Recently, the supervision of the positive announcement of listed companies after the change in the stock price has been followed by a strict inspection. The Shanghai and Shenzhen Stock Exchanges took a joint action on the evening of December 3. Prior to the release of the good news, Xilong Science (002584) and Jinan High-tech (600807) both had “snatch-off” quotations. The exchange pointed out whether the two companies had the core issue of leaking inside information in advance.

Suspected of leaking information in advance

Due to the sale of assets and purchase of assets, the two listed A-share companies-Xilong Science and Jinan High-tech are involved. Prior to the disclosure of relevant announcements, the share prices of Xilong Science and Jinan Hi-tech both had their daily limit in advance. After receiving the letter of concern at Xilong Science on the evening of December 3, Jinan Gaoxin was also inquired by the Shanghai Stock Exchange. The core issue of the exchange was whether there was any leakage of inside information in advance.

According to the announcements disclosed by Xilong Science and Jinan High-tech on the evening of December 2, Jinan High-tech’s wholly-owned subsidiary Jinan High-tech Industrial Development Co., Ltd. (hereinafter referred to as “Jigao Industrial”) and related parties invested 504 million yuan to acquire Shandong Aikewei Biotechnology Co., Ltd. (hereinafter referred to as “Aikewei Bio”) 60% equity held by Long Science. Among them, Jigao Industry intends to invest 229 million yuan to obtain a 27.22% stake in Akway Biosciences. At the same time, Xilong Science entrusts the remaining 13.78% of the voting rights held by it to Jigao Industry to exercise it on its behalf.

It is understood that Akway Bio is an innovative high-tech enterprise dedicated to the development, industrialization and technical services of clinical medicine, molecular diagnosis, and genetic testing technology products and high-throughput testing platforms.

According to public information, the transaction is positive for both Xilong Science and Jinan High-tech.

Among them, Jinan High-tech said that after the company’s acquisition of Akway Bio, it will further develop in the biomedical industry, continue to expand and strengthen the biomedical business, increase the scale and profitability of the biomedical business, and make the biomedical business become the driving company in the future. One of the core engines of high-quality development. After the completion of the acquisition, Akway Bio will be included in the consolidated financial statements of Jinan High-tech, which is expected to have a positive impact on the company’s future performance.

Xilong Science said that after the completion of the transaction, it will help increase the company’s cash inflow, and the proceeds will be used for the company’s production and operation, transformation and upgrading, and focus on the development of its main business.

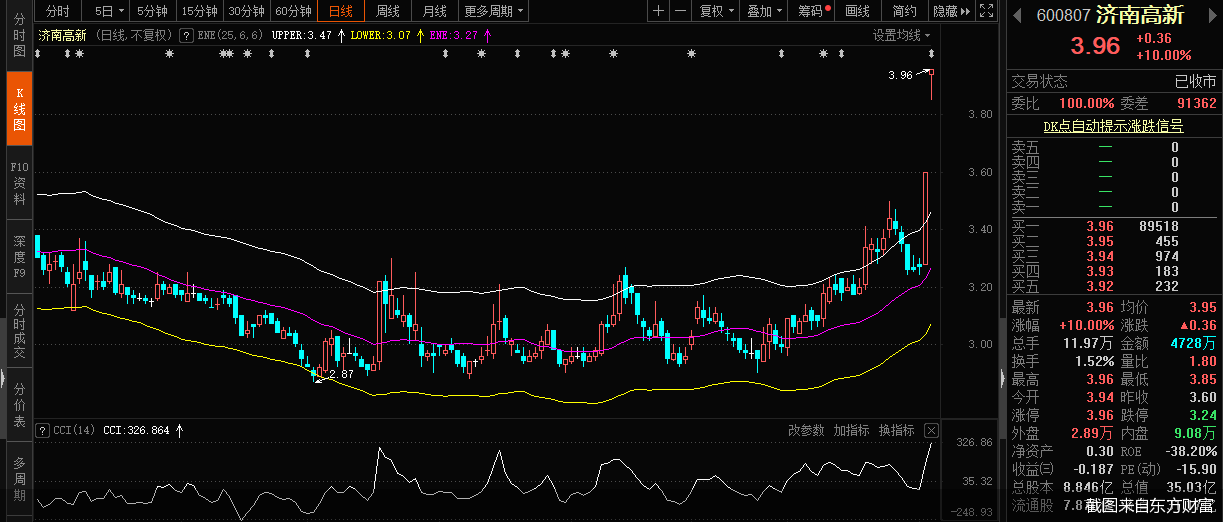

Prior to the disclosure of the above-mentioned good news, Xilong Science and Jinan High-tech appeared in the “snatch-up” market. The trading quotations showed that Jinan High-tech’s stock price closed at its daily limit on December 2. On December 3, Jinan High-tech’s stock price once again rose by the limit, hitting a new high of 3.96 yuan per share in the intraday market. On November 30, December 1, and December 2, Xilong Science had three consecutive daily limits. However, on December 3, Xilong Science “seen to death”, the stock price closed at the end of the day.

Investment and financing expert Xu Xiaoheng believes that the disclosure of good news by listed companies after the stock price rises will inevitably cause the market to question the management of the company’s inside information.

In this regard, the Shenzhen Stock Exchange requires Xilong to scientifically explain the planning process of the above matters, including the starting time, participating planners and decision-making process, the confidentiality of relevant information and whether there is information leakage, and in accordance with the Shenzhen Stock Exchange’s “Guidelines for the Standard Operation of Listed Companies (” Revised in 2020)”, detailing the recent investigations by institutions and individual investors, and whether there are any violations of the principle of fair disclosure. The Shanghai Stock Exchange also requires Jinan Hi-tech to conduct a self-inspection of the registration of insiders and the management and control of inside information, explain whether the inside information management control system is sound, whether the planned equity acquisition is strictly in accordance with the relevant regulations on inside information management and control, and self-examine the inside information submitted by the company Whether the list of insiders is complete, whether there is any situation such as leaking inside information in advance.

In response to company-related issues, reporters from Beijing Commercial Daily called Xilong Science and Jinan Hi-tech’s office of the Secretary of the Board of Directors for interviews, but no one answered the call.

Independent economist Wang Chikun believes that for those listed companies’ positive announcements following changes in stock prices, they should be strictly investigated. Xilong Science and Jinan Hi-tech have received letters one after another, reflecting the “zero tolerance” of the regulatory authorities on insider trading.

It is doubtful whether the performance commitment index is reasonable

In addition to being suspected of leaking information in advance, this transaction is also full of doubts. First of all, there is a controversy over the setting of performance commitment indicators.

The counterparty, Xilong Science, promised that the audited net profit of Akway Biotech from 2022 to 2024 will not be less than 49 million yuan, 63 million yuan, and 78 million yuan (total not less than 190 million yuan).

The Shanghai Stock Exchange requires Jinan Hi-tech to supplement the disclosure of the reason and rationality of using net profit after tax instead of net profit after deducting non-recurring gains and losses as the performance evaluation indicator. The total consideration of the transaction is 504 million yuan, and the three-year performance promised by Akway Biosciences is only 190 million yuan in total net profit, and the 2022 performance indicator is only 49 million yuan, slightly higher than the 2020 net profit. Jinan High-tech also needs to supplement the disclosure of the company and related parties to explain the rationality of the above-mentioned performance commitment indicators and whether they fully protect the interests of listed companies. Independent directors also need to express their opinions.

In this transaction, the target valuation is not low. The transaction was evaluated by the market method. The estimated value of Akway Bio-Bio was 846 million yuan, the net book assets were 182 million yuan, and the appraised appreciation rate reached 363.62%.

However, Akway Bio’s actual profitability is somewhat “lack”. According to the announcement, Akway Bio will have a net asset of 219 million yuan in 2020 and realize a net profit of 48,367,500 yuan. As of June 30, 2021, Akway Bio will have total assets of 294 million yuan and net assets of 224 million yuan. The profit is only 5.024 million yuan.

The Shanghai Stock Exchange requires Jinan Hi-tech to supplement the disclosure of the main composition and proportion of Akway Bio’s assets and liabilities as of the first half of 2021, whether there is a large amount of unliquidated liabilities, and whether there is collateralization of major assets, and if so, the details shall be listed; The net profit and year-on-year changes of Akway Biotech after deducting non-recurring gains and losses from 2018 to 2020. Whether the main composition and proportion of net profit in the first half of 2021 have fallen sharply year-on-year. If so, explain the specific reasons.

Xu Xiaoheng also said that for Jinan Hi-tech, whether the acquisition can effectively integrate the target, give full play to the advantages of both parties through integration, and realize the strategic synergy after the integration is also facing certain challenges.

Under the cross-examination of the exchange, whether the transaction between Xilong Science and Jinan Hi-tech can proceed smoothly is unknown.

Beijing Commercial Daily reporter Liu FengruReturn to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.