On March 23, Tencent released unaudited financial report data for the fourth quarter and full year of 2021. In the latest quarterly financial report, Tencent, the giant company, showed several changes.

According to the financial report, Tencent’s revenue in 2021 is 560.12 billion yuan (RMB, the same below), compared with 482.06 billion yuan in the same period last year, a year-on-year increase of 16%. In the fourth quarter, revenue was 144.2 billion yuan, compared with 133.67 billion yuan in the same period last year, an increase of 8% year-on-year.

In 2021, Tencent’s cost of revenue will be 314.2 billion yuan. In 2021, Tencent’s Q4 net profit (Non-IFRS) was 24.880 billion yuan, down 25% year-on-year, and net profit has declined for two consecutive quarters. In 2021, Tencent’s net profit (Non-IFRS) was 123.788 billion yuan, a year-on-year increase of 1%, which was also the lowest net profit growth rate in the past decade. After the release of the financial report, as of press time, Tencent Holdings ADR fell by more than 5% to $47.86 per share.

In terms of business, in 2021, value-added service revenue will be 291.6 billion yuan, accounting for 52% of total revenue, online advertising revenue will be 88.66 billion yuan, accounting for 16% of total revenue; financial technology and enterprise service revenue will be 172.19 billion yuan, accounting for 172.19 billion yuan. 31% of revenue. Other business income was 7.68 billion, accounting for 1%.

It is worth noting that in Q4 2021, the revenue of the financial technology and enterprise services sector was 47.958 billion yuan, a year-on-year increase of 25%, accounting for 33% of the total quarterly revenue, surpassing the online game sector for the first time and becoming Tencent’s largest revenue contributor. business sector.

As of December 31, 2021, the combined monthly active accounts of WeChat and WeChat were 1.268 billion, a year-on-year increase of 3.5%. In 2021, the number of monthly active accounts of QQ smart terminals will be 552 million, down 7.2% year-on-year and 3.8% month-on-month.

Regarding the overall pressure on short-term performance, Ma Huateng, chairman and CEO of Tencent, said at the performance conference: “2021 is a year full of challenges. We actively embrace changes and implement measures to strengthen the company’s long-term sustainable development, but it will affect revenue growth. We are actively adapting to the new environment, reducing costs and increasing efficiency, focusing on key strategic areas, and striving for long-term sustainable growth.”

Game revenue growth is weak, Tencent is happy to see it succeed?

Starting from Q3 in 2021, Tencent will disclose the revenue of games in the local market and games in the international market as a sub-section under the value-added business. Tencent’s explanation for this is that this move reflects the continuous expansion of the scale of the game business in the international market.

The financial report shows that Tencent’s Q4 game business revenue in 2021 will be 42.8 billion yuan, a year-on-year increase of only 9.4%, and a month-on-month decline of 4.6%. Among them, the game revenue in the local market only increased by 1% to 29.6 billion yuan. Tencent explained that the slow growth of this performance was partly due to the decline in the revenue of “Tianya Mingyue Dao” and “Peace Elite”.

In Q4 2021, Tencent’s game revenue in the international market will increase by 34% to 13.2 billion yuan. It is understood that Tencent increased its stake in Finnish mobile game developer Supercell in 2021, which has remained profitable and has continued to pay dividends to a Tencent-led investor alliance. In 2020, Tencent also acquired Leyou Technology for the US and Canadian markets, and merged its game studios Digital Extremes and SplashDamage.

Although the growth rate of game revenue in the international market is stable, it can be seen from the financial report data of Tencent Games in the past three years that its growth is not optimistic. In the second two quarters of 2021, the year-on-year growth rate of Tencent Games’ revenue will be lower than 10%, and the quarter-on-quarter growth of Tencent Games will be negative twice throughout 2021.

However, this may be what Tencent is willing to show. In the case of domestic calls for strengthening the supervision of games, any troubles may cause fluctuations in Tencent’s stock price. In addition, as the leader of the domestic game industry, Tencent Games also hopes to reduce the outside world‘s impression of its dominance.

Tencent said that it has taken the lead in the industry and achieved remarkable results in restricting the playing time and consumption of minors. In the same period of 2020, Tencent disclosed for the first time in its annual report the proportion of games for minors. In 2021, the total duration of minors in Q4 decreased by 88% year-on-year, accounting for 0.9% of Tencent’s local game duration, and the minors’ turnover decreased by 73% year-on-year, accounting for 1.5% of the total domestic game turnover.

Replacing the top position of the game business is the financial technology and enterprise services sector. In Q4 2021, the revenue of this sector will increase by 25% year-on-year, reaching 47.958 billion yuan. Among them, the growth of fintech services is mainly reflected in the increase in the amount of commercial payment transactions, while Internet services, public transportation and the use of services in the retail industry have contributed to the growth of corporate service revenue.

Ma Huateng pointed out that since 2015, Tencent has begun to integrate the Internet and the industry. In 2018, the company officially embraced the industrial Internet after the 930 structure adjustment. In this process, Tencent is positioned as a digital assistant, providing digital services for all walks of life.

Q4 advertising business growth rate hit a record low

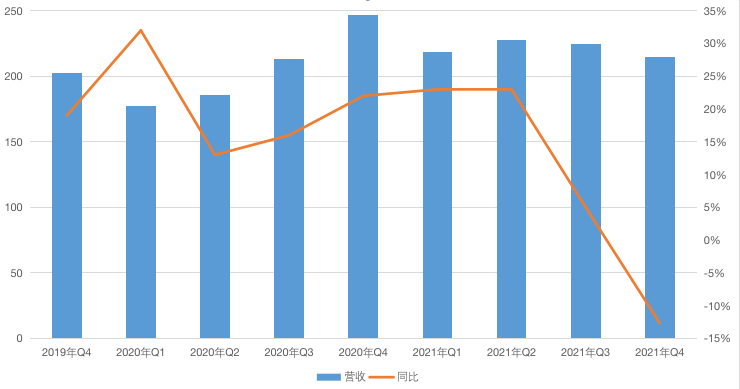

In the whole year and the fourth quarter of 2021, Tencent’s advertising business still has no improvement. The financial report shows that the online advertising business revenue last year was 88.6 billion yuan, a year-on-year increase of 8%, of which the fourth quarter fell 13% year-on-year to 21.5 billion yuan. The decline in growth rate hit a record low. Combing the advertising revenue of Tencent in the past three years, it can be found that since Q2 of 2021, the revenue of Tencent’s advertising business has plummeted.

Specifically, social and other advertising revenue will increase by 11% to 75.3 billion yuan in 2021, but its revenue growth in the fourth quarter will still decline by 4% to 18.3 billion US dollars. And Tencent Video and Tencent News-based media advertising revenue performance is even worse. In 2021 and the fourth quarter, Tencent Media’s advertising revenue fell by 7% and 25%, respectively, to 13.3 billion yuan and 3.2 billion yuan.

Tencent explained that the decrease in advertising revenue was mainly affected by regulatory changes in the industries where advertisers work, such as education, real estate and insurance, as well as the online advertising industry’s own regulatory measures (such as restrictions on open-screen advertising). Its financial report revealed that as it adapts to the new environment and further upgrades its advertising solutions, the advertising business is expected to resume growth in late 2022.

Social applications led by WeChat are still the mainstay of online advertising revenue contribution. The financial report shows that in Q4 2021, the daily active advertisers on WeChat will increase by more than 30% year-on-year, and more than one-third of the advertising revenue in the circle of friends will come from advertisements with mini-programs as landing pages and advertisements connecting users and customer service representatives through corporate WeChat.

Meanwhile, over the past year, Tencent has continued to increase its investment in WeChat video accounts. According to the financial report, the cost of revenue of Tencent’s online advertising business in 2021 increased by 20% year-on-year to 48.1 billion yuan. Mainly due to the increase in server and bandwidth costs and the increase in content costs.

In December last year, the Tencent Video account attracted 27 million viewers by live-streaming the online concert of the West City Boys, which became a big move for the video account to go out of the circle. Tencent believes that additional video accounts will provide important commercialization opportunities, including short video streaming ads, live broadcast rewards and live broadcast e-commerce.

Tencent still has not released the specific growth data of video accounts, only that “the per capita usage time of video accounts and the total video playback volume have more than doubled year-on-year.” Looking at the market environment, compared to Weishi, although Tencent video accounts have grown rapidly, they are far from Not as good as Douyin, which is owned by the old rival ByteDance.

It is worth noting that, as a national-level application, the number of WeChat users is close to the ceiling, and its monthly active users in Q4 2021 will only increase by 0.4% month-on-month.

The average monthly salary of 110,000 employees is 72,000 yuan

At the performance conference, Tencent President Liu Chiping responded to the recent rumors of organizational optimization for the first time: “At present, the Internet industry is encountering structural challenges and changes, and Tencent, as a participant, will also take the initiative to adjust. In the past, the industry was competition-driven. , the investment is relatively large; now, instead of short-term gains, everyone pays more attention to long-term business development and invests more healthily, especially the optimization of marketing costs, operating costs and labor costs. We have also carried out cost optimization actions for loss-making businesses in order to maintain healthier growth.”

And Tencent, as a company that actively embraces changes, will continue to optimize its organization according to social development and business needs. He said that in the future, Tencent will follow the principle of health and sustainability, focus on key strategic areas, deploy personnel in businesses with long-term value, and continue to introduce core technology talents and outstanding fresh graduates. It is expected that the number of personnel will continue to grow in 2022.

According to 36Kr report, Tencent’s recent layoffs are hardest hit by CSIG (Cloud and Smart Industry Business Group) and PCG (Platform and Content Business Group). Among them, the layoff ratio of CSIG is about 20%, and the layoff ratio of PCG is close to 10%.

According to the financial report, as of December 31, 2021, Tencent Group had a total of 112,771 employees, compared with 85,858 in the same period in 2020, a year-on-year increase of 31.3%. In 2021, Tencent’s annual general and administrative expenses will increase by 33% year-on-year to 89.8 billion yuan, mainly due to the increase in research and development expenses and employee costs.

Tencent’s total remuneration cost in 2021 is 95.523 billion yuan. Based on this calculation, the average monthly salary of Tencent employees is about 72,000 yuan, which is the same as previous years.Return to Sohu, see more