Zhang Yaoxi: U.S. inflation CPI is expected to decrease, and gold’s rebound is limited and still under pressure

Last trading day on Wednesday (October 12): International gold/London gold rebounded and closed up, but it is still under the pressure of recent declines, with certain shocks, and is still waiting for the release of inflation data CPI.

In terms of trend, the price of gold opened at US$1,666.13 per ounce from the Asian market, and recorded an intraday low of US$1,661.28 after falling under pressure first, then rebounded, and continued to fluctuate around US$1,670 in the first half of the European and US markets. , and finally strengthened again at around 2 a.m. the next day at the end of the market, recording an intraday high of US$1,678.06, and encountered resistance and shrinking, closing at US$1,672.98 with a daily amplitude of US$16.78, closing up US$6.85, or 0.41%.

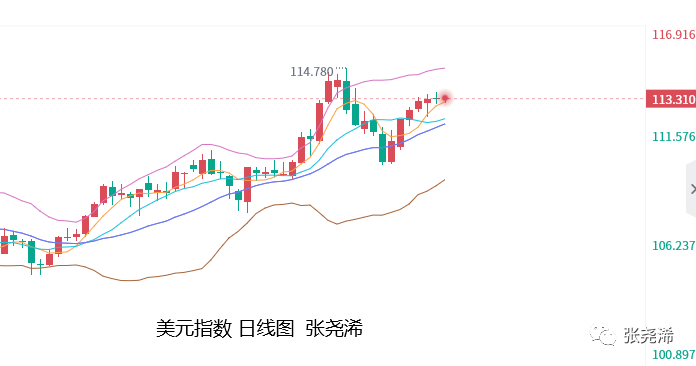

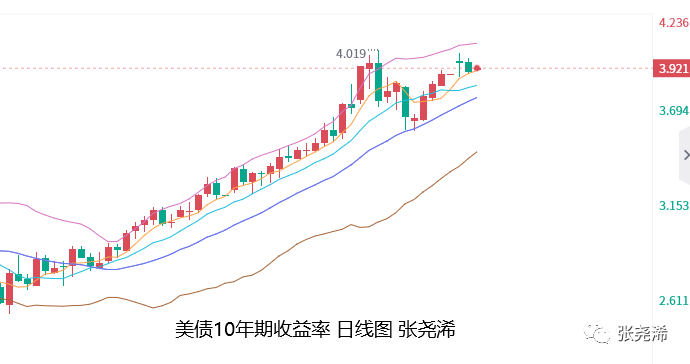

In terms of impact, due to the wait-and-see mood of the market and the narrow fluctuations of the US dollar index and US bond yields, coupled with the rebound of the pound, the bullish momentum of the US dollar is limited, and most of the gold prices are in a volatile recovery;

In the second half of the U.S. market, the minutes of the Fed meeting hinted that Fed officials are beginning to lay the foundation for an eventual slowdown in the pace of interest rate hikes. points, but the overall tone remains hawkish, with the Fed still set to raise rates by another 75 basis points at its November meeting. This limited the power of gold’s rebound, and eventually fell back to the closing line.

Looking forward to today’s Thursday (October 13): International gold’s opening performance was under pressure due to the overall hawkish Fed meeting minutes and the expectation that interest rates will be raised by 75 basis points in November. In addition, the US dollar index and US bond yields were in early trading. On the strong side, it also exerts pressure on it. On the whole, the gold price still has the risk of falling back in the short term.

During the day, the focus will be on the annual rate of the US CPI that is not seasonally adjusted in September and the monthly rate of CPI after the seasonal adjustment in September. The CPI data this time is expected to rise again strongly, strengthening the Fed’s expectation of aggressive interest rate hikes in November. However, according to the U.S. September PPI annual rate dropped from 8.7% to 8.5% released overnight, providing the latest evidence that inflationary pressures are fading, the evening CPI data will suggest that inflation will decrease again, but it will remain high and remain high. It will last for a long time, so regardless of whether the CPI data is lower than expected or higher than expected, the trend of gold in the next few weeks will be mainly under pressure, or maintain the weekly chart level shock.

Fundamentally, the minutes of the Fed’s September FOMC meeting showed that the Fed seems to be aware of the risks brought about by aggressive interest rate hikes. Several participants saw the need to calibrate Fed tightening to mitigate risks. At some point it would be appropriate to slow the pace of rate hikes. This was interpreted by the market as a dovish sign and gave gold prices temporary support, but as some of these officials stressed that historical experience shows that it is dangerous to prematurely end the tightening monetary policy aimed at curbing inflation, and that the The view that it will continue to raise interest rates by 75 basis points remains unchanged. Makes the minutes of the meeting as a whole in the end still more hawkish;

At least in the short term, it will still put pressure on the price of gold, because the Fed’s interest rate hike cycle is still continuing, it has not yet reached its peak, and the inflation data will remain high for a long time. At the beginning of next year, the 200-month moving average may be touched on the market, and then the real bottoming out can be expected.

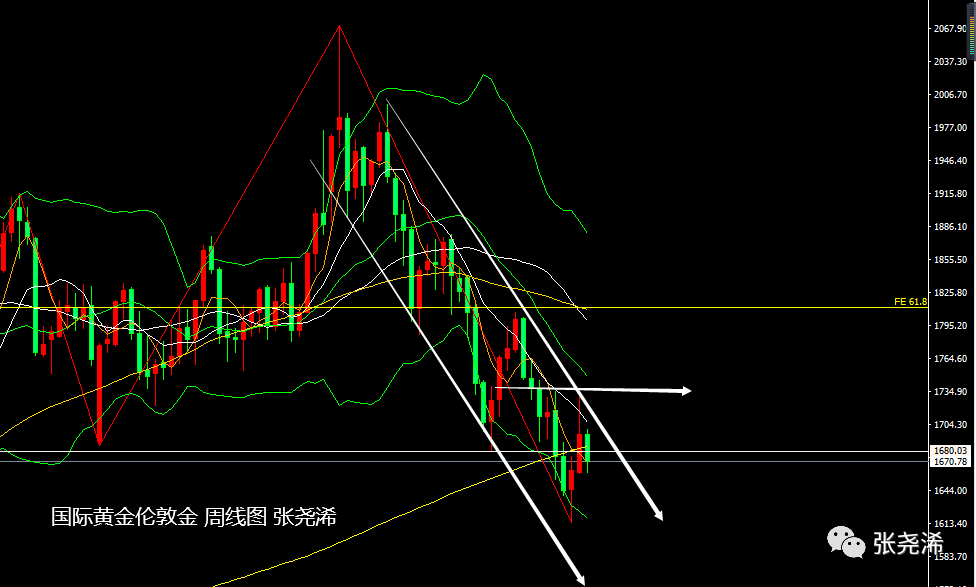

Technically: On the monthly chart level, the price of gold has gone out of a continuous downward trend under the bearish pattern of two consecutive falling vertical lines in March and April this year. It has continued to the current October, and it still maintains this downward trend. , it is not difficult to see that since May, the price of gold has come out of the bottom and rebounded, followed by a surge and decline, and the overall end of the year has been closed. At present, the trend in October is also in the stage of aggravation and decline. , which also shows that it will be difficult to regain stability above $1680 this month, so the probability of closing below this month is high, then it will continue to fall in November to refresh its September low of $1614, and in December It will be the point at which the bottom 100-month moving average support turns bullish, and then we will grasp it in real time according to the real market.However, if the closing line is above $1,680 this month, we are optimistic about bottoming and shocks, and see a continuation to the beginning of next year to see continued recovery.

Weekly level: The price of gold reappeared as scheduled last week. The rule hit the 10-week moving average resistance and showed a retracement, continuing to maintain the downward trend of $2,070, and after the rebound met resistance, it fell back and refreshed the low point. Therefore, the current The falling market is also expected to fall further and refresh the low point of the previous week. Therefore, the market outlook will tend to take the 200-week moving average and the 10-week moving average as the resistance and high altitude, and covet new lows below to refresh.

Coupled with the downward movement of the 100-week moving average, there will be a round of the 200-week moving average in the market outlook, forming a bearish sign of a medium-term dead fork. Therefore, the expectation of this bearish view is still large in the technical market, unless the rebound breaks through the 10-week moving average. Otherwise it will be difficult to break this view and the existing downtrend.

During the week, the top concerns the 200-week moving average resistance and the 10-week moving average resistance, while the bottom concerns the lows of last week and the support near the opening price of the previous week. A break below the new low will directly look at $1,525.

Daily level: The price of gold has stopped falling and fluctuated, but it still fluctuates below $1,680, suggesting that the trend is still under pressure. At the same time, the 10-day and 30-day moving averages above the main picture are still producing resistance to it, short-term bearish The pressure is still large, and the trend is still volatile and then lower and lower, and the upper focus is on the 30-day and 10-day moving average resistance high altitude. Below is concerned about yesterday’s opening price, and the previous day’s low support.

Preliminary point reference for the day:

International Gold: Above is the resistance near $1677 and the resistance at $1683; below is the support at $1665 and the support near $1660/53;

Spot silver: Above the resistance at $19.25 and at $19.45; below at the support at $18.60 and at $18.15;

Note:

Gold TD=(international gold price x exchange rate)/31.1035

The international gold fluctuates by 1 USD, and the gold TD fluctuates about 0.22 yuan (theoretically).

U.S. futures gold price = London spot price × (1 + gold swap rate × futures expiration days/365)

Predict boldly and trade cautiously. The above opinions and analysis only represent the author’s personal thoughts and are for reference only, not as a basis for trading. your money your decision.

Essential Books for Gold Investment Fundamentals: “Play and Earn Gold Investment Trading”