Tips from FT Chinese Website: If you are interested in more content of FT Chinese Website, please search for “FT Chinese Website” in the Apple App Store or Google Play, and download the official application of FT Chinese Website.

The Fed raised interest rates quickly last year in response to high inflation, and most leading economic indicators point to a recession looming. The U.S. dollar once recorded the largest increase in the year after the disintegration of the gold standard. The stock and bond markets experienced an extremely rare double-kill market in 150 years, and the global capital market was in a mess.

Even with a series of warning signs such as the British pension crisis, the thunderstorm of the cryptocurrency exchange FTX, and the redemption difficulties of the Blackstone real estate fund, almost all experts believe that the US economy will not experience a “hard landing” because of the US banking industry. It is very healthy. After learning the lessons of previous financial crises, the optimized and perfected regulatory system makes the banking system rock-solid.

Smaller U.S. banks outperform big banks on key metrics

Carefully read the updated quarterly report of the Federal Deposit Insurance Corporation (FDIC) on March 16 this year, and the data are impressive. The overall financial performance of the U.S. banking industry in 2022 is very solid relative to 2016-2021. Except for individual data such as asset growth rate, most of the data are normal.

In 2016-2017, when the economic recovery was strong, a total of 8 banks (this article does not distinguish between commercial banks and savings institutions) failed, and in 2021-2022, there were no bank failures. Unprofitable banks accounted for 3.4%, slightly higher than in 2021 but better than other years. The number of banks with problems (close to insolvency) is decreasing year by year, and there will be only 39 in 2022. Since the list is confidential, it is not clear whether Silicon Valley Bank (hereinafter referred to as SVB) and signature banks have ever been included.

Taking a closer look at the quarterly and full-year performance of the banking industry in 2022, the interest rate increase has increased bank revenue by US$105.5 billion, but it has been offset by higher reserve expenses and non-interest expenses, so the annual net income has declined relative to 2021 5.8%, but better than previous years, and the overall trend of rising quarter-on-quarter.

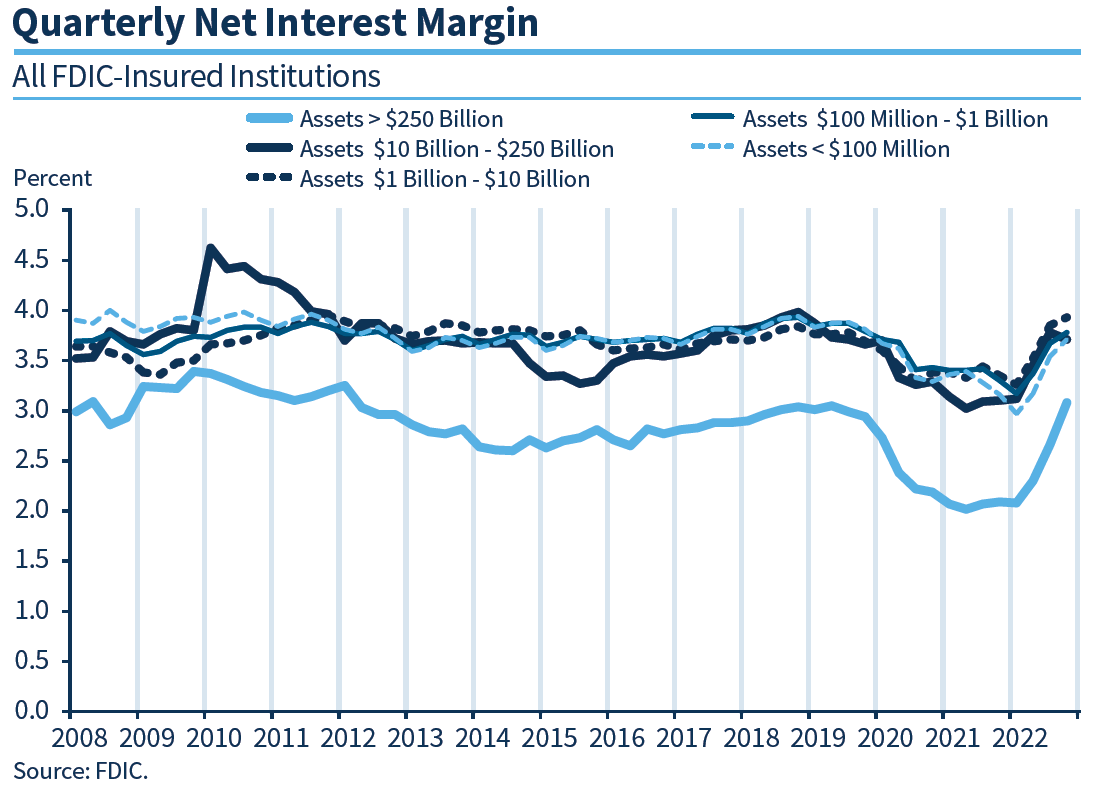

In 2022, the total “net interest margin” of the U.S. banking industry (bank interest income minus costs divided by the size of interest-earning assets) will increase quarter-on-quarter, and it will be the largest annual increase since the FDIC has statistical history. What is even more surprising is that the performance of small and medium-sized banks on this indicator is significantly better than that of systemically important banks (with assets exceeding US$250 billion).

Recent analysis generally believes that small and medium-sized banks are more affected by the inversion of national debt interest rates than large banks. Compared with the latter, the former has a higher proportion of loans and a lower proportion of national debt, so the net interest rate performance is better. Data show that small and medium-sized banks account for about half of commercial and industrial loans, 60% of residential mortgage loans, 80% of commercial real estate loans, and 45% of consumer credit.

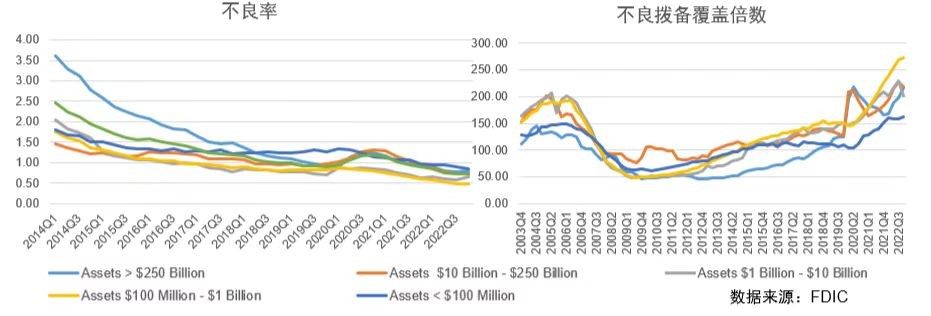

From the perspective of non-performing ratio and non-performing provision coverage ratio, except for banks with assets of less than US$100 million, the data of other small and medium-sized banks are better than those of systemically important banks. And the numbers are improving every year.

FDIC quarterly report fails to provide early warning signs

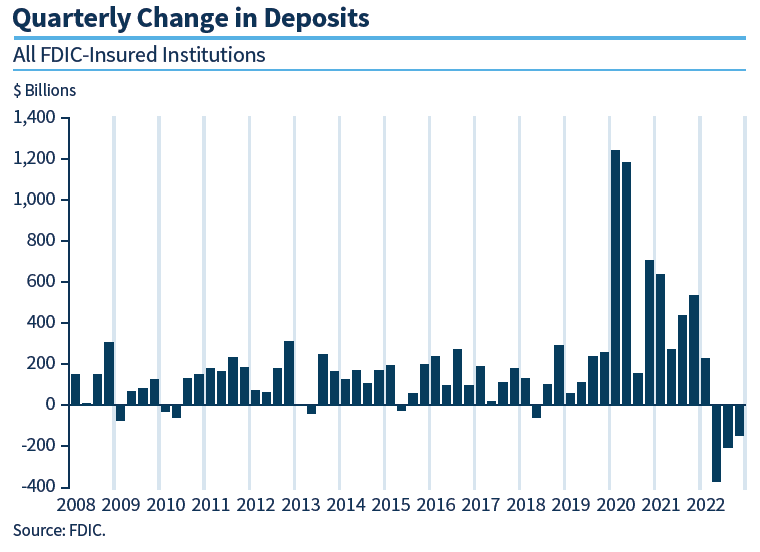

In hindsight, there are two main indicators that show that the banking industry is facing previously rare challenges. First, bank deposits will decline in the three quarters after 2022, but the rate of decline will decrease quarter-on-quarter. At the macro level, this comes from the Fed’s shrinking of its balance sheet; at the micro level, it is the increase in consumer spending by savers in a high inflation environment, or the transfer of funds to investment projects such as monetary funds with higher yields or liquidity.

Second, the unrealized losses of banks’ securities investment reached US$620.4 billion in the fourth quarter of 2022, which is almost equivalent to 30% of the total equity of the banking industry. Of course, these losses are not evenly distributed. The entire banking system may be able to absorb losses, but not necessarily every bank. However, in the quarterly report of the FDIC, the loss in the fourth quarter was brought up because it was lower than that in the third quarter, and even the figure below was not included in the quarterly report.

Many studies, especially Shin Hyun-song, an economic consultant and research director of the Bank for International Settlements, pointed out in the book “Risk and Liquidity” that if the bank’s balance sheet is marked according to the “market value” (MTM) of securities assets, it will lead to negative feedback in times of crisis. , Once the depositors run, the bank cannot solve the inherent “term mismatch” problem, forming a vicious circle in which the market and bank liquidity shrink at the same time. As a result, the U.S. revoked some regulations on MTM when it deregulated the Dodd-Frank Act in 2018. Commercial banks have not had any MTM requirements since then, according to a statement from the American Banking Association.

However, even these two indicators have not had a clear lead or synchronization in predicting bank failures in the past. During the wave of bank failures from 2008 to 2013 (minimum 24 and maximum 157), the forward-looking changes in bank deposits and unrealized losses were not obvious. A total of 21 bank failures in 2016-2020 also showed no correlation with the two indicators. Obviously, these indicators are too macroscopic, and have no warning effect on the bad luck encountered by microscopic individuals.

Taken together, most of the major indicators that the FDIC quarterly report focuses on failed to flash red lights. Even the quarterly report updated on March 16 did not reflect any correlation with the bank failure.

A plunge in bank equity is a good early warning indicator

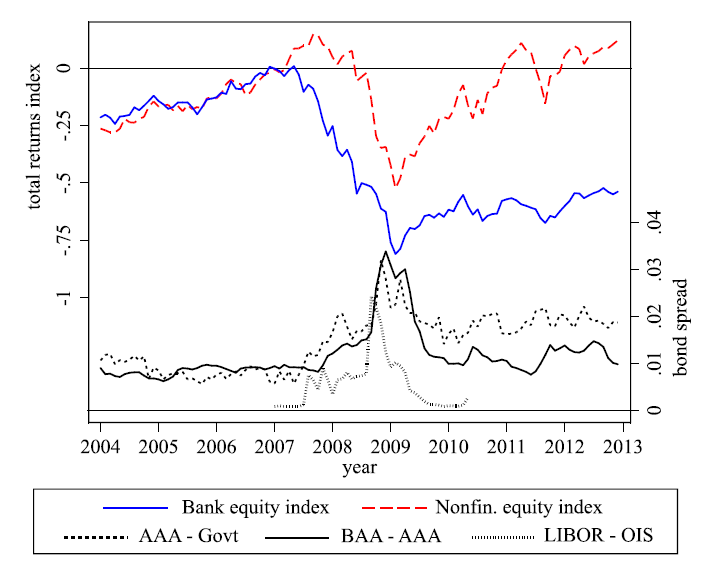

Xiong Wei and other three scholars collected more than 100 bank failures in 46 countries and regions around the world (excluding the two world wars and special years in some countries) from 1870 to 2016, and found that bank equity (shareholders’ equity) has dropped significantly It is a leading indicator for predicting banking crises. A sharp drop in bank equity is usually preceded by a panic and a spike in credit spreads. Substantial bank losses were incurred early in the banking crisis, rather than in subsequent panics. The study found that when a country’s representative bank stock index fell by 30%, on average 7.5 months before a bank panic event occurred.

Taking the global financial crisis as an example, the bank stock index peaked in January 2007, and fell by 30% in February 2008. The crisis broke out in September. The non-financial stock index peaked in October 2007, only to fall by 30% by September 2008. However, corporate credit spreads (such as the spread between AAA-rated bonds and treasury bonds, and the spread between BAA-rated bonds and AAA-rated bonds) and inter-bank lending spreads (the spread between LIBOR and overnight index swap OIS) expanded in August 2007. , but was only 1 percentage point higher than the previous low until September 2008.

A similar situation also occurred in Lehman, whose stock price had retreated 67% more than the S&P 500 index one week before it declared bankruptcy, but its bonds had only fallen by 3% compared with its peers at this time.

Shares of SVB and Signature Bank had retreated 62% and 69%, respectively, from their peaks in the week before bankruptcy. SVB bond prices fell from 90 cents a week before the bankruptcy to 31 cents the day before. In fact, the trigger for SVB’s collapse occurred just after it announced it was raising $2.25 billion in equity.

An essential difference between stocks and bonds lies in their sensitivity to information. Since bonds (deposits are essentially claims on banks) enjoy priority repayment rights, their holders do not care about information that affects the fundamentals of companies (banks) , the repayment right of the stock is ranked last, and its holders naturally care most. This is why the volatility of the stock market is much higher than that of the bond market.

The study also found that the sharp decline in bank stocks is positively correlated with the high proportion of non-performing loans. A third of bank failures did not trigger panic and runs on depositors. However, due to the reduced ability of banks to expand credit, almost all banking crises will cause long-term macroeconomic damage, mainly reflected in the decline in GDP growth and credit tightening.

For policymakers, a marked decline in bank equity returns is a real-time indicator of a crisis. The researchers suggest that timely recapitalization of banks in the early stages of a banking crisis is important rather than allowing policymakers to merely support liquidity in order to prevent subsequent panic outbreaks and minimize negative macroeconomic shocks.

This advice is especially relevant for SVB and Signature Banks. The financial report at the end of 2022 shows that they meet the regulatory requirements on the two main indicators of capital adequacy ratio and leverage ratio, and some indicators are better than the average performance of the banking industry.

The higher the proportion of uninsured deposits in assets, the more dangerous

The day after the U.S. regulatory authorities announced the SVB and Signature Bank rescue plans, four experts including Jiang Xuewei published their research on the overall financial situation of the U.S. banking industry. After estimating the balance sheet information reported by 4,844 banks in MTM terms (according to the price changes of real estate mortgage bonds, commercial mortgage securities and treasury bond ETFs in the same period), it is found that from the first quarter of 2022 to the first quarter of 2023, the currency The policy tightening has reduced the market value of assets in the U.S. banking sector relative to book value by $2 trillion over the same period, equivalent to about 10% of total assets.

Since MTM was performed on only 66% of assets (on average, 42% real estate loans and 24% various types of MBS, ABS, and treasury bonds), the loss figure may be an underestimate (however, the calculation does not take into account that banks may Take interest rate hedging to reduce losses).

Systemically important banks lost at least 4.6% of their assets, while SVB’s assets fell by $34 billion, accounting for 15.7%, but 11% of banks performed worse. If SVB simply fails because of this, then the other 500+ banks are also insecure, with the bottom 5th percentile bank losing 20% of its assets.

From the perspective of the bank’s capital structure, the composition of the liability side is usually 10% of equity, 63% of insured deposits and 23% of uninsured deposits and debts. From the perspective of the proportion of equity in assets, there is not much difference between banks from 8% at the tail to 14% at the head. SVB ranks in the 10th percentile, not particularly out of the ordinary.

However, SVB’s uninsured deposits accounted for 78% of book assets, accounting for 92% of MTM-denominated assets, ranking in the top 99th percentile, and there is a risk of being run if there is a sign of trouble. The 95th percentile in terms of MTM drops to 52 percent.

For comparison, Signature Bank, Citibank, First Republic Bank (First Republic Bank), JPMorgan Chase, and Goldman Sachs accounted for 90%, 77%, 68%, 53%, and 48%, respectively. In hindsight, the runs on Signature Bank and First Trust Bank were not surprising. Even after other banks injected $30 billion in deposits, the latter’s share price still couldn’t stop falling.

If half of the uninsured depositors go to the bank to withdraw money, after the bank sells assets at the market price to satisfy these depositors, the number of banks whose remaining assets cannot cover the insured depositors will reach 186. From another perspective, about 300 billion U.S. dollars have deposits Insured depositors will suffer losses. If all uninsured depositors go to the bank to withdraw money, the number of insolvent banks will reach 1,619. If considering the concentrated sale of assets, the price needs to be discounted, and the number of banks that encounter difficulties will increase significantly.

Obviously, the FDIC’s previous monitoring system did not pay enough attention to the indicator of the proportion of uninsured deposits in market-valued assets. Since healthy banks can also be crushed by a run, US regulators had to fully insure uninsured deposits in their rescue package after SVB suffered a run. Even so, it still caused panic among depositors. This naturally caused the U.S. Treasury Department to hesitate in deciding whether to increase the amount of deposit insurance.

Three Observations for Future Developments

On the whole, the triggering point of the recent risk events of small and medium-sized banks, from the Fed’s rapid interest rate hike, to the double killing of stocks and bonds, the plunge of cryptocurrency and the exposure of FTX scam, implicated venture capital, private equity funds and even wealth management related to cryptocurrency companies, and then evolved to bank failures with a very high concentration of this type of business. Now, both the U.S. Bank Index and the Regional Bank Index (as measured by the two ETFs KBE and KRE) have retraced more than 30% from their highs, although some investors believe that the storm has gradually passed and the market is about to return to calm (especially It is expected that the Fed will end this round of interest rate hike cycle after raising interest rates in March, and then enter the cycle of interest rate cuts). However, historical experience indicates that everything may have just begun, and regulatory agencies in various countries must not take it lightly, and must race against time to resolve market concerns.

Next, there are three important observation points. The first is whether inflation can fall rapidly under pressure. The current statement by the Federal Reserve on continuing to raise interest rates to curb inflation may make bank depositors and investors further nervous, and may exacerbate the phenomenon of deposit relocation; second. It is whether the FDIC will increase the deposit insurance limit of $250,000 (for example, $500,000), or even temporarily cancel the limit to cover all deposits. The FDIC quarterly report shows that the financial performance of most banks is stable, and it is very important to cut off the panic. The third is the actions of private equity fund investors. Pricing updates in the primary market are not as frequent as in the secondary market. It may be that the losses suffered by some private equity funds have not been reflected in the financial report. If investors worry about the upcoming first-quarter earnings report, the run on private equity funds will worsen market liquidity.

(The author is the chief economist of Fangde Financial Holdings. This article only represents the author’s point of view. Responsible editor email: [email protected])