Throughout 2021 we have seen a boom in volumes for ETFsthanks to the fact that all sectors, even if with differences between the various countries, have produced very positive performance. Now we have entered the new year and issues such as inflation look set to persistalthough investors are now learning to live in a new normal.

In the current context in which uncertainty prevails, balancing the portfolio of different sectors, like energy and sanitation, could provide some degree of protection. While ETF investors have made heavy purchases in market segments more focused on growth stocks, such as the technology and consumer discretionary sectors, by contrast, flows of institutional investors show a much more defensive bias, with strong purchases in public utility services and basic necessities. This is what emerges from the report “Sector & Equity Compass” di SPDR funds. Investors in ETFs continue to favor US equities, while institutional investors have continued to move away from these exposures, heading mainly towards emerging markets and Europe, excluding the United Kingdom. Investors remain extremely exposed to the Technology sector and the United States, although strong sales have also been recorded in these areas. Overall, demand for equities remained broadly unchanged during the fourth quarter of 2021, despite quarter-end sales caused by news of the Omicron variant.

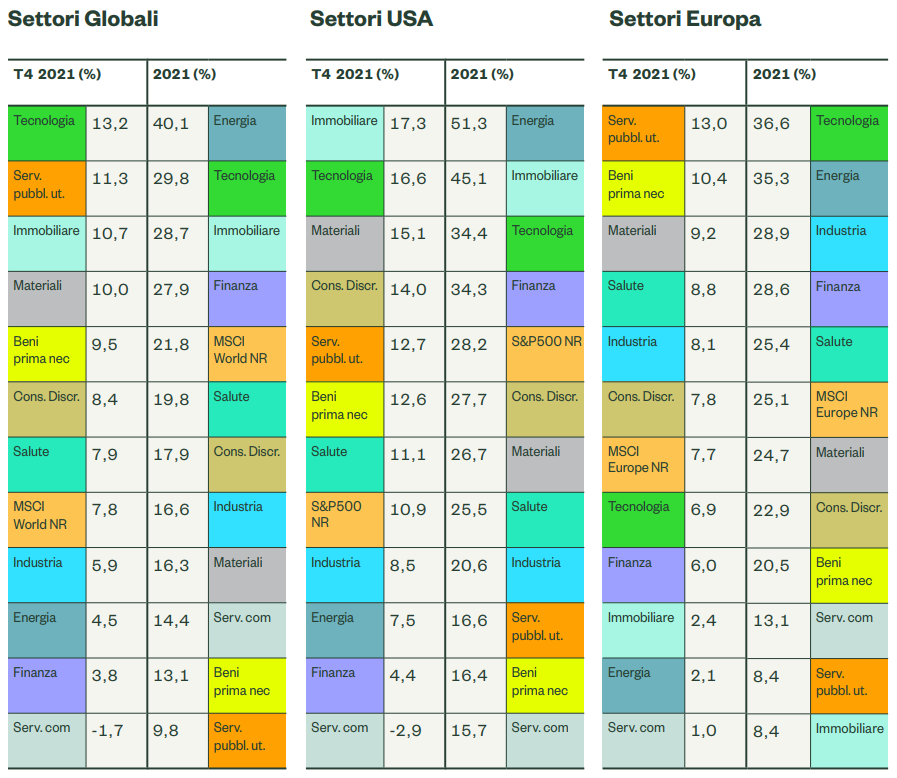

In the table we see the flows of sectoral ETFs (in Europe and the United States) in the last quarter and throughout 2021.

Now let’s see specifically how they reacted and what the expectations could be for some sectors:

Energetic

2021 was a bumper year for the energy sector which recorded the best equity performance in all geographic areas. The fund’s returns were boosted by the proactive stance of oil and gas companies which began to follow up on challenges posed by the transition. Investors responded to this over-performance by the energy sector by adding to previously underweight positions as part of a value strategy and as a hedge against rising inflation, now at 7.5% in the US.

According to analysts, also in the near future the energy sector will continue to be interestingin fact, thanks to the increase in oil prices, the sector continues to boast a better revenue trend than all the others. As experts point out, crude oil prices are likely to remain high in the coming months due to low inventories and the continued increase in global demand.

The increase in profits and cash flows of the energy sector translate into strong increases in dividends, which in some cases have returned to pre-pandemic levels; as well as other parameters such as P / E and EV / EBITDA continue to be very favorable for the sector.

Industry

The demand for capital goods and commercial services has benefited in all markets from the structural advantage due to the development of automation, digitalization and electrification. Despite this, much of the activity of this sector depends on capital expenditure, both by the state and by private companies. The analysts of SPDR funds have included industrial stocks among the most interesting precisely by virtue of their pro-cyclical nature traditionally relevant in the initial stages of the economic recovery.

For the sector, the key element for next year will be the consolidation of demand in the automotive, transport, construction and oil production and refining sectors. Another key factor will be infrastructure spending, including the $ 1.2 trillion in funding proposed by a US law. As can be seen from the SPDR report, analysts believe that there is a favorable earnings dynamic for the industry; however, attention should be paid to the volatility of the fund, especially for aerospace companies.

The industry is a highly diversified sector and companies operating in multi-sector markets allow for a broader exposure to current issues.

The SPDR fund prefers the US sector because its companies are more likely to win the huge contracts awarded by the Department of Transportation and other federal agencies. Public spending on traditional investments such as roads, bridges and water systems should indeed give a significant boost to US industrial demand in the coming years. Alternatively, investors seeking greater geographic diversification might consider exposure to the global industrial sector.

Consumer Discretionary Goods

Investing in the consumer discretionary sector in Europe allows exposure to an attractive combination of luxury goods and auto manufacturers, areas that have performed well in 2021 thanks to reopening and economic recovery. The rest of the sector, which includes the hotel, leisure and retail sectors, recorded a non-homogeneous trend due to the different impact of social distancing measures and travel restrictions. Analysts believe that improvements in supply chains and the recovery in consumption, helped by an easing of restrictions, should support all

segments of the industry in 2022. However, we need to keep an eye on China’s growth outlook in light of its importance to global demand for discretionary products and services in recent years.

Focus on the auto sector

After being penalized last year due to supply chain and semiconductor problems, auto and vehicle component manufacturers are now particularly attractive to analysts. The difficulties in the supply chain are easing, as are the restrictions linked to the Covid-19 emergency and for these reasons a further recovery in demand is expected. Another very important trend is the shift to electric vehicles, which strengthens growth prospects for the entire sector. In Europe, the popularity of these vehicles has also increased due to state incentives for scrapping old cars