Original title: $71.99/barrel!Crude oil futures hit a new high since January last year. Institutions recommend focusing on supply-side changes

At 11:00 am on June 3, Brent crude oil futures rose to $71.99 per barrel, a new high since January 2020.Straight FlushData show that as of yesterday’s close, Brent crude oil futures have risen 2.51% in the past two trading days.By the internationalOil priceUpside impact, today’s Shanghai Energy Exchange crude oil futuresMain forceContract 2107 opened at 441.2 yuan/barrel, and thereafter, it fluctuated up all the way. The highest price of the day was 451.5 yuan/barrel and the lowest price was 440.2 yuan/barrel. As of the close of 15:00, the settlement price increased by 1.66% compared with the previous trading day, and closed at 448.1 yuan/barrel, an increase of 4.50% in the past three trading days.

In this regard, in an interview with a reporter from Securities Daily, SDIC Essence Futures SeniorAnalystLi Yunxu said, “First of all, since the fourth quarter of last year, global vaccines have been actively progressing to boost demand recovery expectations. OPEC+ not only has a high implementation rate of the production reduction agreement, but also held a meeting in December 2020 to set a cautious increase in production for the entire year of 2021. The expectation of de-stocking has been continuously strengthened and confirmed, which has driven the price center to move up. Secondly, since entering the second quarter, OPEC+ has reached an increase of 350,000 barrels per day in May and June at the ministerial meeting in April. The agreement to increase production by 441,000 barrels per day, and Saudi Arabia announced that it will reduce production by 1 million barrels per day since February this year. The reduction in production will push oil prices upward; finally, despite the repeated outbreaks in India and the dawn of the Iranian nuclear negotiations, the rate of increase in oil prices has slowed down. However, due to the obvious effect of epidemic control in Europe and the United States, and the steady increase in oil consumption for travel, the overall oil price still shows a central upward trend.”

Private equity row netfundManager Hu Bo analyzed the “Securities Daily” reporter: “There are many factors that affect oil prices. In addition to OPEC + supply factors, they are related to geopolitics and U.S. shale oil production capacity. All in all, the recent increase in oil prices is due to previous oil prices. After the correction of the excessive drop in the epidemic and liquidity, as the US economy recovers and overall demand picks up, oil prices have continued to rebound.”

From a disk perspective, Brent crude oil futures have risen to around US$70/barrel in September 2019, January 2020 and March 2020. This price can be regarded as an important pressure on international oil prices in recent years. pass.Hou Yanjun, general manager of Hou Shi Tiancheng, told a reporter from the Securities Daily: “From a technical analysis point of view, crude oil is currently near the strong resistance level of 70 US dollars per barrel and is expected to meet resistance. The logic of the previous rise is that the US dollar Headed globalcurrencyExcessive releases have triggered a seesaw effect, leading to higher commodity prices and higher oil prices. Second, compared with last year, the global epidemic has gradually improved, and the European Union has also lifted internal travel restrictions, which is a signal of increased demand. “

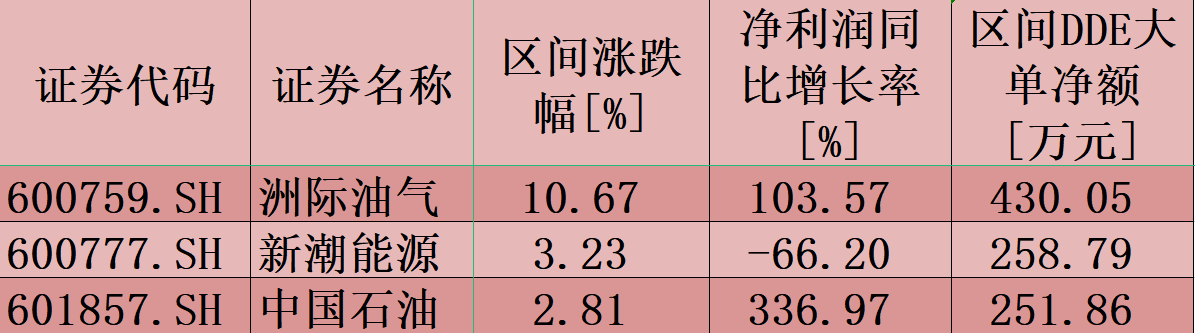

As oil prices continue to rise, it has a driving effect on the corresponding sectors of the A-share market. Take the oil mining sector as an example. As of the close of 15:00, the sector index has risen by 3.30% in the past three trading days, and the sector’s cumulative turnover has reached 2.76 billion yuan. In terms of individual stocks, in the past 3 trading days,Intercontinental Oil and GasThe cumulative increase was 10.67%,New Wave EnergyThe cumulative increase has also reached 3.22%,China PetroleumThe cumulative increase was 2.81%.

FromPerformanceFrom a perspective, among the above companies,China PetroleumThe first quarterNet profitA year-on-year increase of 336.97%,Intercontinental Oil and GasNet profit in the first quarter increased by 103.57% year-on-year.

“The oil stocks in the A-share market have fallen for many years.China PetroleumThe leading stocks have fallen out of value. Even if oil prices do not rise sharply, there are still investment opportunities in oil stocks in an environment where the overall trend of the A-share market is upward. Mao Junyue, director of Xinpu Asset Investment, commented on the “Securities Daily” reporter.

“China is a demanding country for crude oil. The prices of downstream chemicals will increase significantly with the rise in oil prices. You can pay attention to relevant stock opportunities.” Hu Bo said.

Regarding the future trend of oil prices, Li Yunxu said: “With the continuous improvement of travel intensity in Europe and the United States, it is worth looking forward to the accelerated recovery in demand for terminal oil products in May, which is expected to form a long-term driver for oil prices. The supply side in June mainly focused on Iran’s production expectations and the resulting consequences. OPEC + production reduction policy and implementation rate adjustments, if Iran’s output and potential floating positions can be released quickly in the short term, it will greatly slow down the pace of global crude oil destocking and create a certain degree of callback pressure. Therefore, there will be greater uncertainty in June. In the short term, it may follow the macro sentiment to continue the volatile situation. Investors are advised to be cautious and wait until the supply side is clear and enter the market on dips.”

Hu Bo also has a similar view. He said: “Currently, oil prices are at a relatively balanced level, and the probability of volatility is increasing. As oil prices rise, the increase in shale oil production in the United States is the most important variable that deserves attention.”

Table: List of gains of individual stocks in the oil exploration sector from June 1 to June 3

Watchmaking: Yao Yao

(Source: Securities Daily)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.