If you’ve come here it’s because you’ve heard of Post-future Investments. This is one of the latest services offered by Poste Italiane and in this guide I want to explain the characteristics and functioning of this product. it suits use it for your investments? How does it work?

Keep reading, you will find all the answers you were looking for and some advice to better invest your assets!

This article talks about:

A few words about Poste Italiane

Not that there’s a need! The Italian post are present in the insurance sector through the company Post Lifeleader in Life insurance in our country, and also in the Non-Life business.

Poste Vita offers an investment and savings offer, offering products placed through the distribution platform: there are so many postal investments!

But now let’s delve into the product.

What is Postfuturo Investimenti?

This is an area in which to manage your investments remotely, 100% digitally.

By accessing your area, you can find financial instruments that allow you to contain costs and diversification effectively.

Indeed, Postfuture Investments provides a wealth management composed of diversified investment lines, able to respond to the needs of different risk profiles and capitals of various volumes: you will certainly also find the one that best suits your needs.

In other words, PosteFuturo Investments is the service dedicated to those who are looking for new ones investment solutions.

Among the advantages we find:

- the transparency: at any time you can access your investment lines from your private area;

- simplicity: a group of managers, depending on the investment line to be subscribed by the customer, takes the decisions needed to seize market opportunities, keeping the investor always updated on the various operations;

- convenience: the all-inclusive annual management fee relating to the management service provided by Moneyfarm is calculated on the amount invested. There are no entry or exit costs;

- tax efficiency: any capital losses are automatically compensated with the positive management results achieved in subsequent years; generating a positive impact on potentials returns future.

Also, the advantage of opening a asset management in ETFs is the ability to offset capital gains and losses.

This means that on December 31st of each year the management result as a whole will be assessed and the base subject to the tax will only be the positive surplus.

In the event of a negative result as a whole, the loss can be carried forward until the fourth following tax year, thus having the effect of a tax credit.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Poste and Moneyfarm: Opinions on the collaboration

But that’s not all: this happens thanks to collaboration with Moneyfarm.

Moneyfarm is an independent partner that you may already know, as it is a leading service in digital investment management.

Poste Italiane has invested significantly in this company and from this decision the service object of this review was born.

Here is my video review of Moneyfarm if you have never heard of it or would like to receive my complete overview:

A word on asset management

The wealth management it is a type of investment. By choosing it, you can entrust your assets to be invested to a qualified manager, stipulating a portfolio management contract.

It is usually a medium-long term investment, which adapts to market dynamics.

From this it follows that we are not dealing with a guaranteed capital instrument.

If you decide to choose Postefuturo, you will be able to choose and subscribe to the investment lines managed by MoneyFarm, opting for the management line (or lines) that best suit your profile.

However, you will always be able to monitor your investments remotely, from your mobile phone or PC.

investment lines

The financial instruments are managed through 7 lines of investment: in particular, two of these have been developed by MoneyFarm exclusively for Poste Italiane customers.

The investment lines are widely diversified and also calibrated on the basis of each investor’s propensity for risk, and also on the basis of his objectives.

Periodically and based on the trend of the financial market, you can modify also the composition of one or more investment lines subscribed to protect your savings.

The financial instruments that make up the investment lines managed by Moneyfarm are: ETF.

Costs and methods of activation

One of the most evident strengths of the service is its convenience: in fact, you will pay nothing for the placement service provided by Poste Italiane.

Subscribing to a line is free, including contributions that will come later.

The annual management fee of the service provided by MoneyFarm is calculated on the invested value and there are no exit costs with the exception of tax charges.

Activation can only take place online: you can choose from the various investment lines starting from a minimum of 5,000 euros.

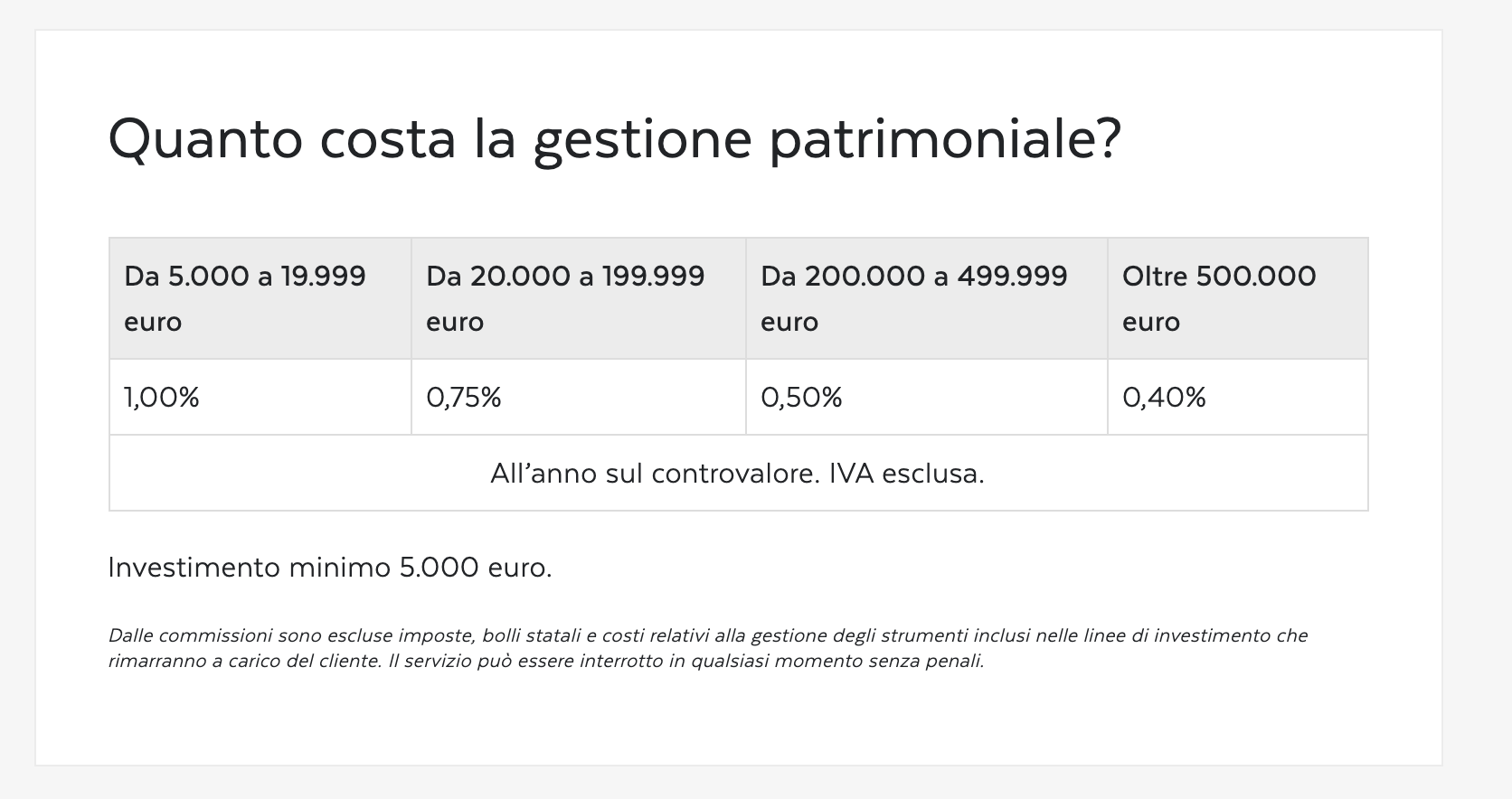

The cost of asset management is as follows:

- from 5,000 to 19,999 euros it is 1%;

- from 20,000 to 199,999 euros by 0.75%;

- from 200,000 to 499,999 euros by 0.50%;

- over 500,000 euros of 0.40% per year on the equivalent value, excluding VAT.

Who can join?

Can activate the Postal asset management who has at least one BancoPosta current account or a Smart Libretto enabled for online disposition functions.

You just have to access your personal area or, if you haven’t done so yet, register.

At this point you have to fill in the MiFID questionnaire to identify your financial profile. Based on this, you will be able to choose the investment line that is suitable for your profile and subsequently you can also activate further lines.

To complete the activation, company online with your Advanced Electronic Signature (FEA) from digital channels the contractual documentation and authorize the transfer of money to your new investment line.

You can consult the trend of the line activated at any time in the Asset Management section of Postefuturo Investimenti in your personal area.

On the Postefuturo home page you can also simulate investment lines.

How to buy ETFs?

With the ETF Asset Management product from MoneyFarm, it is the investor who has to personally take care of the operation: a team of experts will do it.

By activating the management service and subscribing to an investment line, in your personal area, it will be possible to check the trading operations of the ETFs that make up the investment line and verify their composition at any time.

How to divest?

It is possible to divest totally o partially at any moment.

If you decide to partially divest, the residual invested capital must not be less than 5,000 euros. The liquidation does not involve costs.

Poste Italiane asset management: Opinions of Affari Miei

I don’t want to dwell too much on this topic: if you follow me you know it, me I am not particularly in favor of asset managementwhich are often real “boxes” of services that hide costs, and other costs, until your effective interest is eroded.

Personally, and if you’re a client of the Academy you know it, I prefer to be independent in managing my savings, and that’s exactly what I try to teach my students.

If you want to deepen my thoughts on asset management, I suggest you read my guide.

However, Poste Italiane’s effort to rely on Moneyfarm should be recognised, which is a reality that somewhat solves some asset management problems and if you don’t really want to take care of your savings yourself, it can be an acceptable solution.

In this regard, to get a complete picture of the situation, compare this hypothesis with services such as “Fast Investments Planner” or with other alternatives I’ve talked about here.

Useful resources

If you are just starting to take an interest in investments, choose one of the paths below that best suits you:

If this is your first time visiting Affari Miei, I advise you to read the article in which I explain my method for investing.

If you are looking for a guide that will help you acquire the right knowledge to think in a more structured way and you don’t want to waste time – time is money, you could think in these terms and I understand you perfectly – I suggest you take a look at my free video course for investing which is designed to transfer my method to you.

I hope I have helped you to unravel and clarify your ideas about this new service and similar services in general.

Here on Affari Miei you will always find updated reviews and lots of advice for investing in the best possible way.

See you on the next guide!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <