Let’s go back to talking about complementary pension e you Allianz. it suits the pension fund Pension horizon? What are the opinions and opinions about the possibility of evaluating this form of savings investment?

On supplementary pensions you can consult the section where you will find everything you need to know about the subject.

But now let’s start with ours analyses of Orizzonte Previdenza, enjoy reading!

This article talks about:

A few words about Allianz

Before starting with the analysis of the pension product, I would like to introduce you to the institution that offers the product, since it is important to know a minimum of who you rely on.

Allianz Italia is one of the main Italian insurers, and is part of the Allianz SE group: it is one of the world leaders in the insurance sector and in asset management. It can boast more than 8 million customers, through a multi-channel distribution network made up of more than 25,000 agents, collaborators and financial advisors.

In 2014 Allianz SpA acquired the non-life insurance business of the former Milano Assicurazioni from UnipolSai.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <

What is Orizzonte Previdenza?

Retirement horizon of Allianz is a Individual pension plan dedicated to people who wish to add a supplementary annuity to their pension.

It is aimed at both freelancers, self-employed workers and employees: the goal is to build a future annuity which supplements the public pension. We all know that the shortcomings of our pension system lead us to worry about the ways in which to supplement the annuity we will receive: especially for the youngest, the amount received will always be lower, in consideration of the entirely contributory calculation of social security checks.

The accumulated capital, therefore, will be returned in the form of a life annuity, so as to allow (or at least to try) to maintain one’s standard of living unchanged once the working activity has ceased.

Let us remember, then, that Pension horizon it is one of the products that benefit from the tax legislation envisaged to facilitate supplementary pensions.

It is therefore possible to deduct from income each year up to 5164,57 eurothus obtaining significant savings from a point of view tax.

How does it work?

From a technical point of view, we are facing a PIP (Individual Pension Plan), which is characterized, like all products of this type, by the freedom of payment, both in terms of amount and frequency: in other words, it is possible to choose to pay only once each year, monthly, quarterly and so on, and you can consider increasing or reducing the amount to be paid each year.

It is also possible to pay nothing, and therefore interrupt payments, in the event of inconveniences.

Payments can be of two types:

- employees can pay the TFRthus choosing not to keep it in the company, and any other contributions that may be provided for by the employment contract to be paid by the employer;

- free payments, independent of the decision to allocate the severance indemnity.

There are two contractual stages:

- the first phase (that of accumulation) it is represented by the period of payment of the contributions, during which the insured capital is gradually built up;

- the second phase (of delivery of the benefit), subject to the accrual of the right to exercise the supplementary pension benefit, is characterized by the provision of the benefit.

With Orizzonte Previdenza the saver is free to divide the payments into one o multiple lines of investment, in relation to one’s propensity for risk and future objectives.

You can change your choices for free, once a year, according to your needs.

Available formulas

Here are which options you can choose from:

The personalized alternative

As an alternative to choosing individual funds, it is also possible to opt for one of the three investment paths created by the group of experts Allianz, which automatically allocate your capital to internal funds, increasing exposure to financial markets in moments of opportunity and gradually reducing it when you are closer to retirement, so as to safeguard the value of the accrued capital.

The three paths Life Cycle meet three different return objectives and have three different levels of risk:

Are there any additional protections?

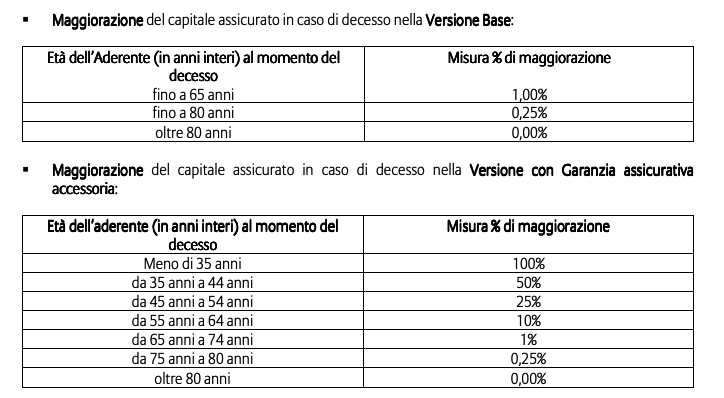

Yes, in the event of predeceasing before reaching retirement age, the capital is paid out to the beneficiaries including an increase which can be increased if you choose the additional guarantee. The increase can reach up to 50,000 euros.

One of the strengths

You can request theanticipation of the capital accumulated to buy or renovate the first home or that of one’s children, for health care expenses or for further needs of a personal nature. In addition, you have the option to redeem it in case of loss of working capacity.

In the event of death before accrual of the right to the supplementary pension benefit, the entire individual position is redeemed by the heirs or beneficiaries designated by the same.

In this case, the insured capital will be increased by the amounts shown in the following tables according to the Participant’s age at the time of death and any activation of the accessory insurance guarantee.

Costs of Orizzonte Previdenza

Costs of Orizzonte Previdenza

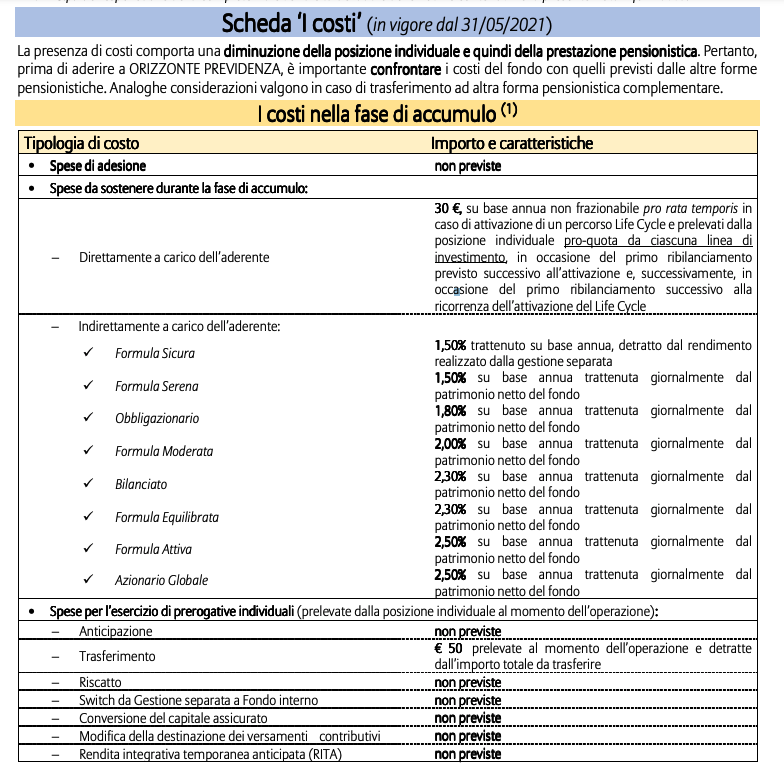

Let us now review the costs of the product offered by Allianz Insurance.

I remind you, as always, that financial products must be compared with each other not only on the basis of the interest given or promised, but especially in the light of the costs that weigh on the premium paid, determining the so-called net premium actually invested

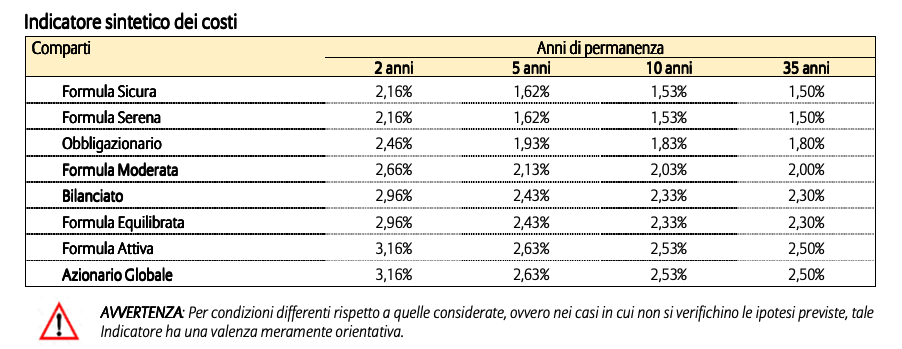

Having said that, let’s start withsummary cost indicator which I report below in the table taken from the information note available on the Allianz website. The ISC is calculated by all pension funds using the same methodology established by the COVIP and is essential to understand how much our investment will cost.

As always, PIP tends to cost less in the long run.

I also enclose the individual cost items, so that you can consult them specifically.

If you are thinking about subscribing this product, carefully compare the cost item that you can download from Who with other similar products: the law requires that they all have to show you the information note and cost statement and, consequently, you can make a fairly easy comparison in terms of costs between the various alternatives on the market.

Opinions on Orizzonte Previdenza: Should You Join?

If you want to subscribe to a PIP I advise you to compare the part of the costs which is standardized and must allow you to view before signing the contract.

Often, in fact, the problem with these products lies precisely in the management costs, which are high, and which inevitably impact on your investment, sometimes even in a very heavy way.

Personally, I practice a broader approach to investing which, in the course of my dissemination activity, I have tried to illustrate to my readers.

In general terms, you must understand that the choice to subscribe to an individual pension plan is part of a broader basket that concerns the management of one’s finances and investments at 360 degrees and in various aspects.

Exactly for this reason I invite you to read this guideand above all to reflect on your personal and financial situation and only then to make or at least try to make the most correct decisions for your life and for your goal.

Conclusions

If you are interested in the topic, here are some insights on the blog that could help you:

Furthermore, if this is your first time on Affari Miei and you are just approaching the world of investments, I suggest you start from one of the following thematic paths that I have prepared for you:

Good continuation on Affari Miei.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <