Cover reporter Zhu Ning

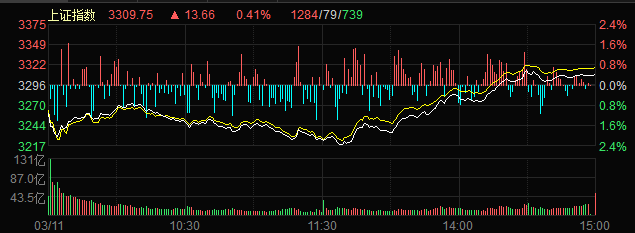

On March 11, the three major stock indexes dropped sharply in early trading, and all fell by more than 2% in the intraday; in the afternoon, driven by the financial, brewing and other sectors, they rebounded and rose. The index rose by more than 1% and recovered 2650 points; the transaction volume of the two cities has exceeded one trillion yuan for 7 consecutive trading days, and the net sales of northbound funds exceeded 5 billion yuan.

As of the close, the Shanghai Composite Index rose 0.41% to 3,309.75 points, the Shenzhen Component Index rose 0.62% to 12,477.37 points, and the ChiNext Index rose 1.15% to 2,665.46 points; the two cities had a total turnover of 1,050.2 billion yuan, and northbound funds sold a net 5.042 billion yuan.

On the disk, sectors such as healthcare, agriculture, brokerage, medicine, food and beverage, and tourism rose higher, sectors such as winemaking, military industry, banking, and real estate rose, while sectors such as electricity, petroleum, construction, steel, nonferrous metals, and gas weakened. ; New crown detection, new crown medicine, prepared dishes, digital currency, biological vaccines, assisted reproduction and other topics are active.

Medical sector rose strongly

On the afternoon of March 11, the COVID-19 testing sector collectively rose in a straight line. As of press time, Lanwei Medical, Kefu Medical, Wanfu Bio, Botuo Bio, and Aotai Bio achieved a daily limit of 20cm.

Among them, the stock price of CanSino (688185.SH), a listed biopharmaceutical company, rose in the afternoon, rising by more than 9% at one point. At present, due to the recurrence of the new crown epidemic, the concept of anti-epidemic in the A-share market continues to attract attention. China Medicine, which previously announced that it cooperated with Pfizer on the new crown vaccine, closed again on the one-word board. The company received 6 daily limits in 8 trading days, and the range rose as high as 88.56%.

On the news, the Wuxi Market Supervision Bureau held a symposium on the development of home-based nucleic acid/antigen detection products. It will continue to pay attention to the development progress of home-based nucleic acid/antigen detection products, actively strive for it, fully guide and serve enterprises, and promote family autonomy in Wuxi. Nucleic acid/antigen detection products will be launched as soon as possible.

A document of the “New Coronavirus Antigen Detection Application Plan” has been circulated on the Internet. The content shows that residents are encouraged to have self-testing needs. They can purchase antigen detection reagents for self-testing through retail pharmacies, online sales platforms and other channels.

CICC commented that the domestic epidemic situation is repeated, and it attaches great importance to pharmaceutical investment opportunities. Recently, the international situation has been turbulent, and indexes around the world have seen a sharp correction; at the same time, the domestic epidemic has repeated, and there have been many cases of Omicron infection. We recommend investing in the pharmaceutical sector to pay attention to investment opportunities in the domestic anti-epidemic line in the short term, and to allocate assets that can attack and retreat.

Afternoon brokerage changes

In the afternoon, when the market was stuck, the brokerage sector suddenly rose strongly, and BOC Securities quickly moved from flat to the daily limit within 4 minutes. Then, the brokerage sector was instantly activated by Hualin Securities to seal the daily limit; CICC, Zhongtai Securities, Shanxi Securities, Guosheng Financial Holdings and other brokerage stocks rose collectively, up more than 5% by the close. The brokerage sector rose 2.31% throughout the day, and all stocks in the sector closed in red.

In terms of policy, this year’s government work report has made arrangements for the construction of the capital market, calling for the improvement of the bond financing support mechanism for private enterprises, the full implementation of the stock issuance registration system, and the promotion of the stable and healthy development of the capital market.

Some analysts said that the government work report requires the full implementation of the stock registration system, and the speed up of the comprehensive registration system will benefit leading securities firms and venture capital institutions with significant advantages in investment banks. Under the environment of increasing demand for residents’ equity asset allocation, institutionalization of the capital market, and increasing proportion of direct financing, securities companies’ large wealth management and institutional business are the main development lines, and securities companies with large wealth management and institutional business advantages are more likely to obtain valuation premiums.

Regarding the index reversal in the past two days, the reporter interviewed Zhou Maohua, a macro analyst of China Everbright Bank, who believes that the domestic stock market has rebounded strongly in the past two days under the circumstance of severe fluctuations in overseas markets, and the trading volume has remained close to one trillion, reflecting the recovery of market sentiment; , domestic fundamentals and policies are friendly, and stock market valuations are low. Although short-term external uncertainties may still be disturbed, it is expected that the overall market sentiment is expected to gradually recover.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.