Caijing Capital Markets News opened on June 21, Gree Electric opened more than 2% lower and then continued to fall. At one time, it fell nearly 5%. As of today’s close, Gree Electric has fallen 4.79% throughout the day and closed at 51.11 yuan per share, setting a new low this year. The total market value has fallen to 307.5 billion yuan. Compared with the high point at the beginning of December 2020, it has been more than half a year. Gree Electric’s share price has fallen nearly 24%.

Gree Electric’s share price plunged again today, and the fuse was an employee stock ownership plan announced a few days ago.

12,000 people can buy stocks at 50% off, and each person can earn 250,000

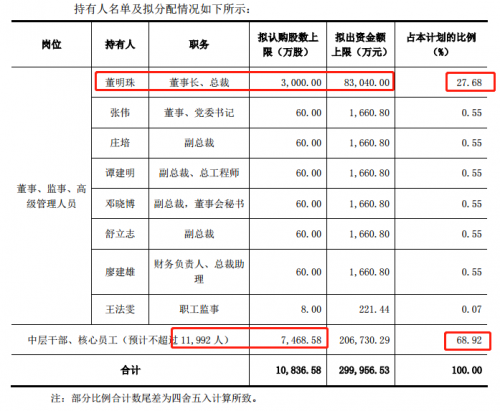

On the evening of June 20, Gree Electric announced its first phase of employee stock ownership plan. The total number of employees who intend to participate in the employee stock ownership plan will not exceed 12,000, and the stock size will not exceed 108 million shares, accounting for 1.8% of the company’s total share capital. The purchase price is 27.68 yuan per share, and the capital scale of the employee stock ownership plan does not exceed 3 billion yuan.

It is worth mentioning that the closing price of Gree Electric on the previous trading day (June 18) was 53.68 yuan per share, and the purchase price of the employee stock ownership plan was only 51.56% of the stock price, which means that employees can “subscribe at a 50% discount.”

In addition, if the capital scale is converted to the upper limit of 3 billion yuan, if all the top grids are subscribed, it is equivalent to giving away nearly 3 billion yuan to employees. If 12,000 people are used, each earns an average of 250,000 yuan.

Among them, Dong Mingzhu intends to subscribe for the upper limit of 30 million shares, and the proposed upper limit of capital is about 830 million yuan, accounting for 27.68% of the employee stock ownership plan. In other words, if Dong Mingzhu Dingge subscribes, his initial floating profit will exceed 800 million yuan.

After this plan was released, a huge controversy has formed at the level of Gree Electric’s investors. In the Gree Electric Appliances stock bar, investors talked a lot, some said that Gree Electric “cut leeks”; some questioned Gree Electric used the company’s money to repurchase stocks at a high price, and then sold them to employees at a low price, suspected of transferring benefits; but there were also a small amount of investment. The author believes that it is understandable that legal compliance motivates management and employees. But overall, negative comments on Gree accounted for the majority.

Set two-year performance appraisal indicators, which may not be difficult to achieve

According to the precedent, Gree Electric’s employee stock ownership plan also set a performance appraisal period for two years.

Evaluation indicators are divided into company performance evaluation indicators and personal performance evaluation indicators.

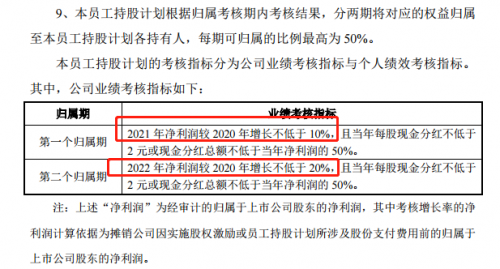

The company’s performance appraisal indicators are divided into two vesting periods. If they can be achieved, the corresponding rights and interests can be vested in each holder of the employee stock ownership plan in two periods, and the attributable ratio in each period is up to 50%.

Among them, the performance evaluation index for the first vesting period is that the net profit in 2021 is not less than 10% growth compared to 2020, and the cash dividend per share for the year is not less than 2 yuan or the total cash dividend is not less than the net profit for the year 50%.

The performance evaluation indicators for the second vesting period are that the net profit in 2022 will increase by no less than 20% compared to 2020, and the cash dividend per share for the year will not be less than 2 yuan or the total cash dividend will not be less than 50% of the net profit for the year. .

According to Gree Electric’s latest annual report and quarterly report data, in 2020, Gree Electric will achieve a net profit of 22.175 billion yuan attributable to the parent, a year-on-year decrease of 10.21%, which is at a relatively low level. In the first quarter of 2021, Gree Electric achieved a net profit of 3.443 billion yuan attributable to shareholders of listed companies, a year-on-year increase of 120.98%.

Judging from the net profit base in 2020 and the performance growth rate in the first quarter of 2021, the company’s performance evaluation indicators may not be difficult to achieve.

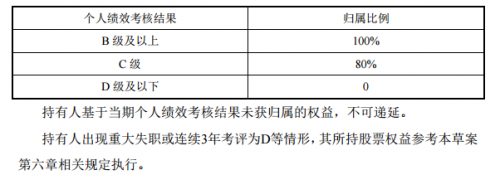

In terms of personal performance appraisal indicators, Gree Electric will implement it in accordance with the company’s internal personal performance appraisal methods. Holders can only be provided that the company’s performance appraisal indicators in each appraisal vesting period meet the standards and the personal performance appraisal grade is C or above, and there is no violation of this draft and the “Employee Stock Ownership Plan Management Measures” and other relevant regulations and commitments. Obtain corresponding equity attribution.

In addition, Gree Electric also stated that the first assessment vesting period expires. If the company’s performance assessment indicators do not meet the standard, the combined assessment will be deferred to the second assessment vesting period. If after the expiration of the second assessment vesting period, the company’s performance assessment fails to meet the standard, the management committee will make a decision to dispose of it, including cancellation or sale of stocks at an opportunity, etc., and the original capital contribution paid by the corresponding holder will be returned to the limit. , The remaining income (if any) is returned to the company.

Holding employees can’t quit at will

This time Gree Electric’s employee stock ownership plan has another “very different” feature: After the ban on the employee stock ownership plan is lifted, employees who hold the stock ownership plan cannot withdraw at will.

The announcement shows that after the establishment of Gree Electric’s employee stock ownership plan, it will be managed by the company itself, and a management committee will be established to exercise shareholder rights on behalf of the employee stock ownership plan. The management committee has the right to assign the attributable stock rights and interests of the two periods based on the results of the individual performance appraisal of the employees. In addition, after the expiration of the second assessment vesting period, the management committee will decide the disposal method for the employee stock ownership plan rights that cannot be vested due to the failure of the company-level performance assessment. During the duration of the employee stock ownership plan, except in the agreed circumstances or with the approval of the management committee, the holder’s stock rights and interests shall not be transferred, withdrawn, pledged, guaranteed, debt repayment or other similar disposals.

The plan stipulates that based on the needs of employees to increase stock appreciation gains and participate in corporate governance through centralized management, the holder of this employee stock ownership plan promises and authorizes that before retiring from the company, the stock rights of this employee stock ownership plan will be transferred to personal securities accounts. As for the shares directly held by the trade union, the trade union shall exercise its voting rights in accordance with the will of the trade union (excluding the voting rights of the shares held by the directors, supervisors and senior executives). Without prior written confirmation by the trade union, the trade union shall not sell or set a pledge on its own, otherwise the trade union has the right to take back The corresponding share income and related income are managed by a special account set up by the trade union and enjoyed by other holders. The specific distribution method is democratically determined by the holders.

In addition, in the case of a number of situations such as those who sell their stocks without obtaining the labor union’s prior written confirmation, voluntarily resign or resign before retirement, or refuse to renew the labor contract with the company or a subsidiary company after the labor contract expires, the stock Before the equity is transferred to its securities account, the management committee has the right to cancel the holder’s qualification to participate in the employee stock ownership plan. The equity held by the management committee will choose the opportunity to sell, and the holder’s corresponding original capital contribution and residual income (such as Yes) is enjoyed by the holders of the employee stock ownership plan.

In other words, if employees participating in the employee stock ownership plan want to dispose of the equity acquired in this plan completely autonomously, they must either obtain the voting rights and disposal rights of the acquired stock after retirement, or they need to wait for the employee to hold the equity. The remaining distribution will be completed after the termination of the liquidation of the share plan.

It is worth mentioning that 8 Gree Electric’s directors and supervisors (excluding independent directors), including Gree Electric’s chairman and president Dong Mingzhu, have promised not to hold positions in the Employee Stock Ownership Plan Management Committee, and at the same time give up their personal positions in employees. Proposal rights and voting rights at the meeting of holders of the shareholding plan.

There may be multiple employee stock ownership plans in the future

It can be boldly speculated that in the future, Gree Electric may introduce incentive measures such as multi-period employee stock ownership plans.

On the one hand, judging from the name of this shareholding plan, “Gree Electric First Phase Employee Stock Ownership Plan (Draft)” means that Gree Electric may have multiple subsequent employee shareholding plans in the future.

On the other hand, Gree Electric has carried out the third phase of the repurchase plan, and its share reserves are sufficient to support multiple phases of employee stock ownership plans.

Since Gree Electric first issued the “Announcement on the Repurchase of Certain Public Shares” in April 2020, in the past year or so, Gree Electric has launched three phases of a huge share repurchase plan, and Gree Electric also pointed out that The purchased shares will be used for employee stock ownership plans or equity incentives.

Among them, the first two repurchase plans have been completed in full. Gree Electric has spent a total of 12 billion yuan to repurchase 209 million shares of the company, accounting for 3.48% of the total share capital.

In May 2021, Gree Electric once again launched the third round of the 7.5 billion to 15 billion share repurchase program.

In contrast, Gree Electric’s current employee stock ownership plan does not exceed 108 million shares, which is far smaller than Gree Electric’s reserve of repurchased shares. It also means that Gree Electric may push several new employee stock ownership plans in the future.

Improve corporate governance structure

When it comes to Gree, it is often impossible to avoid Midea, another major electrical appliance giant. In the past two years, the gap between Gree and Midea is gradually widening.

In terms of market value, as of today’s close, Gree’s total market value is 307.5 billion yuan; Midea’s total market value is 507.3 billion yuan, a difference of nearly 200 billion yuan between the two, accounting for 65% of Gree’s total market value. Two years ago, on June 21, 2019, the total market value of Gree Electric was 298.4 billion yuan, and the total market value of Midea Group was 344.6 billion yuan. The difference between the two was less than 50 billion yuan, accounting for only 15% of Gree’s total market value.

In terms of performance, Gree Electric achieved revenue of 170.497 billion yuan in 2020, a year-on-year decrease of 14.97%; realized net profit of 22.175 billion yuan, a year-on-year decrease of 10.21%. Midea Group achieved revenue of 285.710 billion yuan in 2020, a year-on-year increase of 2.27%, and its parent net profit was 27.223 billion yuan, a year-on-year increase of 12.44%. In 2019, Gree’s revenue was 20.5 billion yuan, and its parent’s net profit was 24.7 billion yuan; Midea’s revenue was 279.4 billion yuan, and its parent’s net profit was 24.2 billion yuan.

In the past two years, the gap between Gree Electric and Midea Group has increased. Gree needs to make some changes, and the employee stock ownership plan may be part of the change.

It is worth mentioning that the last time Gree Electric’s large-scale equity incentive was in 2009, when Gree’s major shareholder, Gree Group, transferred 16.042,500 shares of Gree Electric. Cadres, business backbones, and senior executives of holding subsidiaries are offered equity incentives. This employee stock ownership plan is the first time that Gree Electric has released an employee stock ownership plan after Hillhouse Capital took over.

According to the announcement, the purpose of Gree Electric’s employee stock ownership plan includes three aspects:

The first is to further improve the corporate governance structure, establish and improve the company’s long-term and effective incentive and restraint mechanism, improve the company’s salary assessment system, and effectively combine the interests of shareholders, the company and employees, and promote all parties to pay attention to the company’s long-term development.

The second is to advocate a value-oriented performance culture, establish a benefit-sharing and risk-sharing mechanism between shareholders and management, middle-level cadres and core employees, enhance the cohesion of the company’s management team and the company’s competitiveness, and ensure the company’s future development strategy And the achievement of business objectives.

The third is to advocate the concept of joint sustainable development of the company and individuals, fully mobilize the initiative and creativity of the company’s senior managers, middle-level cadres and core employees who have a direct impact on the company’s sustainable development, attract and retain outstanding talents, and build human resources Advantages inject new impetus into the company’s sustained and rapid development.