Guided readingNorthbound funds on March 11: net inflow of power equipment and net sales of electronics. The top five industries with net purchases are power equipment, defense and military industry, non-bank finance, public utilities, and pharmaceutical biology.

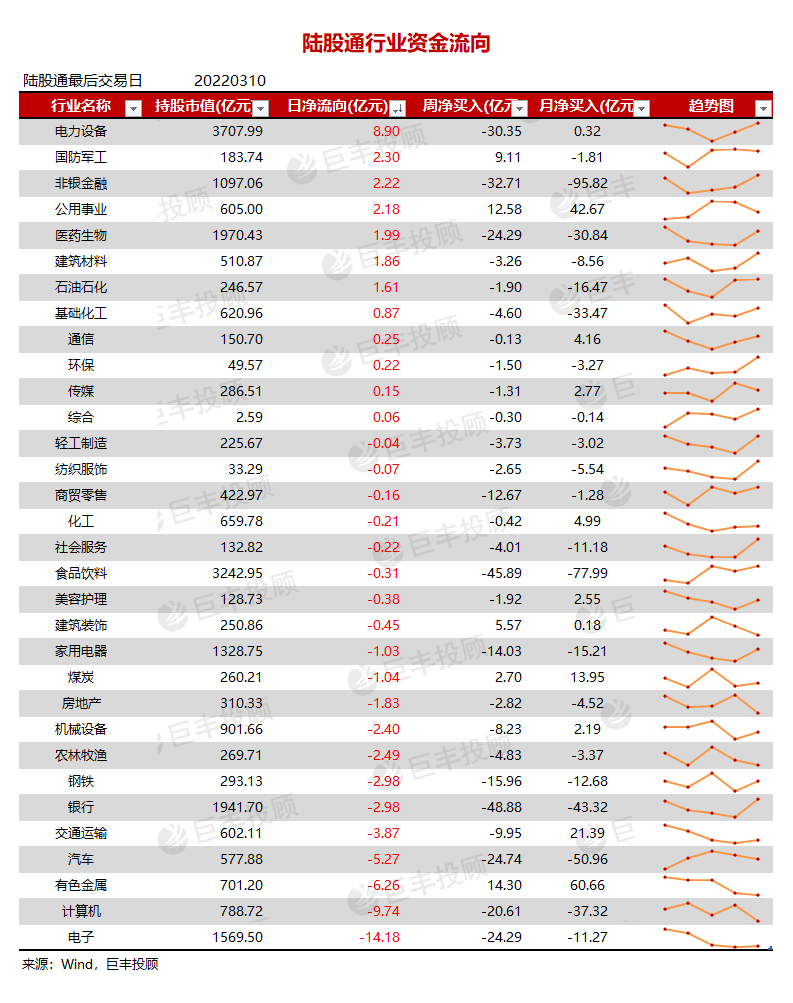

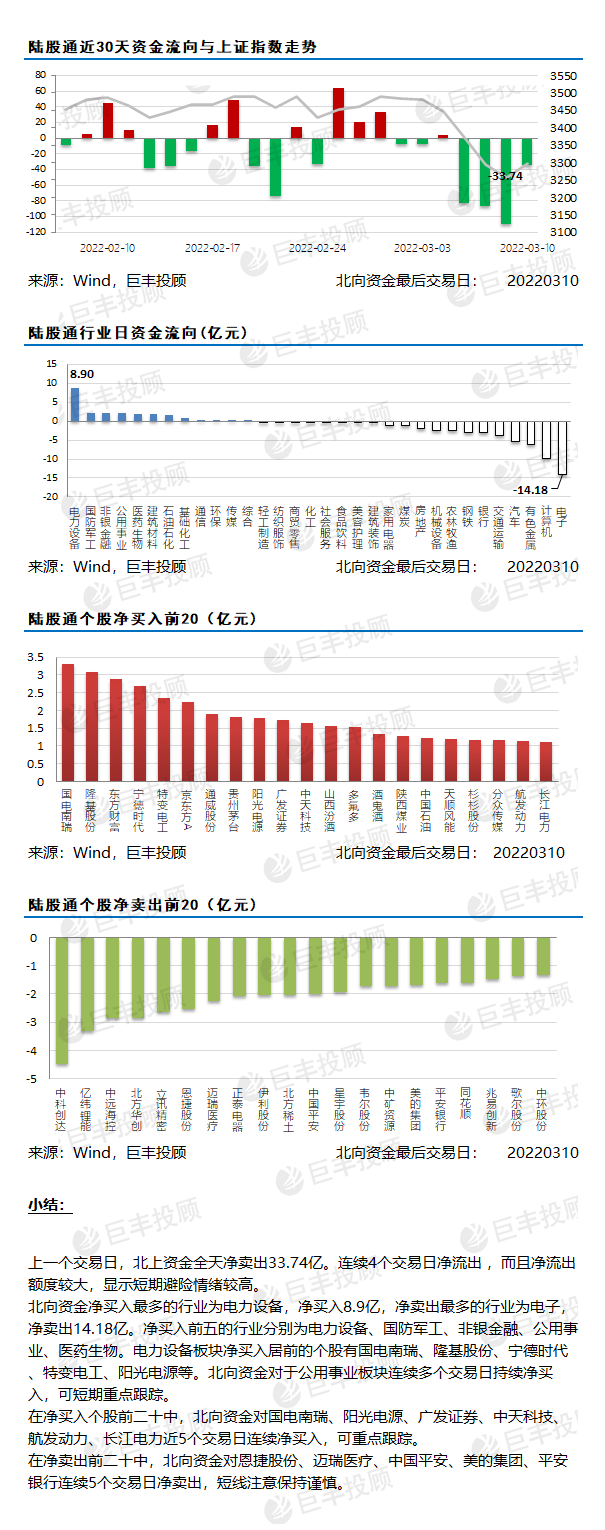

On the previous trading day, Beishang funds sold a net 3.374 billion throughout the day, with a net outflow for 4 consecutive trading days, and the net outflow was relatively large, indicating a high short-term risk aversion.

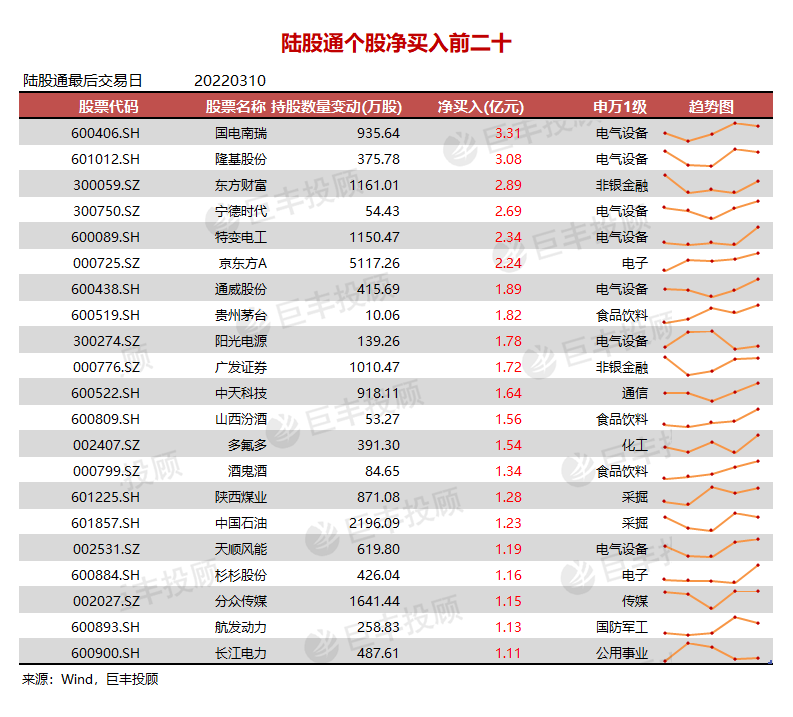

The industry with the most net purchases of northbound funds is power equipment, with a net purchase of 890 million, and the industry with the most net sales is electronics, with a net sales of 1.418 billion. The top five industries with net purchases are power equipment, defense and military industry, non-bank finance, public utilities, and pharmaceutical biology. The top net purchases in the power equipment sector include Guodian NARI, LONGi, CATL, TBEA, and Sungrow. Northbound funds have continued to net purchases in the utility sector for several consecutive trading days, and can be tracked in the short term.

Among the top 20 net purchases of individual stocks, Northbound funds have made net purchases of Guodian NARI, Sungrow Power, GF Securities, Zhongtian Technology, Hangfa Power, and Yangtze Power for the past 5 consecutive trading days, which can be focused on tracking.

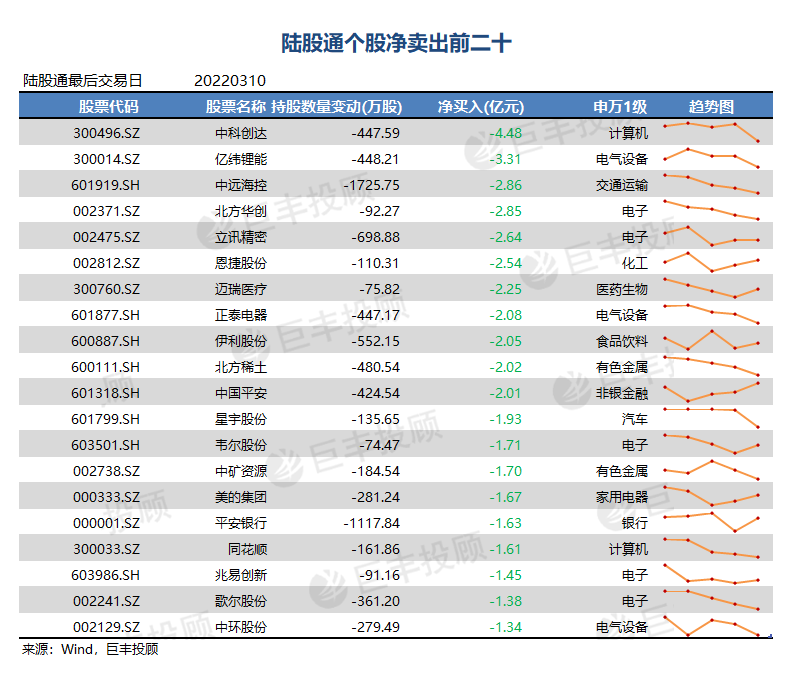

Among the top 20 net sales, Northbound funds have net sales of Enjie, Mindray Medical, Ping An, Midea Group, and Ping An Bank for 5 consecutive trading days. Be cautious in the short term.