[EpochTimesJuly292021](Epoch Times reporter Long Tengyun reported) The recent overseas listed Chinese concept stocks ushered in a “cliff-jumping” decline due to the regulatory storm initiated by the Chinese Communist Party. In July, the authorities first lowered the RRR and released trillions of funds, and then rectified the housing market and tightened supervision. This exposed the chaos and helplessness of the Xi Jinping administration in the economic predicament in the post-epidemic era.

On July 22, the CCP CCTV quoted Zhang Qiguang, director of the Department of Real Estate Market Supervision of the Ministry of Housing and Urban-Rural Development, as saying that it is necessary to resolutely be held accountable to cities with ineffective regulation and rapid housing price rises, and to strengthen real estate financial control. The next day (23rd) the Ministry of Housing and Urban-Rural Development, together with the National Development and Reform Commission, the Ministry of Public Security and other eight ministries and commissions, issued the “Notice on Continuous Improvement and Regulation of the Order of the Real Estate Market” (link), which will implement key supervision on real estate companies with major business risks. Chinese real estate stocks generally fell that day.

On the eve of the Chinese Communist Party’s tightening of housing market supervision, the central bank announced that on July 15 it will cut its RRR by 0.5%. The RRR cut released about 1 trillion yuan in long-term funds.

Reducing the statutory deposit reserve ratio (reduction of RRR) is one of the central bank’s monetary policies. By affecting the amount of bank loan funds, it will increase the scale of credit, increase the money supply, and stimulate economic growth.

The logic behind the CCP’s RRR cut

In response to the RRR cut, the central bank stated that the prices of some commodities have continued to rise this year, and some small and micro enterprises are facing operating difficulties such as rising costs; the RRR cut is to support the development of the real economy, and the orientation of prudent monetary policy has not changed. However, the time and intensity of the RRR cut in July is generally considered to have exceeded market expectations.

Last year, in order to offset the impact of the epidemic on the economy, the CCP adjusted its monetary tightening policy that it had adhered to for several years to reduce financial risks.

Despite the official denial of monetary release, it said that the implementation of monetary policy is still prudent. But the data shows that this is not the case.

According to data from the Central Bank of the Communist Party of China, last year’s new renminbi loans reached nearly 20 trillion yuan, a record high; broad money (M2) also increased by 10.1% year-on-year, setting a new high in recent years. Although the central bank said this year that it insisted on “not engaging in flooding,” the broad money grew by 8.6% in the first half of the year, and RMB loans increased by 12.76 trillion yuan, which is not less than the record-breaking last year.

Earlier, the State Council executive meeting on July 7 mentioned the RRR cut. At that time, most of the market participants judged that it might be a targeted RRR cut. Unexpectedly, the central bank’s action was greater than expected.

At the same time, most people in the Chinese market believe that regulators will continue to guard against capital inflows into real estate.

In fact, in the post-epidemic era, real estate is still the brightest industry in China’s economy.

According to data from the National Bureau of Statistics of the Communist Party of China, the sales of commercial housing in the first half of the year increased by 38.9% compared with the same period before the epidemic (2019). Although the authorities implemented more than two hundred adjustments in the first half of the year, the prices of new and second-hand houses continued to rise. The China Index Research Institute’s “China Real Estate Market Summary for the First Half of 2021” disclosed that this year’s national commercial housing sales are expected to fall year-on-year, but still hope to reach new highs.

In this context, the Xi Jinping administration seems to have chosen conflicting currency and housing market policies:

On the one hand, in order to stimulate the economy, the central bank did not hesitate to exceed market expectations by increasing and lowering the RRR; on the other hand, the authorities have tightened supervision, severely dampened the investment enthusiasm and confidence of real estate companies, and hit the real estate industry that actually promotes GDP.

Epoch Times commentator Li Linyi analyzed, “The logic behind the CCP’s RRR cut is compelling.” He explained, “The CCP propagates that the GDP in the first half of the year has increased by 12.7% year-on-year, and the situation is good, but behind it is shrinking consumer demand and weak economic growth. The embarrassing reality of China. The sluggishness of exports and consumption is the logic behind the CCP’s early RRR cut.”

China’s economic dilemma in the post-epidemic era

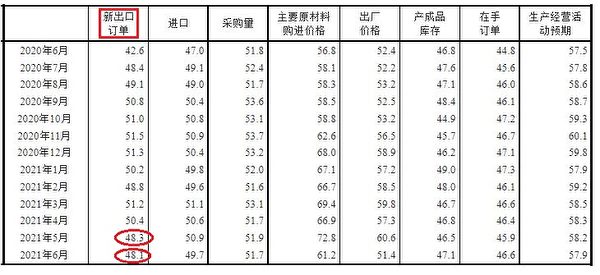

During the same period, the National Bureau of Statistics of the Communist Party of China announced the Manufacturing Purchasing Managers Index (PMI), which measures economic conditions, and the Consumer Price Index (CPI), which reflects consumption conditions. Among them, PMI is higher than 50%, which represents economic expansion; on the contrary, it is a sign of economic contraction.

Data show that in June this year, the PMI was 50.9%, a drop of 1.3 percentage points from the previous month. Although it was still above the 50% rise and fall line, it was 2.4 percentage points lower than the 55.3% peak in March, reflecting the continued production. The downward trend.

More importantly, PMI’s new export orders have fallen for three consecutive months since April, and have fallen below the line of prosperity for two consecutive months. These all reflect that China’s manufacturing economy and exports are declining.

If the downturn in the manufacturing industry means that the international external circulation chain in Xi Jinping’s “double cycle” is about to “drop out,” then the CPI and PPI (industrial producer prices) issued by the Bureau of Statistics simultaneously reveal the double cycle. The main body’s “domestic cycle (domestic demand)” is about to be unstoppable slump.

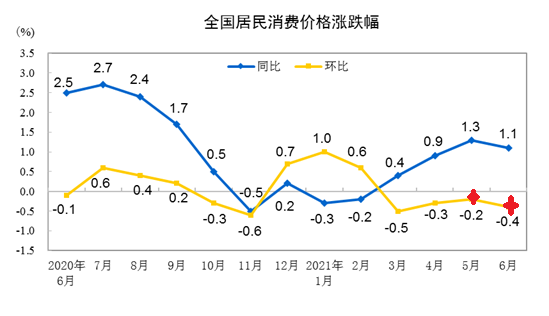

Against the backdrop of global inflation, the CPI in June rose only slightly by 1.1% year-on-year, which itself gave a weak signal.

In fact, the consumer price index CPI is not only an important indicator for measuring price changes, that is, the degree of inflation, but also an important indicator for measuring the health of economic growth. It is generally considered that 3% is the red line of inflation in China, and more than 3% is considered to have entered the inflation range.

In June, the CPI fell by 0.4% month-on-month, and the rate of decline was larger than that of the previous month’s 0.2%, indicating that prices are falling at an accelerating rate, which has confirmed the trend of sluggish domestic consumer demand.

Breaking down the main data of consumer prices in June shows that, except for a few just-needed consumer items such as rent, gas, and edible oil, consumption in other livelihood areas such as mobile phones, automobiles, clothing, food, hotels, and home appliances are all declining. This means that the Chinese are reducing the consumption demand they can control in an all-round way.

Analysis: Behind the CCP’s suppression of the housing market

While the CCP has lowered the RRR and increased monetary release, it has also intensified its supervision of the real estate market and real estate enterprises. Li Linyi believes that this is the CCP’s continuing policy of “reducing the real to the virtual”. In particular, high housing prices have squeezed the consumption power of Chinese people and severely suppressed the “internal loop” Xi Jinping had hoped for.

An in-depth report 3 years ago by The Epoch Times, “How the Data-Speaking Housing Market Soaked Up the “Six Wallets” of Chinese People” (click the link), analyzed how the housing market sucked up the “six wallets” of Chinese people.

The article pointed out that the burden of house purchases (house purchase expenses/balance of income and expenditure) of Chinese people in that year has increased from 56.7% in 2008 to 110.6% in 2018; cumulative purchase expenditure/cumulative balance of income and expenditure is also as high as 80%.

This means that as of 2018, the Chinese people are not earning enough money to afford high housing prices, and they have to emptied the savings of the three generations of parents, grandparents, and grandparents of both spouses.

Using the “six wallets” to collect the down payment to buy a house was a point raised by Fan Gang, a member of the Monetary Policy Committee of the Central Bank of the Communist Party of China in April 2018. Since 2018, although China’s housing market has undergone hundreds of government regulation and control every year, housing prices are still being adjusted higher and higher.

In addition to squeezing the consumption power of Chinese people, the financial risks of China’s housing market have become increasingly prominent.

China’s leading real estate company Evergrande Group was downgraded to negative by Standard & Poor’s recently. The main reason is that the strict supervision of the Chinese Communist Party has hit the company’s financing ability and increased its debt risk.

Forced by the exhaustion of domestic demand and debt risks, the CCP has once again escalated its efforts to clean up the housing market and housing companies.

According to a Caixin report in July, since late June, many major cities in China have experienced a “housing loan shortage”; bankers said that the new government housing loan concentration regulations have put a “tightening curse” on banks, and every bank has received it. “Spirit from the top”, instructed funds to be used to support the real economy and reduce investment in real estate.

Li Linyi analyzed, “China’s real estate or land finance is a double-edged sword. It has drained the wallets and consumption power of the Chinese people to maintain the CCP’s regime, and it has also drained the blood of the real economy. Indefinitely push up debt risk.”

“The CCP now has to strengthen the supervision of the real estate industry, not hesitating to self-harm the real estate industry, but also to strictly prevent the financial risks of capital sneaking into the housing market and aggravating the savings in the housing market.”

The CCP’s Confusing Policy Choices in the Post-epidemic Era

The CCP has recently implemented a number of policies with unpredictable consequences, leaking signals that the authorities may have fallen into chaos and helplessness.

The latest development is the reform of the Chinese Communist Party to rectify the education system, which has just set back China’s education and training industry. On July 24, Xinhua News Agency issued a “double reduction” opinion on reducing students’ burdens and cracking down on off-campus training. Concept stocks in the education sector plummeted in the Hong Kong and US stock markets.

Earlier, the CCP’s education reform also affected the most popular school districts in the housing market. A few months ago, the CCP introduced new policies in many cities to accelerate school district housing reforms on the grounds of promoting education equity and reducing room speculation in school districts.

On June 4, the CCP suddenly issued a notice stating that four government non-tax revenues, including income from the transfer of state-owned land use rights, will be transferred to taxation departments for collection from next year. Seven places, including Qingdao and Yunnan, are pilot projects.

Land sales revenue or land finances are the money bag and lifeblood of the CCP regime, especially local governments. Scholars within the system usually explain that the expropriation reform is the right to know the central government wants to obtain local revenue. However, many people in the industry believe that the game between the central and local governments on land sales revenue will accelerate the authorities to open up new sources of financial resources for Chinese real estate, such as the levy of real estate taxes.

Li Linyi believes that this policy of the Xi government and its subsequent impact on the housing market will have an incalculable impact on the stability of local governments and the CCP’s rule.

“Land finance is an explosive barrel. The central government has countless reasons to grasp the details of land finance, but any changes may cause an explosion, including conflicts within the system and turbulence in the real estate market.” He said, “and now, Xi The authorities have already done so.”

The CCP is not only igniting the explosive barrels buried deep in the local government and housing market, it has also hit the Internet industry, the upstart of the Chinese economy.

From the suspension of Ant’s listing last year and the suppression of Ma Yun Ali, to the recent purge of Didi Chuxing, which had just gone to the US for an IPO, the CCP’s latest attack on the Internet industry is to set up a cyber security office to strictly investigate Chinese companies going overseas.

The Cyberspace Administration of the Communist Party of China announced on July 10 that companies with more than 1 million user data must apply for cybersecurity approval before listing in foreign countries. Including the Chinese medical big data company Lingkrypton Technology, some Chinese companies that originally planned to go public in New York have withdrawn their IPOs (initial public offerings).

Although the U.S. government is strengthening the supervision of China’s concept stocks in recent years, the enthusiasm of Chinese companies to go to the U.S. to make money for listings has not diminished but has increased.

According to data compiled by Bloomberg, there have been 37 Chinese companies listed in the United States so far this year, raising a total of $12.9 billion. According to the US media “Wire China” (The Wire China) statistics, there were 35 Chinese companies listed in the United States last year, which was a 10-year high.

However, the sudden regulatory storm launched by the Xi authorities on the technology and education industries not only seems to be contrary to the previous trend of encouraging Chinese companies to make money in the United States, but also caused heavy losses to foreigners who are optimistic about China’s concept stocks and China’s economic prospects.

Since its IPO in the US, Didi’s share price has fallen by more than 40%. The market value of the New York-listed education and training companies “Good Future” fell from $59 billion in February to less than $4 billion. New Oriental’s share price in Hong Kong fell 37% in one day.

Even the Western financial elites who are close to the CCP’s top management seem to have been hit hard by the CCP’s regulatory turmoil.

The Financial Times reported on July 26 that the CCP’s regulatory storm on the education and training industry may wipe out billions of US dollars in investment by multinational investment banks such as BlackRock Group (also known as Black Rock Group). BlackRock holds a large number of shares in Good Future and New Oriental. BlackRock Group is a well-known investment bank in the United States, and its relationship with the Chinese Communist Party is irreversible. In June this year, it was approved for the first time to establish a wholly foreign-owned public fund management company in China.

According to Bloomberg data on July 27, the Nasdaq Golden Dragon China Index, which tracks 98 Chinese technology stocks listed in the United States, was “bloodwashed” by the CCP’s latest policy. Set the worst record in 2008.

Regarding the CCP’s recent implementation of a series of self-harming regulatory policies, Li Linyi believes that this is the idea of “the party leading everything” and that “political power overwhelms any economic activity. For example, the censorship of Didi and the education and training industry, Xi has no attention at all. As a result of the damage to the stocks, they would rather self-harm the economy, but also want to carry out the will of the party to the end.”

He said that the CCP’s recent regulatory turmoil has not only placed the party’s political goals over the interests of China’s economy and foreign investors, it has even moved the cheese of “old friends” such as Wall Street elites. “It is hard to imagine that the old friends of the CCP will continue to speak out for them even when their interests are damaged.” He predicted that “China’s economy will continue to decline in the future.”

Editor in charge: Ye Ziming#

.