If you are looking for information about postal investmentsyou are in the right place: on Affari Miei I always review the various tools, and today I am dedicating myself to one of the offers proposed by Poste Italiane, BancoPosta Selection Active.

It is a product that could potentially offer you a higher return if you are willing to take a little more risk, so you might want to consider this product that is offered to you by Poste Italiane.

Read on if you are interested!

This article talks about:

A few words about Poste Italiane

Before proceeding with the analysis of the product and therefore with the study of its characteristics, its costs and its advantages, I would like to tell you a few words about the institution that makes the product itself available, even if of course I don’t think there is need a lot of words to present Italian post.

Italian post it is the largest infrastructure in Italy, and with 160 years of history it can count on a network of around 12,800 post offices, 121,000 employees and 586 billion euros in total financial assets. Also they have about 35 million customers.

Poste Italiane represents a unique reality in terms of size, recognisability, capillarity and trust on the part of customers. Our role is decisive for the Italian economic, social and productive fabric and places us at the forefront of promoting sustainable development, digital evolution and the cohesion of the country.

In the last period the company is also very attentive to principles ESGtherefore it is oriented towards investments that are correlated or in any case able to focus on these aspects.

Features of BancoPosta Selezione Attiva

Let’s see together characteristics of this instrument, which is a flexible fund for all market phases:

- Suitable for those who want to invest in a flexible solution, capable of adapting to all market phases;

- The Fund aims to achieve moderate capital growth over the medium term, by investing in a broad and diversified universe of financial instruments without geographical, sectoral or currency constraints;

- The Manager may invest up to 100% of its assets in money market and debt securities. The equity component cannot exceed 40% of the portfolio, while the use of financial instruments linked to the yield of commodities must not exceed 10%;

- The Fund may invest up to a maximum of 30% in Emerging Countries;

- The selection of instruments takes place taking into account the criteria of sustainable finance, i.e. the ESG principles.

Its benchmark

Given the management style adopted, it is not possible to identify a reference parameter (ie the benchmark) that effectively represents the fund’s investment policy, but it is possible to identify an annual volatility measure of approximately 8%.

The risk profile

The product has a summary risk index 3. I remind you that the synthetic risk index ranges from 1 to 7, with 1 indicating the minimum possible risk, and 7 indicating the maximum risk profile that can be achieved by a financial product.

We are therefore faced with a product that has a medium riskwhich is the combination of the preponderant Bond component, then accompanied towards a higher risk profile by the equity component and securities arriving from emerging countries.

Costs

The charges paid by the investor are used to pay the costs of running the fund, including the costs of marketing and distributing the fund. These charges reduce the potential growth of your investment.

The entry and exit costs are equal to 2 euros, while the ongoing costs, i.e. management fees and other administrative fees are equal to 1.08% of the value of the investment per annum.

Transaction costs on the other hand amount to 0.22% of the investment value per year.

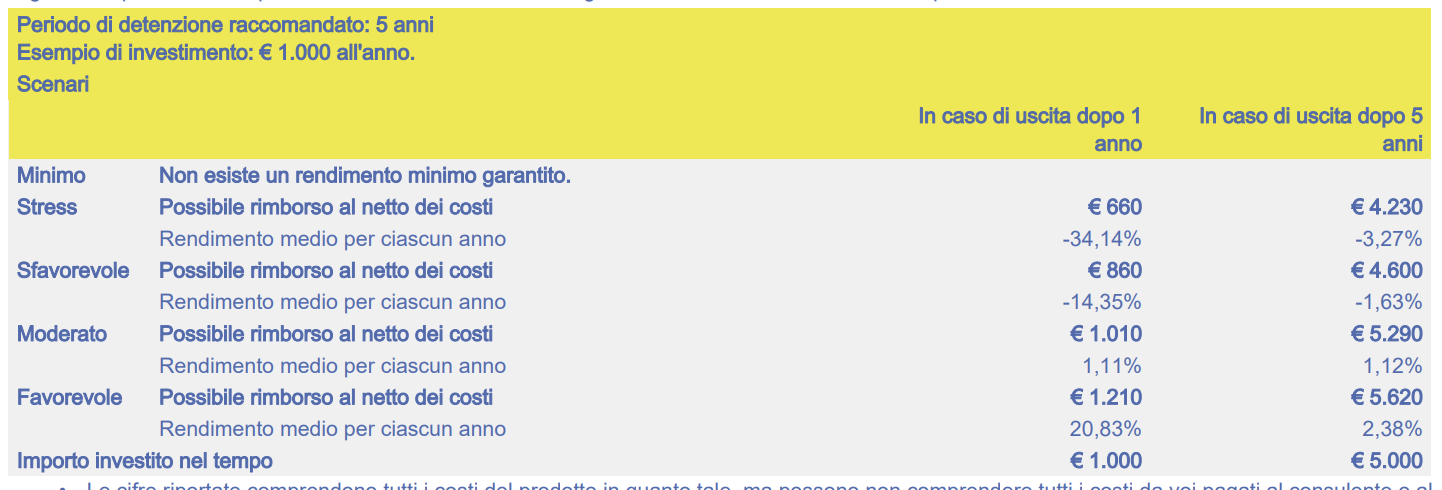

The recommended holding period for such an investment is 3 years.

Here is a screenshot to help you get a clear and immediate idea: it highlights the costs that will have to be paid if you were to exit the investment before the recommended period.

I took it from brochure which can be found on the official page of Banco Posta Selezione Attiva, where you can find all the detailed information:

How can you subscribe to this product?

As with every product offered by Poste Italiane and which belongs to the category of flexible funds, you have two methods for participating in this fund.

You can first proceed with single paymentswith an initial minimum amount that must be at least 500 euros, and with subsequent minimum payments of at least 100 euros.

If, on the other hand, you are interested in a Savings Plan product, you can pay an initial sum of 50 euros, and periodic installments every month, every 2 months, every 3 months or every 6 months, always from a minimum of 50 euros or multiples. The minimum period is 1 year, while the maximum is 12 years.

Is it worth investing in BancoPosta Selezione Attiva?

If I followed My business you already know my opinion on mutual fundsproducts that are very convenient for the management company but not entirely for the investor/saver and which present important problems for those who want to save, first of all costs.

As you well know, in fact, it is precisely the costs that have a significant impact on the investment and, if they are high, the investment could already start badly precisely because of this.

Even with products that are distributed by “friends of savings” institutions such as Poste Italiane, you would in fact find yourself paying over 1% in commissions, commissions that must be deducted from any earnings you will make with the fund.

These are huge sums to pay, especially for long-term investments, fees that make this investment methodology one of the best less convenient for those who operate on markets with small or large capitals.

About that you can read a Morningstar reportrelating precisely to the costs of mutual investment funds.

With the exact same risk profile and therefore choosing tools that allow you to risk in the same way, you can take home investments that yield more and have fewer expenses! For example, you might want to take a look and better understand how the ETFpassively managed funds that are able to reduce management costs and therefore, at the same time, offer you a more profitable investment.

In this regard, I would like to leave you some guides to start your investment journey:

Good continuation on Affari Miei!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <