San Francisco Fed President Daly, a Fed official who will vote at the FOMC meeting of the Monetary Policy Committee in 2024, said on Friday that the Fed should avoid pushing the U.S. economy into an “active downturn” by raising rates too aggressively and that it is time to start talking about slowing rate hikes speed. “We may feel like we’re going to have to add another 75 basis points, and the market must have already priced in that,” Daly said. “But I really advise people not to think it’s always going to be 75 basis points.”

On October 23, Brian Diess, director of the White House National Economic Council, said that the U.S. economy has the strength and resilience to avoid a recession. The remarks dismissed growing concerns that sharp rate hikes aimed at fighting inflation would dampen economic expansion. Diess’ remarks came as economists and CEOs increasingly warned of a recession in the U.S. next year amid a weakening global economy and sharply tightening monetary policy. But the Biden administration is sticking to its view that the U.S. will experience a “soft landing,” where the economy turns to slower growth rather than a deep contraction and job growth slows rather than mass layoffs. Polls show that Republicans will regain control of the House of Representatives and possibly the Senate.

Preliminary U.S. GDP data for the third quarter will be released on Thursday. Analysts at Wells Fargo expect U.S. real GDP to reach an annualized rate of 2.8% in the third quarter after two quarters of negative growth. They still see a recession next year. “We expect underlying demand indicators to remain solid, and based on the most recent September retail sales data, we have raised our forecast for the quarterly rate of actual personal consumption expenditures in the third quarter, which is now expected to be 0.8% (previously expected to be 0.6%).” A mild recession is still expected next year. But as it detailed in its latest monthly report, recent momentum has made it less likely that the economy will start a recession early this year. The recession will come a little later, starting in the second quarter, not the first.

The Fed rarely “shrinks its balance sheet” (Quantitative Tightening, QT for short) for five consecutive weeks, causing the scale of the reduction of the balance sheet to fall below US$8.8 trillion to US$8.79 trillion. The Fed has started to shrink its balance sheet since June. From September onwards, the monthly reduction will be capped at US$95 billion. Since September 15, the five weeks to October 19 have accumulated a reduction of US$88.761 billion, with a reduction of US$51.058 billion from October alone. The Fed’s balance sheet has fallen since hitting a high of $9.015 trillion in mid-April, and has shrunk by $221.078 billion so far. UBS released a report estimating that in view of the impact of U.S. money market reforms and the debt ceiling, the Fed is expected to stop shrinking its balance sheet around the middle of next year. Another influencing factor includes the demand for the Fed’s reverse repurchase agreement tools.

U.S. consumers have shown a willingness to continue paying higher prices in the face of a sluggish economy that could slip into recession, credit card giant Hewlett-Packard said. American Express on Friday reported better-than-expected third-quarter profit and revenue, while raising its full-year guidance. Overall customer spending rose 21% year over year, driven by growth in spending on goods and services and travel and entertainment, the company said. “Analysts may wonder whether the talk of inflation, recession and other factors will lead to slower spending growth,” said Brian Moynihan, BofA’s chief executive. Happening.”

- The U.S. housing market has entered a “quick freezing” mode under the soaring interest rates? Analysts warn: house prices could plummet 20% next year

Pantheon chief economist Ian Shepherdson said house prices could continue to fall by as much as 20 per cent next year as mortgage rates climb and the housing market returns to normal after the pandemic. “We expect home sales to continue to decline until early next year. By that time, sales will fall to an incompressible minimum, at which point only those who have no choice because of work or family circumstances will buy a new home and move. Facing With nearly 400 basis points of rate hikes over the past year, non-essential buyers are disappearing fast.” Mortgage rates have more than doubled this year. The 30-year mortgage rate rose to 6.94% this week, up from 6.92% last week and 3.2% in January.

- Over 70% of U.S. companies’ Q3 profits exceeded expectations, and the S&P 500’s Q3 profit expectations were lowered again

According to Refinitiv, as of October 21, 99 S&P 500 companies have released third-quarter results, of which 74.7% have exceeded market expectations, with an average of 5.4% exceeding expectations; 100% of healthcare and Communications services companies beat earnings estimates, compared with 66.7% of energy companies. 67.7% of the company’s revenue exceeded market expectations, and the average rate of exceeding expectations was 1.4%; 100% of raw materials and communication service companies’ revenue exceeded expectations. Refinitiv now expects S&P 500 third-quarter profits to rise 3.1% year over year (up from 3.6% a week ago). This week, analysts’ third-quarter equity-weighted profit forecast for the S&P 500 fell to $458.9 billion from $46.19 million.

- U.S. may cap Russian crude above $60 a barrel to maintain supply

U.S. officials may seek to cap the price of Russian oil exports above $60 a barrel, higher than previously suggested. Previous discussions on the ceiling for Russian oil have focused on the $40-$60 range. The U.S. hopes the price cap will be enough to cover the cost of production, which will benefit Russia’s continued production of oil. Meanwhile, Russian President Vladimir Putin and other Russian officials have said they will not export oil to countries that support price caps. Some in the industry have criticized the idea of a price cap, and even some U.S. allies have dismissed it as unworkable.

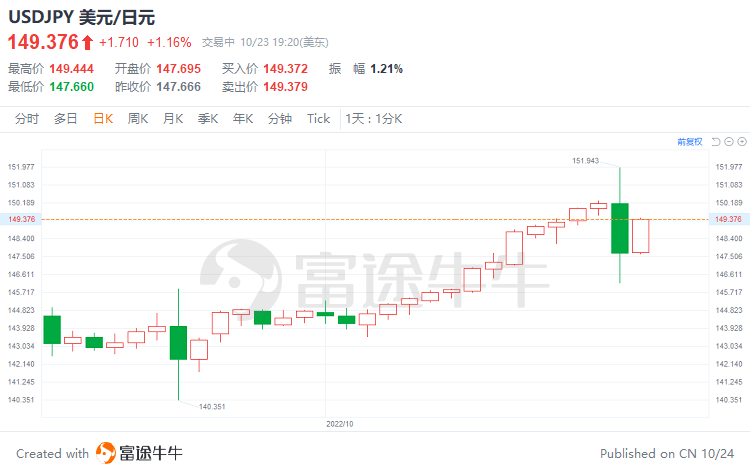

- Back to 147!The Bank of Japan and the government acted together, and the yen rose rapidly and recovered many points

According to the Nikkei news, the yen fell to 151.94 against the dollar at one point, the lowest level in 32 years, but the yen rose rapidly due to the intervention of Japanese authorities. Just before the intervention, U.S. long-term interest rates were falling, and speculation about a narrowing of the Japan-U.S. spread began to spread in foreign exchange markets. A Wall Street Journal report triggered a drop in U.S. long-term interest rates. The report said that the Fed may consider hinting at a reduction in the rate hike in December, raising expectations for a slowdown in the Fed’s rate hike this year. The U.S. long-term interest rate fell from 4.33% to 4.20% in the early morning. Earlier on Friday, Japanese Finance Minister Shunichi Suzuki reiterated that the Japanese government will not tolerate speculative and excessive foreign exchange volatility and will take appropriate actions to deal with excessive movements.

US stocks resume trading

- U.S. stocks rebounded strongly, the three major indexes all rose more than 2%, Snap fell 28%, and Chinese stocks closed up

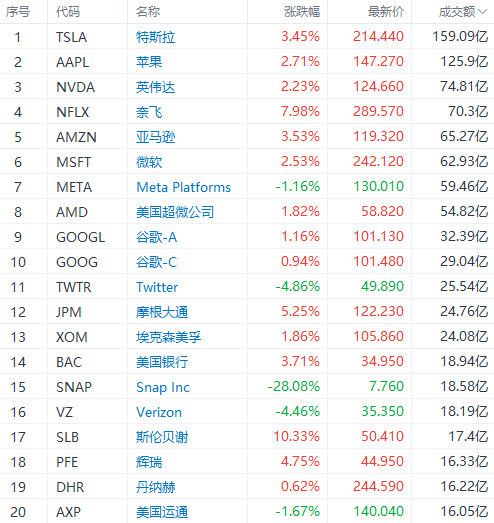

U.S. stocks opened slightly lower on Friday and rebounded strongly, with all three major indexes up more than 2%. The Dow rose 2.47% to 31,082.56 points, the S&P 500 rose 2.37% to 3,752.75 points, and the Nasdaq rose 2.31% to 10,859.72 points.

Most of the large technology stocks rose, Netflix rose about 8%, Amazon rose more than 3%, Apple and Microsoft rose more than 2%, Google rose more than 1%, and Meta fell more than 1%. Snap tumbled 28.08%, dragging down the social media sector, Pinterest fell more than 6%; the Nasdaq China Golden Dragon Index closed up 1.13%, Daily Youxian rose by more than 57% in late trading, and Pinduoduo rose more than 5% %, “Weixiaoli” rose by more than 2%, Vipshop rose by more than 1%, and Alibaba and New Oriental rose slightly.

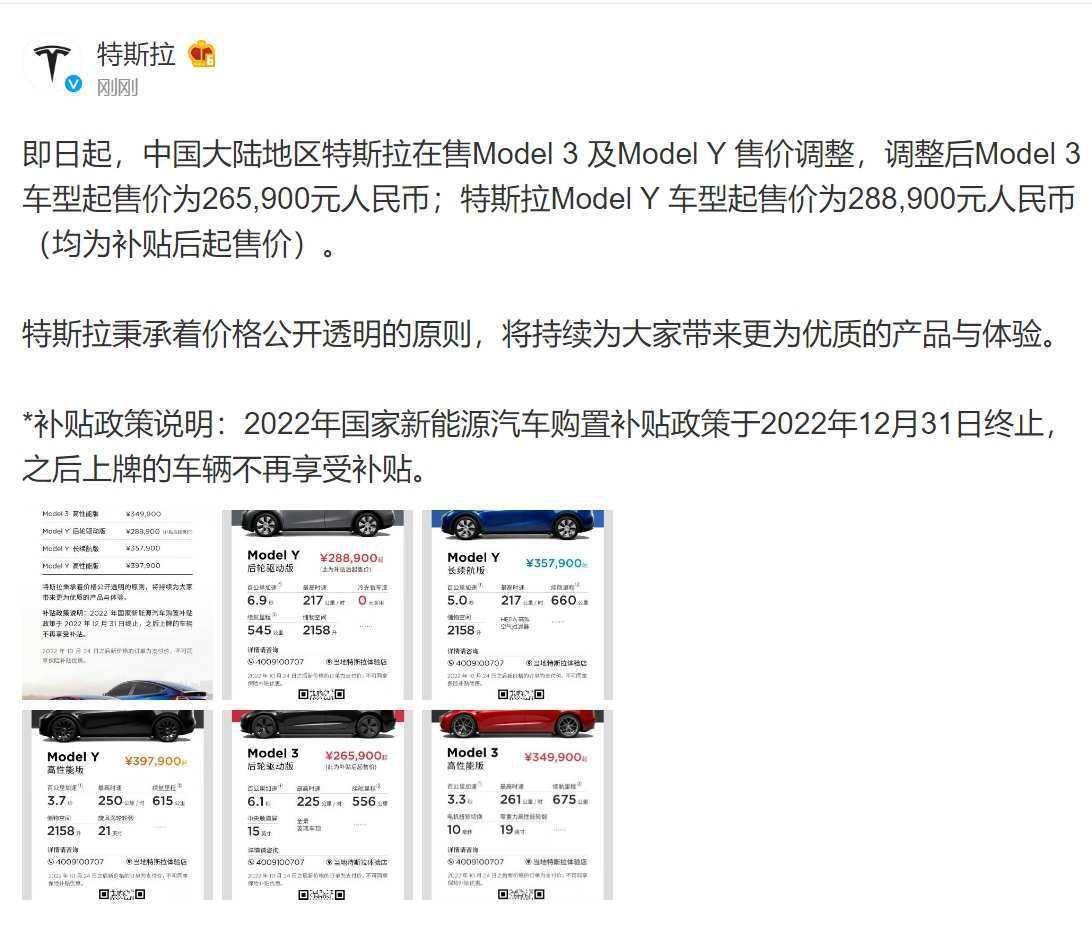

- Tesla’s domestic Model 3 and Y cut prices again, and the rear-drive version of Model 3 dropped to 265,900 yuan

On October 24, $Tesla (TSLA.US)$ China’s official website showed that the Model 3 rear-drive version dropped from 279,900 yuan to 265,900 yuan, and the high-performance version dropped from 367,900 yuan to 349,900 yuan. The Model Y rear-wheel drive version has dropped from 316,900 yuan to 288,900 yuan, the long-life version has dropped to 357,900 yuan, and the high-performance version has dropped to 397,900 yuan.

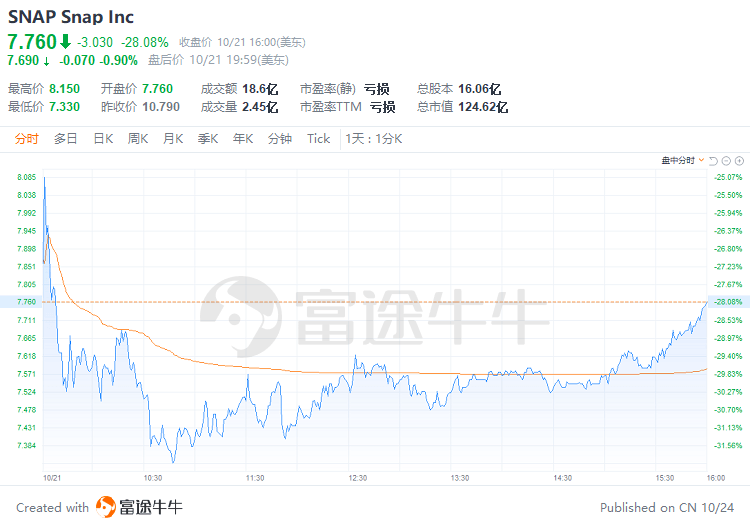

- Snap fell more than 28%, and poor Q3 performance led analysts to generally lower target prices

$Snap Inc (SNAP.US) $ fell 28.96% to $7.67, with a total market value of $12.3 billion, hitting a new low in February 2019. Snap’s third-quarter revenue was $1.13 billion, compared with an estimated $1.14 billion; third-quarter adjusted EBITDA was $72.6 million, compared with an estimated $24 million; third-quarter adjusted earnings per share were $0.08, compared with an estimated loss per share $0.02; 363 million daily active users in the third quarter, compared with an estimated 360 million. Morgan Stanley, JPMorgan, Barclays and UBS all lowered their price targets on the stock.

- Elon Musk’s $13 billion debt to buy Twitter will be held by banks

The bank that pledged to help Elon Musk buy Twitter plans to hold the entire $13 billion in debt backing the deal, rather than syndicate it, according to people familiar with the matter. Musk’s deal to buy Twitter was backed by banks including Morgan Stanley, Bank of America and Barclays. The banks are understood to have decided to keep the debt on their balance sheets to avoid selling at a loss to bond and loan fund managers. Banks could face losses of about $500 million or more if they try to sell Twitter’s debt at current market prices as market volatility intensifies, it was previously reported. Assuming the acquisition goes through, the bank hopes to be able to sell some of Twitter’s debt early next year, when market conditions improve, and is understood to be discussing how to split the debt into different tranches.

- Pfizer’s new crown vaccine plan quadruples the price!Commercial sales as early as early next year

Pfizer (PFE.US) recently revealed that the commercial price of its new crown vaccine is expected to quadruple its original price, and the price of the adult vaccine will rise to $110 to $130 per dose. Based on its median commercial selling price of $120, which is four times the U.S. government purchase price of the vaccine, which is about $30 per dose, the market expects its revenue to grow significantly, driving its stock higher. Pfizer said a vaccine could be commercially available as early as early next year, though that would depend on factors such as when contracts with the federal government expire and when existing U.S. supplies run out.

- NIO announced that it will add a buyout model in four European countries

$NIO (NIO.US)$ announced on its European App on Friday that it will add ET7, EL7 and ET5 buyout models in addition to the subscription model in Germany, the Netherlands, Denmark and Sweden on November 21, and Delivery starts in early 2023. This means that users in the above four countries will be able to buy out or subscribe to own NIO models according to their own circumstances. Previously, Weilai announced during its European launch event that it would initially serve users in four European countries in a subscription model. The information on the Weilai European App shows that the above-mentioned four countries have started the delivery of subscribers.

Top 20 U.S. stocks by turnover last Friday

Related reading: TOP 20 by turnover | Snap’s poor performance, the stock price fell 28%; Tesla closed up 3.45%, and Sister Mu Du entered the market again to “buy the bottom”

Hong Kong City Prospects

- Beishui accumulated nearly 6.7 billion Hong Kong dollars in Tencent last week

On October 21 (Friday), Nanxia Fund bought a net HK$3.407 billion of Hong Kong stocks. Tencent Holdings, Meituan-W, Anta Sports, and Cinda Bio received net purchases of HK$1.211 billion, HK$388 million, HK$175 million, and HK$150 million respectively; Greentown China, China Construction Bank, and China Mobile were sold by net sales of 187 million Hong Kong dollars, 102 million Hong Kong dollars, 90.37 million Hong Kong dollars.

Since August 25, Southbound Capital has bought Tencent Holdings for 34 consecutive days. Last week, it accumulated nearly 6.7 billion Hong Kong dollars in Tencent, and on the 34th, it accumulated about 18.447 billion Hong Kong dollars.

Follow today

Keywords: U.S. Markit Manufacturing PMI, China Overseas Development / Xinte Energy Financial Report

On Monday, economic datathe United States will release the October Markit services and manufacturing PMI.

The initial value of the U.S. Markit Manufacturing PMI in September was 51.8, 51.1 was expected, and the previous value was 51.5; the initial value of the Markit Service PMI in September was 49.2, 45 was expected, and the previous value was 43.7.

Chris Williamson, chief business economist at S&P Global Market Intelligence, commented on the final U.S. Markit manufacturing PMI for September: Employment growth also improved as U.S. manufacturers reported a return to growth in orders for the first time in four months, September data Brings good news that the business environment is starting to improve again. Still, even with this latest improvement, weak data in recent months suggests that U.S. manufacturing was a drag on the economy in the third quarter, if the rest of the year is to see any meaningful positive contribution from manufacturing to GDP. , demand will need to recover further.

The initial value of the U.S. Markit Manufacturing PMI in September was 51.8, 51.1 was expected, and the previous value was 51.5; the initial value of the Markit Service PMI in September was 49.2, 45 was expected, and the previous value was 43.7.

Chris Williamson, chief business economist at S&P Global Market Intelligence, commented on the final U.S. Markit manufacturing PMI for September: Employment growth also improved as U.S. manufacturers reported a return to growth in orders for the first time in four months, September data Brings good news that the business environment is starting to improve again. Still, even with this latest improvement, weak data in recent months suggests that U.S. manufacturing was a drag on the economy in the third quarter, if the rest of the year is to see any meaningful positive contribution from manufacturing to GDP. , demand will need to recover further.

In terms of financial reports,Hong Kong stocks will announce results.

Niu Niu Chen read:

Don’t expect yourself to be right every time, if you make a mistake, the sooner you stop the loss, the better.

——Bernard Baruch

Don’t expect yourself to be right every time, if you make a mistake, the sooner you stop the loss, the better.

——Bernard Baruch

edit/ruby

Risk warning: The opinions of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not be liable for any loss or damage arising from any inaccuracies or omissions.Return to Sohu, see more