Looking back on the past April, all major market indexes fell. in,The Shanghai Composite Indexdown 6.31%,Shenzhen Component Indexdown 9.05%,GEM refers todown 12.80%. Especially on April 25, the Shanghai Composite Index plunged 5.13%, falling below 3,000 points for the first time since 2018.

So, what are the “golden stocks” in May? What configuration suggestions does the organization give? Let’s take a look together.

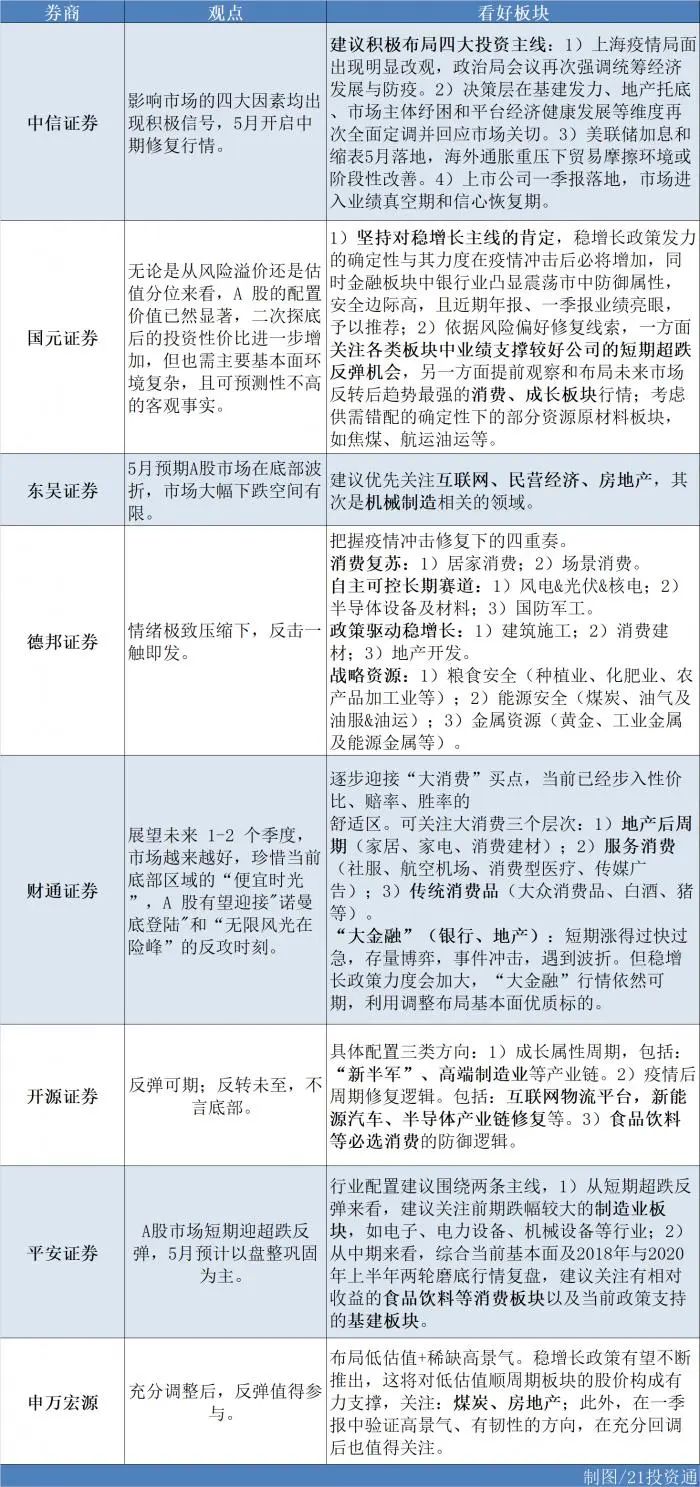

brokerageOpinion: May rebound is expected but the reversal has not yet come

Looking forward to the market outlook, most brokerages expressed a “cautiously optimistic” attitude towards the market, believing that the increase in positive factors is expected to “stabilize” the market, and may usher in a certain rebound in May.

Potential factors that may affect market movements,Everbright SecuritiesAccording to the analysis, the more important question after the fierce market sentiment swings is: how China will deal with the economic growth under the repeated epidemics in the future, and whether the current market prices of the overall and local assets are prepared for the above-mentioned uncertainties.

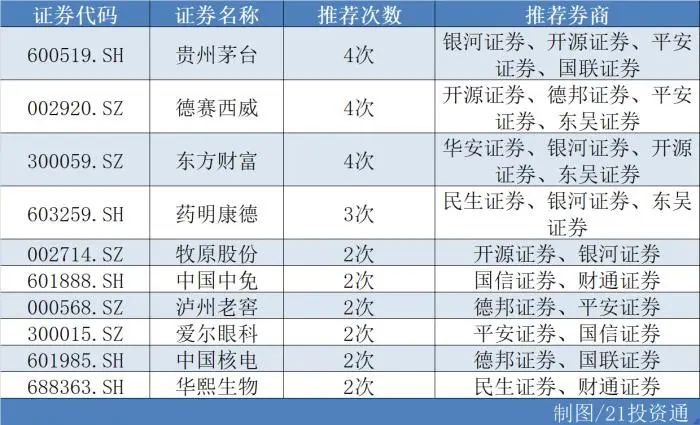

Gold stocks in May:Kweichow Moutai、Desay SV、Eastern Fortunemost popular

According to incomplete statistics, among the May monthly investment portfolios announced by more than ten securities firms, the most recommended isKweichow Moutai、Desay SV、Eastern Fortuneall 4 times;WuXi AppTecIt is recommended by 3 brokers;Muyuan shares、CDFG、Bloomage BioThe other shares were also jointly recommended by 2 brokers.

Some recommendations are as follows:

1) Galaxysecurities: The “five-line strategy” guides high-quality development, with a good start in the first quarter of 2022.

2) Open sourcesecurities: Multi-dimensional market-oriented reform measures support Moutai, and its growth will accelerate in 2022.

3) Peace of mindsecurities: In 2022, the target gear shift will be accelerated, and the direct sales channel will increase the volume of the ton price.

4)Guolian Securities: High channel profits superimposed on the recent return to rationality of batch prices will bring price increase expectations; actively develop direct sales channels to increase the ton price and increase profits; the “133” brand strategy develops a series of wines, which is expected to open up new growth poles, and Moutai 1935 is expected to increase in volume next year; The new chairman’s appointment brings expectations for improved corporate governance.

1) Open source securities: Under the industry logic of “hardware pre-embedded, software upgrade”, domain controllers drive companies to enter accelerated growth.

2) Debon Securities: In the first quarter of 2022, revenue and profit exceeded expectations. The company’s orders were fully loaded, inventories continued to increase month-on-month, and the vehicle supply chain was gradually recovering. It is optimistic that the company will continue to realize its business potential.

3) Ping An Securities: Based on the smart cockpit and promoting automatic driving, the second growth curve is clearly outlined.

4)Soochow Securities: Nearly 200 billion will be rebuilt in 5 years for the intelligent network league.Based on the needs of efficiency + safety + entertainment, consumers are willing to pay to push downstream OEMs to actively increase the penetration rate of ADAS + smart cockpit; intelligent driving field: embraceNvidia+ Adhere to the parallel of two routes of self-research; Cockpit business: Continue to consolidate the leading position of self-research + Embrace Huawei Hongmeng OS.

1)Huaan Securities: “Content-Community-Market-Data-Decision-Transaction” Service Drainage Framework, “fundThe realization combination of agency sales – securities brokerage – two financial services – wealth management”.

2) Galaxy Securities: The market share increases to support the companyperformanceEndogenous growth; Oriental Fortune.com and Tiantian Fund bring brand advantages and massive customer resources, and the platform premium effect is significant; the wealth management track is long-term, and short-term adjustments will not change the upward path. As a leader in wealth management, the company will fully benefit from the development of the equity market.

3) Kaiyuan Securities: Leading the main line of big wealth management, the trend of increasing market share has not changed, the institutional business has contributed to incremental income, and its long-term value has been highlighted. From a marginal point of view, the RRR cut is conducive to boosting confidence in stabilizing growth, and the loose liquidity is good for Oriental Wealth.

4)Soochow Securities: The overall revenue side was in line with expectations; the cost side was slightly higher than expected, and the R&D expenditure was higher than expected; proprietary investment was in line with expectations, and non-recurring income exceeded expectations.

1) Minsheng Securities: Relying on the CRDMO/CTDMO business model, the performance continues to achieve rapid growth; the five business segments are advancing hand in hand, and all maintain a strong growth trend. In the biology business, new molecular types drive high growth, and DDSU’s 22-year iterative upgrade empowers higher-level R&D.

2) Galaxy Securities: The demand for innovation and R&D continues to increase, the industry boom continues to improve, the cost advantage of domestic pharmaceutical outsourcing is obvious, and a large number of overseas orders are transferred to China. As a leading enterprise, the company has huge potential for development of its main business.In the first quarter, all business segments of the company maintained steady growth, and the volume of new businesses accelerated.Operating income8.474 billion yuan, a year-on-year increase of 71.18%net profitIt was 1.714 billion yuan, a year-on-year increase of 106.52%. In the future, epitaxial acquisition + capacity construction will continue to advance, and the company’s production capacity will be released stably and continuously.

3)Soochow Securities: All pipeline businesses have maintained rapid growth with strong performance certainty; the CXO industry has maintained a high boom; the production capacity release leads the way, supporting long-term performance release.

1) Kaiyuan Securities: The production capacity of the pig farming industry continues to decrease, and it is expected that the cycle will reverse in the third quarter of 2022.

2) Galaxy Securities: The company is a leading enterprise in the pig breeding industry, with a leading advantage in breeding costs, and the number of pigs for slaughter is growing rapidly. With the gradual return of pig prices in 2022-2023, the company’s performance is expected to improve significantly.

1)Guosen Securities: In the second half of 2022, the pressure on the base is expected to gradually ease, and projects such as Haikou International Duty Free City and Sanya Phase I No. 2 are expected to be launched.From the perspective of the mid-line, the company will continue to strengthen its supply chain capabilities after being the first in global duty-free and channel expansion and optimization in the future;Online and offlineThe potential of traffic and the realization of multiple monetization; thirdly, under the internal and external competition, the subjective kinetic energy of central enterprises continues to strengthen, from scale to quality, to management for efficiency, and to better cope with the future diversified market environment through the improvement of core competitiveness.

2)Caitong Securities: The size of the new seaport is huge, and it is expected to surpass Haitang Bay in terms of revenue around 2025, which will be a major increase in subsequent performance; based on the tax-free operation model, the cost is relatively rigid, and the headquarters cost is low, which can further improve the profitability of the group .

1) Debon Securities: The profit side in the fourth quarter of 2021 slightly exceeded expectations; the dual-brand strategy has achieved remarkable results, and sub-high-end products such as the Tequ series have begun to increase volume; equity incentives activate management initiative.

2) Ping An Securities: mid-to-high-end products continue to grow, and performance is expected to maintain rapid growth under equity incentives.

1) Ping An Securities: The company’s performance has grown steadily under the epidemic, and its valuation is cost-effective.

2)Guosen Securities: The company is a domestic ophthalmology departmentmedical serviceLeading companies in the field have rapidly expanded through a hierarchical chain model, and “endogenous + extension” jointly supports performance growth. In addition to being affected by the epidemic in 2020, the net profit attributable to the parent has increased by more than 30% year-on-year for 7 consecutive years, the brand influence has continued to increase, and a sound medical teaching and research system and talent training mechanism have been formed. . As the recovery expectations increase after the epidemic is under control,medical serviceThe successive implementation of price adjustment plans in various provinces is expected to increase service prices and expand the application coverage of innovative technologies. The current valuation is attractive.

1) Debon Securities: Policies frequently promote the development of nuclear power, and the advantages under the energy transition are prominent;

2)Guolian Securities: stock coremotorThe group benefited from the rise in market transaction electricity prices and achieved an increase in power generation revenue; new energy continued to maintain a high development intensity. It is expected that nuclear power/new energy installed capacity will increase from 22.5/8.9GW in 2021 to 26/30.3GW in 2025. Transforming from a nuclear power operator to a comprehensive green power operator; it is in line with the main line of investment in stable growth and new infrastructure in 2022, and is the preferred direction of the current market style with the support of incremental new energy; the executive meeting of the State Council approved 3 projects and 6 units. The company has 2 units Sanmen No. 3 and No. 4 approved, and the nuclear power business maintains continuous growth.

1) Minsheng Securities: The growth engine of the cosmetics business is sufficient. In the first quarter of 2022, the revenue of the cosmetics business increased by 95% year-on-year, accounting for 70% of the company’s overall revenue; profitability continued to improve, and the first quarter of 2022 net profitinterest rateThe month-on-month improvement, the second quarter is expected to usher in the recovery of offline medical aesthetics, achieving net profitinterest rateFurther upgrades; the acquisition of the Yierkang project, the entry into the collagen industry, and the enrichment of the company’s bioactive product pipeline, will further enhance the overall revenue-generating capacity.

2)Caitong Securities: R&D technology empowerment, large single product strategy verification, online channel operation efficiency improvement, skin care product business continues to grow rapidly; medical beauty business strategy upgrade, new product twin needles will be launched in 2021 to fill the gap in the static pattern subdivision track, superimposed With the advantage of license, it is expected to continue to increase the volume in 2022; the food business has a long-term business layout, and the market development space is broad.

(Article source: 21 Investment Link)