A pause, but not a stop: Jerome Powell’s Fed does not betray the markets and produces the announcement awaited by the consensus: rates on US fed funds firm for the first time after ten consecutive rises.

The latest increase, on May 3, led to a rise in the cost of money to the range between 5% and 5.25%, record since July 2006.

The range remains the same: the FOMC, the monetary policy arm of the US central bank, stops after that last monetary tightening in May, equal to +25 basis points.

On the other hand, the effects of long series of rate hikes there have been, as demonstrated by the inflation trend measured by the consumer price index (CPI), released on the eve.

The data showed that inflation growth was, in May, the slowest in two years.

Fed, rates firm at 5%-5.25%. Here because

These progresses, in speaking at the press conference following the announcement on rates churned out by the FOMC, the president Jerome Powell confirmed them:

“We have raised our interest rates by 5 percentage points (overall), and continued to reduce the financial instruments held (with QT-Quantitative Tightening) at a fast pace. We have come a long way and the effects of our restrictive maneuvers are yet to be felt.” the Federal Reserve helmsman said.

“We continue to see the impacts of our tightening”, Powell further explained, referring to the demand trend in the “most sensitive sectors of the economy, especially in the real estate market and in investments“.

Said this, the “but” was not missing:

“However, it will take some time for the effects of our monetary tightening to be fully felt, especially on inflation.”

READ THE FOMC RELEASE

Powell warns: more rate hikes in 2023. The dot plot says how many

In short, US inflation may have come down but not as hoped by the US central bank.

For this reason, “nearly all the FOMC exponents,” added Powell, “they think further rate hikes this year are appropriate”.

This sentence was enough to unleash Wall Street, immediately after these words, an “open the sky” style reaction, with the Dow Jones not welcoming the prospect of further monetary tightening, dropping by around 400 points. The US stock market then fluctuated nervously.

But how far should fed funds rates go? still keep going up?

Powell noted that the median (of FOMC officials’ projections) is for “a target for fed funds rates of 5.6% at the end of the year”, adding that “we will continue to make our decisions from meeting to meeting”.

In fact, “we have not made a decision regarding the July meeting“, continued the number one of the Federal Reserve, underlining that “the focus was on what to do today”.

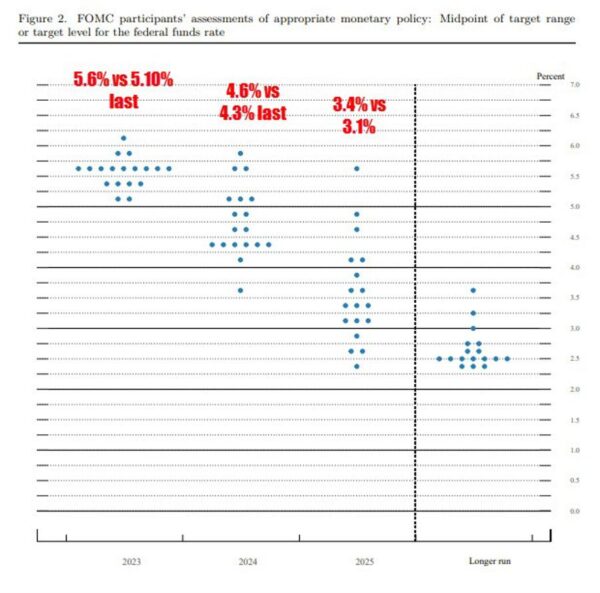

What is certain is that the markets, on a break that was a stop, had hoped for it. But no: to tell it like it is it’s the same dot plot, the document that summarizes the forecasts of the FOMC representatives on the future trend of US fed funds rates.

The document revealed that, of the 18 exponents of the Federal Open Market Committeefour expect another rate hike in 2023, while another nine expect two more monetary tightening.

Two FOMC officials estimate a third of the increases while one even bets on another four raises.

Only two FOMC officials believe there will be no more tightening.

Jerome Powell’s Fed expects higher US fed funds rates for the next two years as well, to be precise at 4.6% in 2024 and 3.4% in 2025, compared to the previous rate outlook of 4.3% and 3.1% respectively.

And again, the US central bank is betting on a better performance of the US economy than previously expected.

In fact, it emerges from the summary of the economic projections an increase in US GDP of +1%compared to the 0.4% growth expected in March.

Greater optimism also towards the labor market, with this year’s US unemployment rate expected to 4.1%, compared to 4.5% in March.

The brightest prospects on the economy however, they also translated into an upward revision of the core inflation outlook:

the Fed raised its core inflation expectations (inflation excluding the food and energy price component) to 3.9% from the previous 3.6%.

At the same time, the outlook on the headline inflation trend (measured by the PCE index) was lowered from 3.3% to 3.2%.