A-share metabolism is further accelerated…

Several stocks were delisted this week.include*ST new billion、*ST Iger、*ST long move, respectively involving major violations of compulsory delisting, delisting of face value, delisting of financial indicators and other delisting situations.Among them, those that touch the delisting at face value*ST Igerdirectly delisting, and there is no longer a delisting arrangement period.

With the new delisting regulations, a group of listed companies with unsustainable operations will bid farewell to the A-share market.It is worth mentioning that, from the perspective of financial indicators, there may be 10 more shares that will be delisted from A shares this year, involvingshareholderThe number of households is close to 320,000.

3 shares have been delisted this year

On the evening of March 22, Xinjiang Yilu Wanyuan Industrial Holdings Co., Ltd.*ST new billion“)releaseannouncementsaid, ShanghaisecuritiesThe exchange decided to terminate the listing of the company’s shares. This means that the company has become the first A-share delisted company this year. Then, the first “1 yuan delisting” company also appeared.

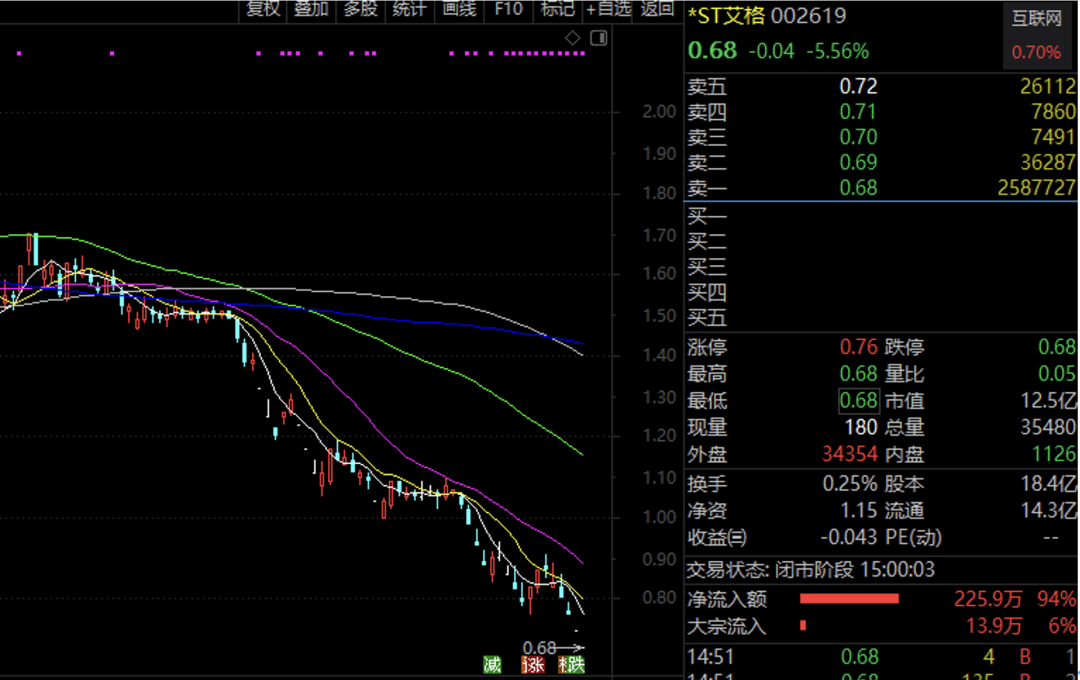

On the evening of March 24,*ST IgerThe closing price is 0.68 yuan, and the closing price has been below 1 yuan for 15 consecutive trading days; according to estimates, even if the daily limit is increased for the next 5 trading days, the stock price will still be lower than 1 yuan, thus hitting a low closing price for 20 consecutive trading days. At the delisting requirement of 1 yuan. Since companies that meet the “1 yuan delisting” standard will no longer have a delisting adjustment period, which means that,*ST Iger will only have 4 trading days left in the A-share market.

The first delisted stock with financial indicators also arrived on the same day.*ST long moveOn the evening of March 24, it was announced that its net assets attributable to shareholders of listed companies in 2021 were negative, and those attributable to shareholders of listed companies were negative.net profitIf it is negative, the type of opinion issued by Zhongtianyun Certified Public Accountants (special general partnership) for the 2021 annual financial report is incapable of expressing opinions. The company’s stock has touched the terms of termination of listing on the Shenzhen Stock Exchange. The company’s stock will start from the market opening on March 25.Suspension。

Delisting means a sharp correction in share prices.for example*ST IgerIt has dropped the limit for 4 consecutive days. The turnover in the latest trading day was only more than 2.41 million yuan, and the number of orders exceeded 2.58 million. Throughout the history of delisted stocks, most of them bid farewell to A shares in the end with a sharp decline.

More than 10 stocks are expected to hit the financial delisting indicator

Most of the stocks delisted in 2021 will be delisted at face value. With the promulgation of new delisting regulations, more delisted stocks will be delisted in financial indicators this year.

securitiesAccording to the statistics of Times·Databao, there are 6 high-risk stocks involved in the delisting indicator of combined revenue and net profit, and 7 high-risk stocks involving the delisting indicator of negative net assets for two consecutive years.

In terms of high-risk stocks that have been delisted by revenue and net profit indicators, the delisted stocks have been determined to be delisted.*ST Iger,*ST long moveBoth stocks are listed.in addition*ST ECCOM、*ST travel for a long time、* ST Akashina、*ST middle roomOther stocks will also hit the revenue-net-profit portfolio delisting indicator.

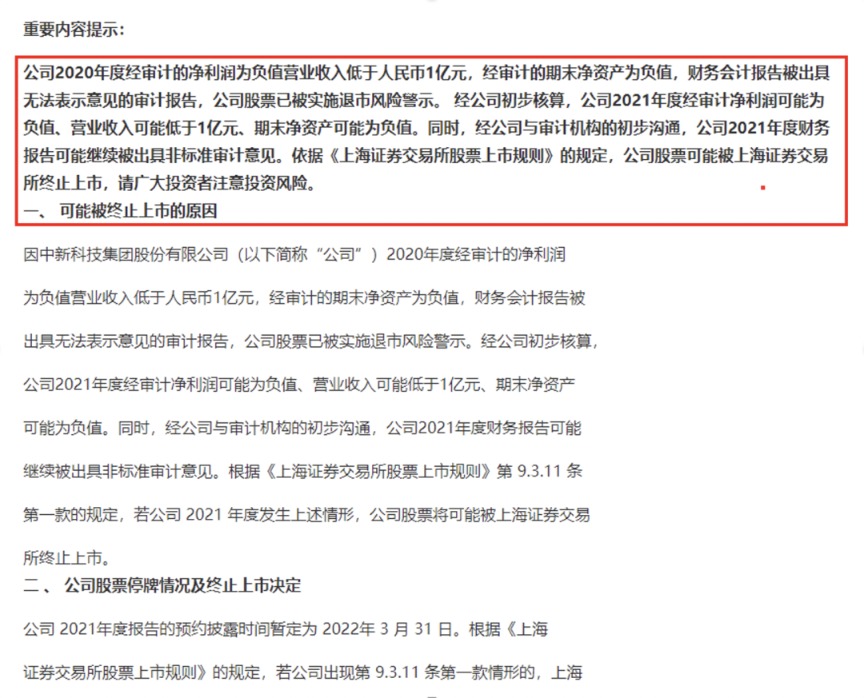

in,* ST AkashinaSaid that in view of the delisting risk warning of the company’s stocks, the 2021performancewill incur losses andOperating incomeBelow 100 million yuan, according to regulations, the company’s shares will face the risk of being delisted.In addition, the company’s 2020 financial and accounting report was issued and cannot express an opinion. If the companyfinancial managementThere is no clear solution for the product, and the 2021 annual financial accounting report may be issued with a non-standard opinion audit report.

Regarding the delisting indicator of negative net assets for two consecutive years, Databao will comprehensively calculate the net assets per share in the third quarterly report in 2021 and the annual report forecast, combined with the performance forecast of listed companies,It was found that 7 *ST shares have negative net assets in the 2020 annual report and may also have negative net assets in 2021.

in,*ST ZhongxinThe net assets per share in the third quarter of last year were -7.57 yuan, and the median earnings per share in the fourth quarter of last year were -0.38 yuan. The 2021 annual report net assets are extremely likely to be negative.*ST ZhongxinThe company has issued several risk warning announcements for the termination of listing of stocks. The company’s audited net profit in 2021 may be negative, operating income may be less than 100 million yuan, and net assets at the end of the period may be negative. The company gave relevant financial indicators in the 2021 annual report notice, which is expected to be attributable to the parent company’s owner’s equity -2.2 billion to -2.5 billion.

Estimated timetable released

The new regulations clearly stipulate that if financial indicators are hit for two consecutive years, the listing will be terminated, and the suspension and resumption of listing will be cancelled. This means that the above listed companies stay in A-shares for a shorter and shorter period of time. According to another regulation, if a listed company hits the delisting target after publishing its annual report, the company will suspend trading the next day, and the exchange will issue a prior notice to the company that it intends to terminate the listing of the company’s shares within five trading days from the date of the suspension of the company’s shares.

Data treasure statistics,*ST TEPCO、*ST Rasha、*ST ZhongxinThe company will publish its annual report for last year by the end of March. This means that the above-mentioned companies will have only 10 days left before their fate will be pronounced. In the end, these companies with delisting risks will remain in the A-share market for just over a month.

The stock prices of some companies have already begun to reflect in advance, including*ST long moveThe stock price fell by more than 64% during the year,*ST travel for a long time*ST IgerWaiting to drop more than 50%.

The latest data shows that the delisting is not counted*ST long moveand*ST Igerthe remaining 10 delisted high-risk stocks, the mostNew crotchThe number of East households is close to 320,000.

(Article source: Data Treasure)