In 2023, the global economy will continue the slowdown trend in 2022, showing a mild recession; the global inflation rate is expected to decline, but it will still be higher than the level before the international financial crisis; affected by the decline in global economic growth and geopolitical conflicts, the world The outlook for trade is also hardly optimistic. Overall, the global economy is still facing considerable challenges this year, but the adjustment process is also giving birth to recovery momentum. Countries need to strengthen economic coordination through multilateral cooperation and promote global economic recovery.

After experiencing a significant decline in global economic growth in 2022, the global economic recovery will face greater pressure in 2023. A series of external shocks, such as geopolitical conflicts, uncertainties about the epidemic, and the spillover effects of the radical withdrawal of the economic stimulus policies of major economies such as the United States, are still difficult to eliminate in the short term, and the global economy continues to be in a period of instability and volatility.

At the same time, in 2023, the macroeconomic policies of the world‘s major economies to promote growth, the restoration of the global industrial chain, the development of new economic models such as the digital economy, and the advancement of global international cooperation will all create momentum for the world economy to gradually return to the track of low-speed growth.

The global economy will show a mild recession

In 2023, the global economy will continue the slowdown trend in 2022, showing a mild recession. The first half of the year will still show fluctuations, and it is expected to improve in the second half of the year.

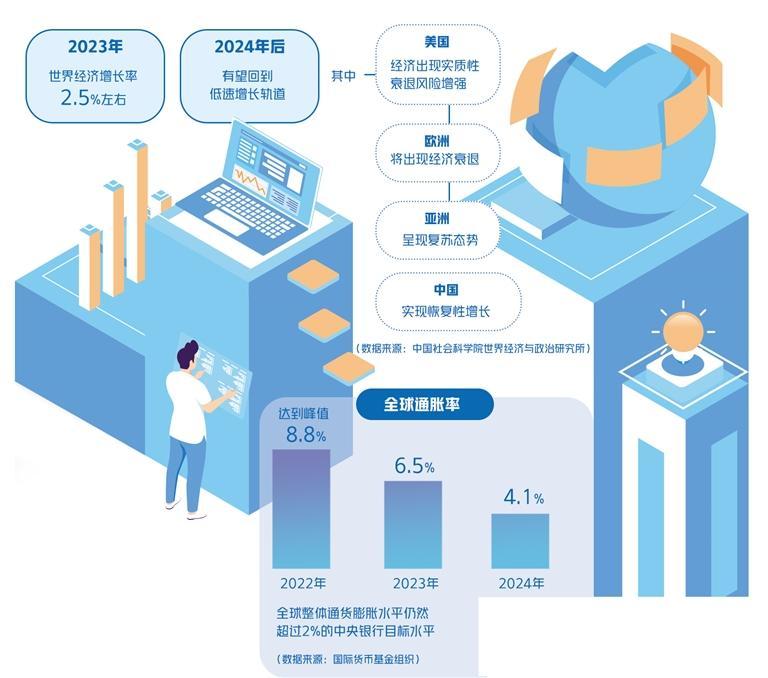

According to the calculation of the Institute of World Economics and Politics of the Chinese Academy of Social Sciences, the growth rate of the world economy in 2023 will be about 2.5%. After 2024, the global economy is expected to return to a low-speed growth track.

Specific to the world‘s major economies, the risk of a substantial recession in the U.S. economy has increased. The Fed’s aggressive interest rate hikes and other tightening monetary policies have a delayed effect on economic growth, while the downward pressure on demand in the U.S. labor market is increasing, and consumption stamina is insufficient. It is difficult for the U.S. economy to achieve a “soft landing” and it is possible in the first half of 2023. There is a recession.

There will be an economic recession in Europe. The continuous impact of the energy crisis, the decline in external demand, and the tightening monetary policy will cause the European economy to stagnate with a high probability in 2023.

The overall Asian economy is showing a recovery trend, and the Chinese economy has achieved restorative growth. After the adjustment of the epidemic prevention policy, the pulling effect of consumer demand on economic growth has been strengthened, but factors such as the downturn of the real estate industry, aging population, and insufficient external demand have affected China’s economic growth. Japan’s economy is slowly recovering, but internal factors such as population aging make it difficult for Japan’s economic growth to increase significantly, while external factors such as the direction of the Federal Reserve’s monetary policy and the global economic downturn make the Japanese economy still face downward pressure. India’s economy continues to maintain a relatively high growth rate. Energy transformation, offshore outsourcing, and manufacturing investment expansion have made India’s economic growth rate at a relatively high level. It is expected to grow by 6.3% in 2023.

The recovery of the Asian economy has provided support to a certain extent for stabilizing the global supply chain, increasing external demand for other economies, and reducing the global inflation rate.

Inflation falls but remains high

In the future, the global inflation rate is expected to decline, but it will still be higher than the low inflation rate before the international financial crisis.

In 2022, in order to curb inflation, the Federal Reserve will adopt a radical interest rate hike policy, and the European Central Bank and the central banks of Canada, Switzerland, the United Kingdom and other countries will also adopt interest rate hike policies simultaneously. At the same time, global inflation is expected to decline in 2023 as supply chain tensions ease, demand slows, price discounts from rising inventories and lower housing prices reduce demand, among other things. According to the forecast of the International Monetary Fund, the global inflation rate will peak at 8.8% at the end of 2022; it will drop to 6.5% in 2023; and it will drop to 4.1% in 2024. Overall, global inflation remains above the central bank’s 2 percent target.

The tightening of global monetary and financial conditions reduces demand and helps to gradually control inflation. The United States is focusing on achieving a “soft landing” in 2023, maintaining a certain employment rate while reducing inflation. In 2022, the United States will not see a large decline in the unemployment rate in the process of falling inflation. Some companies have realized that laying off workers may reduce costs in the short term, but create problems later, so they may move to a more “European” model of keeping workers on the payroll during a recession so that they can work later. Faster, smoother recovery.

Although the Federal Reserve’s interest rate hike in 2022 has shown certain effects and various inflation indicators have eased, compared with several relatively successful “soft landings” in history, it can be seen that the inflation level is relatively high this time, and the labor market is more stable. These factors show that it is more difficult to achieve a “soft landing”.

Under the impact of the energy crisis, Europe is facing enormous pressure of inflation, and supply and demand have a two-way promotion effect on inflation. However, many scholars believe that inflationary pressures in Europe will gradually ease in 2023.

Increased international trade and financial risks

The decline in global economic growth and geopolitical conflicts will bring greater uncertainty to the development of world trade. The outlook for world trade remains gloomy. In particular, the tension in the global value chain has deepened, the United States has adjusted its security supply chain and manufacturing strategy, and adopted “near-shore outsourcing” and “friendly shore manufacturing” in regional economic cooperation with strong political color. All of this reflects the mentality centered on the interests of the United States, undermines the multilateral trading system, tends to shape the existing value chain structure into a new pattern centered on the security of the US supply system, and hinders intra-regional and inter-regional cooperation in the global supply chain. fusion.

In 2022, the world‘s major economies will adopt a contractionary macroeconomic policy of synchronous central bank interest rate hikes and fiscal tightening, which will have a certain degree of impact on the recovery of the global economy. At the same time, developing countries are more likely to fall into a debt crisis. The interest rate hike policies of the United States and Europe have increased the financing costs of developing countries and strengthened the trend of capital outflows. The decline in external demand reduces the foreign exchange income of emerging market countries, causing insufficient liquidity and limited financing, which increases the possibility of debt risks in developing countries turning to debt crises. In 2023, some countries may stop tightening monetary policy due to recession fears. In 2022, raising interest rates has played a role in the face of high U.S. inflation and strengthening inflation expectations. As inflation falls, the cycle of rising interest rates may come to an end.

Commodity prices still have the risk of fluctuations. In 2023, it is expected that commodity prices will not drop significantly in general, but will show a downward trend of volatility. Supply and demand in the energy market are reshaping the geopolitical and economic structure. Energy shortages are still an important challenge to the economic recovery of countries around the world, and have an impact on the stability of the global economy. The adverse impact of the energy shortage caused by the Ukraine crisis on the European economy still exists, and the European economy may be in a state of recession. High energy prices have an adverse impact on real income. Changes in natural gas prices are an important risk affecting the development of Europe. Economic stability has declined, while risks of normalizing food crises in low-income countries have increased.

Overall, although inflation is higher than historical levels, most regions are still in a state of monetary tightening, and the adverse impact of the Ukraine crisis is added, the global economy still faces challenges. At the same time, the adjustment process also breeds recovery momentum. On the one hand, the development of the digital economy and the green economy leads global technological innovation and industrial transformation, thereby enhancing global growth momentum; on the other hand, the continuous development of digital technology and its deep integration with the real economy will boost the digital transformation of industries. At the same time, international policy coordination and international development cooperation have provided a relatively good business environment for global companies and raised expectations for world economic development. At the end of 2022, WTO members will substantially conclude the negotiations on the text of the Investment Facilitation Agreement. 67 members jointly issued the “Declaration on Completing the Negotiations on Domestic Regulation of Trade in Services” and announced the conclusion of the “Reference Document on Domestic Regulation of Trade in Services”, which demonstrates the In the current complex global political and economic environment, countries are still trying to strengthen economic coordination through multilateral cooperation and promote global economic development.

(The author Dongyan is a researcher at the Institute of World Economics and Politics, Chinese Academy of Social Sciences)

[

责编:张慕琛 ]