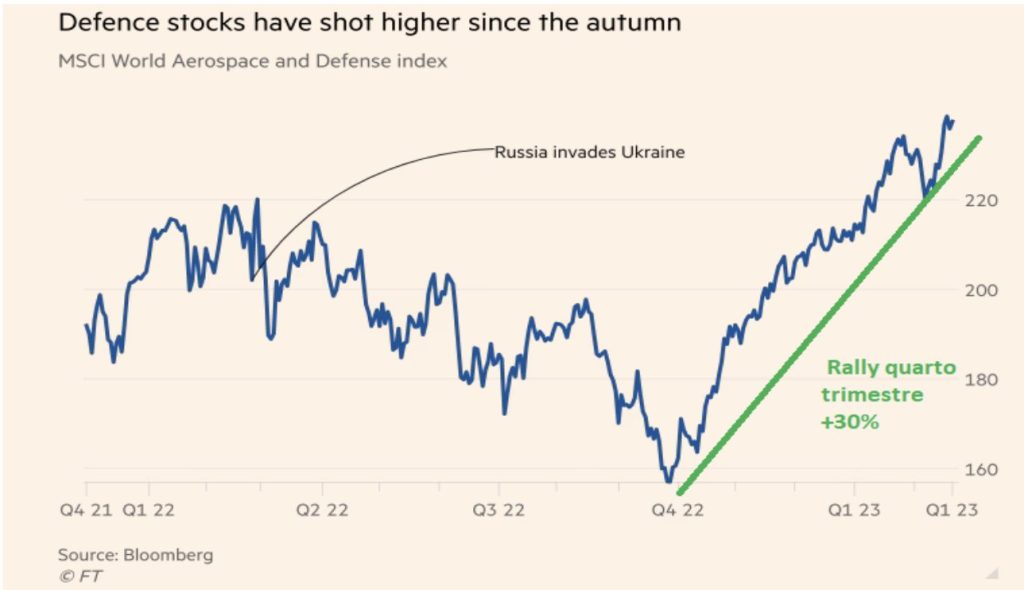

The prolongation of conflict Between Russia e Ukrainethe idea that the end will not be imminent and the increasingly consistent support of the West for the country led by Zelensky, have pushed up the quotations of shares of the defense industry sector. In fact, a registered defense sector rally from October 2022 to today, by 30%!

This article talks about:

The world’s defense and aerospace index beats the world’s stock index

In the autumn it was realized that war would take longer and that more ammunition and war equipment would be needed. This would have necessarily translated into an increased production of arsenal and therefore an increase in production by the companies of the sector, with presumed increases in future profits.

The positive repercussions on the share prices of the companies of the defense and aerospace sector they were, therefore, inevitable.

The index MSCI World Aerospace and defense it rose nearly 30% in dollar terms from early October to the end of the first quarter of 2023, 15 percentage points higher than the broader MSCI World index.

Me too’Stoxx European Aerospace and Defense indexfollowing Europe’s increasingly strong alignment with Ukraine, has increased by just over a third over the same period.

Based on these data, it was found that the fourth quarter 2022 was one of the best quarters for defense stocks in 40 years!

From Blitzkrieg to Endless War: All Explained in a Financial Times Chart!

As can be seen from the analysis of theworld index of the defense and aerospace sectorthe sector underwent a first significant rise in the pre-conflict phase, therefore fueled only by expectations of a potential war between Russia and Ukraine.

Immediately after the conflict became a reality, also on the basis of the speed with which Russia was advancing in the Ukrainian territories and therefore on the concrete possibility that the war could be resolved quickly with the siege of Kiev by Russia, the quotations of the sector they began to record a slow decline, alternating with gradually decreasing relative maximum declines. All in a typical bearish trend.

By the autumn, quotations had reached lower levels than in the pre-conflict period.

In the fourth quarter, the rallyon the basis of the fact that the conflict will not be a blitzkrieg at all or even a war of easy diplomatic solution, but will probably be a long positional war.

Europeans don’t like to profit from war?

An analysis found that the largest investors in European defense stocks with exposure to events in Ukraine are mostly US companies.

Eight of the top 10 shareholders of Rheinmetall AG (German arms manufacturing company) are based in the United States, as are seven from the Italian defense group Leonardo and eight from BAE system (British company involved in aerospace and defense).

The European investors therefore they show greater attention to environmental, social and governance issues and seem to prefer ethical investments, even if this should imply the loss of some earning opportunity.

At least for big investors. It is more difficult to analyze the behaviors of comparto retail.

Defense and aerospace sector still growing in 2023?

There seems to be some consensus among analysts that the strong performance of the defense sector in the last quarter of 2022 is unlikely to continue throughout 2023.

For some analysts, not only will the next 12 months not be characterized by strong growth for the defense sector but it could even underperform the world stock index as by now much of the “good news” is already incorporated in the quotations of the stocks.

If the broader global economic outlook improves, investors may turn their attention to sectors better positioned to benefit from the recovery.

Byron Callanchief executive of research group Capital Alpha Partners, said he expects the sector to face headwinds this year, including continued constraints on the ability to source enough skilled workers and raw materials.

Many companies have warned that supply chain issues are hampering efforts to ramp up production.

Furthermore, in the United States, as indeed in Europe, the question of the national debt ceiling has reopened, which could undermine defense spending.

Of course, however, if the war continues in perspective for several years, the orders will continue. Without considering that this situation has generated a new attention to the defense sector which for years had often suffered budget cuts and investment restrictions.

Without a doubt, therefore, it is a sector to monitor.

Find out which Investor You areI have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation: >> Start Now < |