Edited by Lu Ming every time

Recently, “early loan repayment” has been hotly discussed. However, it is not so easy to repay the mortgage early when the mortgage interest rate is reduced. Not only have most of the convenient online advance repayment appointments of major banks disappeared, but after offline appointments at outlets, the repayment generally has to wait for more than one month, and the longest queue has been until July. Many house and car buyers have tried every means to find repayment channels, and even adopted “unconventional means”, and all these have been seen by black intermediaries and even fraudsters in the market. Recently, many consumers have been deceived .

Regarding the difficulty of repaying the loan, on February 6, a reporter from the Daily Economic News consulted the Guangdong Branch of the Bank of China by telephone. After receiving the hotline, it will give feedback to the department according to the customer’s situation. As for whether there is a chance to reduce the existing housing loans under the pressure of early repayment tide, the staff responded that the interest rate is hard to say, and it should be implemented according to the (policy) announced by the state.

On February 6, the reporter called the China Banking and Insurance Regulatory Commission, the Guangzhou Banking and Insurance Regulatory Bureau, the Shenzhen Banking and Insurance Regulatory Bureau, the Beijing Banking and Insurance Regulatory Bureau, the Henan Banking and Insurance Regulatory Bureau, and the Foshan Banking and Insurance Regulatory Bureau. or did not get a valid reply.

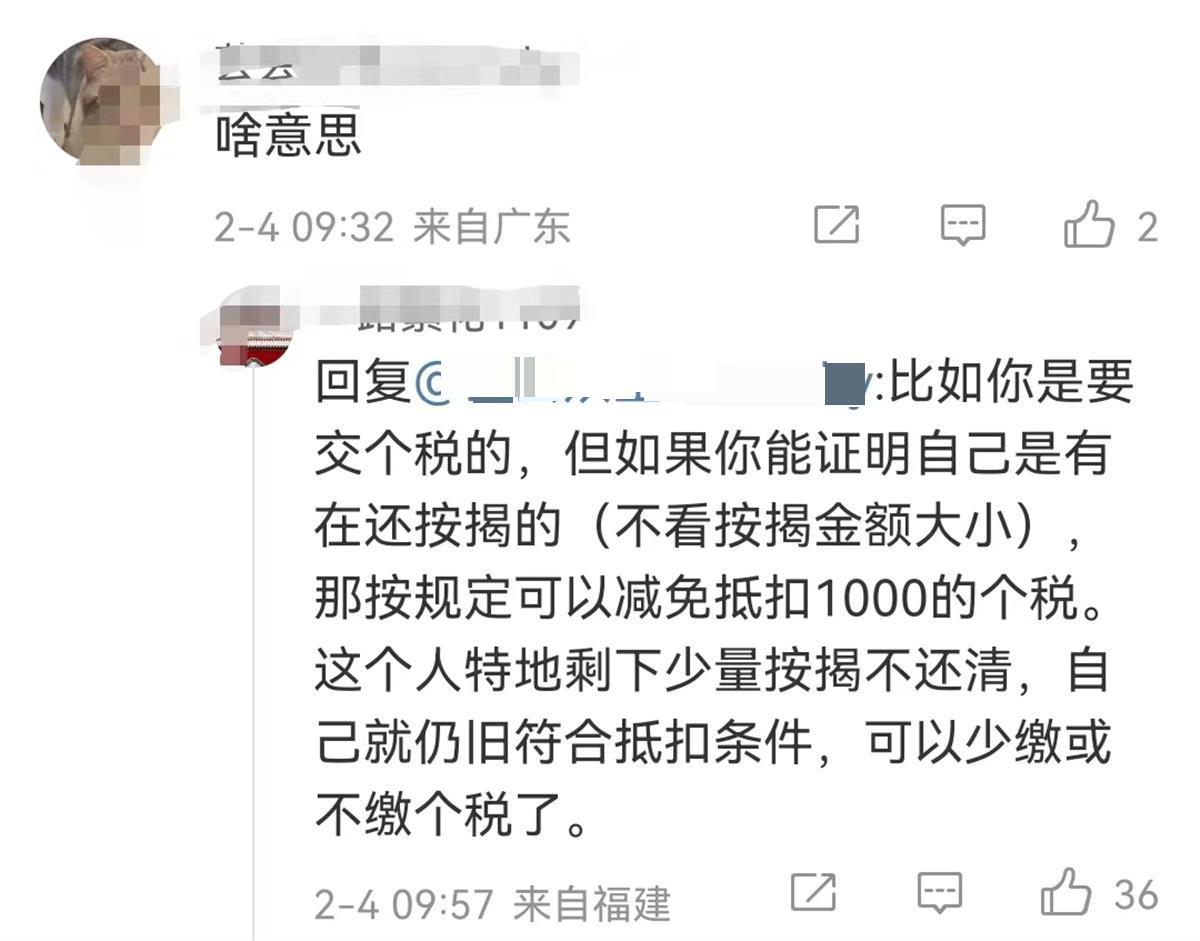

At the same time, the topic of “a monthly payment of 1 yuan to offset a tax” was also on the hot search. Can I still enjoy the personal tax deduction policy if I repay the mortgage in advance? The monthly payment is only 1 yuan, can it also be tax deducted? According to Jimu News, the reporter learned from the tax department thatAccording to relevant regulations, individuals can enjoy the pre-tax deduction of mortgage interest “in the year when the loan interest is actually incurred”.The reporter consulted relevant people in the banking industry and learned that,Different banks have different regulations on the early repayment of mortgages. The lender can refer to the loan contract for details.

“The year-end bonus has been spent, and the loan has not yet been repaid in advance”

According to a report by Qilu Evening News on the 6th, Mr. Tao, a citizen of Qingdao, owns two houses under his name, both of which still have part of the loan to be repaid. “I bought a second house in the first half of 2021 for my children to go to school. At that time, I was catching up with the high mortgage interest rate. Not only was the loan slow, but the loan interest rate also increased by 100 basis points.” Mr. Tao applied for a housing loan from a large state-owned bank. , Unexpectedly, not long after the loan was completed, the policy began to change drastically, from the lender “begging” for a bank loan to the bank actively looking for a loan, and the interest rate continued to drop, which made him very angry.

“The loan has already reached a high point, but now the income of various wealth management products is getting lower and lower. Even the funds recommended to me by professionals have lost more than 10%.” Mr. Tao said, the money saved in the past two years plus the year-end bonus After paying 50,000 yuan, he considered repaying the 200,000 yuan mortgage in advance. “I filed an application for early repayment in early December last year. At that time, I was told that I would not be able to repay the loan until after the year. The earliest February depends on the monthly quota. It is also possible. Have to wait until March.”

Image source: Visual China

“If I don’t make an appointment, the money will be spent.” Mr. Tao said that during the Spring Festival, he was dragged to Yunnan by his partner, and he basically used up the year-end bonus in one go. After the festival, he asked the bank, and he had to wait a month to repay the loan.

According to the Daily Economic News report on the 6th, on February 3rd, Friday, Tianhe District, Guangzhou. Lin Song deliberately asked the company for a day off, and got up at 6 in the morning. He had to go to the bank business hall to apply offline to make an appointment to repay the mortgage in advance. “I get up at 6 o’clock to take the Guangzhou Metro and then transfer to the Foshan Metro. Now I transfer to the bus. There is no online application channel, and it is super troublesome to go offline.”

The real estate purchased by Lin Song is in Foshan City. In 2018, Lin Song borrowed 520,000 yuan from the Bank of China with a term of 30 years and an interest rate of 5.13%. Lin Song said that this is not the first time he has applied for repayment of bank mortgages in advance. In August last year, he applied on the Bank of China APP, and a week later, he passed the review through feedback from all parties. “A total of 300,000 yuan has been repaid, and there is still a loan balance of 180,000 yuan. The loan period is 30 years and the monthly repayment The amount is 1088 yuan.”

In the past few days, when Lin Song wanted to apply for early repayment of the mortgage through the Bank of China APP again, he found that the APP had already prompted that “the operation of early repayment is not supported for the time being”.

The same case also happened in Shanghai. Zhao Zhao said that he bought a property in Shanghai at the beginning of 2019. At that time, he paid a total down payment of 5 million yuan and borrowed 1.8 million yuan from ICBC, of which 800,000 yuan was a commercial loan with a term of 30 years and an interest rate of 5.19%. There is another 1 million yuan provident fund loan with a term of 15 years and an interest rate of 3.57%. After 4 years of repayment, Zhao Zhao still has 750,000 yuan left in the commercial loan and 790,000 yuan left in the provident fund. Now the total monthly repayment of the mortgage is about 11,000 yuan. In the past few days, Zhao Zhao has applied for early repayment of the loan on the ICBC APP, but it still needs to wait for 2 months.

Can prepayment be tax deductible?

According to a report from China Business News, interest rates on first-time homes have continued to decline, and many home buyers choose to repay in advance. Wu Xiao is one of them. He told reporters that he paid off the 900,000 yuan mortgage in four installments, and in the end there were only more than 100 yuan left in his bank account, and the monthly payment was more than 1 yuan, which was used to deduct personal taxes. As soon as the news came out, the topic of “someone has paid 900,000 yuan of monthly mortgage payment and 1 yuan to offset a tax” rushed into the hot search on Weibo. Bar”.

According to the Jimu News report, can I still enjoy the special additional deduction of personal tax if I repay the mortgage in advance? The reporter learned from the tax department that according to relevant regulations, individuals can enjoy the pre-tax deduction of mortgage interest “in the year when the loan interest actually occurs” according to the regulations. However, if the loan is repaid in advance, there will be no loan interest payments, and you will no longer be able to enjoy the pre-tax deduction. Even if you apply for a new housing loan later, it cannot be deducted. After all, the special additional deduction for housing loan interest is limited to the interest on the first housing loan. However, if the mortgage is only partially repaid in advance, the standard deduction of 1,000 yuan per month can still be deducted in the year when the loan interest actually occurs.

“The special additional deduction for personal tax is a real burden reduction policy, which has released the benefits of personalized tax reduction for taxpayers. At present, the special additional deduction for housing loan interest does not set a threshold for the monthly repayment amount. But if The loan has been settled, and it needs to be modified in the “Special Additional Deductions for Personal Income Tax” column of the Personal Income Tax APP. Otherwise, after the annual settlement, the tax department will carry out spot checks and verifications after the fact based on tax big data, and will pursue tax and overdue fines for falsely filled reports. , give administrative punishment.” A professional from a tax accountant firm in Wuhan said.

When the bank applies for a partial repayment of the mortgage in advance, can it be realized that “only a fraction is left”? The reporter consulted relevant people in the banking industry and learned that different banks have different regulations on the early repayment of housing loans. The lender can look at the loan contract for details. Generally, the minimum repayment amount for early repayment starts at 10,000 yuan, and the specific amount can be voluntarily chosen by the lender. “Although early repayment can save mortgage interest, some banks need to pay liquidated damages. Lenders can consult the bank for details.” A customer manager of a state-owned bank told reporters that after part of the early repayment, the lender can choose to shorten the repayment The number of years, keep the monthly repayment payment unchanged, or you can choose to reduce the monthly payment and keep the repayment period unchanged.

Repay the loan in advance, the “small account book” must be calculated

Is everyone suitable for early repayment? According to Qilu Evening News, industry insiders expressed several views to reporters for reference by the public:

First, if you have already enjoyed a preferential mortgage interest rate when buying a house, with a discount of 30% or 20%, even if the mortgage interest rate changes, the difference is not big, so you don’t need to consider early repayment;

Second, if the repayment period of the mortgage has exceeded one-third or even more than half, especially if the repayment method chosen is equal principal and interest, because the repayment of interest in the early stage is more and the principal is less, so the later the repayment period is, the less recommended it is Prepayment;

Third, if you decide to repay the loan in advance, you can also choose the repayment method, whether to change the number of repayment periods or not to change the monthly repayment amount, you can choose the one that is more suitable for you according to your repayment ability.

Image source: Visual China

Beware of being targeted by scammers and intermediaries

In the process of planning to repay the loan in advance, consumers must be careful about routines, otherwise it is very likely that the loan will not be paid off and they will be burdened with new debts. According to a report by Beijing Business Daily on the 6th, “I just had some money in my hand, and I was scammed away by scammers, alas!” According to Yuzhong’s release, recently, a citizen wanted to pay off the remaining loan amount in advance, because no official early repayment loan was found. After entering the channel, I searched the customer service number of a certain bank on the Internet, and then added the other party’s WeChat to contact it.

The other party said that in order to pay off the balance of the loan in advance, the bank account must be swiped to the equivalent of the loan amount, and the swiped money will be returned in the same way afterwards. The citizen believed it was true, and transferred a total of 25,149 yuan to the designated account in multiple transactions under the guidance of the other party. Then the other party continued to ask him to transfer money, and the consumer realized that he had been cheated, and then called the police.

The reporter sorted out and found that, according to police disclosures in many places, at present, many consumers often consider repaying loans in advance in order to reduce loan interest or have ample cash at that time, but because they cannot find the loan repayment entrance on the official software or platform, and cannot contact customer service for help, They would choose to search for the entrance of early repayment on the Internet, but this move is also in the hands of the scammer.

At present, in addition to scammers who are eyeing the upsurge of early repayment, many market intermediaries have also launched active marketing, trying to provide so-called “refinancing” services for those who want to repay their mortgages early and save interest expenses. The intermediary will first provide funds to the home buyer to settle the housing loan, and then let the home buyer use the real estate as collateral to apply for an operating loan from the bank. The home buyer uses the operating loan to repay the loan from the fund intermediary and pay a certain service fee.

It should be noted that the operating loans issued by banks are generally targeted at enterprises, business owners or self-employed persons. However, some financial intermediaries claim to “organize the company registration process” and “help” home buyers successfully obtain approval for operating loans, but in fact they use the information of home buyers to register a “shell” company with no business and no turnover. These seemingly “convenient” services may have hidden risks and even involve violations of laws and regulations.

Li Ya, a lawyer from Beijing Zhongwen Law Firm, also told reporters why the “early loan repayment” scams have appeared frequently recently. This kind of situation may be caused by consumers’ cognitive errors or urgency. Consumers only need to look at the loan contract in their hands and mobile banking to find the bank’s customer phone number and loan branch phone number, and contact these numbers or make an appointment online to solve the problem of early loan repayment. Li Ya bluntly said that to identify this type of fraud, one only needs to understand a simple truth, “money cannot be transferred to strangers.”

Multiple media collectively speak out

The Securities Times published an article titled “Properly Dealing with Difficulties in Repaying Loans in Advance”. The article pointed out that no matter what the motivation is, as long as the home buyer meets the prepayment requirements stipulated in the housing loan contract, the bank should not artificially increase the difficulty of repayment and set unnecessary thresholds for repayment. Put yourself on the opposite side of the customer, even if you keep the interests of the moment and place, how to repair the damaged brand reputation in the future?

The article also stated that relevant parties such as banks and regulators should launch a safe and orderly plan to deal with early repayment of loans as soon as possible. It should not only respond to the concerns of the people, meet the loan repayment needs of house buyers, but also ensure that the bank’s housing loan business is relatively stable, so as to protect the bank. industry and the stability of the entire financial industry.

The China Economic Times published an article titled “Responsively Responding to the Tide of “Prepayment of Loans”” on the 6th. The article pointed out that in response to the wave of “early repayment” and the difficulty of “early repayment”, mortgage lenders, commercial banks and relevant departments should treat it rationally, take reasonable measures in light of the actual situation to alleviate it, and at the same time strengthen policy guidance to stabilize people’s hearts and increase public confidence. Confidence, reduce burden, promote consumption.

Mortgage mortgages should not blindly follow suit. It is necessary to combine your own reality and comprehensively judge whether it is suitable to repay the loan in advance based on the mortgage interest rate and investment yield. From the perspective of reducing the burden of loan repayment, if the mortgage interest rate is at a high level of 5% or even 6%, and you do not have a better financial management method that exceeds the mortgage interest rate level, you can consider early repayment. Conversely, if the mortgage interest rate is low, or even sinks on the basis of LPR (quoted loan rate), there are financial management methods with similar interest rates to choose from, and the repayment pressure is not high, so there is no need to rush to repay the loan in advance. Of course, except in special circumstances.

On the 6th, Elephant News published an article titled “”Retaliatory” Loan Repayment, Because I Don’t Want to Be “Cut Leeks” Again”. The article mentioned that mortgages are high-quality products for banks. From the perspective of banks, they definitely don’t want to see the mortgage business decline too quickly. Therefore, in the face of the “loan repayment wave”, individual banks have come up with a lot of “show operations”. Such as: canceling the online repayment channel, negative approval, etc. After some operations, it may take several months to return it, which has caused many people to complain. Of course, the sudden increase in the number of repayers is also more likely to cause the service to fail to keep up.

Regardless of the reasons, if the economic environment and real estate market conditions do not change significantly, the demand for early repayment will remain high at this stage. In fact, the more this is the case, the more banks should work hard to improve services and simplify processes. Even if the short-term benefits are lost, a large wave of “favorability” can be created in the hearts of consumers, and more intangible and priceless brand assets can be accumulated.

Hourly News published on the 5th titled “Young people “revenge” to repay the mortgage bank? Banks Need Sincerity, Individuals Should Be Cautious”. The article stated that regarding the trend of customers repaying mortgages in advance, banks should abide by laws and regulations, and implement the original contract requirements, and should not be a stumbling block, deliberately increase the threshold, so that customers have to give up their original plans during the long and annoying wait , This is not the demeanor that a large enterprise should have. After all, if you keep your credit, you are not afraid of running out of firewood. You should treat the current wave of early repayment with a normal mind.

However, if the current wave of early loan repayment cannot be reversed in time, it will lead to serious consequences for residents, banks, enterprises and the government. It should be paid enough attention to, rather than relying on procrastination and grinding to solve the problem, we should show sincerity to solve.

On the 4th, Red Star News published an article titled “”Repaying money is more difficult than borrowing money”, and the “pot” of the loan repayment wave cannot be entirely carried by home buyers”. It is pointed out in the article that, obviously, the inversion of income has become the key reason for the high enthusiasm of home buyers to repay their loans in advance, and the bank pushes back on this. However, the “pot” of income inversion cannot be entirely carried by home buyers. Banks should further optimize their services and effectively lower the threshold for early repayment in terms of helping the national economy recover, improving the public’s expenditure structure, and undertaking social responsibilities.

Daily Economic News Comprehensive Qilu Evening News,Beijing Business DailyEveryjing.com, China Economic Times, Elephant News, Hourly News, Securities Times,jimu news

Cover image source: Visual China