On September 17 this year, the Beijing Stock Exchange issued the “Beijing Stock Exchange Investor Suitability Management Measures (Trial)” (hereinafter referred to as the “Measures”). According to the “Measures”, the entry threshold for individual investors of the Beijing Stock Exchange is basically the same as that of the Sci-tech Innovation Board, that is, the assets in the securities account and capital account shall not be less than RMB 500,000 per day in the 20 trading days prior to the opening of the application authority. Securities trading for more than 24 months. Starting from the date of promulgation of the “Measures”, eligible investors can apply to the brokerage commissioned by them to make an appointment to open the trading authority of the Beijing Stock Exchange.

So since September 17th, how enthusiastic is the investor’s enthusiasm for opening the trading authority of the Beijing Stock Exchange? Has the number of securities dealers’ investors’ access rights in the Beijing Stock Exchange achieved rapid growth? In this regard, today’s “Daily Economic News” reporter conducted an interview in the securities industry.

In addition, it is understood that, in addition to the requirements stipulated in the Measures, some securities firms have set up some additional investor suitability management requirements for individual investors to open the authority of the Beijing Stock Exchange.

The opening authority peak or on the eve of the opening of the Beijing Stock Exchange

According to the previous statement of the Beijing Stock Exchange, since the date of promulgation of the “Measures” (September 17), eligible investors can apply to the securities company entrusted by them to make an appointment to open the trading authority of the Beijing Stock Exchange.

So, since September 17th, how enthusiastic is the investor’s enthusiasm for opening the trading authority of the Beijing Stock Exchange? Has the number of brokerage investors’ opening trading rights on the Beijing Stock Exchange achieved rapid growth?

The reporter learned from Essence Securities’ Network Finance Department today that at present, Essence Securities has approximately 35,000 customers who have opened the NEEQ. According to the Beijing Stock Exchange’s account opening rules, investors who have opened the NEEQ trading authority will automatically shift their trading authority without repeating applications. CBEX stock trading authority. Therefore, the number of customers who have opened the authority of the Beijing Stock Exchange is expected to account for more than 50% of the company’s investors who meet the requirements for opening an account with the Beijing Stock Exchange.

A person from Haitong Securities told reporters today that after the Beijing Stock Exchange announced on September 17 that investors could make an appointment with the securities company to open the trading authority, the company responded quickly and preempted to launch the Beijing Stock Exchange trading authority appointment at 2 a.m. on September 18 The activation function provides customers with online appointment service as soon as possible.

“In order to provide investors with trading authority activation services as soon as possible, the Haitong Securities team used the Mid-Autumn Festival holiday to make urgent research and development, and officially launched the trading authority activation function of the Beijing Stock Exchange at 9 a.m. on September 21. Investors who meet the activation requirements can log in to the company’s APP On the homepage, click on “Beijing Stock Exchange” and follow the procedure to directly open the trading authority of the Beijing Stock Exchange. According to statistics, from September 21 to 22, the Haitong Securities Beijing Stock Exchange’s trading authority was opened for two days, and the cumulative number of users has exceeded 10,000. Most investors are in the process of opening one after another, and the one-day increase in the number of subsequent openings is expected to increase further.” The person pointed out.

From the perspective of the business department, in recent days, different business departments have different perceptions of investors’ enthusiasm for opening the trading authority of the Beijing Stock Exchange. Even in the same city, different brokerage business departments have different perceptions.

A relevant person in the Beijing sales department of a large securities firm in South China told reporters today, “In the past few days, it can be felt that there are a lot of online inquiries by investors about the permissions of the Beijing Stock Exchange, and there are also a lot of online permissions.”

The person in charge of the Beijing sales department of a large Shanghai securities firm told reporters that the enthusiasm of investors to open the trading authority of the Beijing Stock Exchange has not been noticeably warmed up in the past few days. The eve of the city, not now.”

The person in charge of a business department of a brokerage in the western region in Shanghai also said that the number of investors who have opened trading permissions on the Beijing Stock Exchange has not increased significantly in recent days.

Some brokerages have additional requirements for opening permissions

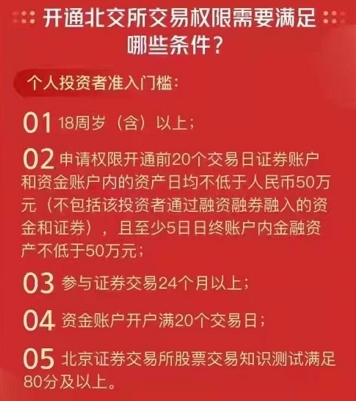

According to the “Measures”, the entry threshold for individual investors of the Beijing Stock Exchange is that the assets in the securities account and capital account must not be less than RMB 500,000 per day in the 20 trading days prior to the opening of the application authority (excluding the investor’s financing Funds and securities incorporated into securities lending), participating in securities transactions for more than 24 months.

However, it is understood that, in addition to the above-mentioned requirements stipulated in the Measures, some securities firms have set up some additional investor suitability management requirements for the opening of the authority of the Beijing Stock Exchange.

For example, CITIC Securities requires individual investors to choose to open an account at the Beijing Stock Exchange, and they must also have 20 trading days to open an account at CITIC Securities, of which at least 3 days have an asset of 500,000 yuan and above.

Picture from: CITIC Construction Investment

Picture from: Huaan Securities WeChat Official Account

For individual investors, CITIC Construction not only requires investors to comply with the above-mentioned provisions of the Measures, but also requires investors to have at least 5 day-end accounts in the 20 trading days before applying for the opening of Beijing Stock Exchange permissions. The internal financial assets are not less than 500,000 yuan. At the same time, several securities firms such as Essence Securities and Huaan Securities also have the same additional requirements.

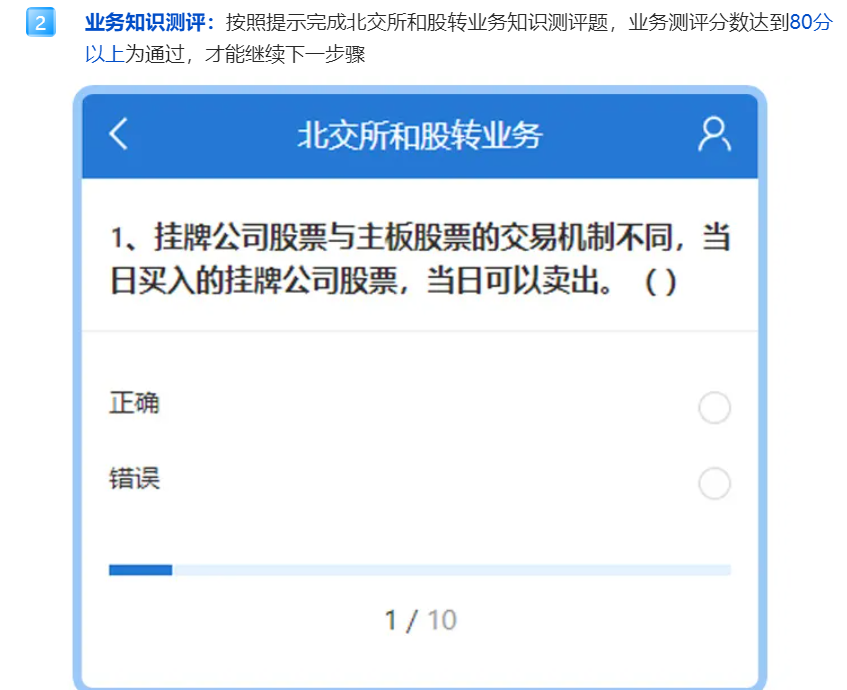

In addition, for individual investors to open an account at the Beijing Stock Exchange, BOC Securities also requires investors to meet 80 points or more when completing the Beijing Stock Exchange investment knowledge assessment questionnaire designed by the company. The reporter found that many brokerages in the industry, such as CITIC Securities, China Securities Investment, Shenwan Hongyuan, Orient Securities, Soochow Securities, Oriental Fortune, etc., also have such knowledge assessment requirements for opening an account at the Beijing Stock Exchange.

A securities company’s business knowledge assessment of the Beijing Stock Exchange

It is understood that before the birth of the Beijing Stock Exchange, when investors opened trading permissions at all levels of the New Third Board, most brokerages would require them to complete a knowledge assessment, and relevant trading permissions could only be opened after the assessment was completed. If investors open a certain trading authority on the NEEQ at the sales department, some brokerage firms will also require investors to complete relevant knowledge assessments on site.

Some people in the industry believe that the various system designs of the Beijing Stock Exchange have generally extended the existing systems of the select layer, so the requirements of various securities companies for this type of account opening knowledge evaluation will naturally be continued in the account opening process of the Beijing Stock Exchange. .

It is worth noting that the reporter learned in an interview today that in addition to the above investor suitability management methods, some brokerages also set more detailed requirements.

Relevant person in charge of Essence Securities Network Finance Department told reporters today that in order to strengthen the protection of investors’ rights and fully reveal investment risks, when customers open the authority of the Beijing Stock Exchange, if the following conditions are monitored by investors, the company will use more stringent The appropriateness management standards:

For individual investors whose account asset changes meet the following two conditions, they should be listed as a key account, and their asset status should be verified and evaluated:

1. With the opening day of the Beijing Stock Exchange stock trading authority as T day, a sum of funds greater than or equal to RMB 500,000 will enter the securities account and capital account during the period from T-20 to T-1;

2. The opening day of the Beijing Stock Exchange stock trading authority is T day, and the trading day when the end-of-day assets in the securities account and capital account is greater than or equal to RMB 500,000 during the period from T-60 to T-21 is less than 5 days ( Including 5 days).

Cover image source: Photograph.com