People’s Daily Online, Beijing, April 12 (Huang Sheng) A few days ago, the People’s Bank of China released the statistical data on the scale of social financing in March 2022, the financial statistics in the first quarter of 2022, and the incremental statistics on the scale of social financing in the first quarter of 2022.

Data show that in the first quarter of 2022, RMB loans increased by 8.34 trillion yuan, an increase of 663.6 billion yuan year-on-year; the cumulative increase in social financing scale was 12.06 trillion yuan, 1.77 trillion yuan more than the same period last year. Among them, the stock of social financing at the end of March was 325.64 trillion yuan, a year-on-year increase of 10.6%.

In this regard, a number of industry sources said that the financial data in March exceeded the expectations of many institutions, reflecting new progress in easing credit. In particular, under the active promotion of various growth-stabilizing policies, the year-on-year growth rates of M2 and social financing have both recovered, and the intensity of credit issuance and fiscal expenditure has continued to increase. The follow-up policy of stabilizing growth may continue to be introduced, and liquidity is expected to remain loose.

Multiple factors increase the growth rate of social financing

According to data released by the People’s Bank of China, the increase in social financing in March this year was 4.65 trillion yuan, 1.28 trillion yuan more than the same period last year. At the end of March, the stock of social financing was 325.64 trillion yuan, a year-on-year increase of 10.6%. Among them, the balance of RMB loans issued to the real economy was 199.85 trillion yuan, an increase of 11.3% year-on-year; the balance of foreign currency loans issued to the real economy was 2.33 trillion yuan, a year-on-year increase of 0.7%.

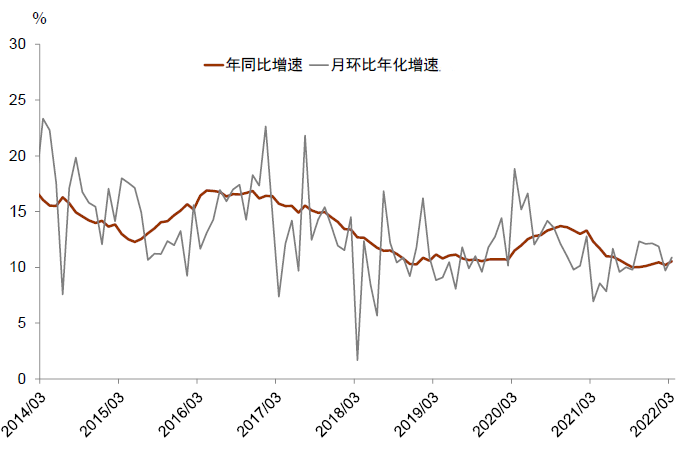

In March 2022, the growth rate of social financing scale rebounded year-on-year.Source: Wind, Bloomberg, CICC Research

Lian Ping, chief economist and dean of the Research Institute of Zhixin Investment, believes that the most obvious increase in the scale of social financing in March is government bond financing, especially the local government special bond financing has increased significantly compared with the previous stage, reflecting the The policy of stabilizing growth has been exerted. Corporate bond financing data is also remarkable. The rapid growth in government bond and corporate bond financing is expected to continue.

Wu Chaoming, vice president of the Caixin Research Institute, said that RMB loans, off-balance sheet financing and government bonds were the main support for the recovery of social financing in March. He believes that, first, benefiting from the People’s Bank of China continuing to increase easing efforts and strengthening window guidance, banks have accelerated credit issuance, which has formed the most important support for social finance; second, with the end of the transition period for new asset management regulations and the marginal loosening of regulatory policies, The shrinking pressure of off-balance sheet financing has been significantly eased, and the scale of off-balance sheet financing has turned positive again in March, an increase of 426.2 billion yuan over the same period last year, which has also formed an important boost to social financing. Third, the domestic finance continued to accelerate its efforts, and the issuance of special bonds continued to advance , which promoted an increase of 392.1 billion yuan in government bonds year-on-year, which is also an important reason for the recovery of social financing scale.

Wen Bin, chief researcher of Minsheng Bank, also believes that the increase in the scale of social financing in March exceeded market expectations, which is a highlight of the financial data in March. In terms of structure, on-balance sheet credit, off-balance sheet financing, and government bond financing were the main factors driving the increase in the scale of social financing in March.

The research department of CICC believes that after the sharp decrease in social financing in February, social financing ushered in a strong rebound in March, significantly exceeding market expectations. The new social financing in March was 4.65 trillion yuan, significantly higher than Bloomberg’s forecast of 3.55 trillion yuan, an increase of 1.27 trillion yuan year-on-year, mainly supported by the year-on-year increase in corporate financing and government debt. Since the beginning of 2022, new social financing has fluctuated greatly, but the growth rate of social financing stock eventually rebounded significantly at the end of the first quarter.

Credit and fiscal support M2 growth rebounded

According to data released by the People’s Bank of China, at the end of March, the balance of broad money (M2) was 249.77 trillion yuan, a year-on-year increase of 9.7%, and the growth rate was 0.5 and 0.3 percentage points higher than that at the end of last month and the same period of the previous year. The balance of narrow money (M1) 64.51 trillion yuan, a year-on-year increase of 4.7%, and the growth rate was the same as that at the end of last month; the balance of currency in circulation (M0) was 9.51 trillion yuan, a year-on-year increase of 9.9%. In the first quarter, the net cash investment was 431.7 billion yuan.

A number of industry insiders said that the increase in credit supply and fiscal expenditure is an important factor supporting the recovery of M2.

Wen Bin said that many factors supported the rapid recovery of M2 growth. First, fiscal policies were put forward and fiscal expenditures increased. In March, fiscal deposits decreased by 842.5 billion yuan, a year-on-year decrease of 357.1 billion yuan. Second, increased credit issuance and enhanced derivation capacity. New RMB loans in March increased by nearly 400 billion yuan year-on-year.Third, the growth rate of M2 in March last year decreased by 0.7 percentage points compared with that in February, and the base also dropped to a certain extent.

The research department of CICC also believes that in March, the policy promoted large banks and policy banks to speed up credit issuance, residents and corporate deposits increased, and the addition of fiscal deposits accelerated, and the M2 year-on-year growth rate rebounded.

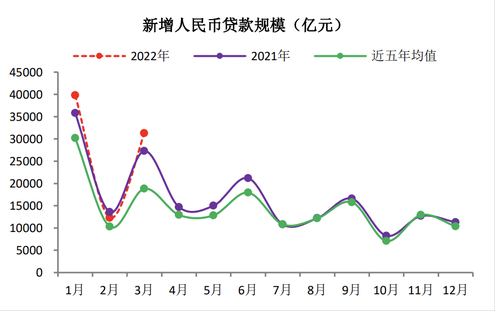

According to data from the People’s Bank of China, in the first quarter, RMB loans increased by 8.34 trillion yuan, a year-on-year increase of 663.6 billion yuan. In March, RMB loans increased by 3.13 trillion yuan, a year-on-year increase of 395.1 billion yuan.

The scale of new RMB loans in March 2022 compared with the same period.Source: Wind Information, Caixin Research Institute

Wu Chaoming, deputy dean of the Financial Information Research Institute, said that the acceleration of credit expansion has led to the acceleration of credit currency creation for loans to create deposits, which is the main reason for the recovery of M2 growth. In addition, affected by the accelerated pace of fiscal spending and seasonal tax payments, fiscal deposits in March dropped sharply by 1,442.7 billion yuan month-on-month and 357.1 billion yuan year-on-year, which is conducive to a phased increase in deposits in the banking system at the same time, and is also important for M2 growth. support.

Zhou Maohua, an analyst at the Financial Market Department of China Everbright Bank, believes that the year-on-year increase in medium and long-term loans in March reflects the improvement in corporate credit demand; the increase in short-term loans reflects the increase in short-term transaction activity of companies, which has correspondingly increased short-term liquidity needs. In Zhou Maohua’s view, the year-on-year growth rate of M2 in March exceeded expectations mainly due to the recovery of financing demand in the real economy, the enhancement of deposit derivation capacity and the increase in fiscal expenditure. At the same time, the year-on-year growth rate of M1 was higher than expected, mainly driven by the increase in corporate demand deposits, and also related to the gradual stabilization and recovery of the real estate market. (Huang Sheng)

[

责编:张慕琛 ]