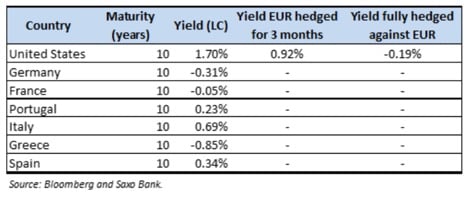

Since the beginning of the year, 10-year US Treasury bond yields have risen by more than 70 basis points. The continued rise in yields in the United States as the rotation from European sovereign bonds to the safe havens of the United States becomes increasingly tempting. It can be read in the report entitled “European sovereign crisis: the periphery counterattacks” by Althea Spinozzi, Senior Fixed Income Strategist and Sales del Centro Studi BG Saxo, according to which a second European sovereign debt crisis will begin with the sell-off of Greek government bonds, which will quickly spread to the periphery, particularly touching on Portuguese and Spanish debt. Italian debt, the report reads, will prove more resilient than the former as domestic investors hold most of it and Mario Draghi’s leadership will positively weigh on market sentiment. In this scenario, the current monetary policies of the European Central Bank, in particular the Pandemic Emergency Purchase Program (PEPP), will prove inadequate. The ECB will need to review its quantitative easing policies to direct efforts directly towards the countries affected by the crisis. These measures will cause the compression of the spread with respect to the Bund, leading to a better monetary union.

Italian debt vs European analogues

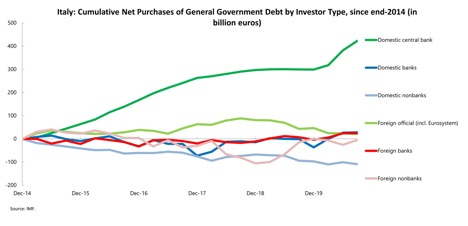

The investor base of Italy’s public debt is the strongest in the periphery, as it has the lowest percentage of foreign investors and the highest share of national banks and non-banks who own it. According to the BG Saxo Study Center, what makes Italian government bonds better than their peers is that non-speculative domestic investors with a long-term investment horizon hold most of the country’s debt.

The Bank of Italy has been the largest buyer of BTPs over the past six years. Since 2020, the report reads, the central bank has increased purchases of Italian government bonds under the PEPP program to resist the Covid-19 pandemic. During the pandemic, demand for BTPs from domestic and foreign banks has increased, showing that whenever Italian yields rise, banks are net buyers, providing ample support.

According to the BG Saxo Study Center, it is also important to consider that Mario Draghi’s arrival in Italian politics provides further support to its sovereign titles. Indeed, while yields on other European government bonds have risen by about 25 basis points from the start of the year for 10-year maturities, yields on BTPs have only risen by half. This is why BG Saxo is confident that in the event of another European sovereign crisis, the selloff of Italian BTPs will be contained compared to peers. Any widening of the spread over the Bund can provide a real exciting opportunity to buy Italian debt cheaply.

ECB forced into unconventional QE measures

Faced with another European sovereign debt crisis, the ECB will find it has no more tricks up its sleeve. According to the BG Saxo Study Center, the PEPP will prove useless because the allocation through the Eurosystem’s capital scheme of national central banks favors Bunds over other European sovereign bonds. In the scenario that BG Saxo is considering, investors would sell the suburbs to buy American safe-haven assets. Once a proper rotation occurs, European investors would rush to buy Bunds, causing a even more rapid widening of the spread of the periphery compared to the Bund. As the report says, one of the ways the ECB can tackle the crisis this time around will be to try to push for the politically unpopular decision to shift central bank purchases to the periphery. This will lead to a long-term compression of euro area spreads and a better monetary union. For BG Saxo, another way to look at the problem would be that the ECB starts buying US Treasury bills in large quantities, reducing the convenience of exchanging European sovereign bonds for US ones. Such a policy, concludes BG Saxo, would sink the euro and temporarily postpone problems without solving them.