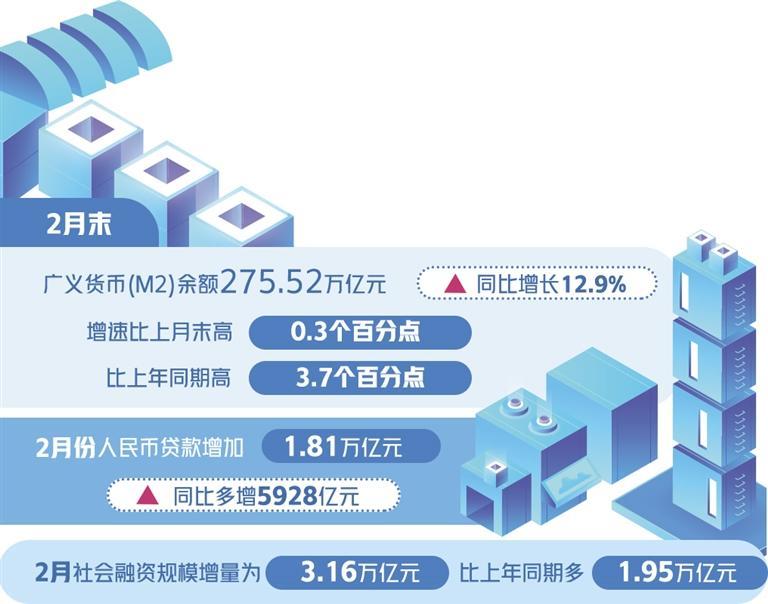

According to financial statistics released by the People’s Bank of China on March 10, at the end of February, the balance of broad money (M2) was 275.52 trillion yuan, a year-on-year increase of 12.9%, and the growth rate was 0.3 and 3.7 percentage points higher than the end of the previous month and the same period of the previous year, respectively. ; In February, RMB loans increased by 1.81 trillion yuan, an increase of 592.8 billion yuan year-on-year. According to preliminary statistics, the social financing scale increased by 3.16 trillion yuan in February, 1.95 trillion yuan more than the same period last year. Industry insiders have said that the financial data in February continued the strong trend in January, and credit supply and demand are booming. Combined with the previous PMI and other indicators, it shows that market confidence and expectations continue to recover, and the macro economy is improving rapidly.

Following the previous month, the growth rate of M2 hit the highest level since mid-2016 again. Dong Ximiao, chief researcher of China Merchants Union Finance, believes that the M2 growth rate has reached a new high, mainly because the loan scale has reached a new high, fiscal efforts have increased money supply, banks’ money creation capabilities have increased, and RMB deposits, especially household deposits, have increased significantly year-on-year. increase. This shows that the monetary policy is more precise and powerful, the market liquidity is more abundant, and the financial support for the real economy is stronger.

Similarly, on the basis of the substantial increase last month, RMB loans continued to maintain a relatively rapid growth rate, continuing the “good start” of credit. According to Dong Ximiao’s analysis, the accelerated issuance of RMB loans is the main contribution. In terms of structure, loans to enterprises (institutions) increased by 1.61 trillion yuan. Renminbi loans, especially loans to enterprises (institutions) grew rapidly, mainly due to the fact that after the Spring Festival, various localities have adopted a series of measures to stabilize the economy and promote development, increase the construction of major projects, boost the confidence of business entities, and promote the continuous financing demand. enhanced.

Zhou Maohua, a macro researcher at the Financial Market Department of Everbright Bank, believes that the growth of new credit in February was stronger than expected, and the credit structure was optimized. The main contribution came from the simultaneous improvement of corporate and residential sector credit. Supporting the recovery of business and residents’ confidence, coupled with the resumption of work and production after the festival, the resumption of business and the resumption of the market, the recovery of credit demand, and the maintenance of high prosperity in domestic infrastructure investment have obvious effects in driving credit demand. In addition, bank credit continued to be positive in February, and continued to increase support for weak links in the real economy and key emerging areas such as manufacturing and infrastructure.

“From a structural point of view, while increasing credit support for the real economy, the credit structure is more optimized, and the support for key areas and weak links is more significant.” Jones Lang LaSalle Greater China Chief Economist and Research Department Director Pang Ming said that the recovery of credit demand in the residential sector is obvious. The dislocation of the Spring Festival caused the increase in auto consumption in February, which led to a significant improvement in the short-term loans of residents. The business climate continued to pick up, and the physical workload of major projects and the start of infrastructure construction further accelerated, which drove a year-on-year increase in new medium and long-term loans for enterprises.

In terms of social financing, new social financing increased year-on-year, mainly due to improvements in real economy credit, government bond financing, and off-balance-sheet bill financing. Zhou Maohua further stated that among them, corporate bond financing continued to increase slightly year-on-year in February, but it improved significantly from the previous month, reflecting the overall improvement of the corporate credit environment. The strong performance of social financing is mainly due to the improvement of the domestic economic outlook, policy support for bailout and growth stabilization, the recovery of financing demand in the real economy and the overall improvement of the corporate credit environment.

Wen Bin, Chief Economist of China Minsheng Bank, believes that from the financial data, it can be seen that in the context of the recovery of endogenous financing demand in the real economy, the policy of stabilizing growth and the environment of low-interest loans, after the rapid growth of credit in January, credit extension in February It still maintained a relatively fast pace, and completed the pre-strength and “good start” goals; government bonds, corporate bonds, etc. also remained at relatively high levels, reflecting “powerful” and helping to boost confidence and speed up the process of widening credit. In order to properly handle the relationship between stable growth and risk prevention, maintain a reasonable and stable growth of money and credit, enhance the stability and sustainability of total credit growth, and meet “effective” demand, the total amount and pace of follow-up credit needs to be further adjusted, so as to provide economic Sound operations and sustainable growth create an appropriate financial environment.

“It is expected that the total amount of credit will maintain effective growth in the future, and monetary credit will maintain a reasonable and stable growth. At the same time, policy tools to stabilize the economy will continue in an orderly manner. Improve quality and increase efficiency, steadily and accurately increase strong and effective support for the real economy, continue to effectively reduce the cost of credit for the real economy, the financing cost of operating entities, and the cost of personal consumption credit, so as to help the economy stabilize and improve. Quality development creates a suitable monetary and financial environment.” Pang Ming said. (Yao Jin)

[

责编:杨亚楠 ]