Nasdaq observed special, after entering the correction phase and suffering a thud of 7.6% on a weekly basis, closing the worst week since March 2020, when global equities plummeted in the wake of the announcement of the Covid-19 pandemic. If the Nasdaq entered a correction, stocks like Tesla and Amazon have already entered the bear phase, traveling more than 20% below the November highs.

Last Friday the hi-tech price list closed down for the fourth consecutive week, reporting the longest bearish phase since April and May of 2021.

The Dow Jones and the S&P 50 also hurt, which closed down for the third consecutive week, also blaming the worst week since 2020.

The S&P 500 is down more than -8% from its previous closing record, factor that puts him at risk of correction, after a weekly loss of -5.7%. Among other things, the index closed below the 200-day moving average, a key technical level, for the first time since June 2020.

The Dow Jones lost 4.6% in what was the worst week since October 2020.

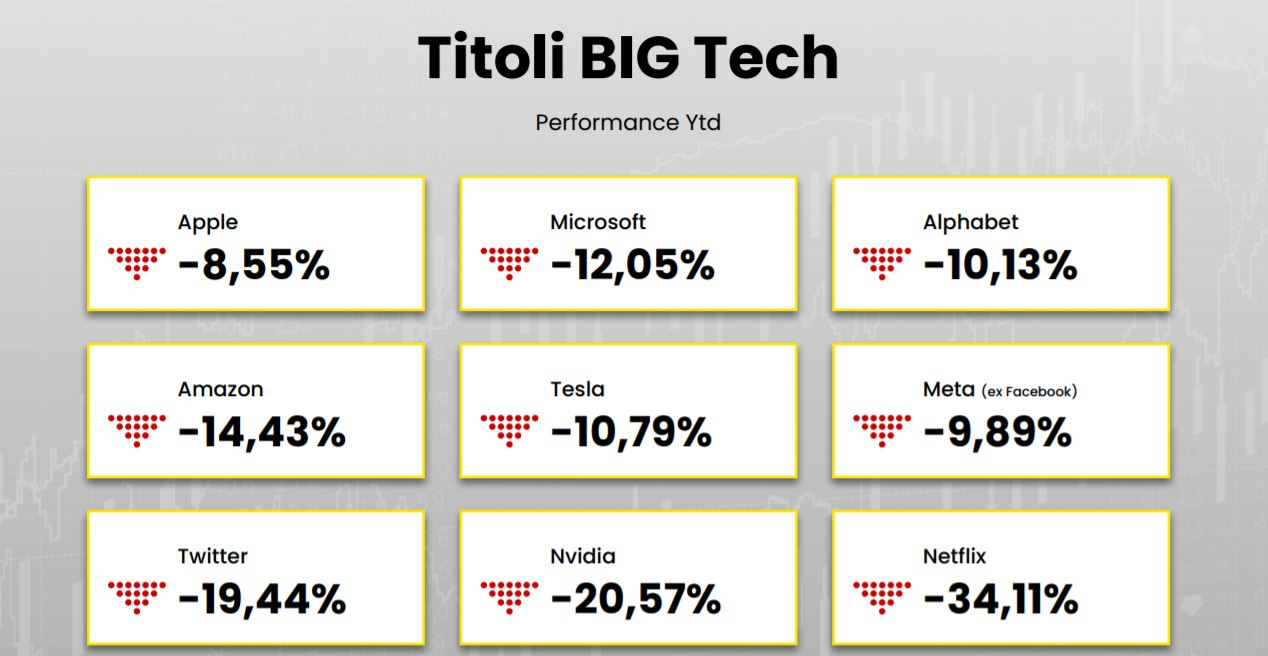

Returning to the Nasdaq, the price list fluctuates at a value down by over 14% from the record closing value of November; Since the beginning of the year, the Nasdaq has lost 12%, underperforming the S&P 500, which lost 7.7% in the same time frame, and the Dow Jones Industrial Average, down by 5.7%.

The sales on tech stocks are mainly explained by the fear of one a decidedly more hawkish Fed, due to the jump in US inflation, a factor that led 10-year Treasury rates to fly above the 1.90% threshold, for the first time since the end of 2019.

Some numbers from companies like Netflix e Peloton, among the Covid Winner titles of 2020.

Netflix stock plunged 22% in the session last Friday, suffering the strongest daily loss in nearly 10 years, and bringing the weekly balance to a total drop of 24%. The thud in the quotations of the streaming giant hit the stocks of other companies active in the sector: Spotify lost 11% during the week, Roblox 13%.

Very bad also Amazon, which has closed worst week since 2018, capitulating last week by 12%.

Very bad also Amazon, which has closed worst week since 2018, capitulating last week by 12%.

Social media headlines are also not doing well at the start of 2022. Today among the victims of the sells it stands out Snap, which falls by more than 5% in pre-market, after Wedbush downgraded the rating on the stock from “outperform” to “neutral”, seeing several obstacles to the growth of its turnover.

At this time, the expectation is great for the quarterly reports that will be released this week by some Big Tech, such as Microsoft, Tesla and Apple.

The tumble in particular of some technological stocks reaches very important figures. Peloton for example, it travels 85% lower than the maximum; Zoom it is down by 72%; Apple is down 11% from previously tested records; Meta (formerly Facebook) by 19%, Alphabet of 11%, Tesla of about 24%. Even worse, Twitter, down 52% from the highs and Nvidia about 30%.

It should be noted that the Nasdaq Composite Index is made up of over 3,000 stocks, but a select group of the top 10 stocks out of these 3,000 they make up more than 50% of the entire index weighting (52.5% to be exact). The first two – Apple and Microsoft – alone account for nearly 21%.