end of February and mid-March, $41 billion of stocks were bought in one go.Despite the sharp drop in cash levels, Buffett said the company will keep enough cash safe, which the company has not launched since Aprilshare repurchase。

Buffett said in his February shareholder letter that “there is nothing exciting” in the market. Big buys started shortly after.

“Always have a lot of cash on hand,” Buffett said at the start of the conference, recalling the 2008 financial crisis.

Buffett said that at the shareholders meeting two years ago, we didn’t know what was going to happen to the epidemic, we didn’t know what was going to happen to the economy.By 2022, Berkshire Hathaway has a $7 billionOperating income。

Buffett said, a lot of things will change, but one thing will remain the same, we will always have a lot of cash, not commercial paper, we do not havecurrencymarketfundwe believe there should be substantial cash holdings.

existperformanceIn the explanation section, Buffett reminded to be vigilant against economic recession and be prepared. “On March 20, 2020, the economy shut down due to the outbreak of the epidemic, almost repeating the situation of 2008-2009. Later, Fed Chairman Powell took quick action (release water, rescue the economy) to avoid the crisis. “If a similar crisis recurs, Berkshire, which has a lot of cash, can be as[comfortable]as the Fed that bails out the market. We need to plan ahead because economic stagnation may happen again.”

▎Buffett: Over the past two years, the stock market has been like a casino where everyone gambles

Buffett said that in the past two years, the entire capital market, the entire large stock market environment, including the trading market, etc., this market is elusive, just like casinos, it may also be that the stock market has been too bullish in the past two years. This is mostly driven by Wall Street institutions, their way of being speculative is to make more money from people’s frequent trades, and the market is sometimes misguided.

For some large transactions, many people only need two or three days to complete. Buffett specifically mentioned index funds, whose holdings tend to be very high. “It’s not an investment, Berkshire Hathaway can’t do that, and the vast majority of big U.S. companies have become poker chips,” he said.

However, Buffett believes that short-term volatility caused by a “gambling mentality” earlier this year has led him to good long-term opportunities.

Munger then named the InternetbrokerageShares of platform robinhood fell below $10 a share last week after announcing layoffs and a drop in active users, a far cry from a peak of $38 in its initial public offering. “Look at what happened, peak to trough. Isn’t it obvious what’s going to happen?” he said.

▎Charlie Munger: Found a better investment than U.S. Treasuries

On March 21, Berkshire Hathaway to acquire property and accident recovery for $11.6 billion in all cashInsuranceThe company Alleghany Corp. Buffett explained what happened: “On February 25, I received a short email from a friend who worked for Berkshire many years ago and said he had become CEO of Alleghany Corp. I’ve been following this company for 60 years, and I said I’d come to New York on March 7th, let’s meet, and the deal was made. I didn’t call the bank, I knew it would come at the price I proposed Buy this company, but I wouldn’t buy it without this email.”

Buffett said thatwestern oilThe company’s annual report is very good, so I decided toFixed votefund it.Speaking of early Marchwestern oilAt the time of the company’s huge investment, Buffett said he acquired 14% of the latter’s outstanding shares in the first two weeks of March, valued at more than $7 billion. Originally, only 60% of Occidental’s shares were tradable. He said short-term volatility in the market due to a “gambling mentality” since late February has allowed him to find good long-term opportunities. Munger also said that he has finally found an investment that is more worthwhile than U.S. Treasuries.

Munger commented that the current stock market is “almost a speculative frenzy”, and he mentioned high-frequency algorithmic trading and the increasing openness to new investors during the epidemic: “The computers that use algorithmic trading are fighting each other. This is an extraordinarily crazy period. There are traders who know nothing about the stock market and get advice from brokers who don’t know more about stocks, and it’s strange to have this system that the stock market has this casino nature, and that’s not what any country wants.”

▎When is Buffett investing? How to seize the moment?

Buffett said he never figured out how to time the market in time and missed the opportunity to buy stocks at the bottom in March 2020. “We have no idea what’s going to happen when the stock market opens on Monday,” he said in response to questions from the audience.

Sticking to a value investing strategy rather than focusing on short-term volatility in the stock market is an important characteristic of Berkshire Hathaway. “We’re not good at timing,” Buffett said. “What we’re good at is figuring out when to get enough money for us. We don’t know when to buy what, but we keep hoping that (the market) will be there for a while. Downside, so we might buy more.”

Buffett also recalls investing, buying his first stock at age 11, and reading Benjamin Graham’s “The Intelligent Investor” when he was 19 or 20. The way of investing has completely changed. “I read the book and saw a paragraph that told me my whole approach was wrong,” Buffett said.

He later said he wasn’t the only one with Berkshire Hathaway’s decision to buy shares. “I see headlines over and over again in newspapers that say ‘What Buffett is buying,'” he said. “Not me, Berkshire Hathaway. The headline says Buffett buys. This company, will attract more people, and the purpose of the title is to get people involved.”

The “stock god” revealed in a shareholder letter in February that the 15 largest holdings were partly selected by Todd Combs and Ted Weschler, who invested $34 billion in the two has full powers, including last year’sActivision Blizzardwhich currently holds a 9.5% stake in the company.

▎Buffett responds to investing in inflationary times: The best investment is to develop yourself

Asked about his previous remarks about inflation “robbing” stock investors, Buffett said the damage from rising prices goes far beyond that. “Inflation also hits bond investors, robbing people who have their money under the mattress. It robs pretty much everyone,” he said.

Buffett said that his answer may be more than (investing) a stock, the best thing you can do in it is that you have to be good at something, for example, you are the best doctor, the best No matter how much someone pays you, whether it pays you billions or a few hundred dollars, they are willing to give you some of the things they produce in exchange for the services you deliver to them. If you choose what you want to do, whether it be singing, playing baseball, or becoming a lawyer, no matter what it is, the ability you possess cannot be taken away by others.

So, Buffett reiterated that the best way to fend off inflation is to invest in your skills. At this time, what is more important is your personal ability. What others trade is your ability. The best investment is to develop yourself.

Buffett pointed out that inflation also increases the capital required by businesses, and maintaining inflation-adjusted profits is not as simple as simply raising product prices.

He advises against listening to those who claim to be able to predict inflation trends. “The answer is no one knows.”

▎Munger: Stay away from Bitcoin

When an investor asks which stocks to invest in amid rising inflation. Munger took the opportunity to reiterate his distaste for Bitcoin. “When you have your own retirement account and your advisor recommends that you put all your money in bitcoin, just say no,” he said.

Why is Bitcoin “evil”, Munger says? It really reduces the capacity of our national currency and the Federal Reserve system, both of which we absolutely need, and which is a key part of our need to maintain the credibility of our government.His answer implicitly refers to this week’sFidelityAn investment news. According to reports,FidelityInvesting will now allow employees to add a Bitcoin account to their 401(k) account.

All the while, Munger has remained hawkish on Bitcoin. At last year’s shareholders meeting, he said: “I don’t like this virtual currency kidnapping our existing monetary system. Bitcoin is like a financial product that was born out of thin air. The development of civilization is the opposite.”

Buffett warns shareholders of “new forms of money” as he recalls the 2008 financial crisis. Unlike farms and apartments, bitcoin doesn’t generate value, he said, and its price is only determined by how much the next person who buys it is willing to pay. Cryptocurrencies may have magical appeal right now because of the hype, but they are not productive by themselves. If someone told him that he could own all the bitcoins at a certain price, he wouldn’t take it because he wasn’t sure what he could do with it.

The analysis said that although Buffett did not directly criticize Bitcoin or cryptocurrencies, he had previously said that Bitcoin was rat poison and had no unique value, and Munger also dismissed such cryptocurrencies.

▎Munger: Better companies can be bought at lower prices in China

Munger said that it is indeed harder to invest in China than in the United States. But the reason he continues to invest in China is because he can buy better companies in China at lower prices.

Earlier, Charlie Munger also mentioned in his speech at the annual meeting of his newspaper company Daily Journal that he is more willing to invest in China than Buffett, and he does not mind holding Chinese Internet and e-commerce giants.Alibabapart of the margin bond. Munger reiterated that Chinese companies are stronger than their competitors and cheaper than their U.S. counterparts.

▎Buffett:InsuranceBusiness can give Berkshire enough confidence

When talking about confidence in Berkshire’s insurance float (referring to the premiums that policyholders pay to insurance companies) revenue and insurance business, Buffett pointed out that float can always be used, and directly said, “I like our float the most. deposit,” and “for float, we know what to do, and we can’t deliver without making a promise.” Berkshire’s first-quarter operating data showed that operating income from insurance underwriting was $47 million ($764 million a year earlier) and $1.17 billion ($1.21 billion a year earlier) from insurance investments.

Buffett also talked about investing in Geico Auto Insurance at the time, noting that it was the right decision at the right time and place and a variety of factors.

▎Munger criticizes shareholder proposal to remove Buffett from chairmanship

Munger responded to shareholders ousting Buffett as chairman. “That’s the most ridiculous criticism I’ve ever heard,” he said. “It’s like Odysseus coming back after winning the battle of Troy and someone saying, ‘I don’t like you winning that battle with a spear in your hand. look.'” he said.

Earlier this month, the California Public Employee Retirement System (CalPERS), the largest public pension fund in the U.S., said it would vote for a shareholder proposal to remove Buffett from the chairmanship while retaining the CEO job. Concerns about corporate governance of one person holding multiple roles. “There are people who have never run any business and don’t know anything,” Munger said. “I don’t take this kind of proposal seriously.”

▎Buffett on life outlook: to become a better person in the second half of life

At the meeting, Buffett talked about his outlook on life. He took marriage as an example. People tend to hide their weaknesses and show a better version of themselves before marriage, and Charlie. Munger added next to it, “It doesn’t matter, people will make progress.” Buffett believes that being a better person later in life is more important than showing off your wealth. This is consistent with his previous view, he believes: “Life is like a snowball, and for snowballing, the most important point is to find a longer ramp.”

Regarding the company’s future, Buffett said Berkshire Hathaway has a culture. While there will inevitably be heated speculation about the company’s path following his departure, the company’s structure means that, hopefully, the superiority of this culture may be better understood over time. Future generations of managers will be “the guardians of corporate culture,” he said. “We have directors and equity, and the size can deter any attempt to change the culture,” Buffett said.

Considering Buffett’s upcoming 92nd birthday, the selection of his successor has been the focus of the outside world in recent years. At last year’s shareholder meeting, Buffett said Abel, who oversees the company’s non-insurance business, would be the best candidate to succeed him if he stepped down.

Related reports

The transcript of Buffett’s shareholders meeting is here! 36 Key Points in 6 Hours Investors around the world are watching!

Speed reading!Buffett’s shareholders meeting highlights are here

Essence! Top 10 Quotes From Buffett’s 2022 Shareholders Meeting

[Video Highlights]A quick look at Buffett’s shareholders meeting in three minutes!

A quick look at the 2022 Buffett shareholders meeting: The stock market has been like a casino for the past two years

(Article source: The Paper)

![[Video]Read the top ten points of Buffett’s shareholders meeting in one article. The stock market has been like a casino in the past two years. [Video]Read the top ten points of Buffett’s shareholders meeting in one article. The stock market has been like a casino in the past two years.](https://dfscdn.dfcfw.com/download/D25487005278537425833_w750h411_o.jpg)