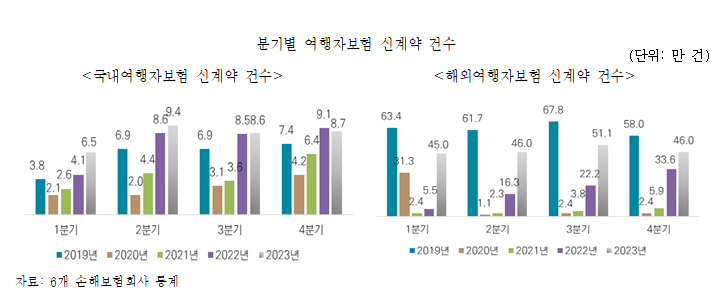

▲Quarterly graph of the variety of new journey insurance coverage contracts. (Photo courtesy of Insurance Research Institute)

With the social distancing motion attributable to COVID-19 utterly over, the journey insurance coverage market is exhibiting indicators of restoration. Recently, consumer-friendly journey insurance coverage that gives quick protection for native emergencies has been highly regarded. It is proven that such modifications in client wants needs to be fastidiously monitored and mirrored in merchandise.

According to the report ‘Travel market modifications and demand for journey insurance coverage after COVID-19’ printed by the Insurance Research Institute on the nineteenth, the variety of journey insurance coverage contracts (2.21 million) and preliminary insurance coverage premiums (KRW 156.3 billion) final yr was 2.76 million , 14.55555% in 2019. It was discovered to be 80.3% and 107.4% of the million received). The journey insurance coverage market as an entire seems to be recovering rapidly and returning to pre-COVID-19 ranges and the rise within the variety of vacationers.

The Insurance Research Institute predicted, “Overseas journey insurance coverage registrations have been rising steadily lately, with a rise from 2022. If the variety of abroad vacationers continues to develop sooner or later, the abroad journey insurance coverage market will have the ability to keep regular progress.”

Although the variety of abroad vacationers final yr was solely 79.1% of 2019, the premium paid for abroad journey insurance coverage elevated to 108.7% of 2019. The Insurance Research Institute has described this as a rise in demand for journey insurance coverage amongst abroad vacationers. Insurance premiums are an indicator of market measurement. The predominant motive for the big enhance in primary insurance coverage premiums in comparison with the rise in abroad vacationers is the elevated demand for journey insurance coverage.

If we have a look at the expansion charge of insurance coverage registrations, there’s virtually no distinction in property injury protection of policyholders for journey overseas in 2022, however the common variety of registrations for the fundamental contract (demise and subsequent incapacity) has elevated by 13.9% in comparison with 2019. . In addition, compensation debt elevated by 25.9%, particular bills elevated by 60.5%, and abroad medical bills elevated by 35.3%.

In addition to the usual protection, the content material is more and more completely different, such because the protection of authorized bills incurred abroad. The Insurance Research Institute mentioned, “This is as a result of the necessity to cowl accidents that require sensible help once they happen abroad whereas touring, akin to medical emergencies, has elevated,” including, “The enhance in curiosity and alter in demand for protection for these points. dangers are additionally thought of within the world market.

“Changes within the journey insurance coverage market as we’re experiencing COVID-19 are usually not solely mirrored within the enhance within the demand for insurance coverage, but additionally within the modifications in vacationers’ preferences for help and the rise in demand for consumer-friendly merchandise,” he mentioned. he mentioned: “Insurance corporations are responding to those modifications in demand for his or her merchandise.”

The significance of accessibility was additionally emphasised. The Korea Insurance Research Institute mentioned, “The digital insurance coverage firm is rising its market share by promoting abroad journey insurance coverage within the digital setting, rising accessibility and offering advantages akin to premium reductions or premium refunds relying on the situations of subscription and insurance coverage claims.” -friendly insurance coverage merchandise which are simply accessible to shoppers and supply a wide range of advantages are attracting consideration,” he mentioned.