Original title: Over 470 billion yuan! The scale of lifting of the ban this week set a new record for the year. The CATL accounted for the majority. The lifting of bans on such concept stocks was the most concentrated. What is the market impact? Look at the institutional point of view…

Summary

[Over 470 billion yuan! The scale of lifting of the ban this week set a record for the year. What is the influence of the Ningde era to account for the bulk of the market? ]This week, the scale of the lifting of the ban on restricted stocks has increased significantly, and the market value of the lifting of the ban is expected to exceed 470 billion yuan, which will hit a new weekly high during the year. Among them, the new energy industry stocks are more concentrated this week, and the market value of Ningde Times, Trina Solar, and Tongwei is relatively large. (Securities Times)

This weekRestricted sharesThe scale of the lifting of the ban has increased significantly, and the market value of the lifting of the ban is expected to exceed 470 billion yuan, which will set a new high in a single week during the year.

Among them, the new energy industry stocks are more concentrated this week.Ningde era、Trina Solar、Tongwei sharesThe market value of the lifted ban is relatively large.

1. The market value of this week’s lifting of the ban reached 470.3 billion yuan, setting a new one-week high for the year

According to statistics, the sale of shares is restricted this weekLifted stocksThe number of shares is 6.58 billion, and the market value of the lifted ban has reached 470.3 billion yuan.

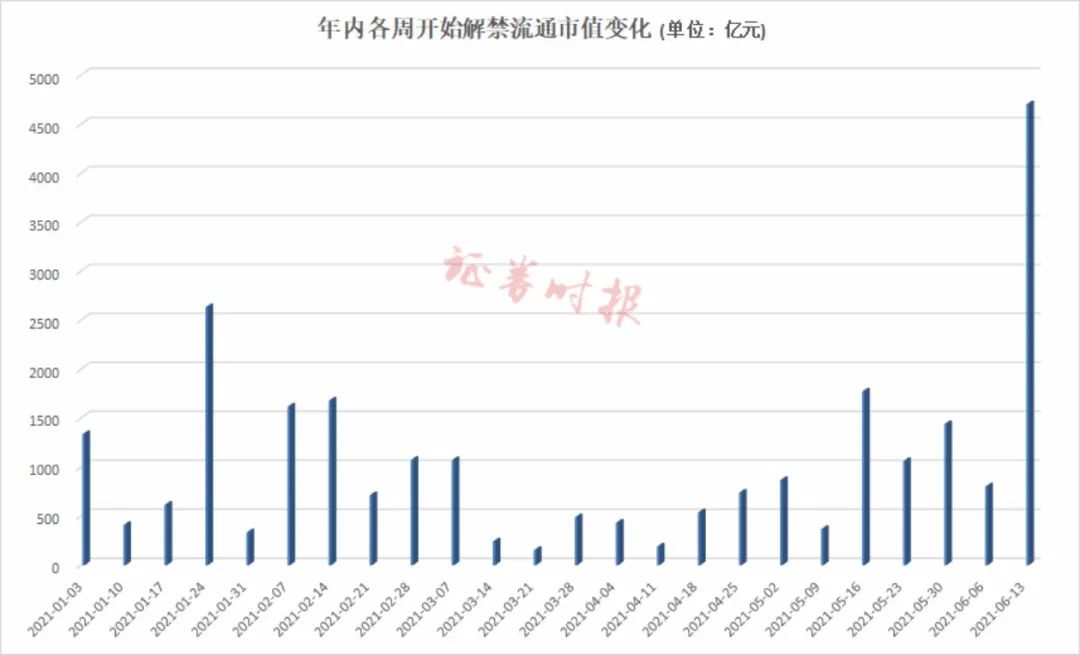

Statistics show that the scale of lifting of bans varies greatly from week to week during the year, with less than half of cases where the scale of lifting of bans in a single week exceeds 100 billion yuan.

Before this week, the largest single-week lifting scale during the year was the week of January 18-24 this year. That week, the A-share market lifted 34 billion shares, the highest number of shares lifted in the year, and the lifted market value was 263.3 billion yuan. High in a single week during the year.

According to the market value of the ban, the market value of 470.3 billion yuan this week will set a new record for the market value of the ban in a single week during the year. However, according to the number of shares lifted, the number of shares lifted this week is relatively small, which shows that the stocks lifted this week are mainly concentrated in some relatively high-priced stocks.

2. The highlight of the lifting of the ban this week is new energy stocksNingde eraLifted the ban, the market capitalization accounted for the bulk

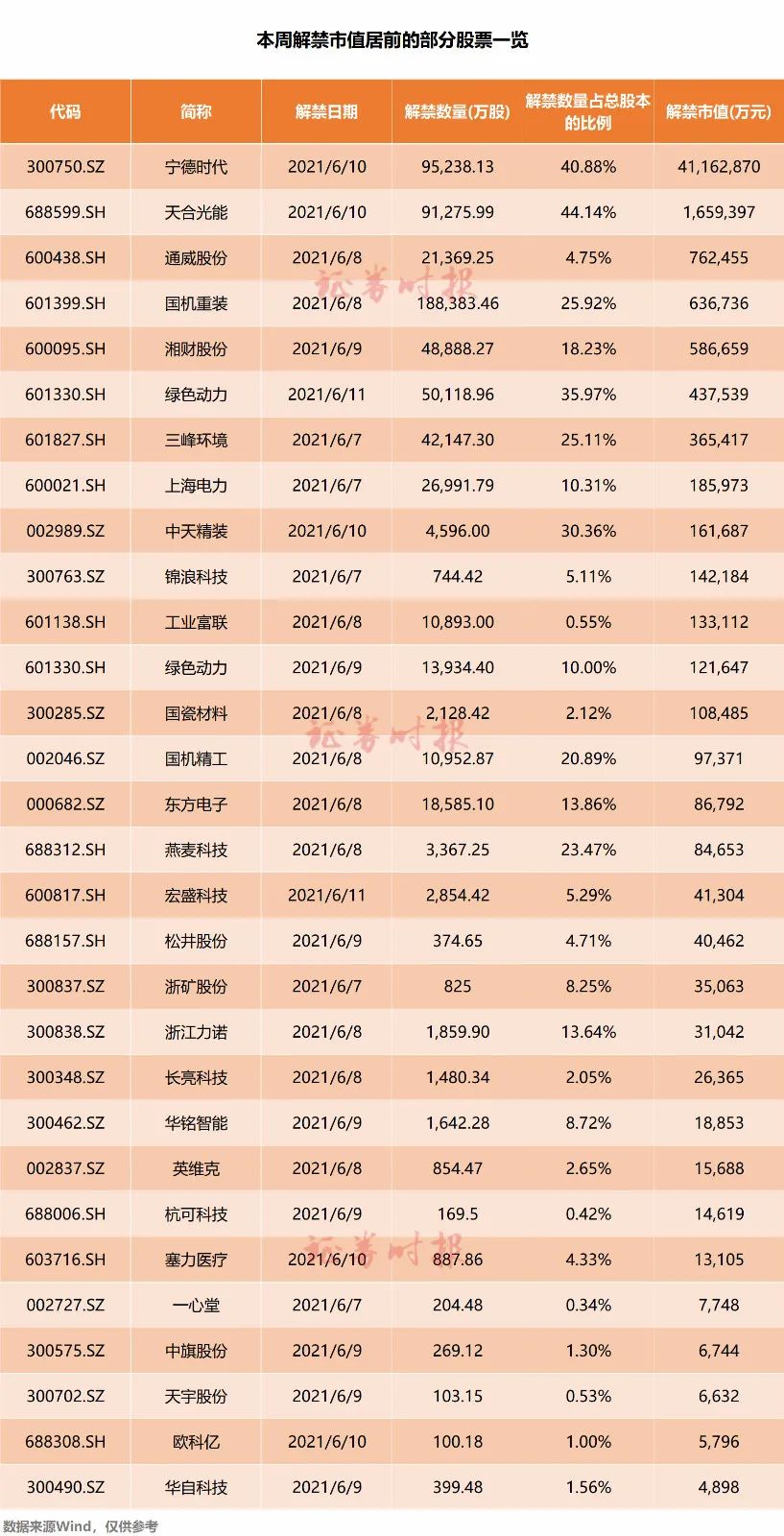

According to the data, calculated according to the latest closing price, the stocks with the highest market value after lifting the ban this week includeNingde era、Trina Solar、Tongwei shares、SINOMACH Heavy Equipment、Xiangcai shares、Green power、Sanfeng Environment、Shanghai Electric PowerWait.

According to the data, the market value of the lifted ban of CATL exceeded 400 billion yuan, the largest stock market value lifted this week, and accounted for the bulk of the market value of individual stocks lifted this week.The stocks lifted by the Ningde era this week are mainly the originalshareholderRestricted shares.

Specifically, according to the sales restriction commitments made at the time of listing at that time, this time the Ningde era lifted the ban mainly by Ningbo Meishan Free Trade Port Zone Ruiting Investment Co., Ltd. (Ruiting Investment), Huang Shilin, Li Ping, Xinjiang Dongpeng, Green Lianjun and Waiting for shareholders. At that time, the above-mentioned shareholders promised that their shares would not be transferred within 36 months from the date of listing of the company’s shares on the stock exchange.

As of the end of the first quarter of 2021, Ruiting Investment, Huang Shilin, and Li Ping were the first, second, and fifth largest shareholders of the listed company Ningde Times. The stock market value calculated at that time was 184.114 billion yuan and 84.054 billion yuan. , 36.06 billion yuan.Among them, Ruiting Investment, the controlling shareholder of CATL, has the largest number of lifted bans, reaching 571 million shares. If the number of shares held by this shareholder alone is the most currentNew crotchCalculated by price, the market value of the lifted ban has reached 247 billion yuan.

From the perspective of the ratio of the number of lifted bans to the total share capital,Trina Solar, Ningde era,Green power、Zhongtian HardcoverWhen the number of stocks lifted accounts for more than 30% of the total share capital, the pressure to lift the ban is relatively high.

Observation shows that new energy stocks are the most concentrated type of stocks that have been lifted this week. CATL, Trina Solar,Tongwei sharesThese are all new energy industry stocks.

According to data, CATL is the world‘s leading provider of lithium-ion batteries, focusing on the development, production and sales of new energy vehicle power battery systems and energy storage systems, and is committed to providing first-class solutions for global new energy applications. The company has core technology advantages and sustainable research and development capabilities in key areas of the industrial chain such as battery materials, battery systems, and battery recycling. It has formed a comprehensive and complete production service system, and promoted the use of lithium-ion batteries as high-quality energy storage carriers through business model innovation. widely used. CATL is the first stock with a market capitalization of more than 1 trillion yuan on the GEM, and its current share price is at 432.21 yuan.

Trina Solar is a world-leading provider of integrated photovoltaic smart energy solutions. Its main business includes photovoltaic products, photovoltaic systems, and smart energy. Photovoltaic products include the R&D, production and sales of single and polycrystalline silicon-based photovoltaic cells and modules; photovoltaic systems include system product business and photovoltaic power plant business; smart energy includes photovoltaic power generation and operation and maintenance services, smart micro-grid and multi-energy systems Development and sales, and energy cloud platform operations.

Tongwei’s main businesses include agriculture and new energy. In terms of new energy, Tongwei shares use high-purity crystalline silicon,Solar energyFocus on the research and development, production and sales of batteries and other products, and at the same time devote itself to the investment, construction and operation and maintenance of the “fishing and light integration” terminal power station. As of the end of the 2020 reporting period, the company has formed an annual production capacity of 80,000 tons of high-purity crystalline silicon.Solar energyThe annual production capacity of the battery is 27.5GW, of which the annual production capacity of the monocrystalline battery is 24.5GW.

Tianfeng SecuritiesAccording to the research point of view, on the overall level, historical data backtesting shows that the actual peak of the lifting of the ban has no obvious rule on the index level of A-shares. From a structural perspective, different types of lifting of the ban have different impacts on different types of individual stocks: the lifting of the original IPO shareholder will have a smaller impact on subsequent stock prices;Additional issuanceThe lifting of the ban and the lifting of the ban on equity incentives will have a greater impact on the subsequent stock prices, especially the short-term impact with a higher percentage of the ban. The stocks with relatively high valuations have a higher probability of negative impact on the stock price after the ban is lifted.

Related reports:

Private equity bigwigs such as Gao Ling and Jing Lin are making big profits!Many star stocks will increase and lift the ban

The single week with the most pressure to lift the ban in the whole year is here!Bull stocks with a market value of over 400 billion yuan face the lifting of the ban and the list of stocks released

(Source: Securities Times)

(Editor in charge: DF372)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.