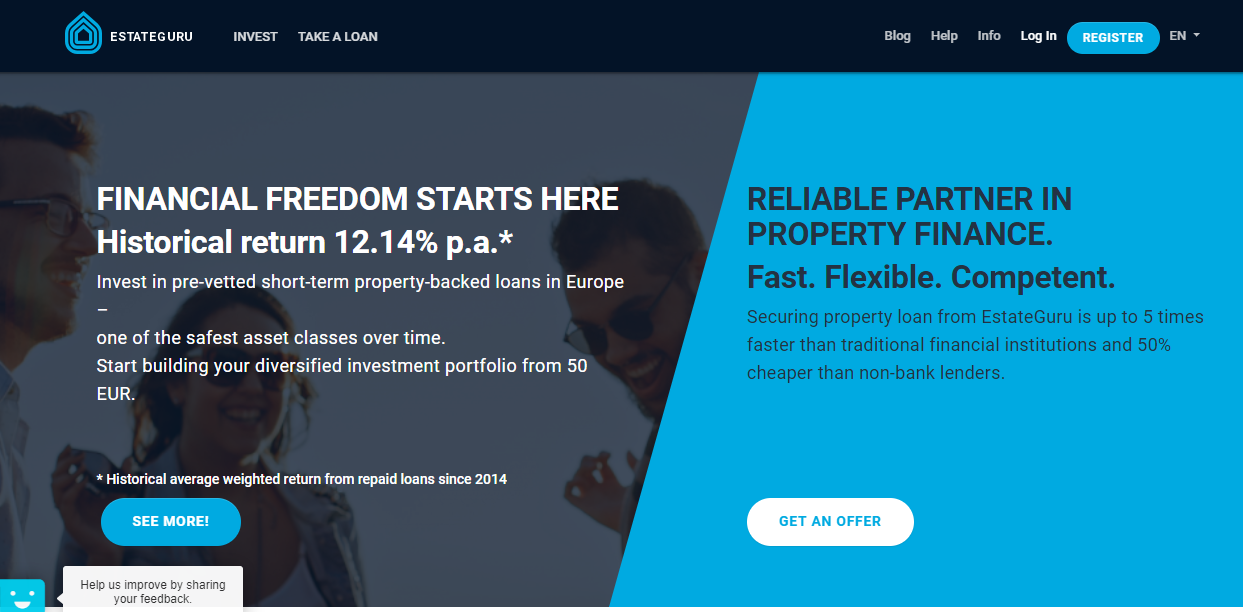

EstateGuru is an online investment platform that allows you to invest, even with very low capital, in the possibilities offered by the real estate market, otherwise closed to small savers.

I’m not talking about earning from the possession and direct administration of a property, but about exploiting the principle of crowdfunding (funding from the crowd) and participate with a minimum of 50 € in the realization of real estate projects.

EstateGuru it’s hardly the only platform out there to deal with Real Estate Crowdfunding; let’s see together what it has to offer you compared to the competition: in this review I analyze its operation, the investment proposal, the type of gain it promises, the risks related to its use and the opinions of those who use it to invest.

Follow me in reading the article to find out more!

This article talks about:

Who is EstateGuru?

EstateGuru it is such a platform Lending that offers short term loans guaranteed from property real estate. In practice, it allows real estate companies to borrow capital from small investors who in return receive interest payments.

EstateGuru was launched in 2013 by a group of real estate and fintech experts, is headquartered in Tallinn, Estonia. The reference market (borrowers and properties) is limited to Estonia, Latvia, Lithuania, Finland and Spain.

Instead, investors come from different countries: as long as they are of age and have a bank account in any of the member states of the European Economic Area or Switzerland.

The use of the platform and investment operations they do not involve commissions for the investor who can do everything from the comfort of his home, from his PC or smartphone. Currently the official site is provided only in English and we hope that it will also be translated into the remaining European languages.

How does the platform make money? Through fees charged to borrowers.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

How does the investment work?

Borrowers (real estate companies) submit loan applications on EstateGuru which evaluates their creditworthiness, business plan and possibility of guaranteeing the loan. Indeed all loans on the platform must be secured by mortgage to protect creditors.

Once approved, loans are posted on the platform, where investors can view them and decide whether to invest. There is no limitation on the type of real estate project that can be financed (bridge loan, business loan, development loan ecc.).

When a loan has been successfully funded, the borrower agrees to repay the investors by meeting the repayment schedule. In the event that the loan fails, all invested funds are released to the investors. The borrower always has the option to accept the amount that has been raised, even if it is less than the collection target.

Client funds are kept separate from EstateGuru’s operating funds. In case the company faces financial difficulties or goes bankrupt, clients’ funds would be safe.

Earnings and duration of loans

As I wrote in the title, EstateGuru offers the opportunity to invest starting on your own 50 € per project, this makes it possible to diversify the portfolio across multiple micro-loans – once upon a time such a small figure would have been unthinkable in the real estate sector.

The platform records an average return per year of 10.73%. The interest rate paid by the borrower is fixed throughout the loan period and depending on the characteristics of the chosen project, it can fluctuate between 8% and 13%.

The reimbursement program is of two types, the type of payment is marked on the form of each project:

- Bullet payment: interest on loans is paid periodically and the principal amount is paid only at the end of the loan period;

- Full bullet payment: Both interest and principal are paid at the end of the loan period.

What is the duration of an investment? The duration also varies, but usually it is about investments ranging from 12 to 18 months.

Registration guide

To start using the EstateGuru platform, you need to register as an “Investor” via the registration form or through your Facebook or Google accounts.

- Register, it is simple e fast. Once you have created your account and presented proof of identity and your bank account details, the manager will check that everything is in order and confirm your registration;

- Upload the necessary funds to your virtual account by bank transfer;

- Select the loan that interests you. Needless to tell you, the selection of projects must be accurate. But if you want to save time, you can activate the function AutoInvest;

- Click on Invest.

In case of a successful campaign, you will always be able to monitor payments from your account. Once the loan has been fully repaid, the funds are released and you can withdraw them or reinvest them in another project.

Tool AutoInvest

AutoInvest it’s an automatic function that invests for you, you just have to select the amount to allocate to each project; it’s the best way to diversify your investment portfolio without wasting time selecting projects. You can activate or deactivate the function directly from your profile.

Is it a safe investment? What are the risks?

Let’s start by clarifying one thing, EstateGuru can not guarantee your investment completely.

The loans are mortgage-backed on the real estate such that if a borrower cannot repay the loan, the process of selling the assets will be initiated.

Once a loan is fully invested, the borrower must go to the notary’s office and enter into an agreement with the Security Agent to register the mortgage. The Security Agent is a limited liability company whose main purpose is to hold securities for the benefit of EstateGuru’s investors, the entity is controlled by a leading legal department.

The risk of losing your money is minimized but it’s still about venture capitalmeans that you may not get paid for all or part of your investment.

Income taxation

All interest received is treated by the tax authorities as investment income and therefore subject to income tax. The annuity received should be taxed at a marginal rate applied to personal income tax (from 23% to 43%) when filing the tax return, but it is still better to consult the accountant.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

My Business Opinions

When I deal with investments of the type real estate crowdfunding I always make some recommendations: it’s not an activity to be taken lightly, even if it seems easy, safe and profitable. It is a real investment, with real risks and since you lend your money to strangers without having an absolute guarantee that you will see it again, you cannot afford to be superficial.

The smartest thing you can do is invest only small numbers of your assets that you can afford to lose and must seek to diversification as much as possible. I don’t want to discourage you from trying online investments, on the contrary, the real estate market is still one of the most solid and represents a promising opportunity, but it must be tackled with the right maturity and awareness.

EstateGuru allows you to start with a small investment and then invest modest amounts, diversifying across multiple projects. It also offers you some extra guarantees to protect your capital, and the return proposal isn’t bad either. The site is pleasant and easy to use. You are in front of a valid platform.

This does not mean that, before making a choice, it is always good to compare this portal with other competing platforms. Find the reviews in the section of My business dedicated to Crowdfunding.

I want to give you one last piece of advice: no matter which platform you choose you have to train first!

Conclusions

In this article we have analyzed the Real Estate Crowdfunding platform together EstateGuru; now you know how it works and what investment opportunities it offers you. I hope you will follow my advice and educate yourself before investing, but clearly you have the freedom to do as you see fit.

Anyway, My business represents a very useful resource to rely on, here on the blog you will find interesting content, articles, reviews, courses, videos, lessons on the subject of investments, savings and economic growth every day.

You can also start immediately from this thematic path to take your first steps in the world of investments, it is designed for all types of readers:

Good continuation on My business.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <