Eataly, net losses of 28.7 million euros. The recapitalization closing is ready

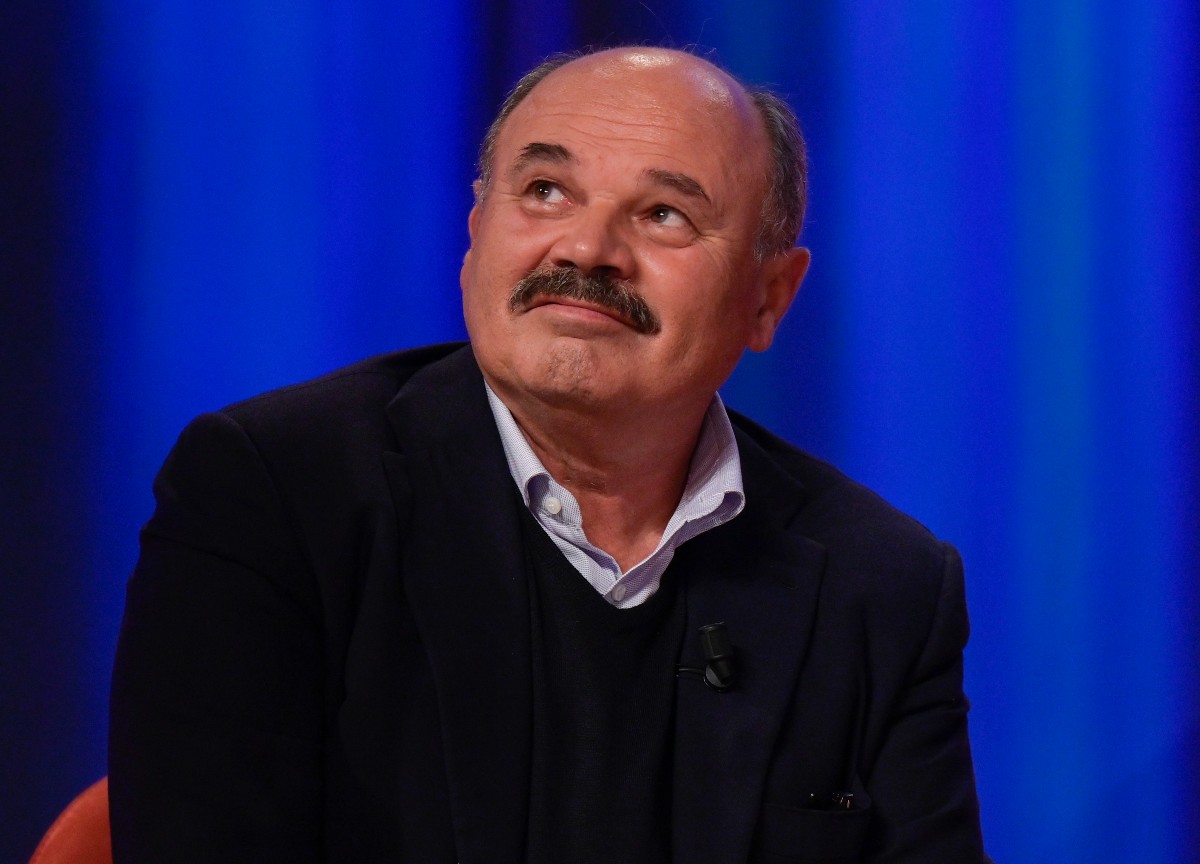

Deep red for Eataly, the supermarket group of high-end Made in Italy food products, founded by Oscar Farinetti. As the site reports Bebeez.it, 2022 was closed with a net loss of 28.7 million euros.

Il consolidated financial statements 2022 of the group, which was approved in recent days by the assembly, has also highlighted a strong growth of revenues of 601.9 million euros (from 462 million since 2021) and above all ofebitda at 25.5 million (from 14.4 million), numbers which, however, have not yet been sufficient to bring the group into profit, which precisely closed the year with a net loss of 28.7 million, although down from that of 31.1 million of 2021. Losses that added up to those of almost 70 million euros carried forward at the end of 2021, with the consequence that the shareholders’ equity at the end of 2022 fell to just 744 thousand euros from 28.7 million at the end of 2021. All for one net financial debt of 117 millioni (da 126 million).

READ ALSO: Eataly leaves a bad taste in Farinetti’s mouth, submerged by millions of debts

A financial situation that therefore needed to be addressed and precisely for this reason, an agreement was reached last September with Investindustrial, as mentioned. Always as reported Bebeez.it, however, the announced operation has yet to be concluded and therefore, since an injection of liquidity is necessary, in the meantime Eataly issued a first tranche of 20 million euro at the end of December of a bonds for a total of 35 million, conditional on the repayment of the loan with SACE guarantee which last June refinanced the 105 million euro loan again with SACE guarantee disbursed under the Covid-19 legislation in 2020 and which expires on 30 June 2028. In detail, in fact, we read in the Report on the 2022 financial statements, the first tranche of the bond, which matures on December 31, 2028 and pays an 8% coupon, was fully subscribed by Food Experience Investment sarl, the investment vehicle headed by the Investindustrial VII fund and which will acquire 52% of Eataly’s capital. The subscription of the bond also follows a previous injection of liquidity from 15 million eurosin the form of a shareholder financing expiring after 30 June 2028 and also subordinated to the SACE loan. The shareholder loan was disbursed last spring by the partners Eatinvest spa (for 13.5 million) e Carlos Alberto SS (1.5 million), but there was no news at the time.

We recall that the Investindustrial fund VII will be the new majority shareholder of Eataly both by subscribing a capital increase and 200 million euros (pari al 30,77% of the capital of Eataly) and taking over for another 140 million shares representing a total of 19.62% of the share capital of the current shareholders. The operation provides in detail that, at the closing, the historical partners Eatinvest (holding of Farinetti family, which today has the 58%), the family Mustache / Miroglio (al 19,8%through the Carlo Alberto s.s.) e Clubitaly (vehicle of club deal coordinated by Tamburi Investment Partnerstoday at 19,8%) will collectively own the 48% of the capital. ClubItaly, for its part, will not only not sell its shares in its portfolio, but rather will increase its participationunder conditions such as to allow it to significantly lower the average book value.

Subscribe to the newsletter