Every reporter: Xie Zhenyu Every intern reporter: Fan Qianqian Every editor: Liang Xiao

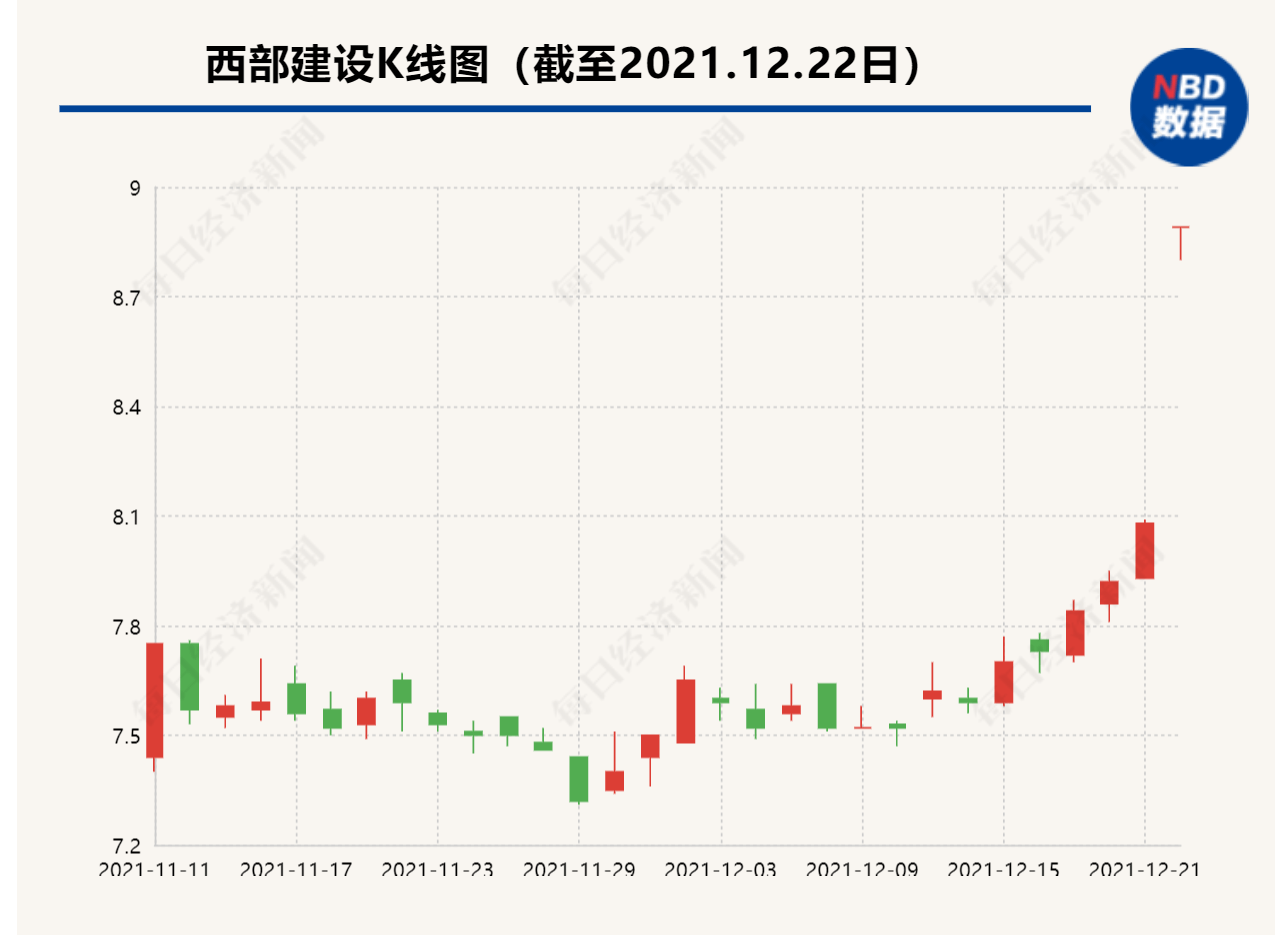

Today (December 22), the western construction daily limit, closed at 8.89 yuan per share.

On the news, on the evening of the 21st, West Construction (002302, SZ) announced that it planned to raise 1.96 billion yuan to supplement working capital and repay bank loans. In this transaction, Conch Cement (600585, SH) intends to invest 1.76 billion yuan to subscribe for 90% of the shares. After the transaction is completed, Conch Cement will become the second largest shareholder of Western Construction.

This is already the third financing for West China Construction this year. Why does the company raise funds frequently this year? In this transaction, Conch Cement also signed a strategic cooperation agreement with Western Construction. What is the purpose of the cooperation between the two parties?

2021 is the first year of the “14th Five-Year Plan” period. Construction related projects have increased significantly, and the revenue of western construction has increased significantly. However, due to the generally long construction period in the construction industry and the slower collection of payments, the pressure on debt repayment of Western Construction is also increasing. For the purpose of cooperation, the staff of Conch Cement’s Secretary Office told the reporter of “Daily Economic News”: “We are optimistic about the long-term investment value of Western Construction. It is our downstream. We have some cooperation with them and can also consolidate some direct sales customers. Our sales channels are beneficial to our overall industrial chain or downstream markets.”

Western construction accounts receivable hit a new high

According to the Western Construction Announcement, the company intends to raise 1.96 billion yuan through non-public issuance of shares. After deducting the issuance costs, all funds will be used to supplement working capital and repay bank loans. This is the third time this year that Western Construction has raised funds through direct financing.

On August 23, Western Construction disclosed that it had completed the issuance of the first phase of medium-term notes. The actual total issuance amounted to 700 million yuan and the issuance interest rate was 3.35%. On December 7, West Construction disclosed that it had completed the second phase of medium-term notes issuance. The actual total issuance was 600 million yuan and the issuance interest rate was 4.3%.

Why does the western construction frequently raise funds this year?

Western Construction focuses on ready-mixed concrete and related businesses. Commercial concrete accounted for 98.11% of revenue in the first half of this year. From the perspective of operating conditions, the first three quarters of the Western Construction achieved operating income of 19.392 billion yuan, a year-on-year increase of 19.57%.

Western Construction stated in the announcement that this year is the first year of the “14th Five-Year Plan”. All regions are stepping up efforts to plan and reserve major projects. Many provinces across the country have announced this year’s major project investment plans, including a large number of transportation, energy, water conservancy, etc. The “two new and one heavy” projects have been launched one after another, providing a broad market space for the construction industry. In the first half of the year, infrastructure investment increased by 7.8% year-on-year; real estate development investment increased by 15.0% year-on-year; construction and installation engineering investment increased by 17.6% year-on-year.

However, as the sales scale increased, the payment collection slowed down, which also led to a record high in the balance of accounts receivable of Western Construction. As of the end of the third quarter of this year, the balance of accounts receivable for Western Construction reached 20.504 billion yuan, an increase of 103.88% from the beginning of the year. The slow payment has also led to increased pressure on the debt repayment of Western Construction to a certain extent. The company’s total debt in the first three quarters at the end of the period was 19.755 billion yuan, an increase of 43.39% from the beginning of the year. Against this background, Western Construction has also seen an increase in revenue but not profits. The net profit in the first three quarters was 558 million yuan, a year-on-year decline of 14.21%.

In order to speed up the collection of accounts receivable, in October this year, Western Construction also launched a factoring business of accounts receivable without recourse in a total amount of not more than 2.6 billion yuan with China State Construction Finance Co., Ltd. Compared with the factoring business of receivables with recourse, non-recourse means that if the debtor of the factoring business of accounts receivable refuses or is unable to pay the arrears, the factoring company shall bear all the losses, and the enterprise does not need to bear the losses. Almost all risks and rewards have been transferred.

Conch Cement’s response: optimistic about the long-term investment value of western construction

There are two targets for the non-public issuance of Western Construction. One is China State Construction Southwest Design and Research Institute Co., Ltd. (hereinafter referred to as China State Construction Southwest Institute), a subsidiary company controlled by China State Construction Group Co., Ltd. (hereinafter referred to as China State Construction Group), the actual controller of Western Construction, and the other is Conch Cement in the same industry.

Among them, Conch Cement will invest 1.76 billion yuan to subscribe for 251 million shares, and China State Construction Southwest Research Institute will invest 200 million yuan to subscribe for 28.57 million shares. After the completion of the additional issuance, the total share capital of West China Construction will be 1.542 billion shares. The total shareholding ratio of the company through the subsidiary companies controlled by China State Construction Group will drop to 53%, and Conch Cement will become the second largest shareholder of West China Construction. The shareholding ratio is 16.3%.

According to the announcement, in this non-public offering, the three parties did not sign a bottom-up agreement such as performance commitments, but Western Construction and Conch Cement signed a “strategic cooperation agreement.” Conch Cement’s main business is the production and sales of cement, commercial clinker, aggregates and concrete. It is the upstream supplier of the western construction industrial chain and one of the leading enterprises in the cement industry.

In the ready-mixed concrete industry, the supply of raw materials is increasingly important. Western Construction stated that with the tight supply of upstream raw materials for ready-mixed concrete and the impact of environmental protection policies, most companies have noticed the importance of raw material supply to companies. Some large cement and concrete companies have begun to promote the coordinated development of the industrial chain, and gradually The “Trinity” development model of cement, aggregate and concrete was launched.

In addition to the supply and marketing of raw materials, Conch Cement and Western Construction will cooperate in the incremental market of concrete mixing plants, sand and aggregate business, logistics and transportation, industrial Internet projects, scientific research technology, overseas business, etc., and explore “cement, sand + concrete + The whole industry chain development model of “consumer market + technical service + Internet”.

The staff of Conch Cement’s Secretary Office told the reporter of “Daily Economic News”: “We are optimistic about the long-term investment value of Western Construction. It is our downstream. We have some cooperation with them and can also consolidate the sales channels of some direct customers. It has certain benefits to our overall industrial chain or downstream market.”

In recent years, Conch Cement has repeatedly invested in upstream and downstream companies in the industry chain, including Yatai Group (600881, SH), Qilianshan (600720, SH), Fujian Cement (600802, SH), Huaxin Cement (600801, SH), etc. In this regard, the above-mentioned Conch Cement staff said: “The most basic starting point is to be optimistic about its long-term value. In fact, most of the stocks in the entire cement sector are undervalued. We are optimistic about the long-term development trend of the (industry).”

Daily economic newsReturn to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.