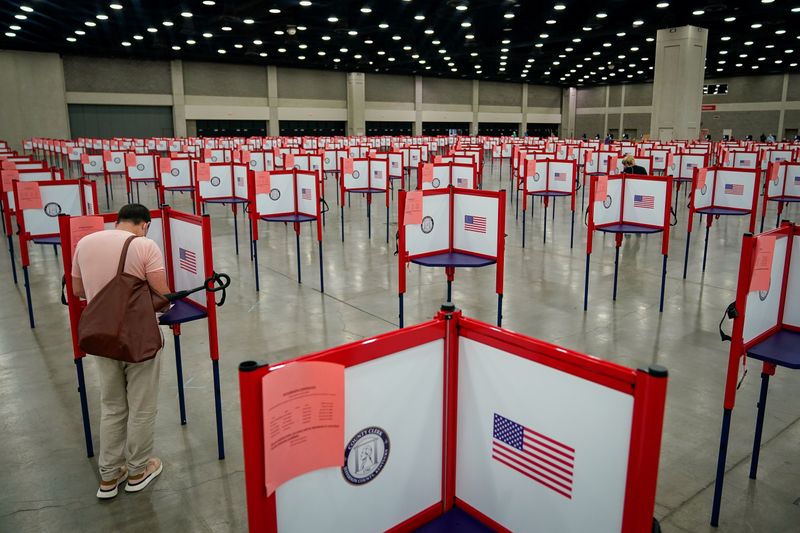

Yingwei Financial Investing.com – U.S. midterm elections entered a critical juncture, which will determine the control of Democrats and Republicans in Congress, as investors awaited the results on Tuesday. Analysts at Morgan Stanley said the market can expect a positive catalyst for stocks from the midterm elections.

European and American stock markets

U.S. stocks closed higher on Monday as the market waited to see the outcome of the U.S. congressional midterm elections and waited to see U.S. data to be released on Thursday.

As of the close, it rose 1.31% to 32,827 points; it rose 0.96% to close at 3,806 points; it rose 0.85% to close at 10,564 points.

Among large technology companies, shares of Meta Platforms Inc (NASDAQ: ) surged 6.53% after news that Meta Platforms plans to lay off workers starting this week. The layoffs were announced as early as Wednesday and are expected to affect thousands of workers. A spokesman for Meta declined to comment. As of the end of September, the company had more than 87,000 employees, according to previously released information from Meta. Meta has told employees to cancel non-essential travel starting this week, these people said.

In addition, Apple (NASDAQ: ) shares fell nearly 2% in intraday trading on Monday, and closed up 0.39%. Previously, the company gave a rare warning of a problem with the supply of the iPhone 14, and it was reported that it had lowered its shipment target by 3 million units. At the same time, Barclays lowered its price target for Apple from $156 to $144.

Meanwhile, shares of U.S. ride-hailing software LYFT Inc (NASDAQ: LYFT) fell more than 12% in Monday’s extended trading session after the company reported earnings that its losses widened to $422 million in the third quarter ended September, compared with a loss of $99.7 million in the same period last year. USD, mainly affected by the closure of autonomous vehicle startup Argo AI, which requires provisions; operating profit for the period was USD 66.2 million, which was better than market expectations of USD 62 million; revenue rose 22% to USD 1.05 billion, lower than Market expectations of $1.06 billion.

It is also worth noting that Digital World Acquisition Corp (NASDAQ: ), which previously planned to merge with the social media company owned by former U.S. President Donald Trump, jumped 66.48% on Monday, as Trump had previously hinted that he would run again.

Finally, “stock god” Buffett’s investment flagship Berkshire Hathaway ( Berkshire Hathaway ), ( ) recorded another investment loss of more than 10 billion US dollars in the third quarter, but the overall business performance was better than expected, and the stock price rose 1.52%.

European stocks closed up 0.33% at 418 points; closed at 13,533 points, up 0.55%; closed at 6,416 points, slightly up less than 1 point; and closed at 7,299 points, down 0.48%.

Asian stock markets

A shares: closed at 3,077 points on Monday, up 0.23%, with a turnover of 424.429 billion yuan; it closed at 11,207 points, up 0.18%, with a turnover of 581.74 billion yuan; it closed at 2,454 points, up 0.14%.

Hong Kong stocks: On Monday, it rose 2.7% to 16,595 points; it rose 2.8% to 5,636 points; it closed at 3,396 points, up 4.1%.

commodity market

In terms of crude oil, the US dollar was weak on Monday, which supported oil prices. It closed down 0.66% at US$97.92 per barrel; it closed down 0.88% at US$91.79 per barrel.

In the gold market, it reached a peak of US$1,685.6 on Monday and closed at US$1,680.5 per ounce, up US$3.6 or 0.2%; it retreated 0.43% to close at US$1,675.5, and reached an intraday low of US$1,667.1, a decrease of 0.93%. Traders said the market was waiting to see U.S. inflation data on Thursday to gauge the likelihood of a rate hike by the Federal Reserve in December. However, the decline of the US exchange rate is favorable for the performance of gold prices.

Foreign exchange market

In the foreign exchange market, it fell for the second consecutive session and finally closed down 0.54% at 110.19. Analysts believe that the reason for the dollar’s decline on Monday is that the market is full of dollar longs, so there is a need for profit-taking.

In addition, it closed up 1.21% at 1.15. It should be noted that the British “Guardian” quoted sources as saying that the Chancellor of the Exchequer Jeremy Hunt will announce tax hikes and spending cuts on November 17, involving an amount of 60 billion pounds.

It also closed up 1.14% at 1.00. Survey data showed that investor sentiment in the euro zone improved in November, but energy issues still cast a shadow over the economic outlook of the euro zone. Euro zone finance ministers agreed after a meeting on Monday that next year’s budget discussions could be complicated by energy aid measures that may need to be retained beyond March.

[This article is from Yingwei Caiqing Investing.com, to read more, please log on to cn.Investing.com or download Yingwei Caiqing App]

(Editor: Li Shanwen)