The chip war between China and the US is played out between the Netherlands, Japan, South Korea and Taiwan

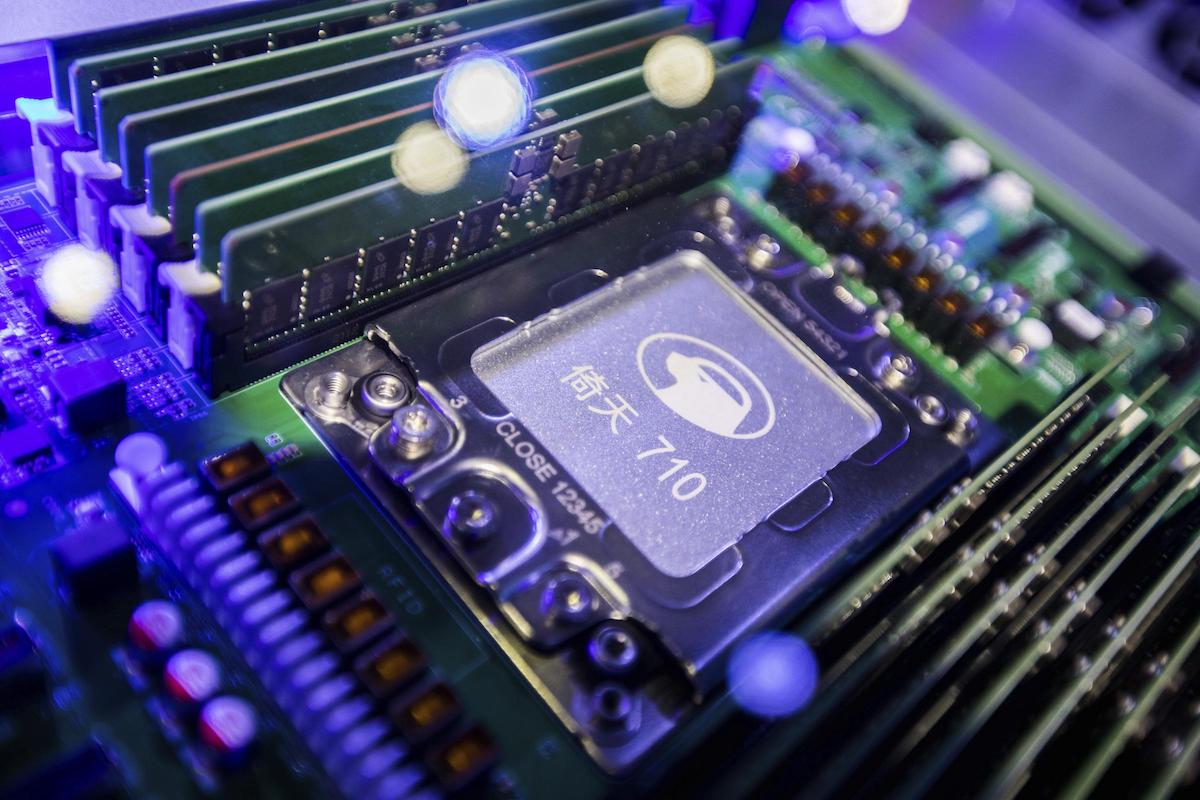

Signs of dissatisfaction from US Asian allies in the chip war. Yes, because there is a war that is fought with weapons. That in Ukraine and, sadly, in several other parts of the world. And then there is a war that is fought with investments, special funds and restrictions that allow us to glimpse the specter of a decoupling technological decoupling. At the heart of this second conflict there is above all one thing: i semiconductors, commonly known as a microchip. And the two main contenders are always them, United States and China. With the first engaged with all their strength to try to exclude the second from supply chains of the most advanced technologies. And the second committed with all her strength to trying to achieve the technological self-sufficiency that shields her from the closures of the outside world on the other.

Joe Biden has intensified the maneuvers started since Donald Trump to persuade key partners in semiconductor manufacturing to block or limit ties with Beijing. He succeeded especially with Japan and the Netherlands, which despite the grumbling (especially the Dutch) seem to have almost aligned. Companies in both countries are not happy given the risks of losing a vital business.

The same ASML he made it known that he hoped to be able to limit the damage, but in reality the ban risks speeding up the Chinese attempt to develop similar technologies to achieve a still distant self-sufficiency. However, Japan’s ok was not in question, given the increasingly close relations between Tokyo and Washington, sealed by the visit of the premier Fumio Kishida at the White House last January 13, during which a further strengthening of the partnership in the military field was announced.

Less obvious was instead the green light of the Netherlands, who had always tried to avoid American requests for restrictions. And it is an even more significant green light, given that the ASML holds the substantial monopoly in the production of machinery for ultraviolet lithography, essential for one of the production steps of the microchip. Depriving China of these machines can significantly curb growth in the industry.

South Korea criticizes Biden’s moves on chips

Ma if semiconductors are the oil of the future, this oil flows mainly in East Asia. At least on a material level. Particularly between Taiwan and South Korea. All of the world‘s semiconductors are manufactured and assembled here below 10 nanometers, the more advanced ones. Taiwanese companies control more than 65% of the global share of the semiconductor manufacturing and assembly industry. TSMC alone weighs over 50%. The first competitor is the South Korean Samsung with 16% of the market. The domain is even more extensive from a qualitative point of view: Taiwanese manufacturers hold 92% of the manufacturing of chips under ten nanometers

Both at the center of diplomatic and geopolitical tensions, both recipients of political pressure. Both Taipei and Seoul have postponed as long as possible the moment in which they would be forced to make a choice of sides. Well, now the Asian partners of the US and members of the so-called Chip 4 (a sort of alliance proposed by Washington with Japan, South Korea and Taiwan to strengthen production and “democratic” supply chains) express reservations about Biden’s plans with unprecedented vigor.

“The South Korean government will clarify that the conditions of the Chips Act could exacerbate trade uncertaintiesviolate the management and technology rights of companies and make the United States less attractive as an investment option,” said South Korea’s commerce ministry as it awaits a meeting with its US counterpart in Washington in the coming days.

Under the Chips Act, companies that accept the incentives are required to share with the US government a portion of their profits that exceed initial forecasts by an agreed threshold. Companies that win chip subsidies would be barred from engaging in joint research and technology licensing activities or to expand semiconductor production capacity in foreign countries of interest such as China for 10 years. Both Samsung Electronics and SK Hynix have chip factories in China.

Chip companies are also concerned about disclosure of profit projections and operations because they are considered trade secrets. Lthe same thing, albeit more subtly, takes place in Taiwan. The fear is that of losing that so-called “silicon shield” which is believed to serve as a potential (and very partial, it must be said) deterrent against possible military action by Beijing. The function of that “silicon shield” it should also be seen in reverse: for many Taiwanese it also represents a partial guarantee of Washington’s will to defend them, in order to prevent the TSMC foundries from ending up under the control of the Chinese Communist Party.

For this the construction of two TSMC plants in Arizona and the US regulatory maneuvers make Taipei fear that that silicon shield could risk crumbling.

Subscribe to the newsletter