With a net profit of 14 billion in the first quarter of 2022, Jiu’an Medical (002432, SZ) has become the focus of the market again.

On the evening of April 29, Jiu’an Medical released the 2021 annual report and the 2022 first quarter report at the same time. The company achieved operating income of 2.397 billion yuan last year, an increase of 19.36% year-on-year, and a net profit attributable to shareholders of listed companies of 909 million yuan, an increase of 274.96% year-on-year. In addition, in the first quarter of this year alone, the company’s operating income was as high as 21.737 billion yuan, and its net profit was 14.312 billion yuan, while the total net profit in the years after the company’s listing (2010-2020) was only 71.8755 million yuan.

The surge in performance stemmed from the company’s acquisition of a large order for new crown self-testing products. In November last year, the new crown antigen self-test kit of iHealth, an American subsidiary of Jiu’an Medical, was approved for use in the United States. As of the close on April 29, the company’s stock price was 80.66 yuan per share, an increase of more than 10 times compared with about 6 yuan per share in early November last year.

Investors rejoiced, but there were voices of reason in the market. They asked, in addition to the new crown self-test kit, when will Jiu’an Medical’s main business Internet medical be fully rolled out?

Dark horse: New crown self-test products create wealth

Received a total of over 2 billion US dollars in large orders

The new crown self-test kit is a product that cannot be avoided in the market discussion of Jiu’an Medical. Driven by this product, Jiu’an Medical’s regional revenue structure has undergone a major adjustment last year, of which foreign sales revenue increased by 35.09% year-on-year, and revenue contribution increased from 80.05% in 2020 to 90.61%; it is also by this product. , the company gave a good result of net profit of more than 14 billion in the first quarter of 2022.

In this regard, Jiu’an Medical once clearly stated in its performance forecast that due to the impact of the epidemic situation in the United States, the local demand for new crown antigen detection kit products has increased significantly. The company’s iHealth US subsidiary sells iHealth’s new crown antigen detection kit products through its own channels and the Amazon platform, and signs major contracts and orders with customers.

According to the reporter’s review, since the approval of the new crown self-test kit in November last year, Jiu’an Medical has received a total of 2.108 billion US dollars of orders, which is about 13.934 billion yuan according to the real-time US dollar exchange rate of 6.61. This figure is Jiu’an Medical. It is more than double the combined income of each year from 2010 to 2020.

As of the press date, Jiu’an Medical has received orders from the US government

Data source: company announcement

Jiu’an Medical’s 2021 annual report also shows that last year, the company’s top five customers had a combined sales of 1.273 billion yuan, accounting for 53.09% of the total annual sales.

However, in addition to the successful big single products, the relatively diverse business structure of Jiu’an Medical is also easily overlooked. As a medical device company that started with the research, production and sales of blood pressure monitors and blood glucose meters, in addition to the home medical devices and IVD fields under the new crown self-test kit, Jiu’an Medical is also involved in the field of Internet medical care and the field of Internet of Things consumer electronics products. Before the emergence of the new crown self-test kit, these two areas were the focus of the company’s transformation and development in recent years.

So, how has the revenue performance of these two areas been over the past year? In terms of products, Jiu’an Medical’s forehead thermometers, oximeters, sphygmomanometers, blood glucose meters and other household medical device products will perform well in 2021. Among them, the operating income of ODM/OEM (OEM) products was 297 million yuan, an increase of 38.98% over the previous year; the operating income of traditional hardware products was 73.6239 million yuan, an increase of 12.70% over the previous year.

However, the company’s mobile medical communication equipment sales and services, new retail business and other product revenue are not ideal, down 24.98%, 54.87% and 46.74% year-on-year respectively, and the sum of the three types of products’ revenue ratio also fell to 10% the following.

On the expense side, in addition to the 13.54% year-on-year increase in administrative expenses, the various expenses of Jiu’an Medical in 2021 will also decline significantly.

Popularity: Information disclosure is becoming more standardized

Continue to develop overseas markets

From obscurity to market star, while being sought after by funds, Jiu’an Medical also faces many troubles and occasionally touches the boundaries of market rules.

In January of this year, Jiu’an Medical almost took all the “soul questions” to investors, such as “Are you considering acquiring Microsoft?” “Are you willing to acquire Tesla to expand the business scope of the company to diversify and promote the competitiveness of the company?” Nonsense questions are answered. Some financial commentators questioned that the core of the company’s reply should focus on issues that are actually related to listed companies.

A month later, the chairman and board secretary of Jiu’an Medical were interviewed by the Tianjin Securities Regulatory Bureau due to the previous company announcement. The regulatory agency believes that Jiu’an Medical only disclosed some of the experimental results that were successfully tested on January 7, but did not disclose all the experimental results, and the disclosed information was incomplete.

For a time, the company was pushed to the forefront of public opinion. In this regard, the company responded to the “Daily Economic News” reporter through WeChat in February this year, saying that at that time, it was mainly due to the fact that there were many professional terms involved, and it did not want to make the announcement too difficult to interpret, so it used a relatively concise statement. More care will be taken to avoid such problems.

The reporter read the reply of Jiu’an Medical on the investor platform “Interactive Easy” and found that its recent reply items were significantly less than before, and they remained silent on important matters that have not been announced.

In the focus of the market, Jiu’an Medical’s voice has become more and more low-key, but the company’s “new development” in the field of new crown self-test kits has not stopped.

According to the annual report, in April of this year, the official website of Jiu’an Medical’s US subsidiary launched a new crown antigen detection video verification service, which can provide new crown antigen detection reports for people who plan to enter the United States by flight. Consumers can simultaneously purchase iHealth kits and products online. Attestation services further expanded the scope of the company’s new crown testing business. However, the new business is currently small, and its future impact on the company’s performance is uncertain.

Under the background that Jiu’an Medical’s new crown self-test products have not been approved in China, as domestic testing reagent companies such as Oriental Bio (688298, SH), Aikang Bio, and Bosheng Bio entered the US market, Jiu’an Medical chose Develop more overseas markets.

On February 14, the company revealed in an institutional survey: “We are actively engaging and communicating with customers in the Japanese market to see if we can open the Japanese market as soon as possible.”

At the end of April, Jiu’an Medical’s new coronavirus antigen home self-test kit obtained the conditional import or sales authorization in Canada and received the authorization letter. This means that the product can be sold in Canada during the Canadian public health emergency; it also means that with the repeated global epidemic, the new crown self-test kit will also contribute revenue to Jiu’an Medical in the future.

The future: developing innovative service models for diabetes

How long will it take to bloom?

While the COVID-19 self-test products focused on by the public have created huge wealth for Jiu’an Medical, the Internet medical business represented by “Diabetes O+O” has been neglected. In 2019, which is also the last fiscal year before the COVID-19 outbreak, the company adjusted its strategy to promote the new “O+O” (online + offline) model of diabetes diagnosis and treatment globally, and launched the most cost-effective products on the new retail platform. two core strategies.

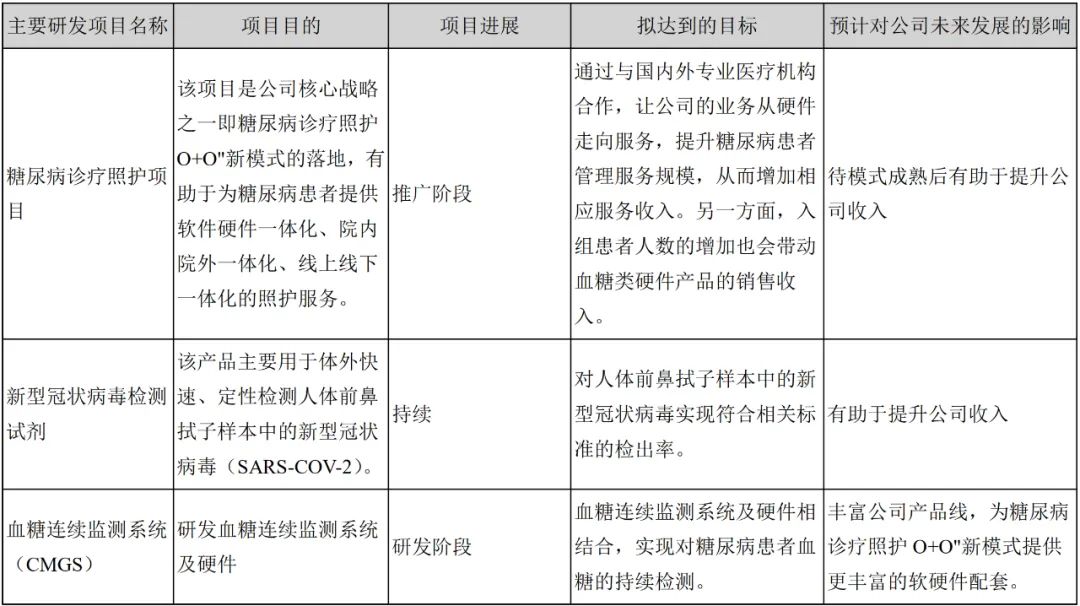

Jiu’an Medical’s 2021 annual report shows that among the main R&D projects, the new crown detection reagent “helps to increase the company’s revenue”, while the other two are related to diabetes diagnosis and treatment, and the long-term strategy is more meaningful.

Image source: Screenshot of Jiu’an Medical’s 2021 Annual Report

The annual report explains that the new “O+O” model of diabetes diagnosis and treatment is an innovative service model for diabetes, which realizes the integration of software and hardware, the integration of offline and online, and the integration of inside and outside the hospital through “intelligent hardware + APP + cloud platform”.

At present, the model has been implemented in 46 cities and 191 hospitals across the country. The average glycated hemoglobin compliance rate has increased from about 30% of the baseline to about 60%, the non-performing rate has dropped below 5%, and the standardized management rate has reached 70%; The United States has partnered with more than forty clinics.

However, Jiu’an Medical did not disclose financial indicators such as revenue and profit of this part of the business in the annual report. At the end of 2021, when the company responded to the Shenzhen Stock Exchange’s letter of concern, it mentioned that “the promotion of the new ‘O+O’ model of the company’s diabetes diagnosis and treatment care in China and the United States is still at the stage of investment, and the current income is low.”

In March this year, when the reporter interviewed Liu Yi, chairman of Jiu’an Medical, the other party said that the core strategy of Jiu’an Medical has not changed, but after this epidemic, there are more funds on hand. In the future, the abundant cash brought by the new crown self-test kit will mainly be invested in two core strategies.

The annual report also shows that in 2022, the company will accelerate the implementation of the new “O+O” model of diabetes diagnosis and treatment care nationwide with the goal of rapidly increasing the number of diabetes care patients. The company will invest funds in the procurement of project equipment and software, product development and employee training. It plans to open nearly 600 “shared care” centers in hospitals in many cities and regions across the country in the next three to four years, so as to expand patient care. number of business objectives.

In addition, according to the announcement on the use of self-owned funds for cash management issued by Jiu’an Medical on the 29th, the company’s board of directors agreed that the company will use idle self-owned funds of no more than 9.5 billion yuan or equivalent foreign currency for purchases with high safety, low risk and liquidity. Investment products issued by financial institutions such as banks and brokerages with good character. The matter still needs to be submitted to the 2021 Annual General Meeting for consideration.

Reporter| Lin Zichen

Edit| Liang Xiao Lu Xiangyong Gai Yuanyuan

proofreading |Cheng Peng

Source of cover image: Photo Network-401088303

|Daily Economic News nbdnews Original article|

Reprinting, excerpting, copying and mirroring are prohibited without permission

Source of cover image: Visual China-VCG111359925144