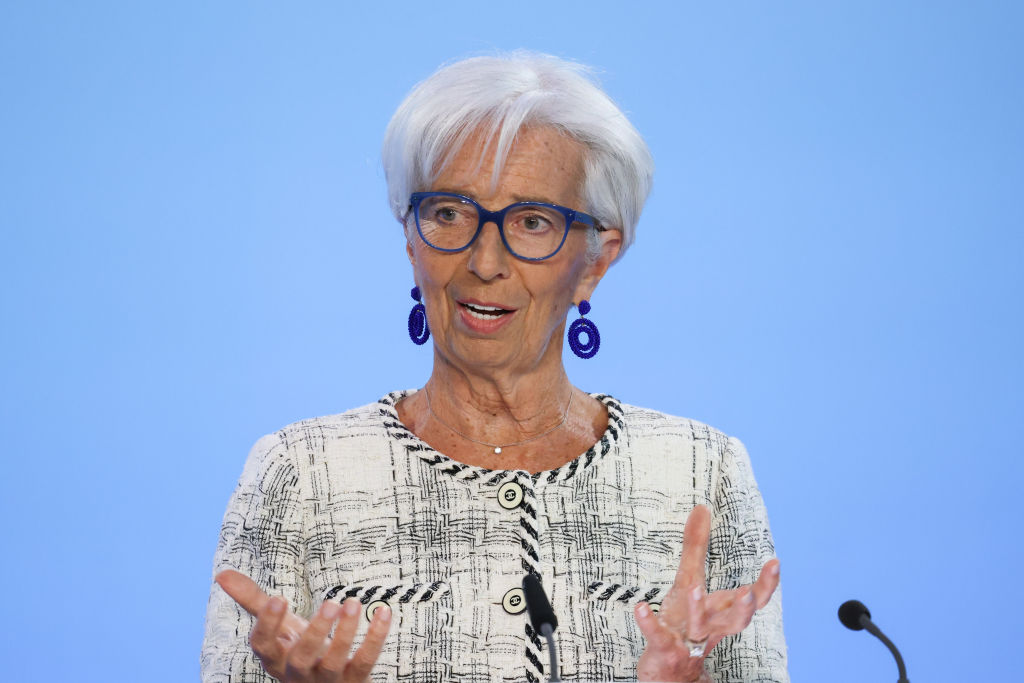

A few days after Christine Lagarde’s announcement on rates – but also on QT – by the ECB, rumors are arriving that do not exactly bode well for BTPs, in particular, and for sovereign bonds in the euro area in general. These were reported by the British newspaper Financial Times which, in view of ECB Day on Thursday 27 July, reports that, according to some officials and economists, the hawks of the ECB could accept a lower terminal rate in the euro area, provided that Lagarde decides to speed up the reduction of her balance sheet flooded with BTPs and other government bonds through QT, or Quantitative Tightening.

The opinion of Paul Hollingsworth, chief economist at BNP Paribas, is reported, according to which, “while we do not believe a decision is imminent, some hawkish ECB officials may be willing to accept a lower terminal rate, if at the same time the QT is accelerated”.

The hypothesis is that, beyond the QT which has already targeted the assets, including the BTPs, which the ECB of Lagarde bought with Quantitative easing, or with that plan that bears the technical name of APP, in particular of, Frankfurt decides to launch a Quantitative Tightening which translates into a divestment, too, of those assets, and here too the Italian government bonds appear, which were taken over with the other plan launched by the ECB: the so-called pandemic QE or , also, PEPP.

The genesis of the PEPP plan, an acronym that stands for Pandemic Emergency Purchase Programme, is learned on the Bankitalia website: the launch of the plan, “temporary in nature”, dates back to 26 March 2020, or in the month in which the whole world woke up to the nightmare of the Covid-19 pandemic.

The firepower of this monetary bazooka, initially set at 750 billion for the whole of 2020, has been extended and strengthened, up to an endowment which, in December 2020, was raised to 1,850 billion. The net purchase horizon and the reinvestment phase have been extended until at least the end of March 2022 and December 2023, respectively. The PEPP reinvestment horizon has also been extended “at least until the end of 2024”.

So far, in the face of the QT that has hit the APP or even the PPA, “as regards the PEPP (pandemic emergency purchase programme), the Governing Council announced in the statement issued on 15 June, the day on which it launched yet another rate hike in the euro area as part of its battle against persistent inflation in the bloc, its intention to continue “reinvesting the principal payments on maturing securities under the program at least until the end of 2024″ adding that, ” in any case, the future gradual reduction of the PEPP portfolio” would be “managed so as to avoid interference with the appropriate monetary policy stance”.

In the specific case of Italy and therefore of its BTPs, Robin Brooks, Chief Economist @IIF aka the Institute of International Finance and former Goldman Sachs Chief Forex Strategist, he pointed out that, in reality, the reinvestments made by the Lagarde ECB in Italian government bonds with the PEPP plan are such that one could say that, in the case of made in Italy bonds, the QE would not even have ended. That said, the Financial Times recalls how, on the occasion of the central bank forum organized by the ECB itself in Sintra, Portugal, last month, a Eurotower official questioned by the newspaper spoke of the possibility that the central bank would start discussing the possibility of selling some bonds even before their maturity. The number one of the Bundesbank, the central bank of Germany, Joachin Nagel, had also already said in March that, “later this year” the ECB could also consider the possibility of disinvesting more quickly the PEPP plan launched during the pandemic.

And it is this possibility that some economists are looking at. Jens Eisenschmidt, chief economist of Morgan Stanley’s European division, also stated that the ECB could start reducing the amount of BTP & Co purchased with the PEPP starting from January next year, to then stop reinvestments by July. “Everything so far suggests that there is no reason why the ECB can’t move even faster.”