Wednesday, Eastern Time,MidlandReserves released the interest rate hike schedule, the US stock market reversed in intraday, and the three major indexes collectively rose. By the end of the day, the Dow rose by 1.08%, the Nasdaq rose by 2.15%, and the S&P 500 index rose by 1.63%.

Most popular Chinese concept stocks fell, while e-commerce stocks and new energy auto stocks generally fell.JingdongFell more than 5% (the largest intraday drop was more than 9%),PinduoduoFell more than 4% (the largest intraday drop was more than 9%),AlibabaFell more than 3% (the largest intraday drop was close to 7%);Wei LaiFell more than 4% (the largest intraday drop was more than 10%),Xiaopeng MotorsFell nearly 3% (the largest intraday drop was more than 8%),Ideal carFell 2% (the largest intraday drop was more than 6%).

In terms of other Chinese concept stocks,GaotuFell more than 11%,51TalkFell more than 10%,Dada、Dingdong ShoppingFell more than 6%,Kingsoft CloudFell nearly 6%,Funny headlines、Huya、BilibiliFell more than 4%,IQIYI、Didi、Fogcore TechnologyFell more than 3%,shell、Fighting fish、NetEaseFell more than 2%,BaiduFell more than 1%.NetEase Youdao、Daily FreshRose nearly 2%.

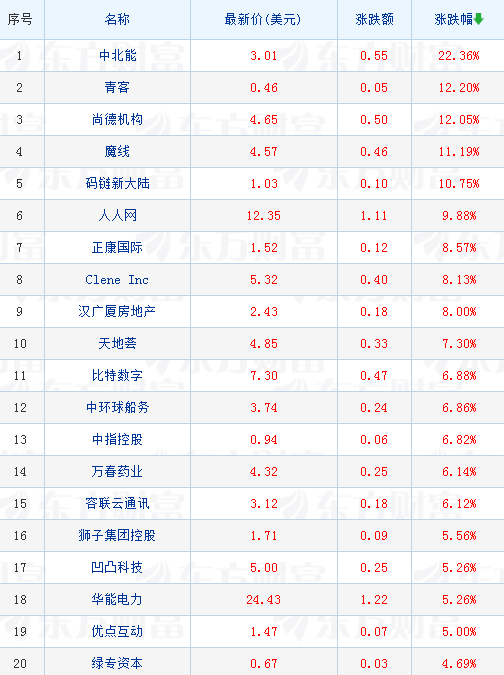

List of leading Chinese stocks:

List of leading stocks:

The following is a summary of important information in the global market:

Overnight news

The Federal Reserve FOMC Resolution: Keep the policy interest rate unchanged, Taper speed doubled, and most committee members expect to raise interest rates three times next year

At 3 o’clock in the morning Beijing time on Thursday,MidlandChu announced the benchmarkinterest rateMaintained at 0%-0.25% unchanged, in line with market expectations.MidlandAt the same time, the Reserve Bank announced that due to inflation factors and the progress of the job market, starting from January next year, the rate of monthly cuts in the asset purchase plan will be doubled to 30 billion U.S. dollars (20 billion U.S. bonds and 10 billion mortgage-backed bonds). The Fed expects to cut its asset purchase program at the same pace in subsequent months. In terms of economic expectations, the 18 FOMC committee members unexpectedly gave a strong change. Compared to September, half of the committee members expected to raise interest rates in 2022 and 2023. All members in the December dot matrix are expected to raise interest rates from 2022. Among them, 12 committee members believe that they will raise interest rates at least three times next year. .

The Biden government will strengthen the final standard of vehicle emission limits to be released within a few days

The Biden administration is preparing to impose stricter limits on the emissions of cars and trucks to curb greenhouse gas emissions in the United States, thereby responding to climate change. According to three people familiar with the matter, these standards will apply to small cars and light trucks from models 2023 to 2026. It will reverse the Trump administration’s relaxation of environmental protection regulations, and specific policies will be released within a few days.

IMF issued a warning: global debt levels have increased at a record high after World War II. Please think twice before the central bank raises interest rates

internationalityMonetary FundOrganization (IMF) stated that global debt soared to a record 226 trillion U.S. dollars last year.interest rateThe rise has raised concerns about debt sustainability. Faster-than-expected interest rate hikes may put pressure on highly indebted countries and force governments and companies to reduce debt and expenditures, harming economic growth. 2020 global debt/GDPThe ratio rose by 28 percentage points to reach 256%, the largest increase since World War II. As interest rates rise, fiscal policy usually adjusts because the government needs to spend more to pay off debts and cut spending to control deficits.

Business executives get together to sell stocks as the U.S. SEC intends to tighten related trading regulatory loopholes

This year, the founders of American companies andExecutivesAre reducing their holdings at historic levels, which has caused the United StatesSecuritiesThe Exchange Commission (SEC) noted that the agency is currently considering making stricter rules to ensure that company insiders do not violate insider trading laws when selling stocks. SEC Chairman Gary Gensler said on Wednesday that he is concerned that the existing rules (formally known as the “10b5-1 Plan”) are not enough. Gensler hopes that the SEC will consider establishing a 120-day “cooling-off period” for corporate executives to deal with any new or changed portfolio management plans, and will prohibit overlapping trading plans. A single person or entity can only have one 10b5-1 at the same time. plan.

Fauci: There is no need to develop specific vaccines to strengthen the effectiveness of Omi Keron

Anthony Fauci, the chief medical adviser of the White House, said on Wednesday that the currently available new crown vaccine is more effective against the Omi Keron variant and does not need to develop a vaccine against specific variant strains.Fauci said that althoughPfizerThe two-dose vaccine series of BioNTech and BioNTech were severely affected by Omi Keron, but still provided considerable protection against severe COVID-19. The protection rate of the two doses of vaccine against infection dropped to 33%, while the protection capacity was 80% before the emergence of Omi Keron. However, Fauci said that in South Africa, the two-dose vaccine is still 70% effective in preventing hospitalization of people infected with Ome Keron.

Operating data unexpectedly weakened, US stocks “Meta Universe No. 1” plummeted by more than 9%

U.S. local time on Wednesday, onlinegameServices company Roblox disclosed weaker-than-expected operating data for November, triggering a sharp decline in stock prices. As of the close of trading, Robles fell 9.07% on Wednesday, a retracement of about 30% compared with the record high set at the end of November, and also touched the jump gap after the announcement of the three quarterly reports. According to the company’s disclosure, the number of daily active users on the platform in November was 49.4 million. Although a year-on-year increase of 35%, it was significantly weaker than the 50.5 million daily active users of the 27 calendar days before October. Previously, the market expected the November data to be at least the same as the data during the normal operating period in October.

Overview of the outer disk

The Fed keeps the benchmark interest rate unchanged, the three major U.S. stock indexes closed sharply higher

On Wednesday, Eastern Time, the Federal Reserve announced that the benchmark interest rate will remain unchanged at 0%-0.25%, which is in line with market expectations. The three major U.S. stock indexes bottomed out and closed higher across the board. As of the close, the Dow rose by 383.25 points to 35927.43 points, an increase. 1.08%; the Nasdaq rose 327.94 points to 15,565.58 points, an increase of 2.15%; the S&P 500 index rose 75.76 points to 4,709.85 points, an increase of 1.63%. On the disk, large technology stocks, anti-epidemic concept stocks,semiconductorThe sector rose collectively,AppleIt closed up 2.85%, and the total market value was approaching 3 trillion U.S. dollars.Amazon, Meta rose more than 2%,Microsoft、TeslaRose nearly 2%;Novavax PharmaceuticalsRose more than 6%,PfizerRose more than 5%, BioNTech rose more than 3%, Modena rose more than 2%;Chaowei SemiconductorRose more than 8%,NvidiaRose more than 7%,AsmerRose more than 5%,QualcommRose more than 4%; most popular Chinese concept stocks fell,Zai LabFell more than 12%,BeiGeneFell more than 10%,JingdongFell more than 5%,PinduoduoFell more than 4%,AlibabaFell more than 3%.

Major European stock indexes were mixed, France’s CAC40 index rose 0.47%

European time on Wednesday, the major European stock indexes were mixed. As of the close of trading, the FTSE 100 index closed at 7170.75 points, down 47.89 points or 0.66% from the previous trading day; the French CAC40 index closed at 6927.63 points. Compared with the previous trading day, it rose by 32.32 points, or 0.47%; the German DAX30 index closed at 15476.35 points, which was 22.79 points higher than the previous trading day, or 0.15%.

U.S. stocks’ large technology stocks generally rise, Apple soars by nearly 3%, and its stock price is only $0.15 from its closing historical high

On Wednesday, Eastern Time, U.S. stocks’ large technology stocks generally rose.AppleSoared by nearly 3%, and the stock price was reported to be US$179.30, which is only US$0.15 from the closing historical high, and its market value is still ranked first in the world;Amazon, Meta rose more than 2%,MicrosoftRose nearly 2%, Google,NetflixRose more than 1%. Chip stocks soared, AMD soared more than 8%,NvidiaRose more than 7%,AsmerRose more than 5%,STMicroelectronics、Broadcom、Applied Materials、QualcommRose more than 4%,United Microelectronics、ON Semiconductor、TSMCRose more than 3%, GF,Texas Instruments、Micron TechnologyIt also recorded an increase.

(Source: Hafu Information)

.