In this guide I want to talk about Genertellife Safe Deposit. This is not a classic deposit accountI am sure that when I have described the features you will be amazed: in fact, it is a policy who wants to compete and act as alternative to the deposit account.

A policy that wants “substitute” a savings account? Is it really possible? But above all, is it worth it? Of course you know mine opinions on policies intended as a savings and investment instrument, which are mostly negative, but today we are talking about something different.

In the next few lines we will see if it is convenient and how it works, examining all its features, so keep reading!

This article talks about:

A note on the Group

Before starting I want to frame, as always, the Institute that offers this product. Verifying their history and work is always a good way to immediately understand whether or not it is worth evaluating their offers.

Genertel is the direct insurance company of Generali Italia, and was founded in 1994: today it is among the first direct insurance companies in Italy.

Genertellifehowever, it is the first Direct life and pension company in Italy and constitutes, together with Genertel, the only Italian direct insurance hub capable of providing all life, non-life and pension insurance services online and over the telephone.

For years, therefore, the company has been offering its services to customers without ever having given problems in terms of safety. But remember that safety and convenience do not always go hand in hand, which is why we will now talk about Secure Deposit in terms of convenience and effectiveness.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

What is Safe Deposit?

Already from the name this product recalls the concept of deposit accountsi.e. instruments that have recently attracted the attention and hopes of Italian savers, who are looking for more advantageous alternatives than current accounts to preserve their liquidity.

Just for the trust of Italians in the deposit account, a research by Fabi on the reserves of Italian families showed that there are more than 440 billion euros in deposit accounts.

Genertellife has therefore developed a tool which, despite being a branch I life policyhas intrinsic characteristics capable of competing with deposit accounts, starting from returns.

To summarize the main features, the capital is guaranteed and is invested in management separate Glife Premium, which invests both in government bonds that in bonds.

In addition, it is expected every 5 years a deposit bonus of 0.25%, while at the signing of the contract a 1.30% return linked to the GLife Premium Separate Management. There is an immediate advance of part of the 1st year yield equal to 1.20%.

The similarities do not end here, since as in deposit accounts, all or part of the capital can be withdrawn after the first 12 months, and there are no subscription or intermediation costs.

But an advantageous difference is that, unlike deposit accounts, branch I policies do not include stamp duty.

During 2019 Secure Deposit made l’1,85% net of management fees and gross of tax obligations, in 2020 made the1,60% while in 2021 it made the1,30% (which, for these instruments, involve a rate equal to 12.5% on the portion relating to government bonds and a rate of 26% for the portion invested in corporate bonds or shares – which in any case are minor compared to those of government bonds). Of course, remember that past returns are not indicative of future returns, but only serve to provide an overview.

In this paragraph I have proposed the characteristics of the product, but I want to examine them one by one.

Genertellife features

As you will have understood, we are dealing with an insurance investment for savings, characterized by a variable return linked to the Glife Premium Separate Management, with no subscription costs and with the guarantee of invested capital in the event of the insured’s death.

The investment has a lifetime duration, but you can decide to redeem the capital when you want, totally or partially, after 12 months from each payment.

The risk

Obviously, even if with almost hybrid characteristics with a deposit account, we are still talking about a policy, and the risk should not be ignored.

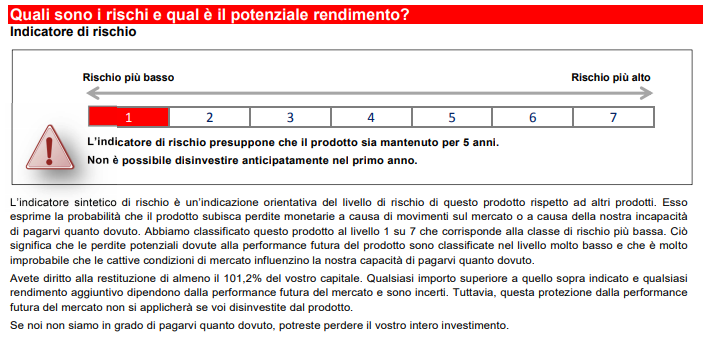

I am attaching the image of the risk indicator taken from the official documentation.

As you can see, we are facing a very low riskjust like a savings account. So from this point of view you can still be calm: we are not dealing with an aggressive policy.

Performance and costs

Thanks to the 2021 certified yield of 1.30%, you will protect your assets from the volatility of the financial markets. Performance is related to Glife Premium Separate Managementcharacterized by low risk. Performance bonus of 0.25% every five years. Immediate advance of part of the 1st year yield equal to 1.20%.

Is the return net or gross?

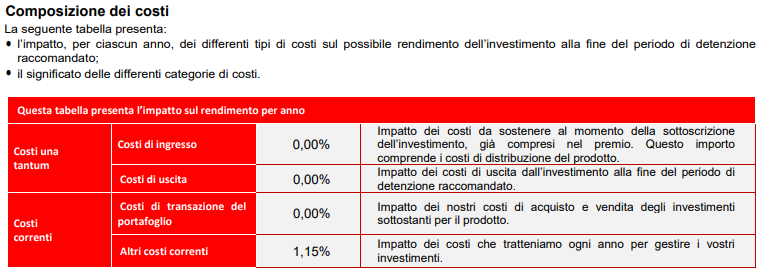

It is fair to ask: in this case, it is calculated at net management costs of 1.20% and gross of tax charges, which will be calculated at the end of the investment period.

There are no other additional costs on this product: the capital gain accrued does not constitute IRPEF income and stamp duty does not apply.

In case you don’t know, or want to clarify, the tax charges are there taxation due to the tax authorities on capital gains generated by the investment at the end of the period.

To date, this taxation involves:

- A tax rate of 12.5% on capital gains derived from investments in government bonds or equivalent;

- A 26% tax on capital gains from other investments.

To calculate them, you must apply the weighted average rate obtained starting from the rates of 12.5% and 26% to the capital gain.

The Revaluation

The paid-up capital yes reevaluate on 1 January of each, according to a revaluation measure obtained as the difference between the annual return of the Glife Premium Separate Management and the return retained by the Company, equal to 1.20%.

This percentage withheld increases by 0.10% in absolute value for each point of return of the Separate Management above 4.00%. The first revaluation measure, relating to the year of subscription, is applied “pro rata temporis” between the effective date (or effective date of any additional payments) and 1 January of the following year.

Separate management

When it comes to Separate Management, means that the investments of customers who adhere to contracts connected to it flow into this management. It has a low risk profile, since asset management is prudent and aims to maximize returns in the medium to long term.

Over the years the yields have not shown strong fluctuations, not to mention the fact that, in any case, the investment in the Glife Premium Separate Management is protected since it is separate from the other activities of the insurance company from an accounting point of view.

What about insurance benefits?

The product provides, in case of death of the insured and at any time it occurs, the payment of an amount not less than the sum of the 101,2% of the initial single premium he was born in 100% of any additional single premiumsall re-proportioned for any partial redemptions.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

How to Open Safe Deposit?

Becoming a Protected Deposit holder is easy and accessible: just think that you only need 5,000 euros to get started (up to a maximum of 150,000 euros) and you can make additional payments at any time.

The limit is linked to the type of investor, which must be one physical person and must be over 18, but under 87. Nothing transcendental, in short.

To activate it you just have to go to the Genertellife home page and:

- Simulate the investment by filling out the questionnaire;

- Get in touch with your advisor via email, telephone, or chat or video chat;

- Deposit capital and download the app.

Is this policy worth it?

One of the advantages of Deposito Protetto is that it guarantees protection, since your investment is protected also thanks to the addition of a traditional life insurance policy, with the guarantee of the initial capital plus the advance of return to your loved ones, in case you are gone.

Compared to a traditional Branch I policy, this is more flexible and convenient, because there aren’t any subscription costs nor of brokerage.

Furthermore, the customer has the possibility to withdraw all or part of the capital, already 12 months after the payment without costs.

Finally, there is the possibility of paying and supplementing your investment freely and without costs.

But we said that your capital is protected… How? The invested capital is unforgivable e unattainable. Furthermore, before each revaluation, you can decide whether to accept the return or redeem your capital.

Genertel Safe Deposit: Opinions of My Business

Now let’s see what my opinions are: as I said at the beginning, I am generally against insurance investments: I find it absurd to combine two opposing concepts (such as that of protection and that of investment – which always involves a risk).

However I can not be entirely pessimistic about Secure Deposit: finally we are faced with an interesting insurance product, which manages to compete with deposit accounts.

In fact, this tool tries to “solve” the problem of low ratesoffering customers of traditional deposit accounts an alternative which, yes, has a few less guarantees (for example: for example it does not adhere to the Interbank Fund for Deposits and does not offer an absolute capital guarantee).

In this regard, the KIID itself specifies that there is no public or private guarantee system that can compensate for any losses due to the insolvency of

Genertellife.

But there is still some “good news”: the assets covering the commitments held by Genertellife will be used to satisfy – with priority over all other creditors – the credit deriving from the contract, net of the costs necessary for the liquidation procedure.

Of course, as insuranceyou have the lump sum guarantee in the event of death, against a very low risk.

Conclusions

I could say that I do not advise against this tool a priori (as I do with other insurance policies), but be careful: I think it is only for those who want to invest their assets diversifying and perhaps opting, among the various products chosen, also for a protective instrument (such as, in fact, a policy), which however does not involve management costs that frustrate the investment itself (as in the case of Deposito Protetto).

If you are a beginner in the world of investments, or you don’t feel confident anyway, I suggest you read the others guide that you find here on Affari Miei, starting with these:

Have a good time!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <