Real property markets can create vital dangers for buyers, monetary stability and total financial improvement. A radical evaluation of those dangers is due to this fact important. Increased threat might require management measures to scale back threat. It is smart to differentiate between cyclical and structural dangers.

The nice monetary and financial disaster of the final 15 years made actual property market gamers, regulators and, above all, hundreds of thousands of households painfully conscious of the necessary function that actual property markets can play within the improvement of the final financial system and the steadiness of economic markets. This was in no way the primary lesson on this relationship, however the convergence of many regional faults brought on by world connectivity creates a world disaster. Since then, actual property markets have been monitored extra carefully, and regulatory measures have been taken to scale back the sensitivity of economic markets, particularly the power of banks to supply loans has decreased considerably.

However, world networks or classes from the monetary disaster should not essentially harmonized constructions and, consequently, uneven market dynamics have emerged. Of course, actual property markets are additionally decided by world developments and cycles and have phases of generally robust and generally weak correlations. But it’s true that there are nonetheless very robust regional variations within the improvement of the actual property market right this moment. For instance, housing worth indices in OECD international locations have elevated by a unique fee of 110 % since 2010 – and these are already inflation-adjusted values. The common progress distinction is even higher. And nationwide indices conceal massive regional variations in particular person international locations. If the markets develop differently, this generally is a manifestation of various deficit relations, arising, for instance, on account of totally different incomes or inhabitants progress, however it will also be a sign that the markets are topic to totally different dangers of attainable market corrections.

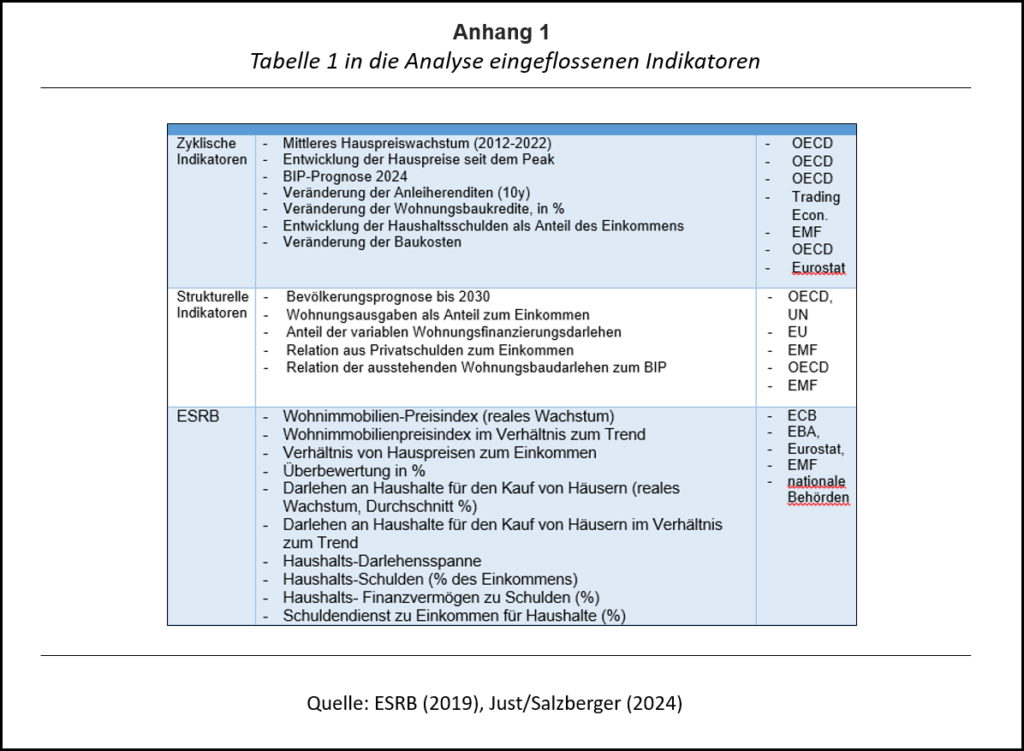

So it’s price contemplating these senses. ESRB (European Systemic Risk Board) does this with numerous parameters and derives an evaluation of threat within the housing markets of the 31 international locations examined. This is meant to point out whether or not the market can alter and the way dangerous such changes might be to the steadiness of the monetary system.

The collection of the symptoms thought of may be very comprehensible, however it’s primarily based mostly on sound issues; due to this fact it’s not necessary. Other analyzes might choose different indicators. Above all, the score of indicators is all the time arbitrary. In a latest research, we confirmed how a lot the willpower of weight components can affect threat evaluation (Just/Salzberger, 2024).

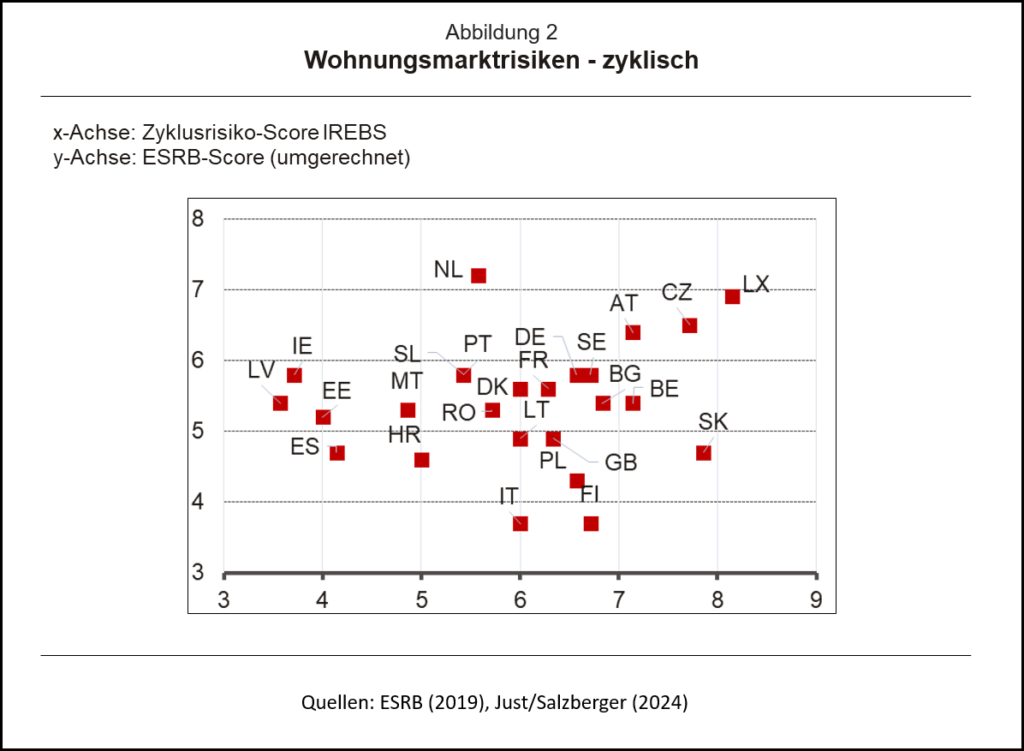

This article offers with one other associated facet: it divides the danger indicators used, that are similar to these of the ESRB (however not the identical), into indicators that present structural variations and cyclical indicators. To allow comparability between the ESRB’s threat scores and our assigned scores, the score scales have to be aligned. To do that, the ESRB’s 4 threat classes – ‘restricted’, ‘low’, ‘reasonable’ and ‘excessive’, which primarily symbolize values from zero to a few – are transformed to an prolonged scale from one to 10 utilizing quantiles. This conversion happens whereas sustaining equal weighting of the underlying standards and helps to calculate an total threat rating that may be in comparison with internally developed scores. Correlating these two threat scores, each cyclical and structural, with adjusted values from the ESRB evaluation reveals necessary extra info.

There are clearly vital variations between international locations as to which dangers are marked by which indicators: some markets (notably Portugal) rating excessive on our structural sub-index, however common on the sub-cyclical index. In the Czech Republic and Austria the image is totally totally different, the place structural indicators level extra in direction of stability, a part of the cycle exhibits dangers.

This distinction is necessary as a result of cyclical and structural threat could make totally different measures helpful: cyclical threat might result in an extra threat buffer, whereas structural threat might be decreased primarily by altering these constructions. So this division is smart to assist threat with applicable measures.

Additionally, the charts additionally present that there are markets that rating comparatively excessive on the ESRB rating and rating low on each the cyclical and structural parts of our rating. This applies to Ireland, for instance. There is a distinction right here that outcomes solely within the selection of indicators and weights. What is “proper” can solely be precisely decided in hindsight. In such unsure conditions, it might make sense to find out a number of factors in parallel with a view to receive a comparatively dependable image of the danger within the present distribution. Unfortunately, absolute safety can’t be decided on this approach, decreasing the uncertainty considerably – not less than.

Sources:

ESRB (2019). Risks within the residential housing sectors of the EEA international locations in September 2019. Frankfurt.aM

Just, T. (2023). European housing markets with fastened dangers. Economic freedom, July 3, 2023, [Zugriff am 03.07.2023]

Just, T., und Salzberger H. (2024). Structural Risk and the Housing Cycle in OECD Countries. In: Intereconomics 3 (2024).

Source: ESRB (2019), Just/Salzberger (2024)

University of Regensburg

University of Regensburg