They are My business find them reviews up-to-date on all the main investment instruments that can be subscribed to. On this occasion I analyze the characteristics of the Eurizon Fund Reserve 2 Years Class Aa mutual fund managed by Eurizon Capitaluse SGR of the group Intesa Sanpaolo.

I intend to address all the most important points: the investment policy of the fund and the composition of the portfolio, the historical performance and the costs borne by the investor (direct and indirect), the methods of subscription, disinvestment and use of proceeds.

Finally, I will share with you some thoughts on the category of actively managed mutual funds, and I will also give you some tips to understand if this investment is consistent with your strategy.

Enjoy the reading.

This article talks about:

A few words about Eurizon Asset Management

Eurizon Capital SGR is the company that controls the Asset Management division of Intesa Sanpaolo group.

Eurizon is controlled by the Luxembourg subsidiary Eurizon Capital SA, the Italian companies Epsilon SGR and Eurizon Capital Real Asset SGR, and the company based in London Eurizon SLJ Capital LTD.

The Division is active in 24 countries in Europe, while it is present in Asia with the subsidiary Eurizon Capital Asia Limited based in Hong Kong and the investment in Penghua Fund Management (49%).

It has a wide range of products under Italian and Luxembourg law, and is aimed at both retail and institutional customers.

We are facing one very solid and serious realitywith a large and distributed network in different parts of the world.

The savings solutions proposed by Eurizon make use of different strategies: multi-asset, multi-style and multi-product, Active market, and strategies based on quantitative methodologies.

Fund profile Eurizon Reserve 2 years

Let’s start right away by framing the main features of the fund Eurizon Reserve 2 Years Class A. It is an actively managed fund, belonging to the flexible bond category.

I flexible funds differ from other actively managed funds in that the manager operates aasset allocation tatticacompletely free and without constraints, without adopting a benchmark as a reference – i.e. without using a pre-established portfolio as a draft.

The management objective is the conservation of the invested capital and the contained growth of the fund’s assets, in a short time horizon of 2 years.

To do this, the management does not set too rigid limits in the choice of financial instruments, in the proportions between the various asset classes, in the selection of the various geographical areas and of the various currencies.

The only one “constraint” to be respected is the risk/return profile of the fund expressed by the synthetic indicator, which we will see shortly.

Instead of the benchmark, a measure of risk is provided a priori, the Value at Risk (VaR) which, in fact, measures the maximum potential loss that the portfolio can suffer over a time horizon of one month. The Var must be consistent with the risk level of the fund.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <

What the Eurizon Reserve 2 Year Fund invests in

The Fund invests in financial instruments of a bond and/or monetary nature, and makes an investment in bank deposits which tends to amount to up to 50% of the assets.

Bonds and monetary instruments are issued by governments, supranational bodies/agencies and companies.

The fund invests up to 30% of assets in emerging market instruments.

Investments denominated in currencies other than the euro cannot exceed 40% of total assets, while the Fund’s average duration is less than 2 years.

The risk profile

The fund has a risk profile of 2 on a scale of 1 to 7, making it a low-risk fund.

The risk indicator is a guideline of the level of risk of this product, taking other products into consideration.

Risk refers to the possibility that the product may suffer monetary losses due to market movements or due to the company’s inability to pay the amount due.

Methods of subscription, exit and use of proceeds

Eurizon Reserve 2 anni is an open-ended fund, therefore investors can subscribe for units at any time and, equally, they can request reimbursement from the SGR at any time, as a result of which the total assets and the value of the units can vary constantly.

Participation in the fund is achieved with a minimum investment of 50 euros, therefore by subscribing a total of shares corresponding to the amount invested.

The Class A identifies a category of units of the fund, which can be subscribed both with a single payment and through periodic payments, i.e. by opening a Capital accumulation plan (PAC).

The fund is placed by the Intesa San Paolo group and by numerous banks and SIMs.

Finally, the income distribution policy is ad accumulationthis means that the profits accrued each year are not distributed but reinvested in the fund itself.

Costs

Let’s analyze the cost schedule that we need to evaluate the real convenience of the investment. In fact, expenses eat up part of your capital and potential return.

The expenses you have to bear for the investment are divided into:

- Subscription charges one-off payment equal to 0.30%;

- Exit charges to get out of the fund, not foreseen;

- Current expense withdrawn from the fund each year equal to 0.89%, of which 0.70% to pay the manager;

- Performance fee it is equal to 20% of the lower value accrued in the period between 1 May of each year and 30 April of the following year.

Historical returns

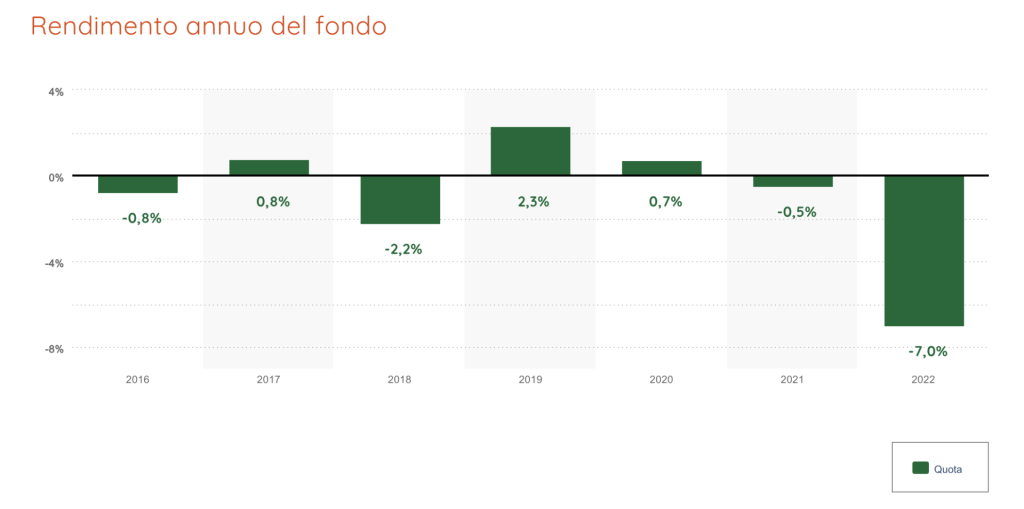

Finally let’s look at the past performances, bearing in mind that they are not indicative of future ones. Inside the KIID (the key information document) you can see the performance chart starting from 2016, as the fund has only been operational since 2015. Here is the screenshot:

Dal graphic it appears that the performances have been fluctuating, in 2016 and 2018 the performance was negative, while in 2017 and 2019 it was positive. Also in 2020 we had a positive performance, while in 2021 the performance was negative.

2022 was a negative year for all markets in general, and not even this fund was able to escape the negativity and low yields, so much so that it recorded -7%.

This makes you understand that it is not possible to predict the results of the investment, and you must then consider that low returns often fail to reduce the overall costs of the investment, so even when the performances are positive, the investor can find himself at a loss.

My Business Opinions

Before concluding the review I want to push you to make a few reflectionsboth with regard to the fund analyzed and to the category of actively managed mutual funds.

Let’s start with the objective assessments of the 2-year Eurizon Riserva: when the fund is consistent with your strategy and when it’s not for you.

When and why to invest

What we analyzed today NON it is a simple bond fund; If so, I’d give you something like this:

“This is a consistent investment if your risk tolerance and growth ambitions are modest, and if your time horizon is very short. If, on the other hand, you aim for significant capital growth over the long term, then you must opt for an equity fund”.

But here we are not talking about a simple bond fund, but a flexible fund, a particular and heterogeneous category of funds that can invest hands-free, not having major constraints inasset allocation.

In practice, the manager does what he wants based on complex analyzes and calculations, meanwhile the average investor gives him carte blanche because he understands little or nothing.

Not having a benchmark objective reference how will you evaluate the work of the management? The consequence is finding yourself, at a certain point, in an investment that has changed since the beginning, and that no longer reflects your expectations.

If the manager is competent, the dynamism of the investment can be an added value; but since there is no certainty, the risk that the manager makes wrong choices adds to all the rest.

However, the biggest mistake is that of the investor who subscribes to a complex instrument without knowing what he is getting into. Therefore think carefully about the choice of this fund, ask yourself if, compared to a simple bond basket, there is really a convenience, so much so that you blindly entrust yourself to the SGR.

Because actively managed funds aren’t the only option

And now I’ll tell you briefly how I think about mutual funds actively managed. I find them too expensive and opaque, so I don’t use them in my wallet.

I have been directly involved in the management of my money for years, therefore I like to know exactly where and how my capital is invested, and other things being equal, I like to spend as little as possible on management commissions.

It’s not a universal rule, but often funds a active management they are more expensive and less convenient than other instruments.

For example, based on my experience, I find the most effective ETF, a class of exchange-traded funds that are passively managed, i.e. they simply track a benchmark index 1:1.

I don’t want to say that they are the best tools for any type of strategy, on the contrary, if mishandled they do more damage than good. However, they lend themselves to a cheaper and more transparent investment, as you always know what the strategy adopted by the fund is and how the resources are used.

To learn more, read these articles:

Conclusions

Before choosing the instruments to put in walletit would be better to define an investment strategy and, possibly, increase one’s own financial education.

You can find several, in order to choose the one that best reflects your risk profile and your return expectations.

Before saying goodbye, I also suggest you read these guides:

Good continuation!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <